This week was a rough one. I had 3 Red days and 2 Green Days. Overall I ended up with a positive week. Slowly but surely I’m on my way to 6 figure salary. January I had $3001 in profits and $6158 for the month of February, so I’m only shy $90K+ to make my first $100K. Little by little everyday with a fresh positive mindset.

This week was rough starting off Monday with a fever, but freedom to sit at my desk with my daughter at daycare. Unfortunately all week until Friday I had a nasty head cold that filled my sinuses with congestion and I think distracted me from making the best trades possible.

I found I did not have the best executions and rushed trades or tried to anticipate the moves. My biggest loser was a short $RAX that I let get out of control. I didn’t cut the loser quickly. Now in writing this I read it received a forth downgrade to strong sell. Murphy’s Law that since I covered now it will drop like $GLUU last week.

As many people have asked me how I find my trades. I start my day looking for Gappers on Equityfeed (at the bottom of their page you can try it free for 14 days) in the morning. I like that Equityfeed will let you look at yesterday’s ending prices as well as the present day action. I check to see if the gappers up from the night before have continued with higher volume. My morning gappers are run with a scan of price .5-100, Volume over 100K and trades over 100. Sometimes on low volume days I go down to 75K or 50K to get at least 5 gapping up and gapping down. I use that to get an idea of stocks from the open.

Something I have learned this week in particular is don’t anticipate the moves let the stock dictate the reversal from open. I check on level 2 to see where the strength is located and also the RSI and the time. I find anywhere from 950-1015 the stocks reverse pretty strong in the other direction and can be an easy way to profit.

