I have to say Thank you to you. I began my real journey of day trading intensely day to day almost one year ago. It was in September that I started to devote each morning to my studies to become a successful day trader.

The statistics of 90% that fail didn’t get me down. I knew that I can do anything I put my mind to and with hard work become successful in that 10%. So I was watching stocks at open to study the charts to see trends. Just like many individuals look for overextended charts to the upside I thought to myself I bet there is a trend to the oversold stocks.

So began my Excel studying of stocks that sold off big with earning losses or negative press. I entered the stocks and I tracked the price action at open and close for 5 days. I began to see trends. And then I began to see trends on certain days of the week.

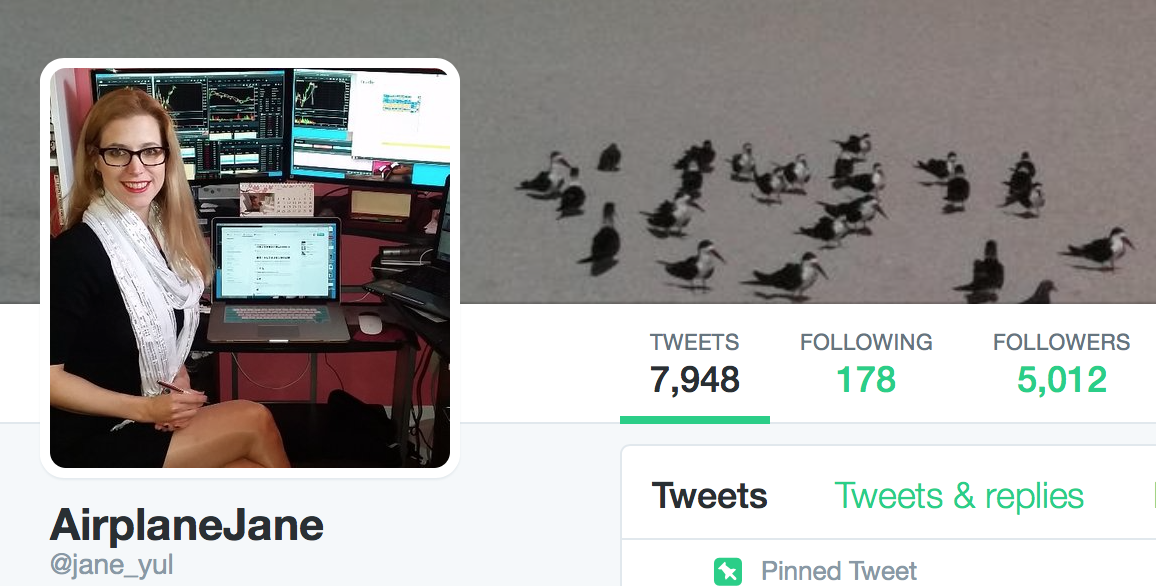

At this time I was brand new to Twitter I think I maybe had 5 followers. I never thought me as a stay at home mom would have a followers interested in what I had to say. I still remember the day I broke 10 followers and told my husband and then 100. It was exponential growth like a short float stock. Today I broke 5000 and I’m happy to help each and everyone of you.

Having everyone interested helps me to become a better trader. I want to be transparent with my entries and exits, wins and losses and psychology behind it all. When I was just beginning I remember reading about the losses other traders had. There is so much to learn from each loss and not just a negative.

If you continue to make the same mistakes after you have analyzed your trades you are ignoring your own weaknesses. Another very important part of my trading journey has been my trading journal. I write down every trade with my entry and exit. I then review my trade vs the price action of the day. Analyzing both good and bad trades helped me improve.

I also took the time to read books about traders. The Market Wizard books and Momo Traders are great reading material which really helped me to learn from individuals compiled together in one place. This literature also inspired me to work on a book of my own which should be off to publishers for release in 2017.

I say all of this as a thank you, because holding me accountable makes me perform better and want to share more to help others. I am a mom and love teaching my daughter and being a positive influence in her life and I like to help all of you too. When I was just starting off it was extremely overwhelming but I continued my studies on a day to day basis. With perseverance you can do it too.

From past blogs you know that you have to find a style that fits you. Everyone’s risk tolerance is different and so is their timeframe for a trade. Some people love the adrenaline rush of a 1 min trade and some like a timeframe of 1 month spending most of the time away from the computer. It is up to you with practice that you will find your niche.

I will be updating my Profitly profile to reflect all my trades from this week. Honestly this week I learned more about myself. I had set up some swing trades before going on vacation and they have taken more time to perform than I anticipated. I got frustrated and closed some at a loss to have more capital to trade intraday. I know that I really enjoy the intraday work usually from 9-12:30 and then the rest of the day for family and life and maybe a visit back to my desk for power hour.

As you can tell the learning curve to success does not happen overnight with stocks and day trading. My husband has been watching videos and listening to my advice and now his paper trading is becoming successful because he studied first. There is also a learning curve involved with the software and that can’t be rushed either. So bottom line is learn it right from the beginning and don’t waste money in the market with losing trades. You are expected to lose a bit in the beginning but the more you look at risk/reward for each trade setup the more successful you will become.

Someone asked me about stops and stop losses. I use stops many times once the price action is in the green for me. Most of my trades are at what appear to be an oversold area of the stock. As the price action moves up I set a stop to protect profits. Sometimes I get stopped out before the upward momentum is complete, but I’m not upset because I locked a profit. A loss can be frustrating but a profit is never frustrating as it was more than I started with in the morning.

Thank you again for inspiring me to inspire and help others.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Thank you for sharing all of your information! Always learning something from you everyday!

Keep up the good work!