by Jane | Nov 2, 2016 | Uncategorized

I’m very excited to share my experience and inspire more women and men to trade. Women actually make better traders as we are less risk averse. I will post more details as they become available. This idea all started about one month ago when Dan asked me to share my experience to others as he has seen my progression over the past 8 months. For those interested in signing up you can go here.

It was back in March when Dan Mirkin CEO of Trade Ideas first reached out to me via Twitter about trying out Trade Ideas after he saw my budding day trading career. He is one of the few that supported my desire to succeed as a day trader from my beginning.

It has been quite a journey so far in the past year as many of you know. Changing my career to be a day trader. Having some amazing months and days in trading and then I found out I was pregnant with our second child. An amazing blessing to have another daughter on the way for her introduction into the world the second week of February. Then I saw my monthly profits decrease over the past two months.

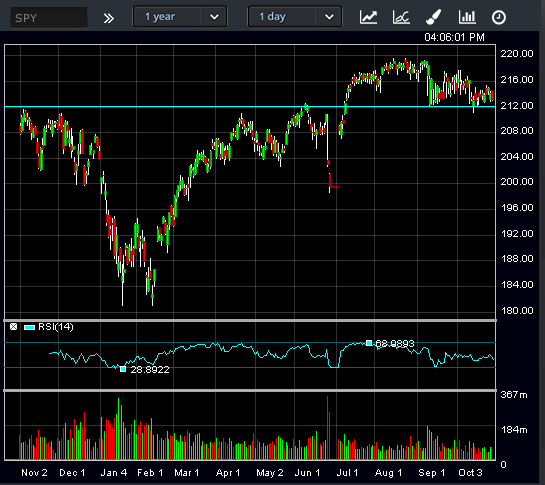

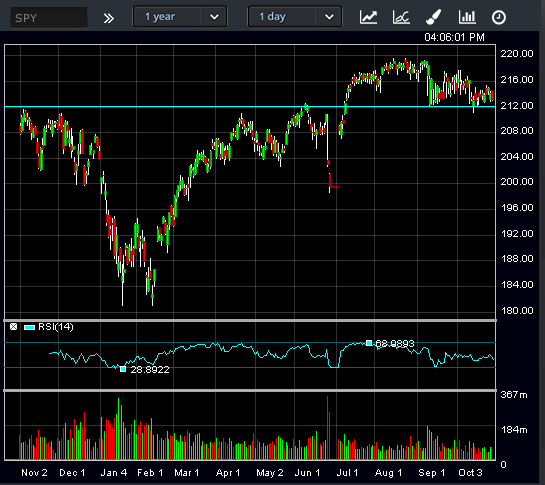

The past two months were definitely not as prosperous for me. I saw my strategy was not creating the same profits as it did before. My husband encouraged me to step away from the market when I had a red week which hadn’t happened in a while. In that time I looked at the year chart of the SPY.

As you can see it was roughly the past two months that the market has been bearish. I posted this a couple days ago on Twitter and advised that when we break the 212 support we will definitely be in a bearish forming market. Sure enough the momentum is continuing downwards with the SPY closing down at 211.01 below that 212 support.

Now there isn’t a reason to fear a Bearish market it just means that the strategy that works really well in a Bullish market won’t be as successful in a bearish market. So this means it is time to adapt to the market. This adaptability will create a forehand and backhand to your trading style . I have been predominantly a long biased trader but I see from the past two months and today that longs are not performing as well as shorts. There is more strength on the selling side intraday as roughly 80% of the market will follow the major indices. So my bounces that I was trading aren’t bouncing as long and as strong with more sellers in the action.

Yesterday was the first day I really flipped my strategy and went short AKAM with clear indicators to me that the momentum was changing. 3 days that showed slowing volume even though the price was increasing with a top of a new 52 week high. Then yesterday it sold off from the 52 week high and day one where it closed red and Today was the second red day selling off another for a daily price drop of 1.80. I did not trade it today and I’m learning that just as there can be a 3 strong up days it seems that there can be a second stronger red day. Time time to study the new market and analyze stocks reactions. I absolutely love the market and this job.

I saw this setup and had so much fun shorting. I shorted more today….INCY and SCAI. The shorts performed well. I also saw a bounce setup for YRD and it never bounced. and I ended up red for the day. Overall I’m red on the week by a couple hundred dollars but I see that it is because my old strategy just did not function.

