$STRP a type of stock I search for and get excited about.

If you have been following me on my blog, Profitly and Twitter you probably know that I look for stocks that have been oversold and down at an extreme looking to return back to a sense of equilibrium.

If you have been following me on my blog, Profitly and Twitter you probably know that I look for stocks that have been oversold and down at an extreme looking to return back to a sense of equilibrium.

This week in particular I was looking at low float stocks because they tend to really run if the demand increases and there is only so much supply so the price really goes up quickly but it also goes down quickly. This past thursday alone there were 3 stocks that really moved and had breakout spikes. It just so happened that I had just set alerts for low float breakouts and caught them. HMNY went from 7 to 15, RGSE went from 6 to 11.60 and GBR had a 30% run from 3 to 4.

I don’t only trade low float stocks, but the potential for great returns in a short period of time is possible. To me and many others a low float stock is typically a stock with 20 million in the float. Now what is the float you might be asking? Well a float is the amount of shares of the stock that are available for the public to trade and exchange hands on a daily basis.

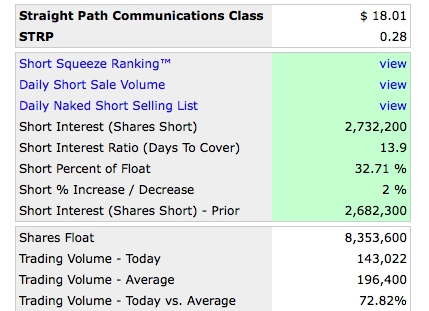

Back to STRP and what indicators give me the signs that this stock should have a nice upward rise soon. Not only is this a low float stock but there is roughly 30% of the float short. As you can see from this shot taken from www.shortsqueeze.com the float is 8.3 Million and the shares short are 2.7 million.

Now if you are new you might be saying what does it mean to be short? Well short means that roughly 30% of the shares available have been borrowed from brokers being sold without ownership looking for the stock to drop. In order for these short share owners to make money the stock has to go down. If the stock goes up then they buy to cover their borrowed shares from the broker.

This is what many refer to as a short squeeze. Many times the fear of a stock going up will cause the shorts to cover (buy) shares to lock in a profit. Not only will the fear cause the short owners to cover their position but the brokers will give the short owners margin calls to buy back the shares. If the owners of these shares do not cover their stock many times the brokers will cover for them. This is a forced buy in and the brokers don’t care what price they buy the stock they want to no longer lend the shares to the short owners.

This all causes the momentum and volume to increase as well as demand for the stock. Then you add the traders that are interested in capitalizing off this squeeze and their demand to buy the stock low increases and drives the price up as well.

