Always learning…and this time it was about teaching and trading.

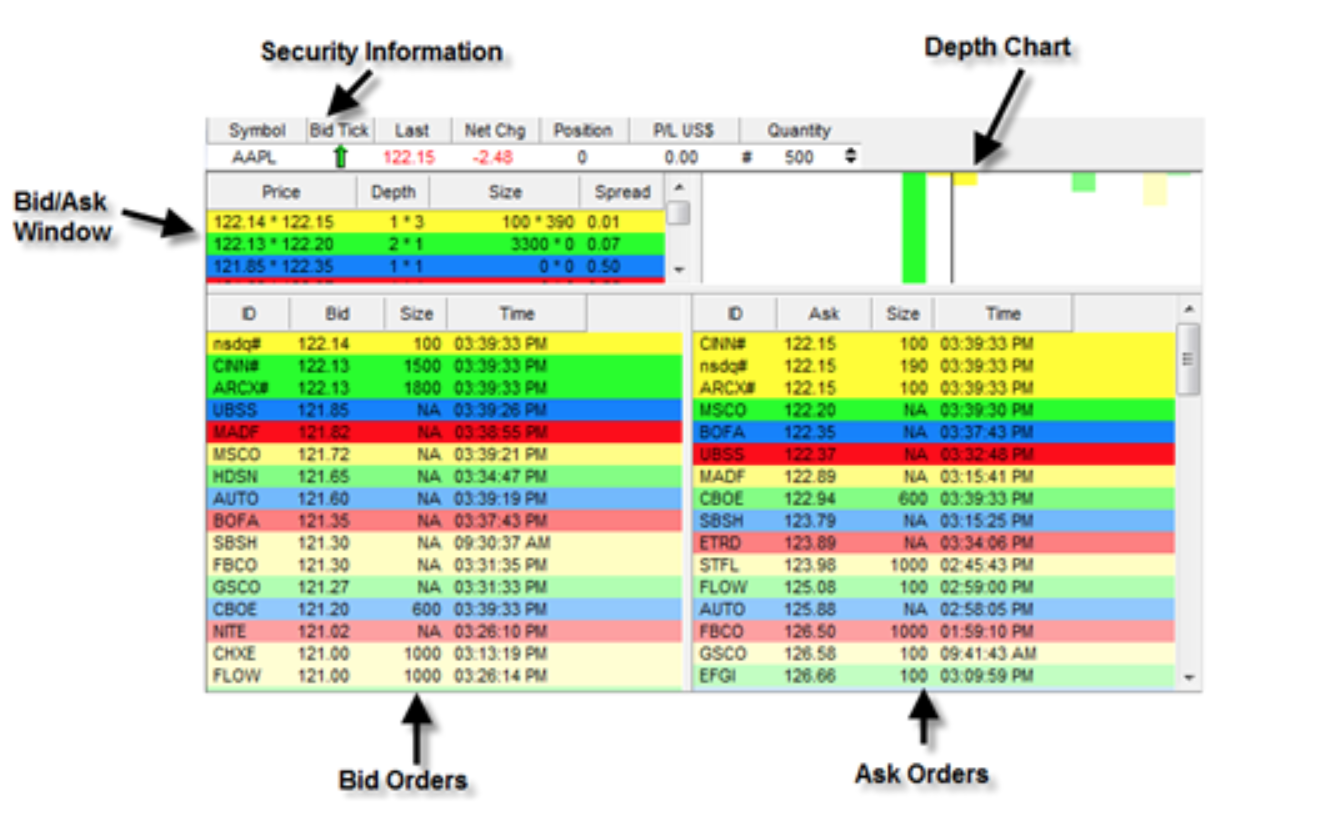

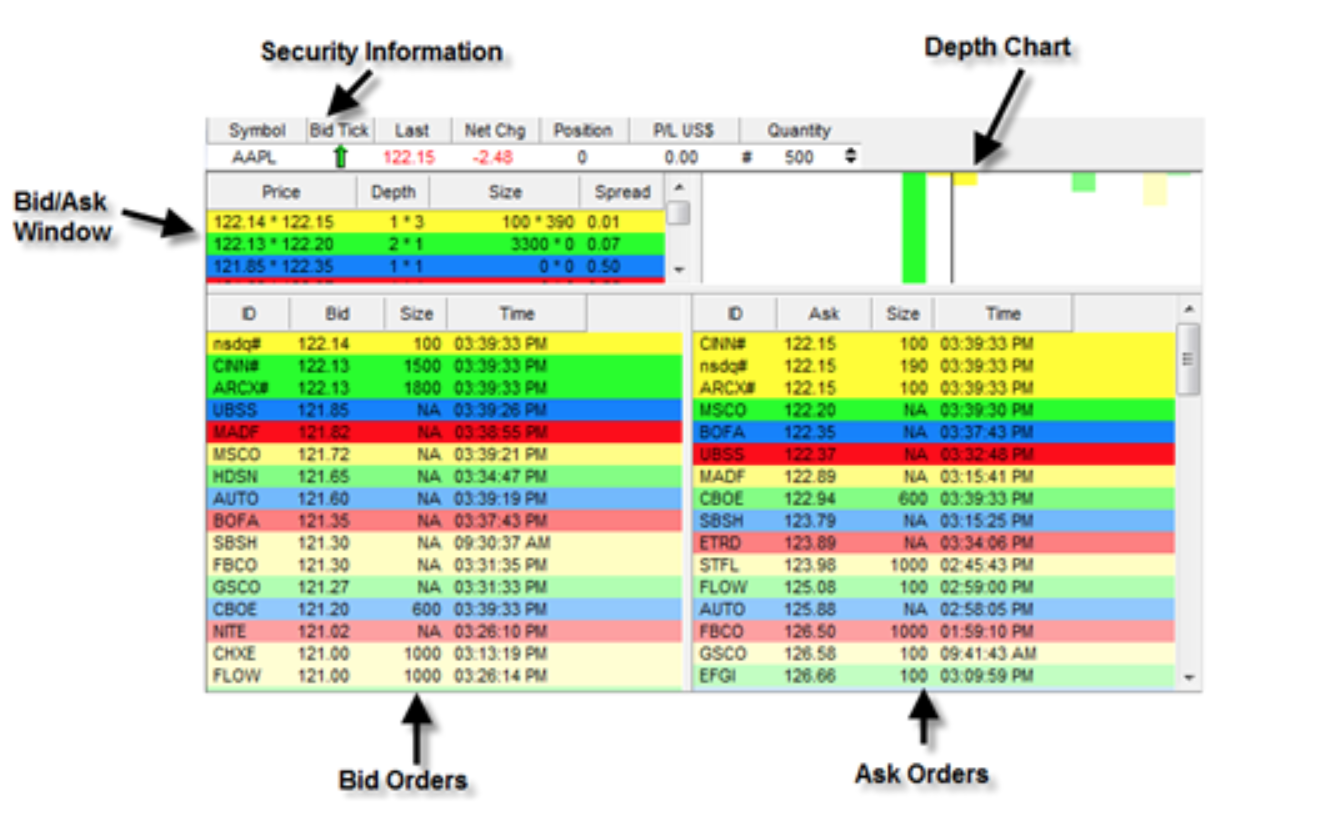

This week I began on cloud 9 from last weeks trades. Excited to teach a fellow friend the foundations from the ground up. I forget that the terms such as Level 1 and Level 2 are not known by everyone. If you don’t already know what I mean by Level 1 and Level 2 here it is for you. Level one is the basic price quote information that you can find on Google Finance or Yahoo Finance or any stock tracking app. It will show you current price and the % change for the day, The Bid price (what people want to pay ) the Ask price (what people want to sell for). Typically the Level 1 will show you the price that it closed previous day, and the high and low for the day as well as the last 52 weeks.

