by Jane | Mar 15, 2016 | Blog Post

Today began with pure utter frustration and me yelling profanities at my computer. I am usually a calm and even tempered person but don’t mess with my internet connection to trade.

I logged on at 9:15 after dropping my daughter off at daycare to pull up equityfeed only to have the router drop my laptop connection. I was ready to punch my screen! I spent 45 minutes last night trying to figure out the problem so there would be no issues with trading.

I even called Apple Care. Once my husband heard me cursing he came into my office and hugged me and reminded me about the hotspot capability on my phone.

So I set up a temporary solution to tether to my phone, while my husband went out to buy our new amazing d-link ac 3200. By the time he came back I was proud to tell him of my success to be my most profitable day yet.

I have the chart of SCOR posted as it was my swing trade that I exhibited great patience. I entered last Monday at 28.26 after a huge selloff. I should have been a bit more patient to enter near the low of year and week of 26.20. I knew that the news of the delay of the reporting of their financials and a sell off of 30% was an overreaction.

I think this comes from my value investing days where I saw this negative news as a catalyst, however the value of the stock would bring it back to close the gap. Once the news of the selloff slipped away and some positive press behind it my target of 29.45 would easily be hit.

My husband would ask me daily about the stock ever since I asked him to watch it when I took the day off last Tuesday.

We discussed last night about my sell target and I took my partial profit at 29.45. I had another target set to 30.49 and then as I saw it break 30 I let the emotions get to me. I saw the profit and I wanted to lock it in. As soon as I sold at 30.10 it continued to climb hitting 30.50.

I then saw an opportunity to short and sold at 30.40 and in a fat finger error I closed my short at 30.21. After that gap down it contined to climb up to high of day 30.89.

Once again I need to work on letting my winners develop and not cut too soon. I am so thankful I made $4300 and learned how to anticipate these moves. I ended up going long again at 30.74 3:55 looking for a gap up and further climb to the stock.

Today was my best day yet with $4558. I am so thankful I took the time to work hard and learn. I

t is crazy to know that I basically made my husbands one month take home pay (converted to CAD) in one day. I was honestly in shock when I was sitting down eating lunch with my husband. My adrenaline was coursing through my veins and I couldn’t believe this has become my reality.

You can make it happen too with hard work!

Study hard have the right tools and change your life starting today! It just takes small steps daily to make your dream come true no matter what you dream for yourself.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Mar 12, 2016 | Blog Post

In reviewing my trades, for some reason my lacklustre Friday with $430 in profits I feel like I didn’t perform my best. I think it is because I felt like I was scalping all day. I saw some trades set up today and I entered but was too cautious on my exits.

Obviously I’m never going to be perfect on my entry and exits, but I need to get much better at letting my winners develop and not cutting them too soon. In two trades I wasn’t patient enough and I left potential earnings of $900 in the market.

I entered FXCM after seeing it on Trade Ideas scanner for being oversold and I watched and I entered just 13 cents off the bottom 10.51. For some reason I traded very fearful today and cut way to early at 10.68 as it ran up to 13.00 for the next hour and half.

I did the same thing with STRP too selling it right at open after CLUB failed to spike. It ended up around 37 from my 33.49 entry and I sold at 33.99.

So my lesson for today is to remember to be patient in letting the trade develop and having confidence in it. I am still presently in SCOR from Monday as my swing trade. I entered way too soon with a 28.26 average. The low of the year and this week was 26.21.

So my lesson for today is to remember to be patient in letting the trade develop and having confidence in it. I am still presently in SCOR from Monday as my swing trade. I entered way too soon with a 28.26 average. The low of the year and this week was 26.21.

I felt that the stock was way oversold on news and has more value. This is where my prior training from value investing comes in handy. I am swinging it up to my target from 29-30 depending on action, which will hopefully be met on Monday.

Today’s price action reminded me that this is the right move to be patient. I’m looking forward to watching it at open on Monday.

Looking at my week in review, I hope you had a profitable week and learned from your trades. I know I’m not perfect and try to learn from each trade.

Keeping at it each day and starting with a fresh clear mind has allowed me to end up this week up $2541. I traded 22 trades this week and 15 were wins.

I hope to improve, 2 out of 3 trades winning isn’t so bad.

I think understanding how to read the charts is very important but having the right tools to make it easier really helps. That’s why I really enjoy Trade Ideas with all the different preprogrammed scanners and the ability to create your own alert windows.

It is really amazing and worth the investment to help you make money. Since I have been using it to help me find winning stocks my track record for winners has definitely improved.

This week has been quite complimenting with multiple people asking for help to learn, since Timothy Sykes posted my testimonial.

I am always happy to help others as I was there myself just over a year ago. I am a firm believer that in giving back to others it will come back to me in other ways.

