ETFs & $DWTI, $UWTI $DGAZ and $UGAZ to grow my 401k

In the past year of trading I also discovered 3x ETFs or ETNs to really grow my 401k. Last year from Febuary to June I gained 100% in my 401k trading UWTI and DWTI. The ETFs are great because the 3x means that the volatility and price action tends to be 3 times as strong in the trend direction.

Now this can be quite a benefit as long as you are on the right price action. If you get caught in the wrong direction it can also eat away at capital very quickly. So I what I learned is to make sure to protect that capital with a stop.

I will usually go in with a bracket of a trailing stop on the sell side and move it tighter once I’m in the money or above my entry price. I like to do that to make sure that I lock profits and protect capital.

Last year oil was at all time lows and so trading DWTI and UWTI was very profitable. This year I saw the all time high in the price of Natural Gas and with my RSI extreme knowledge and knowledge general of price action I traded DGAZ and UGAZ.

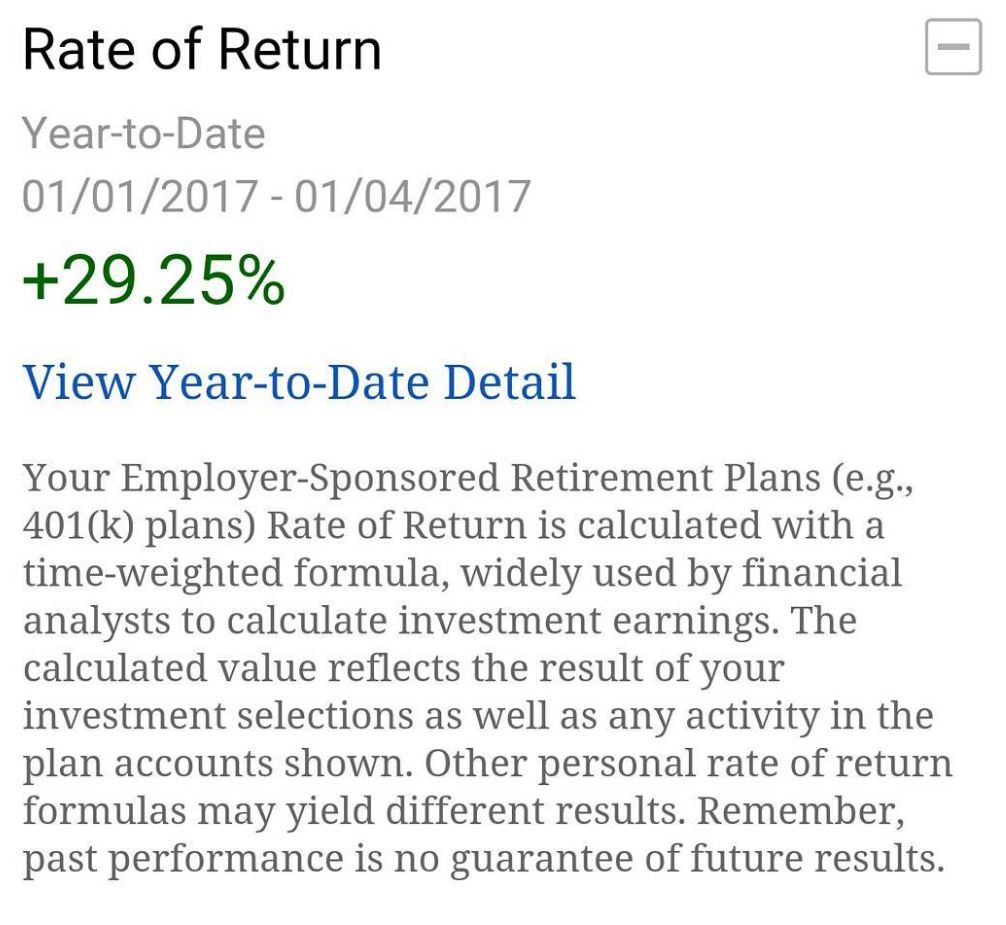

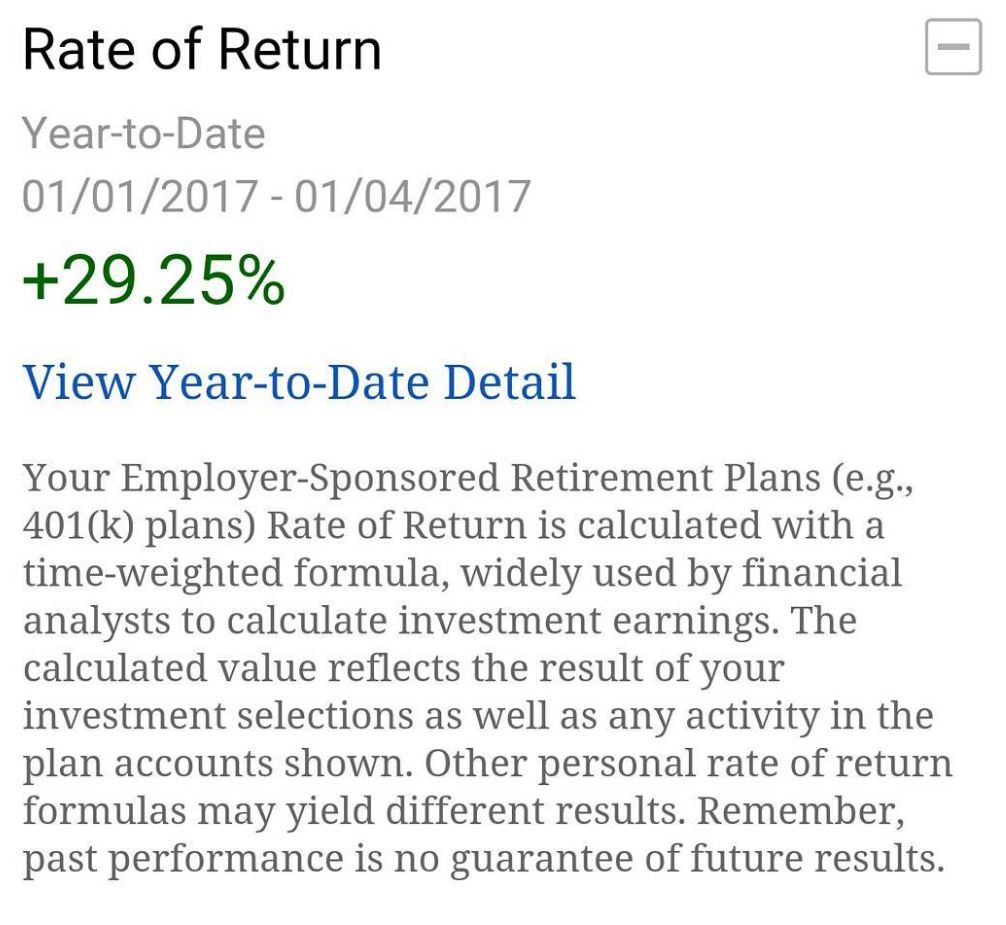

I took a nice 29% profit overnight when the Natural Gas price pulled back from highs however I now know I was conservative and could have made almost 85% in 4 days. Once it looked like DGAZ was at an extreme I went long UGAZ and my entry was actually one day too early.

There is always room to learn something new and how to trade them. I like ETFs for the 401K as I like to just “crockpot” the trades or swing them with the bracket orders. The natural gas numbers I know are now announced every Thursday at 1030 EST and usually there is an extreme reaction one way or the other based on the news. As I see the extreme happens like a stock spike and then you can trade the reverse to get a quick intraday trade.

The same occurance happens when Oil numbers are announced on Wednesdays. For now these are the only two that I have traded and I am starting to learn how they react to news and price action.

As with stocks once you start to study and action see the patterns of that particular financial instrument you can see ways to grow your account where your risk is mitigated.

I am definitely not the be all master of stocks, but I enjoy helping to share my experience to help others in their journey. When you put in the work and continue to learn you can only get better. I’m also someone that believes the more you share the more it comes back to you and I look to help others succeed. There is great satisfaction in hearing that others have profited or learned along the way with a little motivation from my journey

This week has been a busy one with finishing up chapter one on the book and 9 more to go before sending it off to the editor. I can’t wait to share it with all of you. IT is not just my experience, but others as well which is what really helped me in the beginning.

I am officially 3 weeks away from my little one’s due date on Monday so I might be a little MIA once she is born to give you a heads up. With my first I had high blood pressure and had an emergency c section 1 week early, so praying this one has no issues and she is born naturally. Out of my control like market price action and I will react based on what is presented to me.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon. If you want me to email you as it is available shoot your name over to carpeprofit@gmail.com.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Discount Code for Sunday and Monday for MLKDAY for up to 20% off and there will be an open house to test the full trial starting Feb. 6th. Stay tuned for link for open house.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.