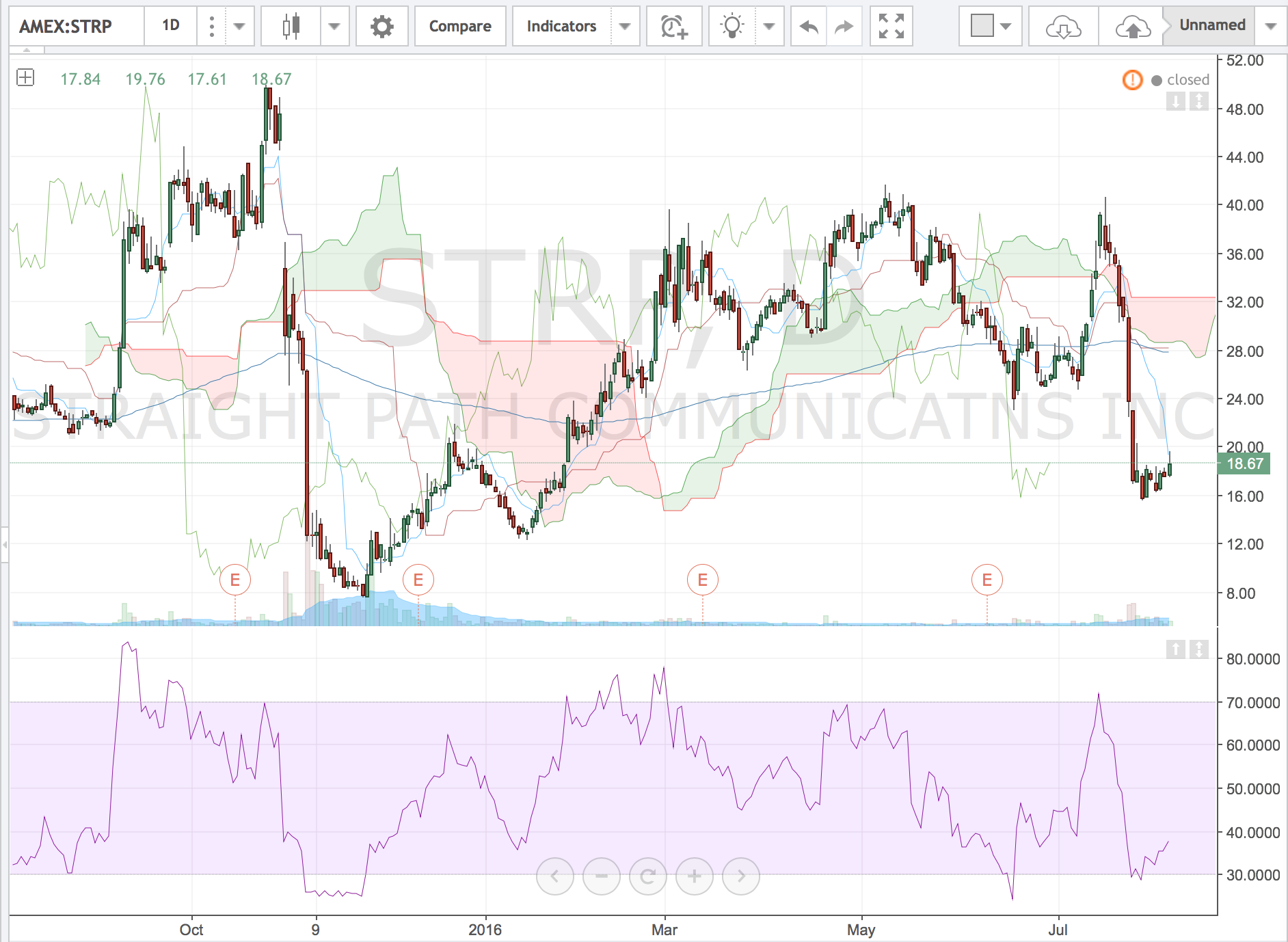

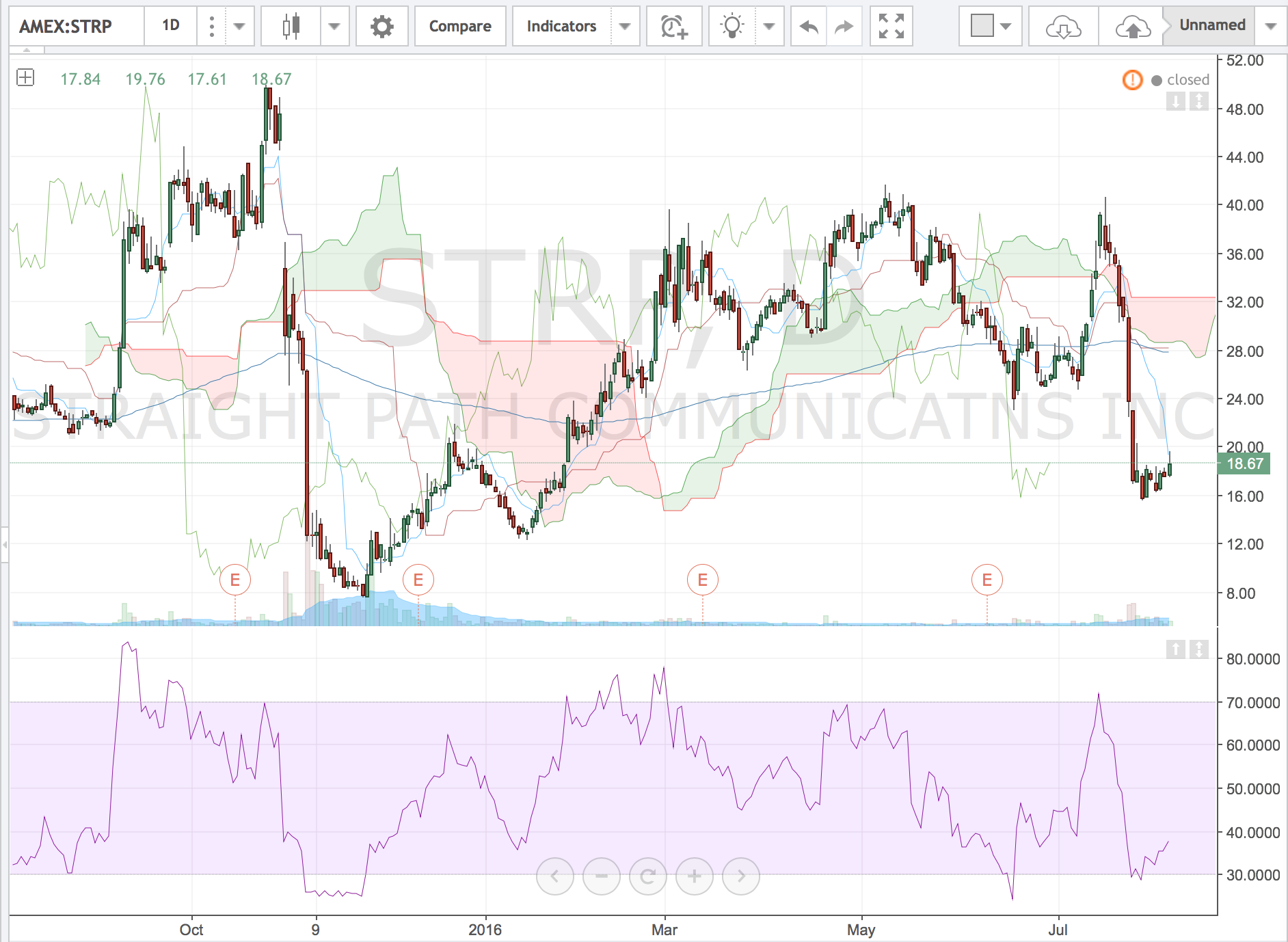

When you look at the big chart at the top (tradingview.com) you can see the RSI for STRP dropped below 30 on July 26th and 28th. When it hits 30 it can be an indicator overall that the stock has been oversold. Since the 28th the price action has slowly increased but the volume has still been around average of 196K a day. Friday had an above average day in volume and the price broke out a 6 day high. The next level of resistance is 20.46

From July 18th at a high of 40.75 to July 28th with a low of 15.65 there is big range of growth potential from the 18.67. I’m swinging this stock and looking forward to when the volume and demand drives the price up above 20.50 and the shorts stops start executing and driving the price up at a fast rate.

Please note my blog is based on my personal opinion and my experiences in the market. I am NOT a licensed broker.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.