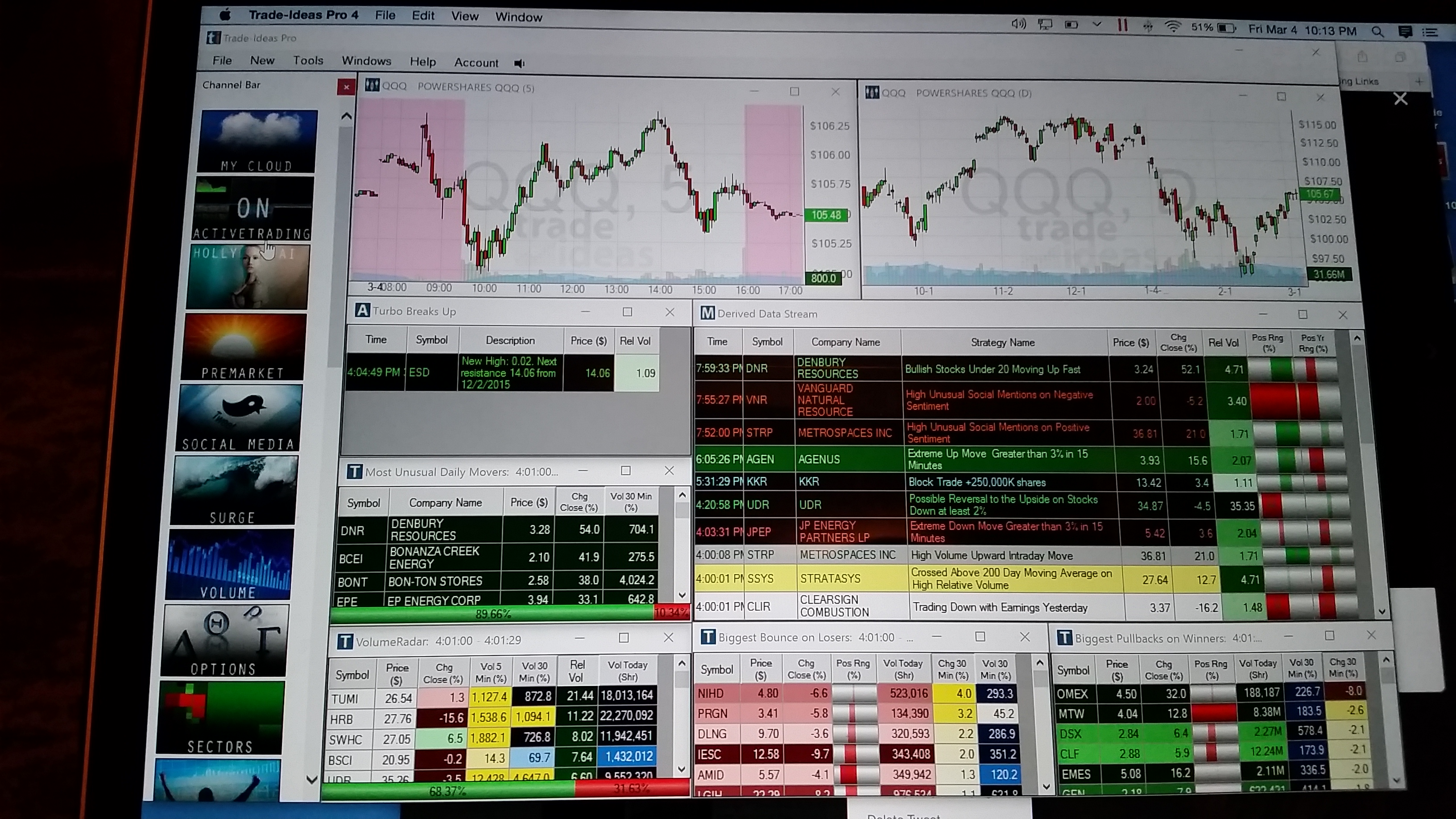

After my initial reversal play, I check on Trade Ideas. Trade Ideas is absolutely amazing. You can set up your own alerts or there are 21 preset scanning pages from channel bar on the left as well as the Artificial Intelligence Holly. Here is one of the preset scanning pages, Active Trading as pictured below. This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.

This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.

I found $SM from Holly, $CENX and numerous reversal plays. Definitely worth checking out the site. On the bottom of the link to Holly page you can sign up to test the demo mode. Check it out.

As always I’m super thankful to be able to have learned this skill and I’m happy to share and help others. If you want to know something please feel free to ask here on on twitter @Jane_Yul.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

I would love to learn how to do this, where to start, etc. I have Sykes DVD that in watching. Any other guidance would be great. Tired of losing at this game. Want to learn. Thank you.

Yan you are starting off the right way by studying with DVDS. It is important to study the action of a live chart as well. Honestly it started to click once I saw the trends to the charts. To me I assimilate it to going to college and learning your major and then you have your internship where you apply what you have learned. Paper trade at first (writing your trades on paper) until you are consistent. 90% of people that try lose because they don’t do the work to become profitable. So study hard and practice on paper first. Learn level 2 and chart trends. The more you look at charts you can see what trade has a good reward to risk. It becomes almost second nature. I hope this helps. Don’t get discouraged just keep trying and studying.

Hi Jane-

This blog is great. Very informative. I find it interesting that I found Ross and Warrior Trading too. Did you learn to use Trade Ideas from him? He too uses the Gap Scanners every morning for his Gap and Go strategy. Do you still subscribe to their chat room? I’ve also noticed that you are in Tim’s chat room as well. Do you find the chat rooms helpful? For me, as a new trader, I’m finding them a little distracting; most likely because I’m still trying to figure out what I am doing.

Sorry for the many questions. I just really excited when you mentioned Warrior Trader a few blogs back.

Thanks,

Mario

Yes I learned about trade ideas through a free day on warrior trading. I subscribe to their chatroom and I am also in Tims chat as well. I do find there is a lot more noise in Tims chat room. For me the visual aspect of the warrior trading chat room is better for me. I do the gap scanning myself in the morning on equity feed through attributes that I have specified myself. I am one that believes there is value in both chat rooms. They both have their strengths.

Agreed. They both have their own advantages. I’m sure I will learn how to better use them as I get better at trading.