by Jane | Apr 13, 2016 | Uncategorized

I would say the hardest part about closing out the loss was accepting it. I had to accept it wasn’t going to rebound soon and I made a mistake. It’s the hard part of looking yourself in the mirror and being honest with yourself about it. Sure I could have easily said I had 1,000 shares, but that is not being transparent. It is refreshing to be completely honest with everyone about wins and losses.

In writing this post I want to answer both Ashley’s and Lam’s questions that they shot over to me. Lam’s question was how do you recover from a big loss and Ashley’s is about risk management.

Getting over this loss happened when I took the weekend to fully accept that I made a bad entry. I analyzed why it happened and I was not in the trading zone. I was distracted and made a bad entry. I should have cut it while up $400. I need to get better about taking the profit while ahead. I really had to swallow the tough pill that I let a loss get so bad. However I have learned not to live in the past. I can’t change what happened, but I can learn from it to improve my trades in the future. Day trading is about being present in the moment. If my mind is caught up in a past trade or overthinking or clouding my judgement it will be a bad trade. So my best recommendation is accept you can’t changed what happened in that trade. It is ok you are not perfect. Size smaller until you gain your confidence again. Lock profits quickly if you have to and try to stay green.

I feel like my big loss was a basic risk to reward novice mistake. I saw the stock dropping and I didn’t cut the loss. I saw the momentum was going down. To me I enjoy shorting a stock from the top or buying at the bottom. I did not wait for 3 greens( 1,2,5 min chart) to go long . My best example for risk reward was my entry today on INSY. I saw that it had hit a new 52 week low of 12.50 and it was at 12.96. The high of the day was 14.23. So to me there was .46 cents to the downside and the whole year to the upside. My target was preferable up to 14 if it could get up there, but I pay attention to price action and try to lock a profit before it drops. So I watched it go up to 13.47 and it was struggling. I thought it might tank the rest of the day. So I went ahead and locked my profits at 13.40. I have learned taking a profit is always better than a loss. The goal to grow your account is consistent wins. There are some wins better than others, however all help to grow your account.

A good entry is crucial in your trade being easy and stress free. When you chase the price action and enter in the middle it is really easy for momentum to shift and you end up under water. If you are stressed about your entry don’t let it go against you. For me I have found I tend to have bad entries around 1030 am so for me my goal is to either stay in a trade or try to sit on my hands.

My office is also my daughter’s playroom as well as our workout room, so I will try to get in a little home work out. Or go to get a snack, as I tend to forget to eat lately while trading. I become engrossed with price action. All part of my plan to get balance back in my life.

As always, I love hearing how I have helped you or if you have questions you would like answered. I was brand new to day trading not long ago and now I feel blessed to have stumbled across Tim Sykes’ page armed with the DVDs to help learn the basics.

If you have a bad day. Don’t let it cloud your judgement. If needed step away for a day or two. Digest and more forward.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 9, 2016 | Uncategorized

Monday began the week with a new challenge of trading and teaching. Well the rest of the week has been a challenge too. I think this week in my closed positions after commissions I might be up around $300. It seems like a scratch week for me.

Wednesday morning at 2am my little one woke up with a fever of 101.9, so that meant a day of TLC and no daycare. Not only was my little snuggle bug home, but we also had repair construction going on from water damage that happened back in February. I thought I can still trade.

My mind this week has not been as devoted to trading as it should be and it showed with my poor entries. I have not been attentive to getting out of my trades and cutting losses quickly thinking they will rebound. I am still long $BABY, $HRB, $KORS and $BKE.

This week I feel like I let all my readers down without having a stellar week again, however I know I’m human. I make mistakes and I can only try to learn from them. It has been rough week.

Monday is a new beginning to the week and a new trading day. I will try to start fresh there. I have received some requests for questions to be answered in the blog and I will get to them.

