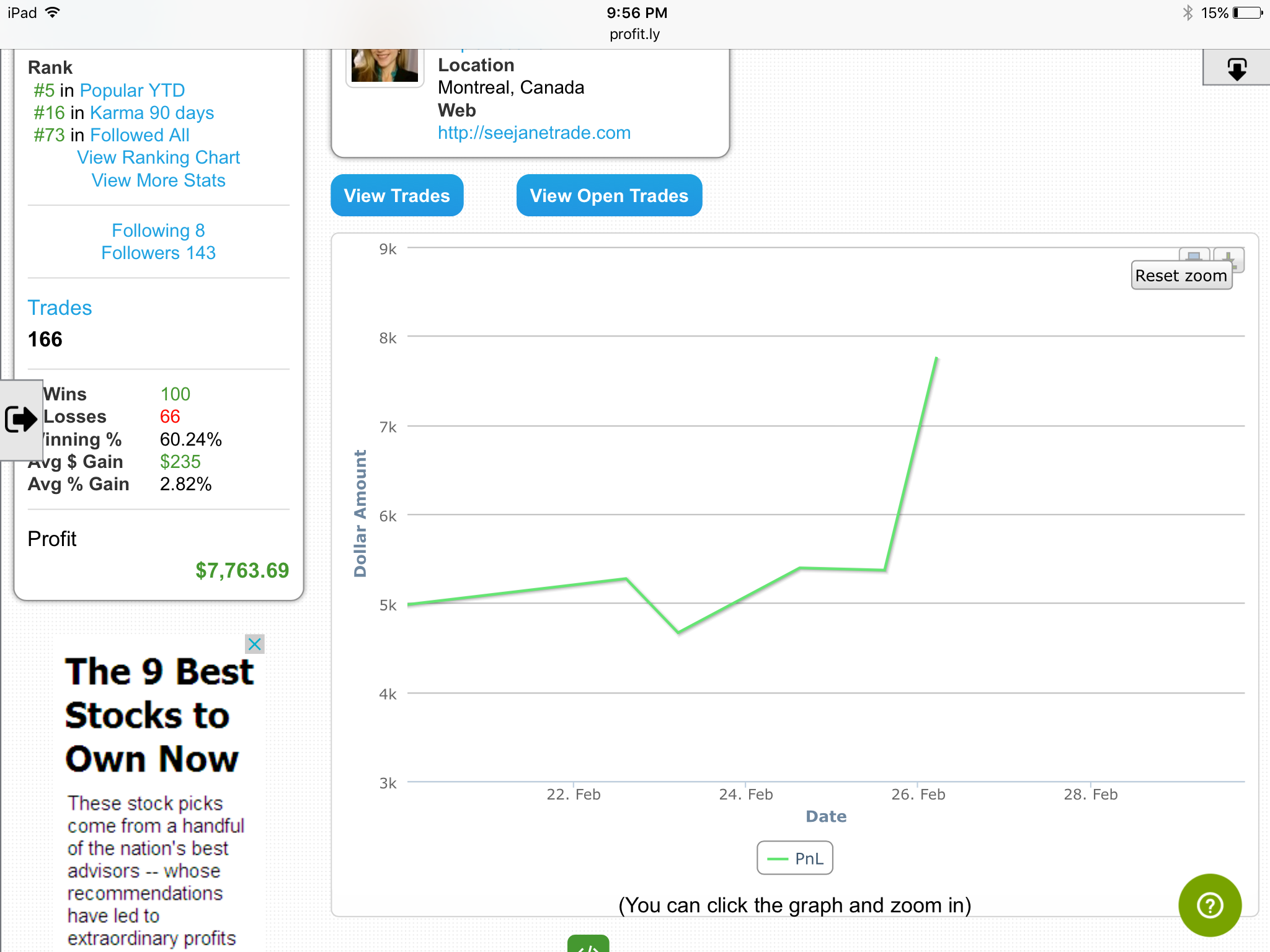

Here are my trades and profit chart for the week.

This week brought me back to the beginning of my day trading career. My daughter was unfortunately home sick 4 out of 5 days this week. The proof of my attention to the stocks was reiterated this week.

Monday a gain 586, Tuesday loss 608, Wednesday gain of 728, Thursday a loss of 25 and baby free day a gain of 2300+. I know I should really call it quits when I have her home sick. I coordinated her naps to the open, but it wasn’t enough. I was still distracted.

I believe as a result of being distracted I went outside my normal routine and it went against me. I tried to hold earnings overnight and a loss happened.

I tried to go long $GLUU and it went against me so I thought it’s up 100% and it will go back down after news, so I shorted it. Well I should have covered Thursday afternoon as soon as I was alerted that Tim Sykes bought.

Covered for a loss this morning to protect myself from a short squeeze like $KBIO. I am seeing that the reversal plays and the earnings winners are the bread and butter that I need to stick with.

The Force of Momentum

I honestly love seeing the waves of momentum in the stocks and ETFs. Today was also the first day I day traded UWTI and DWTI. Made more than 10% of investment. +$1300. The week ended up being roughly +$2600 making the majority of February almost twice the profits of January.

I’m so very thankful to have found this passion for stocks. Trading from home allowing me the time to be present for my daughter is priceless. Honestly Tim Ferriss’ book the 4 hour workweek helped me to change my mindset to work for myself. I’m also a fan of The Secret and find the stock market truly has abundance for everyone to win and be profitable with the work.

If you are considering trading for a living be aware it doesn’t happen overnight. It takes time to study and learn. Best thing I can recommend is paper trade until consistent. I wish I did before then I would have $6k more to trade with, but I consider it trading tuition to learn.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Hi Jane, I like your blog and your dedication to be a successful trader. I noticed you’re trading stocks in different price ranges. Can you please write a post explaining what criteria you use when selecting what to watch and what to trade. Great Job! Good luck!

Maxim I hope my last blog post helped to answer your question about how I find the stocks I trade. Let me know if you have more questions. Study Hard and wishing you lots of profits. There’s enough for all of us.

Thanks! It definitely helps better understanding your trade sources!

I am a 14 year old kid currently living in Houston, TX and I was wanting to look into penny stock trading by the problem is I’m only 14 so I have really no money to trade with. Now your probably wondering im not determined maybe becuase I’m only a teen but I really want this becuase me and my mom have been struggling financially wise for our whole lives we’ve never had our own good apartment my mom has never own a new car and we can’t even afford to buy groceries sometimes. And I was wondering if there’s a way I could get tought how to trade penny stocks?

Practice first on paper until you are consistent then once you are doing well get you mom’s help to open an account. It will take some studying first to get the knowledge to be profitable. Way to go in trying to help your family very honorable! Good luck and study hard

Thanks for sharing this perspective… am just starting and it’s like drinking from a firehose, but it’s encouraging to see where you are a year later.