There is always something to learn everyday in the market and if your trades are not working it is time to analyze the trades. That analysis can only help you and that is why I have partnered with my good friend and fellow female trade Mandi Pour Rafsendjani to create our 6 week Day Trading and Psychology training starting November 13th. You can see a sample of our encouraging style with this free webinar.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Oct 19, 2016 | Uncategorized

Some of the most difficult days in trading are the imperfect ones where your trading decisions for that day are wrong.

This morning I sat down late at my desk because my daughter was being a rascal at school. I am usually at my desk by 9:15-917 but today it was 9:22 and I was opening up my software. I opened it up and it began working and then nothing. The internet shut down on me and it took me a couple minutes to figure it out.

I immediately went and rebooted the router and the modem. I was then able to open up my software after market open and I was able to see that my two stocks I was long overnight were gapping up. I felt unprepared for the day, out of control because I couldn’t set orders to protect the profits. If all was working at open I could have locked my $1k profits in the first 5 minutes of open. I should have sold immediately once I had the internet up instead of getting caught up in my head with emotions.

You can ask my husband I was pissed yelling at the computer. I am usually pretty good about not being frustrated when the internet goes down because I have set up an exit plan already. For some reason this morning that was not the case. I then got held up in the emotions and just watched the market so as to not make a revenge trade or irrational trade based on emotion.

I watched both REN and ACIA follow the way of the SPY. They both went down and I was stuck in the emotions and did not protect myself. My day was thrown off by emotions. By the time that I had calmed down to act rationally it was now 11 in the morning knowing the trend of the reversal throughout the day I did not panic sell at the lowest point. I watched them and waited to minimize my losses.

I was patient with ACIA and locked a nice little profit with a swing entry of 91.93 and an exit at 92.47.

I sat and watched the market today not trying to revenge trade. I was waiting for perfect setups. I saw PTCT down 50% in 2 days and the volume was slowing and the time of day was right so I bought a small position at 7.22. I proceeded to drop down to 6.90 and bounce. up to 7.60. When I saw the resistance at 7.40 I sold as it could have easily fallen back down.

I felt more confident with my trades and then saw BANC on my RSI scanner at the low extreme. I saw it drop from 16 to 15 and watched further and opened a small position at 14.08. It was testing 14 and forming a 5 min green candle so I added some at 14 when it went down and bounced. Then it dropped further to 13.15 and I added some at 13.25 when it bounced and looked like it was reversing. My average was 13.75. My error with BANC was trying to anticipate the reversal instead of letting it show itself to me.

The emotions of the day got to me and I should have stayed out of this trade. It was a revenge style trade and not cutting the loss early. In the future when I’m that frustrated it is a sign to step away and go enjoy the day. The internet is something I cannot control, but my reaction to the situation is controllable.

My frustration came from wanting to be able to provide the daily profits to my family to support them. In the future I will remind myself the internet is out of control and I will walk away. Exit the trades and a turn the page until the next day.

As I always say each bad trade provides a learning experience. We have to look at why we execute a losing trade the way that we did and what we can do better in the future. I admit my errors and strive to improve on them. Losses are never easy and when you examine them you can see what caused your decisions at that time.

To become a better more profitable trader make sure to examine your wins and your losses. Each one will provide insight into what you can do to improve your trades. All trades come with risk and reward and the goal is to stop the risk from becoming too large.

BANC will be on watch for tomorrow with the speculative Seeking Alpha fraud article written by an author that is Short.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Oct 6, 2016 | Uncategorized