I always appreciate the feedback and all the thank yous. Its easy to write when it has been a successful week. A week like this past one is harder to share.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 6, 2016 | Uncategorized

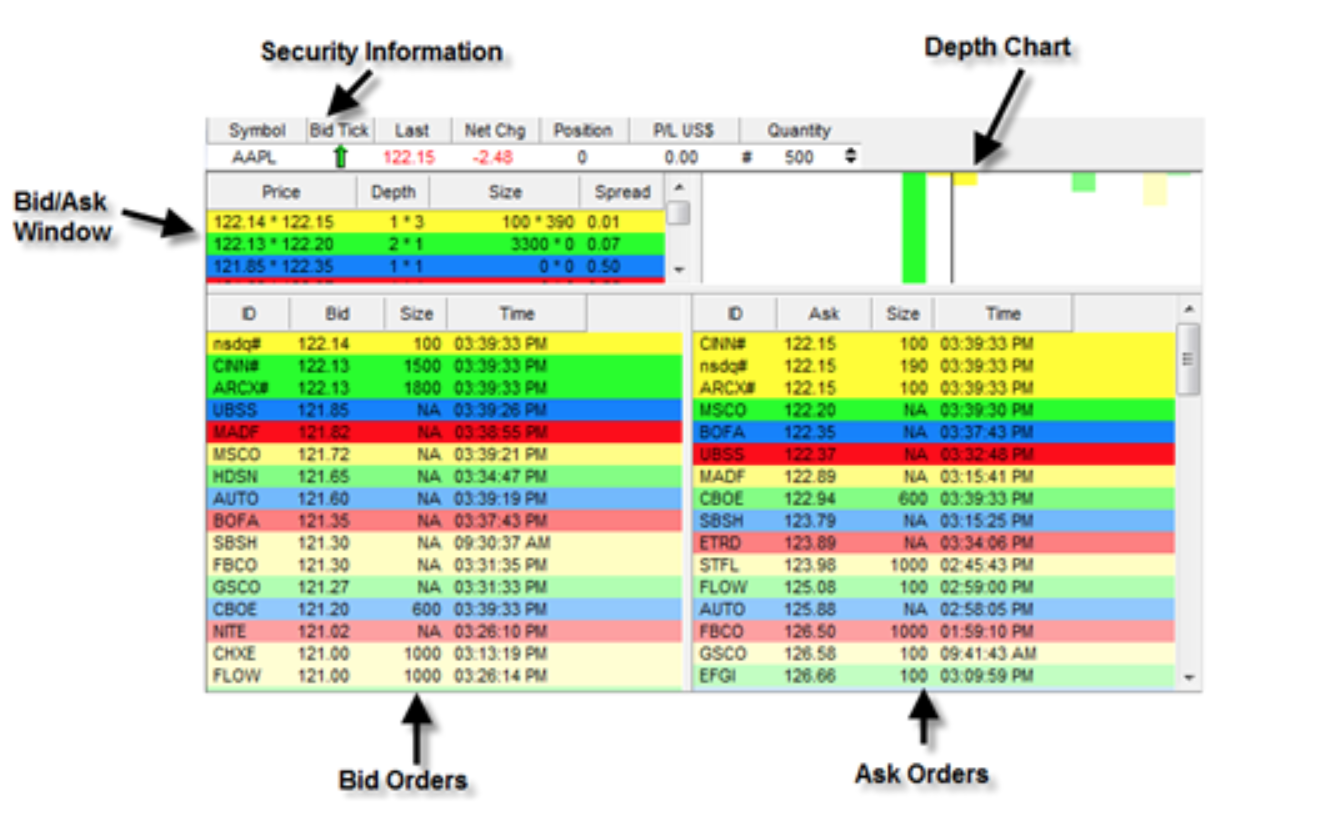

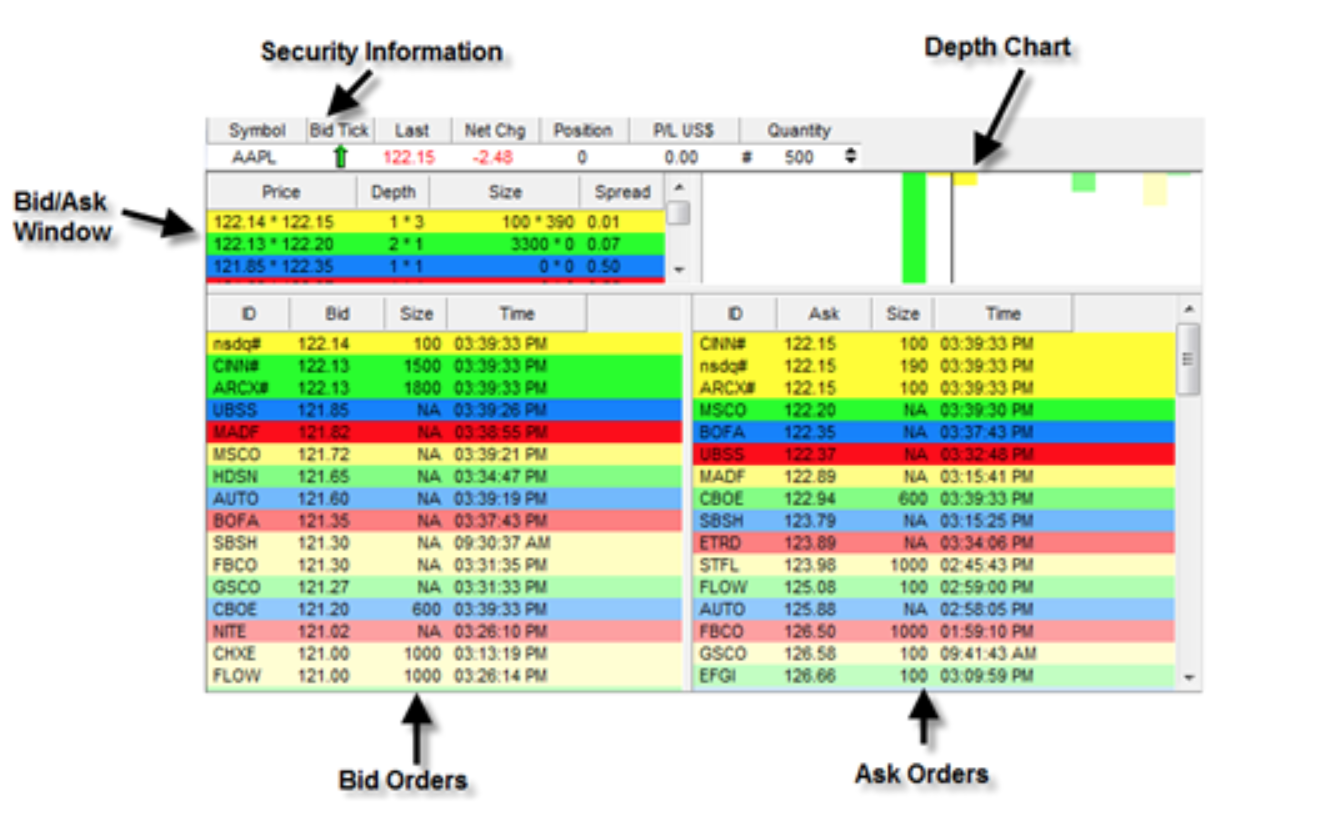

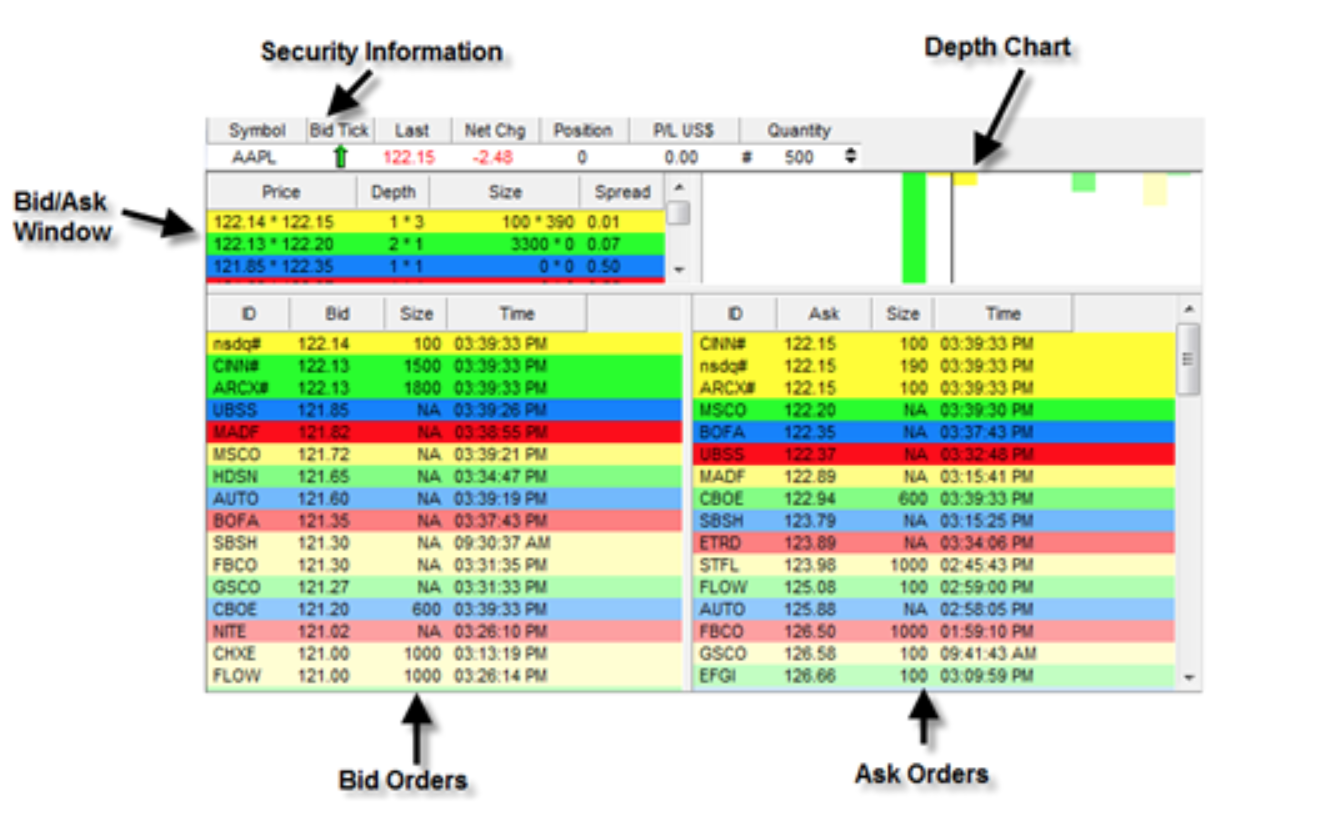

This week I began on cloud 9 from last weeks trades. Excited to teach a fellow friend the foundations from the ground up. I forget that the terms such as Level 1 and Level 2 are not known by everyone. If you don’t already know what I mean by Level 1 and Level 2 here it is for you. Level one is the basic price quote information that you can find on Google Finance or Yahoo Finance or any stock tracking app. It will show you current price and the % change for the day, The Bid price (what people want to pay ) the Ask price (what people want to sell for). Typically the Level 1 will show you the price that it closed previous day, and the high and low for the day as well as the last 52 weeks.

Level 2 will go one step deeper to show you the information above the Ticker, whether it up ticked or down ticked with red or green. I will show you the different Market Makers that receive the orders from the brokers and create the market price action. The order sizes and the times they were received. In dealing with a reversal play