Level 2 will go one step deeper to show you the information above the Ticker, whether it up ticked or down ticked with red or green. I will show you the different Market Makers that receive the orders from the brokers and create the market price action. The order sizes and the times they were received. In dealing with a reversal play I look at the Level 2 in detail to see the strength on the buying or selling side. If there are 5 MM on Bid with 2000 shares and 1 MM on Ask side with 200 shares the price would likely go up with the buyers taking out or buying up the shares on the selling side. If at the bottom of a short sell off the short seller wants to cover so they might up their buying 2000 shares to the ask price and then eat up the 200 shares. Then it moves up to the next ask price. And there is a breakdown hopefully for you to understand Level 1 and 2 and a little price action.

Level 2 will go one step deeper to show you the information above the Ticker, whether it up ticked or down ticked with red or green. I will show you the different Market Makers that receive the orders from the brokers and create the market price action. The order sizes and the times they were received. In dealing with a reversal play I look at the Level 2 in detail to see the strength on the buying or selling side. If there are 5 MM on Bid with 2000 shares and 1 MM on Ask side with 200 shares the price would likely go up with the buyers taking out or buying up the shares on the selling side. If at the bottom of a short sell off the short seller wants to cover so they might up their buying 2000 shares to the ask price and then eat up the 200 shares. Then it moves up to the next ask price. And there is a breakdown hopefully for you to understand Level 1 and 2 and a little price action.

I was in the midst of trying to explain this and I was watching BABY which had gapped down Monday morning. I played it well off the open with a nice $650 gain. Then I was up $400 and I didn’t close as I was still talking away. My lesson is to try to save teaching for after hours for now or don’t trade while teaching. Gotta learn somehow right. It is human nature to answer someone immediately and not ignore them to watch the charts. In reality, I have to watch the charts if I’m trading. I am still long BABY after my poor entry as I believe there is value to the stock and this 30% sell off from 39.60 down to 29.90s is exactly what I look for in my swing plays. This one gapped down 20% then lost another 10% and is almost at the 52 week lo. An entry around 30 is fairly safe to go long and swing as in my opinion is more likely to go up than continue down again. Once it hits the 52 week lo shorts cover and analyst and brokers start to recommend people buy the stock at the bargain price. The initial drop causes panic and it sells off then the smart people come in and follow the saying “Buy Low, Sell High”. It’s the classic phase people mention in buying stocks. It is a matter of finding those stocks and having a great entry. I am under water now, but I won’t panic as I believe in my strategy and will swing it.

That is pretty much my same reasoning with SWHC, HRB and ENDP. I closed out ENDP after it tested resistance of 27 about 3 times and it couldn’t break it. So rather than have it gap down on me at open I closed it out. With HRB my position size is smaller and it is up 20 cents from the new 52 week low, so I went ahead and held it overnight.

My biggest winning trade today Tuesday was SBOT, which I found after flipping over to Finviz.com to check out the market overview. Finviz offers a free view of the market and different sectors and the gainers and losers in those sectors. They also offer their own screener service if you want, but the home page is pretty awesome for being free. I’ve never tried their registered service or the Elite. However for someone starting out the Elite seems like it would be good at $24.95 a month.

I know with my friend yesterday she was talking about all the upfront fees with broker and level 2 and scanning services. It can be overwhelming so anytime that I can help with trying to find a quality service at an affordable beginners price I will try to pass it along for you.

Back to SBOT. I found it at that moment as one of the two oversolds stocks listed. The homepage is updated throughout the day. I looked back at the chart for the past month and it really did look oversold. I went in at 3.19 and I held it until I saw a big seller on the ask side with 8000 shares at 3.40. Rather than have a sell off happen I went ahead and took my 20 cent profit. Man was I wrong it went on up to to 3.80 before coming down to close at 3.73. I will watch this for tomorrow. In fact it might gap up at open. A good penny stock to watch.

As always I hope these help and if there is anything in particular that you would like me to write out in a blog post for everyone please let me know.

Even thought I have a bad entry I will not let it destroy my confidence in trading. I am human and learning from my lesson on Monday.

Don’t let a bad trade get you down, simply learn from it and how you can improve from the error. We are all human not computers.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.