That being said I am happy to answer any and all questions. I think the easiest way to help is to by answering questions here for everyone to read. So if you have a question shoot it my way either here with a comment, on Twitter @Jane_Yul , Instagram Missairplanejane or Facebook.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Mar 5, 2016 | Blog Post

This week was a rough one. I had 3 Red days and 2 Green Days. Overall I ended up with a positive week. Slowly but surely I’m on my way to 6 figure salary. January I had $3001 in profits and $6158 for the month of February, so I’m only shy $90K+ to make my first $100K. Little by little everyday with a fresh positive mindset.

This week was rough starting off Monday with a fever, but freedom to sit at my desk with my daughter at daycare. Unfortunately all week until Friday I had a nasty head cold that filled my sinuses with congestion and I think distracted me from making the best trades possible.

I found I did not have the best executions and rushed trades or tried to anticipate the moves. My biggest loser was a short $RAX that I let get out of control. I didn’t cut the loser quickly. Now in writing this I read it received a forth downgrade to strong sell. Murphy’s Law that since I covered now it will drop like $GLUU last week.

As many people have asked me how I find my trades. I start my day looking for Gappers on Equityfeed (at the bottom of their page you can try it free for 14 days) in the morning. I like that Equityfeed will let you look at yesterday’s ending prices as well as the present day action. I check to see if the gappers up from the night before have continued with higher volume. My morning gappers are run with a scan of price .5-100, Volume over 100K and trades over 100. Sometimes on low volume days I go down to 75K or 50K to get at least 5 gapping up and gapping down. I use that to get an idea of stocks from the open.

Something I have learned this week in particular is don’t anticipate the moves let the stock dictate the reversal from open. I check on level 2 to see where the strength is located and also the RSI and the time. I find anywhere from 950-1015 the stocks reverse pretty strong in the other direction and can be an easy way to profit.