I look at the Level 2 in detail to see the strength on the buying or selling side. If there are 5 MM on Bid with 2000 shares and 1 MM on Ask side with 200 shares the price would likely go up with the buyers taking out or buying up the shares on the selling side. If at the bottom of a short sell off the short seller wants to cover so they might up their buying 2000 shares to the ask price and then eat up the 200 shares. Then it moves up to the next ask price. And there is a breakdown hopefully for you to understand Level 1 and 2 and a little price action.

Level 2 will go one step deeper to show you the information above the Ticker, whether it up ticked or down ticked with red or green. I will show you the different Market Makers that receive the orders from the brokers and create the market price action. The order sizes and the times they were received. In dealing with a reversal play I look at the Level 2 in detail to see the strength on the buying or selling side. If there are 5 MM on Bid with 2000 shares and 1 MM on Ask side with 200 shares the price would likely go up with the buyers taking out or buying up the shares on the selling side. If at the bottom of a short sell off the short seller wants to cover so they might up their buying 2000 shares to the ask price and then eat up the 200 shares. Then it moves up to the next ask price. And there is a breakdown hopefully for you to understand Level 1 and 2 and a little price action.

I was in the midst of trying to explain this and I was watching BABY which had gapped down Monday morning. I played it well off the open with a nice $650 gain. Then I was up $400 and I didn’t close as I was still talking away. My lesson is to try to save teaching for after hours for now or don’t trade while teaching. Gotta learn somehow right. It is human nature to answer someone immediately and not ignore them to watch the charts. In reality, I have to watch the charts if I’m trading. I am still long BABY after my poor entry as I believe there is value to the stock and this 30% sell off from 39.60 down to 29.90s is exactly what I look for in my swing plays. This one gapped down 20% then lost another 10% and is almost at the 52 week lo. An entry around 30 is fairly safe to go long and swing as in my opinion is more likely to go up than continue down again. Once it hits the 52 week lo shorts cover and analyst and brokers start to recommend people buy the stock at the bargain price. The initial drop causes panic and it sells off then the smart people come in and follow the saying “Buy Low, Sell High”. It’s the classic phase people mention in buying stocks. It is a matter of finding those stocks and having a great entry. I am under water now, but I won’t panic as I believe in my strategy and will swing it.