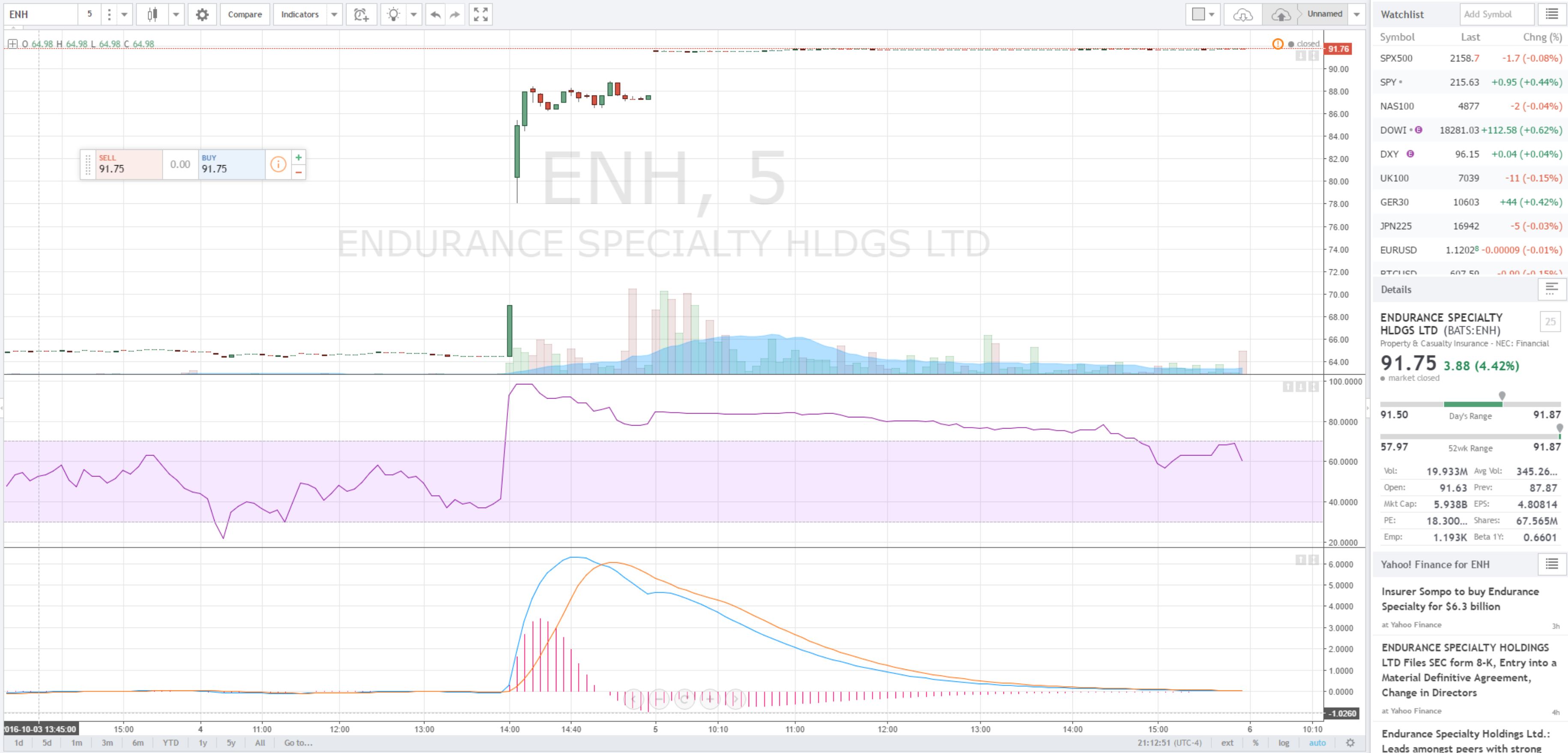

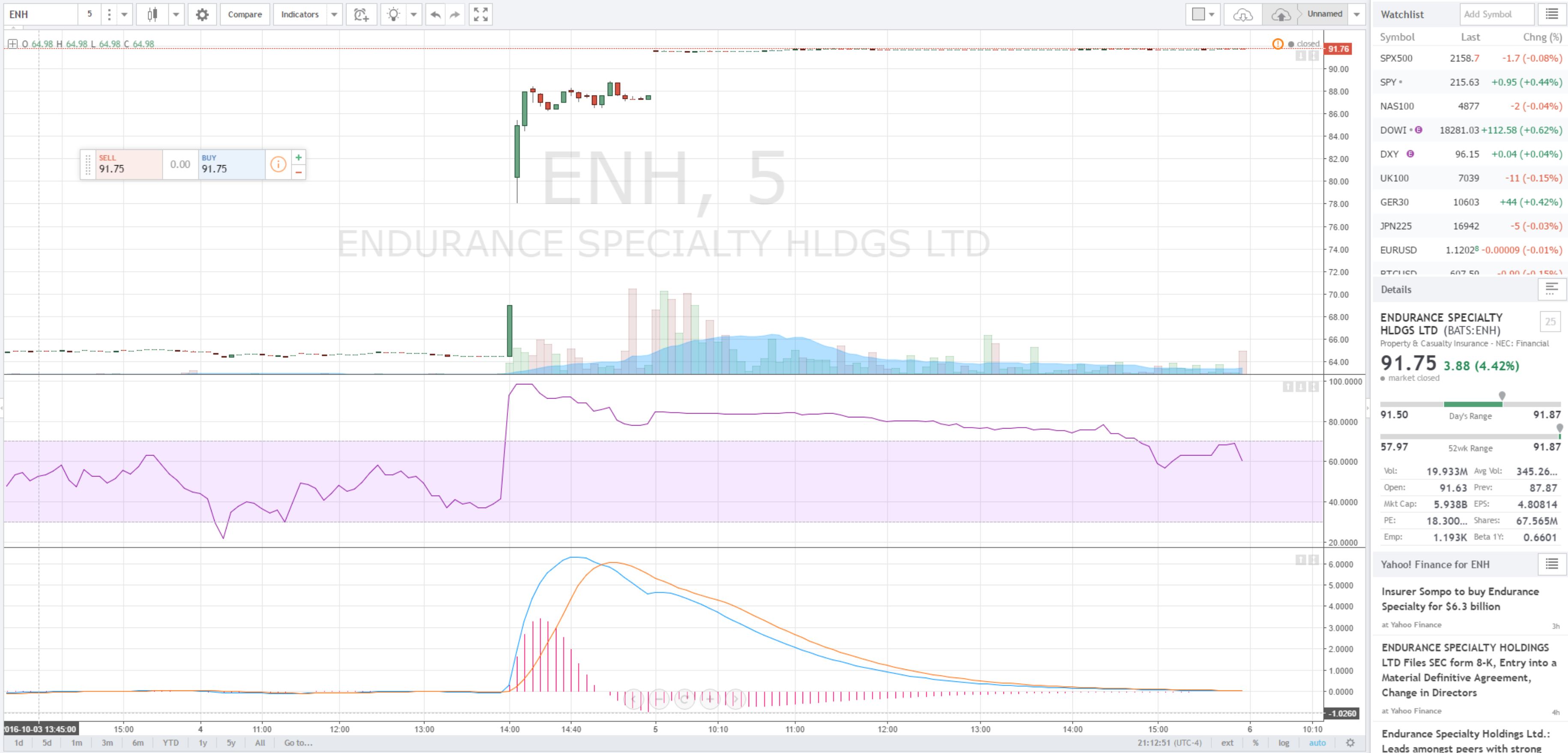

Each trading day can bring new experiences. I have heard of halts happening before with stocks that have gone bankrupt, but never with the news of a merger. I was out all day yesterday waiting at the OB/GYN office for my appointment and once I was done I checked the stocks ending strong for the day.

