by Jane | Jan 28, 2017 | Uncategorized

In the past week I have really seen a difference in my mental capacity with the constant waking up in the middle of the night around 2:30-3am at 38 weeks pregnant and not being able to get back to sleep. After the first couple of nights it happened I realized that my brain is not running at 100%

You know when someone asks you your cell phone number and you can’t remember it. Or you walk into a room and can not for the life of you remember why you went in there. Well that, as well as my hubby clueing me into this change lead me to watch more now until our little one’s birthday in the next two weeks. If I’m 100% rested and running all cylinders great. I will be full on active.

In the meantime I will continue to study the market, videos, research. Work on the book, blog, YouTube videos and testing out Stocks To Trade. They offer a one week trial for $1. Also Trade Ideas has a TI Premium week open house Feb 6th trial for $8.88.

It is not worth it to force a trade and not be at 100%. If you are feeling sick or off your game be honest with yourself. There will always be a good stock to trade and the market will be open the next trading day. In the beginning I felt like I was missing out…but now over time I see there are stocks to trade everyday.

In editing my book it brings me back my beginning and the thoughts I had as a newbie trader. I wanted it soooo bad. However rushing the process does not mean success will happen faster. You cant just jump into a trade because you want to trade.

It is important to understand the why behind it and to do that you have to study. Study the charts. Study the news and catalysts. This week has been a whirlwind as well with Trump’s first week as President. I will touch more on this an my weekly watchlist in my YouTube video coming on Sunday.

For example the pipeline deal is back on and oil spiked on the news and the Canadian dollar strengthened. Then the reality set in of the details and it could be more than a year for permits and everything to go through in order for the work to commence. So with all the executive orders we are seeing immediate jumps in one direction or another, but there is from what I see little follow through in the days after.

His executive orders are acting as catalysts it seems the day traders are in and out in a day with potential long term growth but nothing like the first day reaction.

The markets are always changing and Friday was an interesting one with the Dow down and Nasdaq up. Then the two are in disagreement it can be tough to trade. I was talking with a trading buddy and he was frustrated with the ambiguity of the market.

If you see things like this dont fight the market. It will always win. Be smart with stops mental or hard and stick to them. If the trade does not go your way then get out. Dont anticipate, but react to present price action.

I have from what the Doctor anticipates less than 2 weeks for our little love to be here and I really want to achieve that goal of sharing my book with you. So literally working day and night (when insomnia happens) to make that goal come true. 60% done with editing chapters so far. If you are interested in being put on the list to get the news shoot me an email at carpeprofit@gmail.com

When you want to make a change in your life it starts with a positive mindset first that you can do it and second an action daily to make that change happen. So if you want to see change do it today. I even recommend a post it note on your mirror for the morning to ask yourself what are you going to do to change your future today? The work has to initiate within you! You control your future with your daily decisions!

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon. If you want me to email you as it is available shoot your name over to carpeprofit@gmail.com.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. There be an open house for just $8.88 for a week to test the full premium services starting Feb. 6th.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Jan 22, 2017 | Uncategorized

These stocks, when the timing is right have rocking momentum to the up and downside. This all comes from being lower float stocks and typically having a highly shorted float percentage to them.

SGY Float :4,924,000

ETRM:1,613,000

GLBS: 3,662,100

ZYNE:6,537,500

When the momentum starts the chart as you will see tends to spike at open, have a nice little pullback and then surge again before lunch. Here are two different stocks that ran this week and the similar set up that I am talking about. SGY on the left and ETRM on the right

As you can see there is momentum right off the bat typically due to news of some sort and the inital shorts that see this happening and start to buy to cover their positions. So the upward movement happens with shorts buying, their stops being executed and also new buyers with momentum. Then you have the new buyers that take some profits and some shorts that get on board. The stock sells off and finds a new support, consolidates and runs again with many times surging through the previous high and burning more shorts in a squeeze.

As with GLBS from last week I was long from 6.06 on Friday then it was halted with news that was speculated from their prior press releases to dilute the overall number of shares of the company and drop the value of the stock. Well the news released after the halt said that this secondary financing was not going through and although the company in the long term needs to find financing the immediate drop in share price was not due to happen. More than 50% of the float was short from Friday and when the fear set in on Monday it drove it right back up and then some.