That is pretty much my same reasoning with SWHC, HRB and ENDP. I closed out ENDP after it tested resistance of 27 about 3 times and it couldn’t break it. So rather than have it gap down on me at open I closed it out. With HRB my position size is smaller and it is up 20 cents from the new 52 week low, so I went ahead and held it overnight.

My biggest winning trade today Tuesday was SBOT, which I found after flipping over to Finviz.com to check out the market overview. Finviz offers a free view of the market and different sectors and the gainers and losers in those sectors. They also offer their own screener service if you want, but the home page is pretty awesome for being free. I’ve never tried their registered service or the Elite. However for someone starting out the Elite seems like it would be good at $24.95 a month.

I know with my friend yesterday she was talking about all the upfront fees with broker and level 2 and scanning services. It can be overwhelming so anytime that I can help with trying to find a quality service at an affordable beginners price I will try to pass it along for you.

Back to SBOT. I found it at that moment as one of the two oversolds stocks listed. The homepage is updated throughout the day. I looked back at the chart for the past month and it really did look oversold. I went in at 3.19 and I held it until I saw a big seller on the ask side with 8000 shares at 3.40. Rather than have a sell off happen I went ahead and took my 20 cent profit. Man was I wrong it went on up to to 3.80 before coming down to close at 3.73. I will watch this for tomorrow. In fact it might gap up at open. A good penny stock to watch.

As always I hope these help and if there is anything in particular that you would like me to write out in a blog post for everyone please let me know.

Even thought I have a bad entry I will not let it destroy my confidence in trading. I am human and learning from my lesson on Monday.

Don’t let a bad trade get you down, simply learn from it and how you can improve from the error. We are all human not computers.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 2, 2016 | Uncategorized