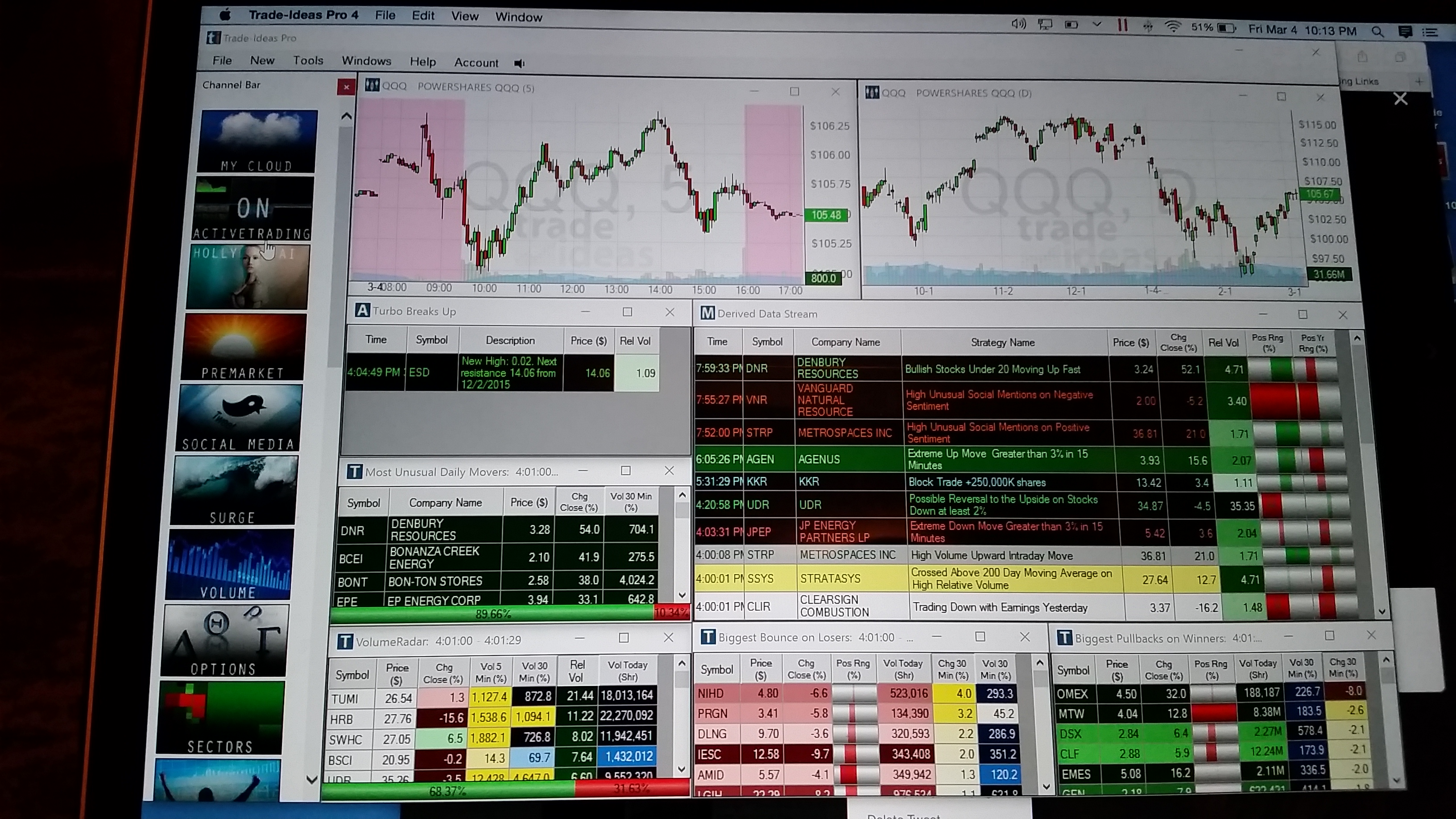

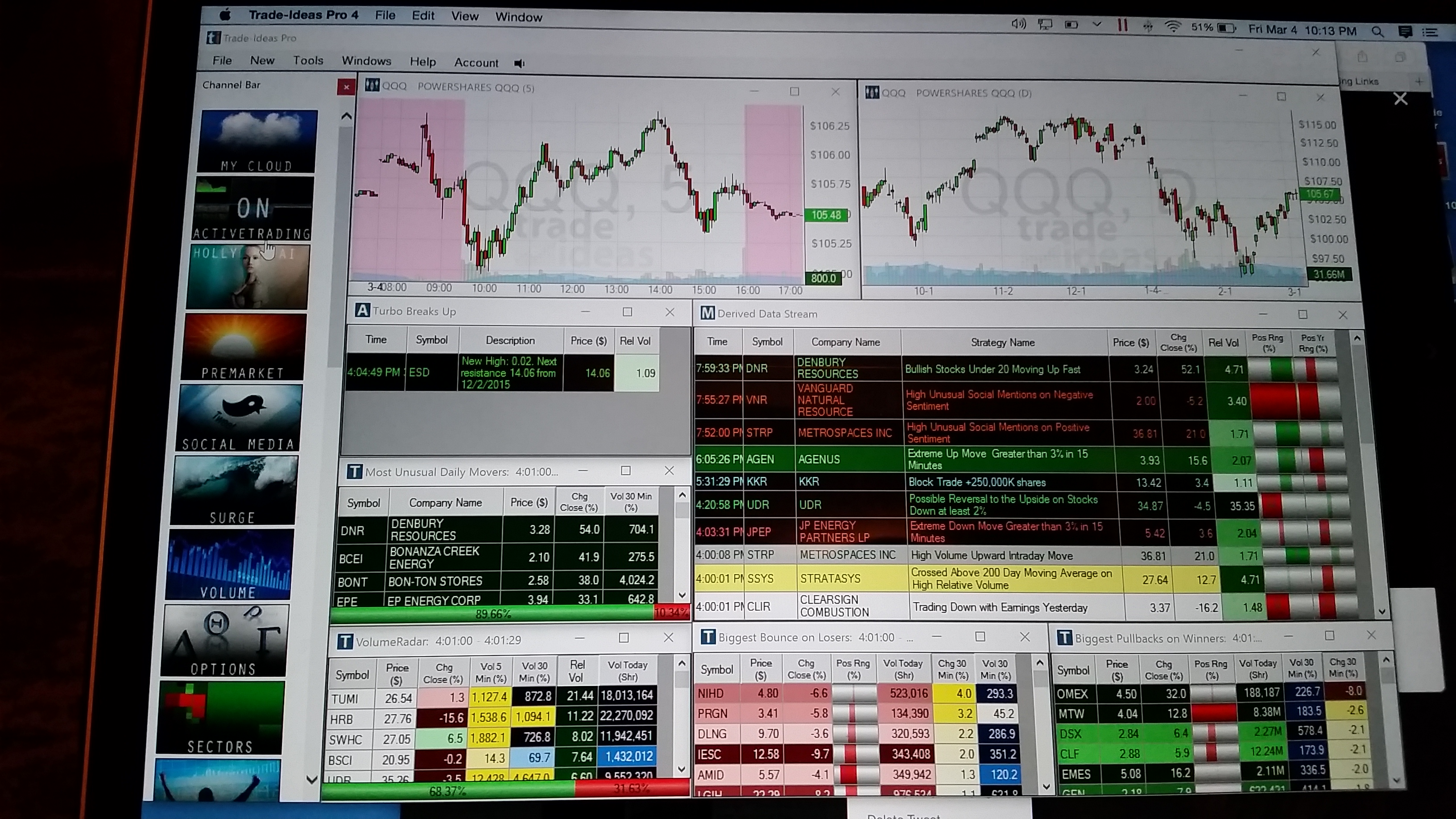

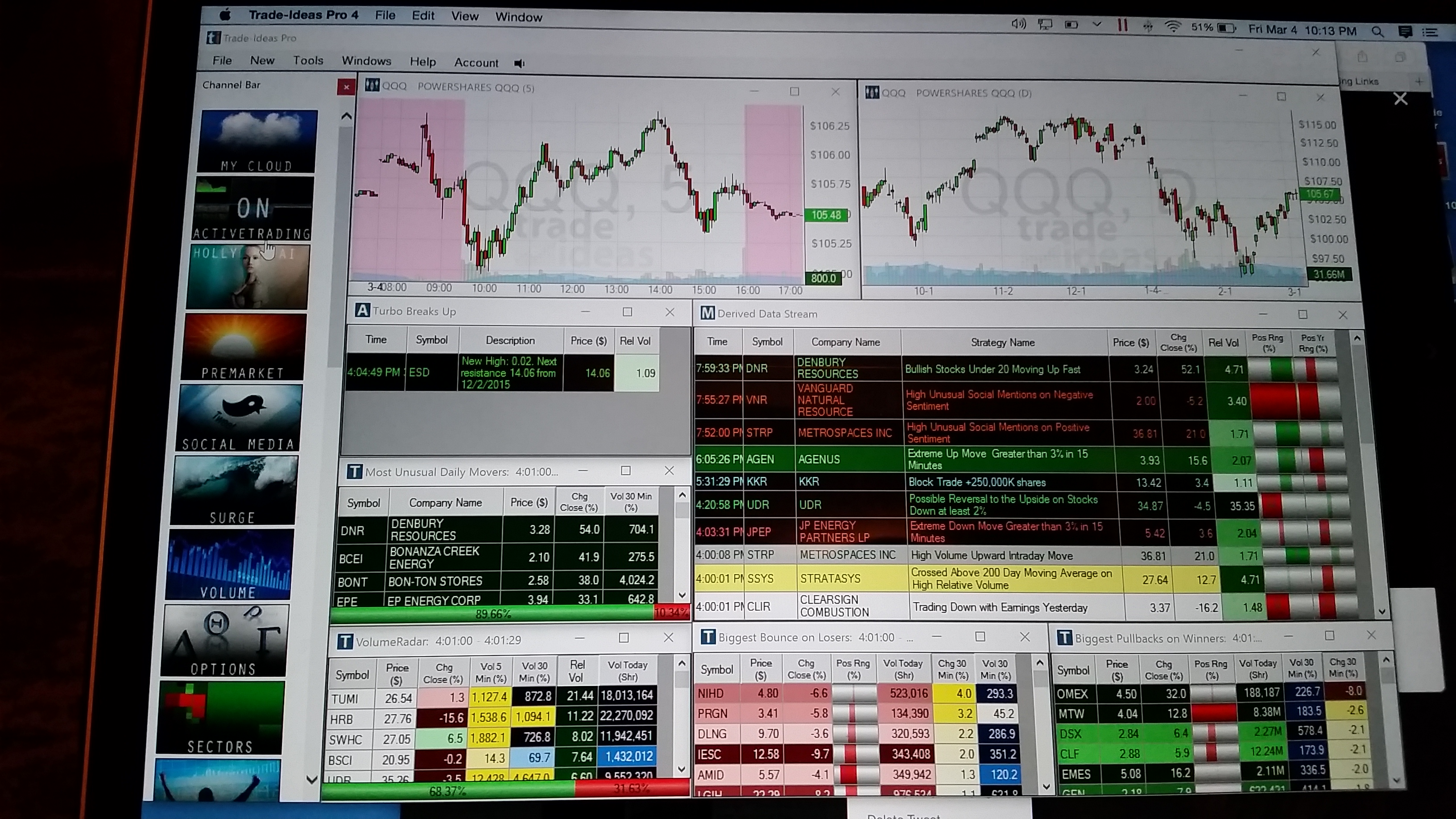

After my initial reversal play, I check on Trade Ideas. Trade Ideas is absolutely amazing. You can set up your own alerts or there are 21 preset scanning pages from channel bar on the left as well as the Artificial Intelligence Holly. Here is one of the preset scanning pages, Active Trading as pictured below. This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.

This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.

I found $SM from Holly, $CENX and numerous reversal plays. Definitely worth checking out the site. On the bottom of the link to Holly page you can sign up to test the demo mode. Check it out.

As always I’m super thankful to be able to have learned this skill and I’m happy to share and help others. If you want to know something please feel free to ask here on on twitter @Jane_Yul.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.