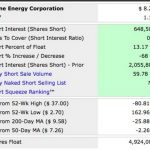

The same has been true for SGY going into friday. On Thursday there was news that the company was a good long term value buy and the share price rose some. Then the short float that sold the chart on Thursday was 59% of the volume. I find these numbers with shortsqueeze.com premium service. To me it is well worth the small monthly fee to see the % short sold of the volume from the day before. This is a sample of the information that I am talking about. SGY Thursday data on left and Friday data on the right.

I will definitely be watching SGY going into Monday for more squeeze potential because it has held its value even with 48% of Friday’s volume being short. That means that roughly 2.7 million shares wer sold short on Friday. It does not take into account the momentum buyers and sellers that rode it up and took profits along the way. The stock has been a multiday spiker when you look left in the chart and when the momentum is there to the upside it can cause major runs. And this stock has been recommended as a good value stock for the longer term investor and it has seen two good days of upward momentum and the value investor would love a nice 30% return like this has been showing lately.

These stocks are great because you can take large percentage moves in a day, but the action is very fast and hard to set a hard stop as they tend to get executed by Market Makers with the volatiliy very quickly.

I honestly trade these stocks uber conservatively and take profits way too soon because I am cautious about them pulling back. And what goes up can go down just as fast in the low float world. When there is demand it runs up quickly and when people sell and want to dump their shares it can go down just as fast if not faster. I try to always sell into strength as it is easier to get a fill with buyers. When it is dropping down it can be hard to get a limit to execute if you are not finding people to buy.

Now you ask how do I find these stocks that are moving like this. Well it is a custom alert alert that I use with Trade Ideas. It is amazing software and you can create alerts for any style of trading. Everyone has their own type of alert system that they enjoy using whether it is an email service, squawk service (like Benzinga) or text alert or chat room. I enjoy the audible part of Trade Ideas as I know I’m an audbile learner and I can easier type the ticker without having to filter through alerts visibly and take my eyes off my charting screen.

Everyone at some point or another gets the news to find stocks moving but it is the ones that are able to find them in the beginning of the movement that are at an advantage. Being late to the party can end up in losses over and over to the long side. These short float stocks are great when they crack if you can get shares, but be cautious of the the short squeeze against you.

If you have been following me for a while or just new to following me I am 2.5 weeks away from the estimated due date of my second daughter. I am working very hard to get my book off to the editors before she arrives. In the meantime before delivery I will keep all of the blogging and tweeting and videos up as long as possible, but there might be a couple weeks where I take a break to take care of the new bundle of joy. I have a passion for stocks and sharing and helping others grow.

Our own successes come from the energy and dedication we put forward to making our dreams reality.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon. If you want me to email you as it is available shoot your name over to carpeprofit@gmail.com.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. There be an open house for just $8.88 for a week to test the full premium services starting Feb. 6th.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Jan 14, 2017 | Uncategorized