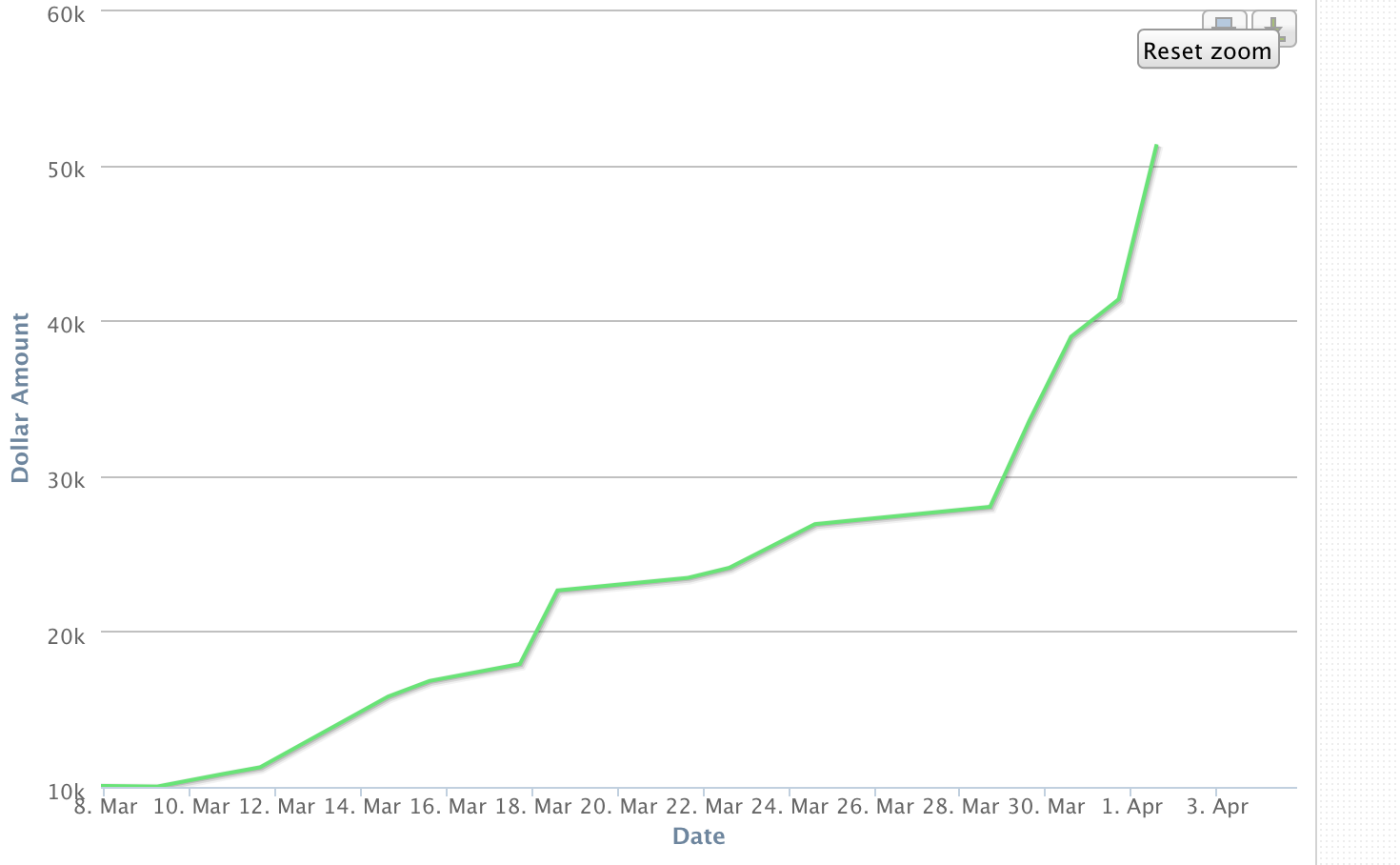

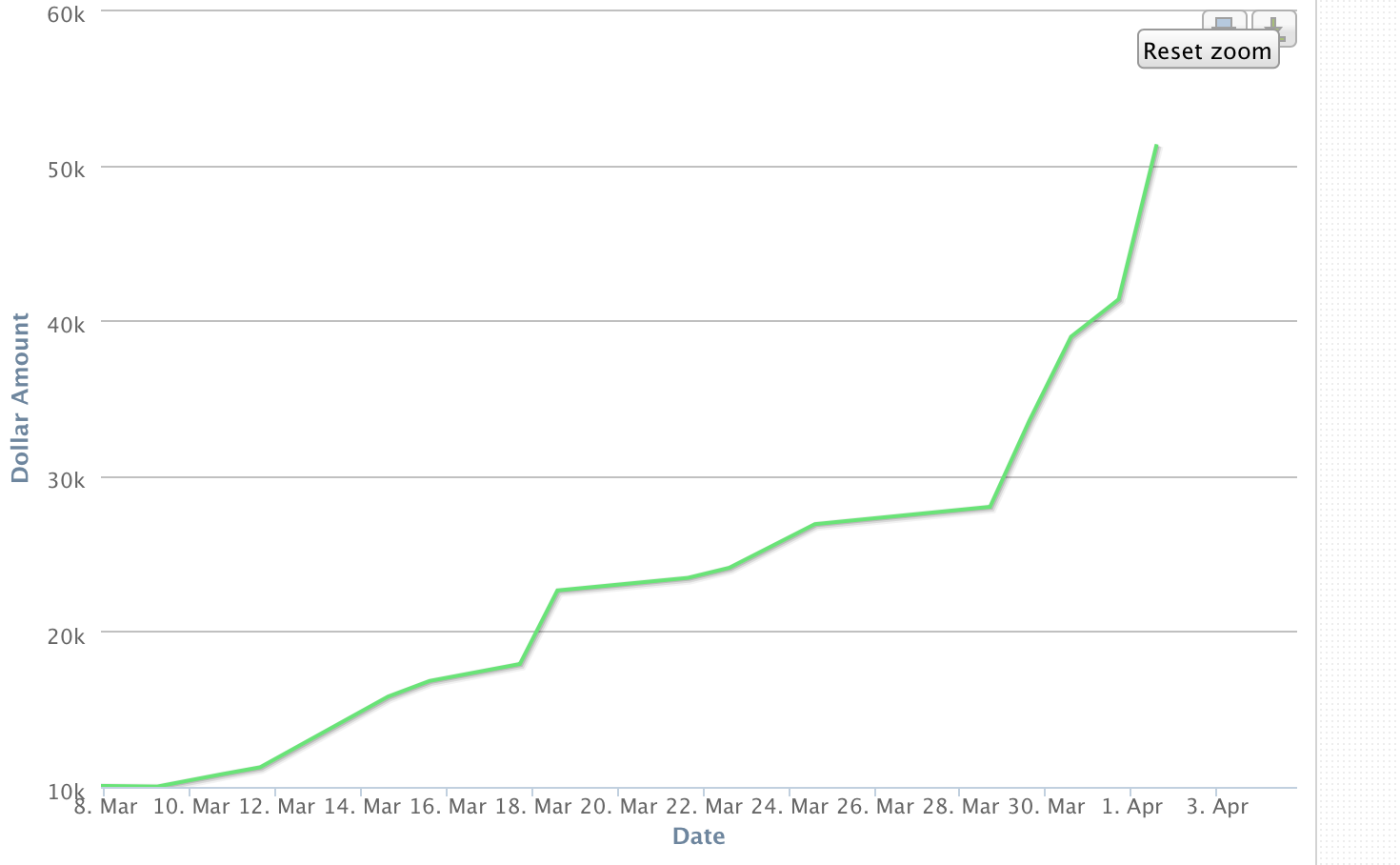

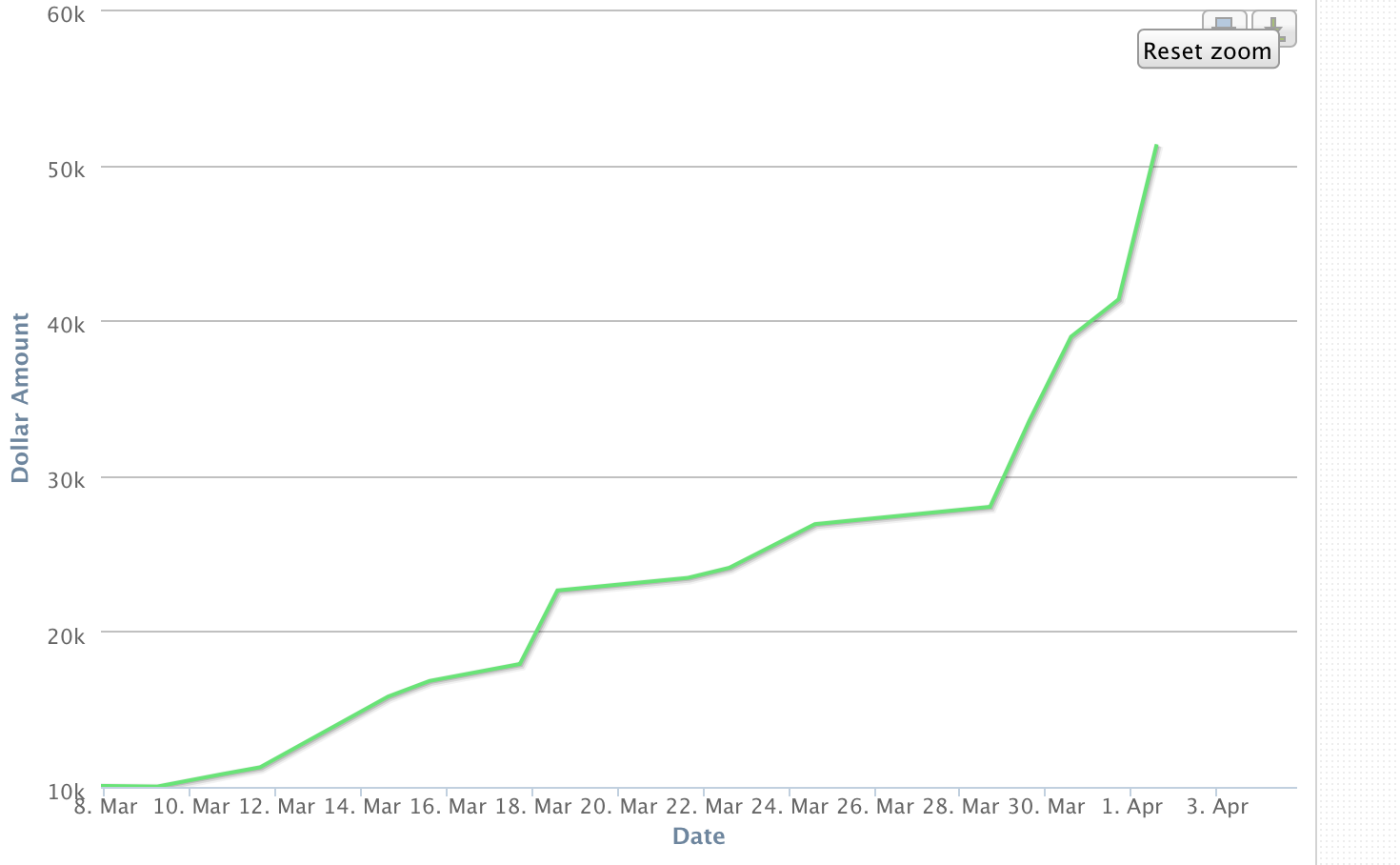

This is my profit chart you can see on Profitly as well as many great tools by Tim Sykes and other stock trading Gurus

