Stock Earnings Calendar

When it is earnings season day traders get excited. It increases the volatility in the market to open up more trading opportunities. The stocks that are reporting earnings before the open or reporting earnings after the close tend to always have more volume and activity.

Today July 25th is in the earnings calendar one of the biggest days of the earnings season. I love EarningsWhispers.com for seeing the upcoming earnings in both calendar format and also individual breakdown with expected earnings results.

Here is today’s earnings Calendar. You can see this morning before the bell there were 156 companies reporting and 152 to report after the bell. Not only are there 152 reporting but some of the strongest stocks in the market such as AMZN, GOOGL, GOOG SBUX, INTC,

SPY ETF Holdings

These are part of the SPY and QQQ ETFs and when they have a big gap it can affect the market overall. To give you some idea of the strength that they have in affecting the market here is their weight in the ETFS.

- $AMZN is 3.29% of the $SPY and 10.31% of the $QQQ

- $GOOG is 1.39% of the $SPY and 4.17% of the $QQQ

- $GOOGL is 1.36% of the $SPY and 3.67% of the $QQQ

- $SBUX is 0.44% of the $SPY and is 1.27% of the $QQQ

- $INTC is 0.94% of thh $SPY and is 2.67% of the $QQQ

I use ETFdb.com for my stats. A great resource to find out the holdings in ETFs and what ETFS hold a certain stock and the weight within the ETFs as well as overall shares held.

So overall we have 7.42% of the $SPY ETF reporting tonight and 22.09% of the $QQQ ETF reporting tomorrow. So this could cause big moves in the indexes tomorrow and the market overall. So how do you possible trade this into earnings

Options Trading Strategies Earnings

As Ricki the Options Whisperer from the Java Pit Trading room says, Options have options. There are 101 different ways to trade options, but this will help you with some simple strategies and concepts into trading them with earnings.

The number one important thing to remember with options into Earnings is that the Implied Volatility goes up and so does the cost of the options. Below is a screenshot from Think or Swim and their estimated Market Maker Move in Yellow.

So you see that the estimated Market Maker Move is 68.345 points. This could be either a gain or a loss with earnings. There are never any guarantees in trading.

In option chains you can see that the Market Maker Move is priced in with the premiums on the options so if you were to go outside of the Market Maker Move you would like be making better money if it moves further.

So the expected range for Amazon to report is 1993.1-68.35 =1924.75 or above 1993.1+68.35 = 2061.45. This is a very wide range and sometime AMZN can move over 100 points in a day.

Now options trading overnight into Earnings is a Gamble. There is no way to know where the price will open. The market will decide the direction. Many time the larger traders in the market already have a hint of what will happen and make their trades days or weeks before the report comes out.

I can’t advise you what to do in trading, but in my opinion unless you want to place a lotto trade into earnings for profit knowing you can lose 100% It is better to trade up to earnings with options and then the stock the day of earnings.

Options as Insurance

If you are a longer term investor there is always the possibility to buy options as insurance for your position. So say you have 100 shares of AMZN that you have been holding as it has been gaining in value.

As a vertically integrated company there has been a great amount of growth not only in the Retail Sector but also in their cloud services and now airline and robotics and potential crypto currency.

Back to insurance for your position. So you have your 100 shares and you are worried potentially about the DOJ saying they have to be broken up, or Bezos having to sell shares with his divorce or whatever the cause. Earnings is tonight and you want to make sure that those shares are protected in case of massive drop.

Knowing that the Stock has a $68 projected move you could buy cheaper options to protect yourself. You could do that on $AMZN options or also on $QQQ options as you know that it is 10% of the ETF and could case a big move.

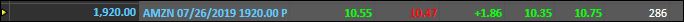

You could buy 1 put contract on $AMZN expiring tomorrow Juy 26th at 1920 in case it had a bigger drop. The cost of that option in writing this would be 10.5 roughly or $1050 and if you had your 100 shares drop down there roughy $73 that would be a $7300 loss.

Another potential option would be an ETF that has lower cost options and might still have a big potential move. In going through the ETFS holding AMZN that have weekly options QQQ , XLY and IVV are potential option considerations. We know AMZN is 10.31% of QQQ, 23.53% of $XLY and 3.3% of IVV.

$QQQ is expecting roughly $1.93 move into tomorrow, $XLY is expecting roughly $1.26 move and $1.6 for $IVV into tomorrow.

Now we can look at the costs for that move for $QQQ to 191.5 puts for roughly $2 move it would be roughly .28 cents for $XLY a $1.26 move would put us at 122 puts costing .21 cents and finally $IVV drop would put us at 300 put roughtly .25 with wide spreads.

It looks like $XLY might be the best option to hedge in this scenario as the puts are less expensive and you could buy 50 contracts if you wanted to equal the cost of 1 AMZN put contract.

All thoughts on how you could possible protect you investment with $100 or 5 122 puts on $XLY expiring tomorrow. And as we know insurance in life is only good when you use it. If the stock gaps up you will be gaining that $100 on your 100 shares in a $1 gap up. This is the protection if you have a gap down.

Trading Options after Earnings Reporting

First of all if you have ever traded options you see that the implied volatility and cost of the options are always higher in the first couple minutes of the market open with the volatility of the stock. Once the stock settles into a direction the prices of the options drop.

Well on Earnings Day that implied volatility from the day prior drops back to normal morning open. If the market makers move was 68 pintsand it moves 60 points you might even see that you have a bit of a loss depending on what option you bought.

In the above example of buying out of the money options as insurance the implied volatility will only cover the drop and really become profitable when those options become in the money.

There are other options to trading options into earnings, with butterflies, strangles, straddles and more. Some even selling close up options and buying out a week. The abilities to use options to trade is limitless.

Bottom line is trade with proper risk management and be cautious of holding through earnings and prepare yourself for that potential move that is coming in the market tomorrow.

Tonight could be a pivotal night in the direction of the market. It could catapult is into the next new highs or it could be the beginning of the drop that everyone has been talking about.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you would like to be in Training Pit with me sign up here or if you want one on one training you can email me jane@thedarkpools.com You can contact me here or Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use tradingview.com which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.