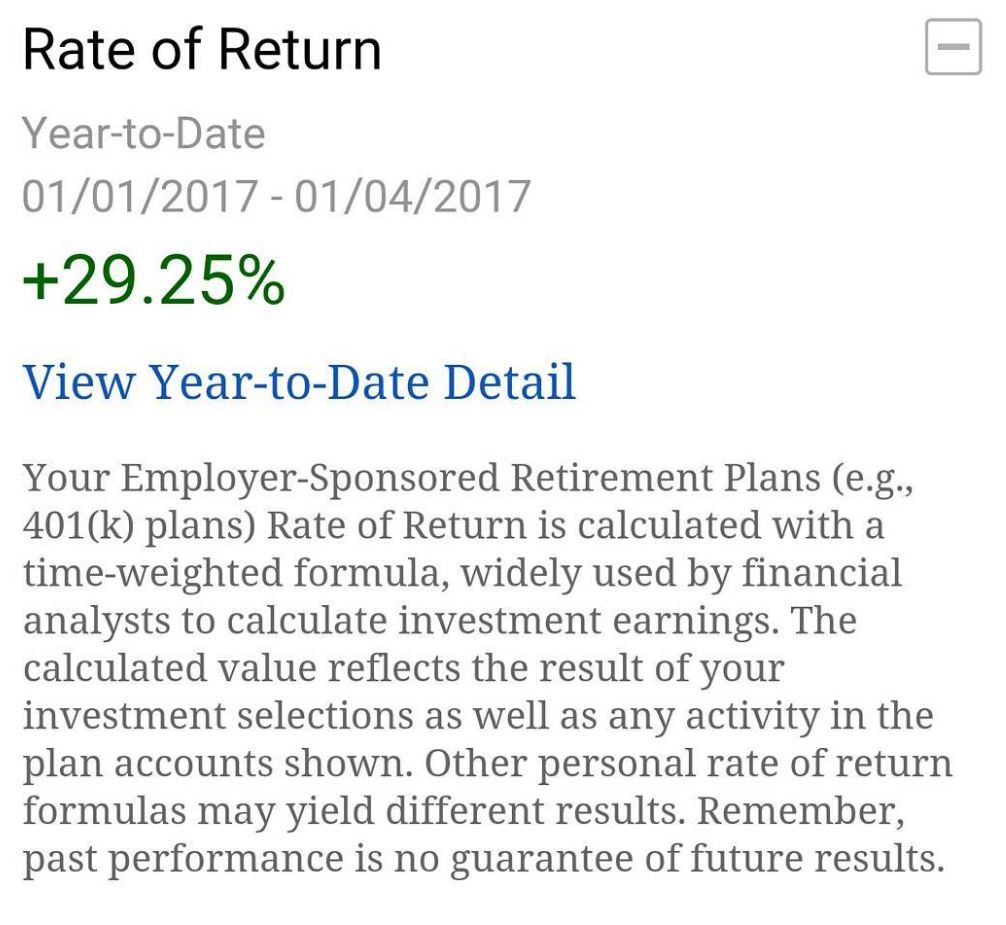

In the past year of trading I also discovered 3x ETFs or ETNs to really grow my 401k. Last year from Febuary to June I gained 100% in my 401k trading UWTI and DWTI. The ETFs are great because the 3x means that the volatility and price action tends to be 3 times as strong in the trend direction.

Now this can be quite a benefit as long as you are on the right price action. If you get caught in the wrong direction it can also eat away at capital very quickly. So I what I learned is to make sure to protect that capital with a stop.

I will usually go in with a bracket of a trailing stop on the sell side and move it tighter once I’m in the money or above my entry price. I like to do that to make sure that I lock profits and protect capital.

Last year oil was at all time lows and so trading DWTI and UWTI was very profitable. This year I saw the all time high in the price of Natural Gas and with my RSI extreme knowledge and knowledge general of price action I traded DGAZ and UGAZ.

I took a nice 29% profit overnight when the Natural Gas price pulled back from highs however I now know I was conservative and could have made almost 85% in 4 days. Once it looked like DGAZ was at an extreme I went long UGAZ and my entry was actually one day too early.

There is always room to learn something new and how to trade them. I like ETFs for the 401K as I like to just “crockpot” the trades or swing them with the bracket orders. The natural gas numbers I know are now announced every Thursday at 1030 EST and usually there is an extreme reaction one way or the other based on the news. As I see the extreme happens like a stock spike and then you can trade the reverse to get a quick intraday trade.

The same occurance happens when Oil numbers are announced on Wednesdays. For now these are the only two that I have traded and I am starting to learn how they react to news and price action.

As with stocks once you start to study and action see the patterns of that particular financial instrument you can see ways to grow your account where your risk is mitigated.

I am definitely not the be all master of stocks, but I enjoy helping to share my experience to help others in their journey. When you put in the work and continue to learn you can only get better. I’m also someone that believes the more you share the more it comes back to you and I look to help others succeed. There is great satisfaction in hearing that others have profited or learned along the way with a little motivation from my journey

This week has been a busy one with finishing up chapter one on the book and 9 more to go before sending it off to the editor. I can’t wait to share it with all of you. IT is not just my experience, but others as well which is what really helped me in the beginning.

I am officially 3 weeks away from my little one’s due date on Monday so I might be a little MIA once she is born to give you a heads up. With my first I had high blood pressure and had an emergency c section 1 week early, so praying this one has no issues and she is born naturally. Out of my control like market price action and I will react based on what is presented to me.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon. If you want me to email you as it is available shoot your name over to carpeprofit@gmail.com.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Discount Code for Sunday and Monday for MLKDAY for up to 20% off and there will be an open house to test the full trial starting Feb. 6th. Stay tuned for link for open house.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.