Wow what an amazing week? I thought it was going well on Tuesday and I had my swing trade set up for PTLA overnight. Then I began my day and took my daughter to daycare and came back and opened my computer to work on our business investment Miss VVs Mystery and I just glanced at the stock. I saw that it was past my limit order price and sure enough I’d made $3500 by 9:55 in the morning on my so called day off from the market. I continued with business work and looked at around lunch time and saw that it had tanked and was primed for another long opportunity, so I went in again and made another nice profit.

Thursday was a rough day because my daughter was home from daycare sick and I was mentally really wanting to trade. I traded through breakfast with her while she was a captive audience in her high chair munching away and once it was time to put her down closed down my position on my PTLA short stock. While she was napping I scanned and went into some more trades. I completely forgot about PBYI on Thursday which was on my watchlist. I went long OPK and MOV and PTLA again. I let the work for me seeing my risk on the entry was low and watched from my phone while playing with my daughter. My entries on Thursday definitely could have been better but my daughter with her infectious smile had my attention. She gets into everything now at 20 months old. While she was napping in the afternoon I set up my swing trades overnight for PBYI, PTLA and MOV.

This morning I was way to conservative with my exit on PBYI and MOV. I have a hard time letting my winners develop. I see a pullback which I know is due to happen with the RSI going higher and then I let fear jump in and protect the profit and right after I close the position it goes up. For most of my trades today I found I had to use market orders because my limit orders were not getting filled. The size of my orders was too much and causing a price barrier. Rather than let it bounce I would play the spread and if selling wait until the bid price reached a price I was happy with and execute there. Honestly today was my biggest day with profits before commissions were just shy of $10k. It’s on days like these that I really have to pinch myself to see if these numbers are real. My husband is still in denial phase that it is happening. The week before commissions was $27K.

If you have been following my trades you can see that I tend to gravitate to stocks that have been largely oversold. When I began my paper trading I started trend following at the same time. I would write down data and compile it on excel spreadsheets and I found my strategy. So I tend to look for Gappers in both up and down directions from the night before and that morning.

I look at the charts back 2 days, 5 days, 15 days , 1 month, 3 months and 6 months. The key to have and amazing week like this past one is definitely entry point and risk liability. If it looks like a good entry I will load up on shares.

Prior to going on maternity leave, I was working as a part-time customer service agent for a major airline for an annual salary of roughly $14K CAD. It blows my mind that I made almost double that in a week.

I have come along way in 14 months and you can too. I posed a question on Twitter if you would pay for alerts and the response was 75% yes. It will come but for now I want to give back and help people that are in the same place I was 14 months ago.

I just listened to Tim Grittani’s Q&A on Digital Stock Summit and it is very true that in the beginning it is important to find a good mentor who can help you learn the basics and then you can blossom into a trader with your own niche. So learn from others now while it seems like an overwhelming mass of information. Take it one step at a time. I’m making what seems to be ridiculous profits now, but I know I can still learn. Will I necessarily change my strategy…. I don’t think I will for now, but I can improve on it.

One of the hardest things I found in the beginning was accepting a loss. It is humbling when you first lose $500, or even $50. Especially if it is hard earned money. It is a punch to the ego. Don’t be negative about it. Instead turn it into a positive and figure out what went wrong. The psychological aspect really got to me in the beginning and that is why I turned to paper trading. It will build you confidence so that when you are ready to use that real money you know more how the stocks act and will be less likely to loose your initial account funds. Instead you will be more likely to grow them.

I have had a couple people reach out and ask me questions through DM on Twitter and I really enjoy helping them and seeing their growth. It is inspiring to see people take on the challenge. Way to go! keep up your hard work and don’t get discouraged.

Have an amazing weekend and enjoy your time with family and friends. Money can’t buy that.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.