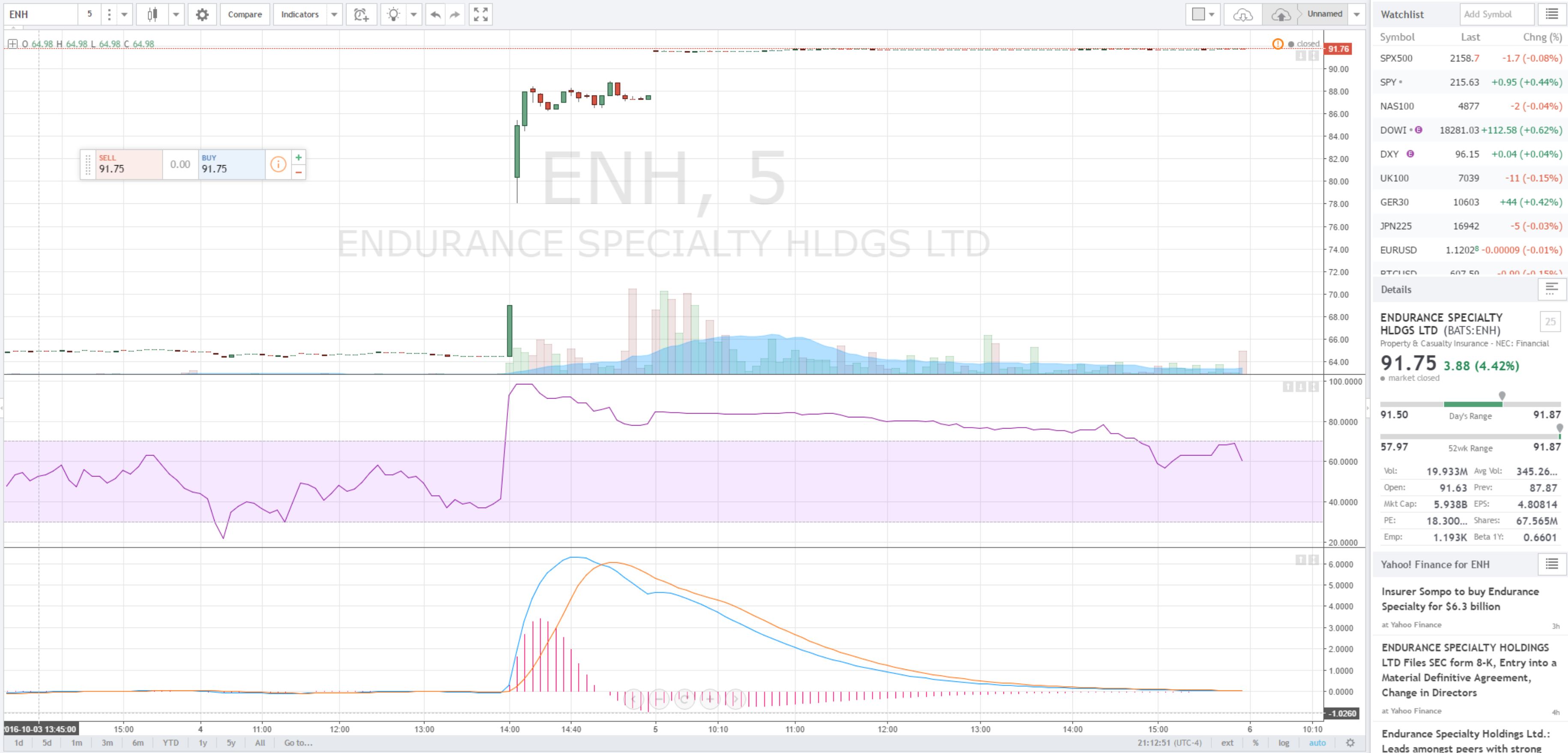

I stopped at the grocery store and in the car at the parking lot I discovered $ENH. Sure enough I saw the initial spike and and entered after the pull back and made a quick $250 on the bounce. I went in bought groceries for dinner and checked it again before heading home. Sure enough it pulled back again. I saw it hit almost 89 and pull back so I entered at $88.44. I went on my way home and unloaded. By the time I was back on my phone checking the stock before close I saw it was halted. They halted it at 3:32 due to the more than 35% increase in value and waiting for further news confirmation about the speculation of the merger.

Before I went back into it the second time I did more research about the speculative offer price of $6.4 Billion and the out standing float of 67.58 Million. Some quick math and it gave me rough merger price of $94 a share. So I thought what a deal at $88.44.

After putting our daughter down to sleep, I diligently checked the news. I went to see what time the halt was lifted which was 4:11 pm. I had also seen that Endurance Holdings had put out a press release stating that they were in final stage talks with Sompo. At that point I was still a bit unnerved by the halt. I knew that Sompo was going to release the news Wednesday afternoon their time in Japan, so I would wake up to the news.

In hindsight I don’t think the NYSE would have lifted the halt if they new that the news was all speculation. It did not occur to me until the morning and I saw the confirmed news that the buyout was going through at $6.3 Billion for a share price close to $93. It was great news to wake up to knowing that the gap up was definite based on the news.

I sold on open at 91.61 to go ahead and lock the profit. $3.17 profit per share which was not too shabby for a strong momentum overnight swing stock. I am finding that I enjoy the overnight swing trades with waking up to profits with the stocks that are continuing based on the overnight interest.

These overnight swing trades are becoming a strong strategy for me especially the earnings winners that tend to be strong for a couple days.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Sep 29, 2016 | Uncategorized

Once you have put in the time in studying and practicing everyday the rewards pay off. You are able to set your schedule and enjoy your life from anywhere in the world. It is not an overnight process.

There are hurdles along the way. You have to be willing to fail and learn from those failures. If you don’t stop to analyze your errors you will continue to blow up your account and be in the 90%. That 10% that makes it as a day trader have dedication and drive and the mentality they can do anything they put their mind to.

So know that in moving forward you will make errors. I had someone message me yesterday about getting into a stock and then the stock was halted and lost 76% value after the halt due to an announcement of bankruptcy. This individual had a stop limit in but it dropped so fast that the limit did not execute because it bypassed the limit price. Now there are two different outcomes from this situation.

One is you mentally shut down beat yourself up and get frustrated. You could revenge trade lose more money and go into a downward spiral. You can blow up your account and quickly if you are not careful. This is not healthy thought process.

The better way to look at this situation is to step away from your computer. Know that you are human and you will make errors in trading. You will have bad days, but how are you going to deal with them. Sometimes the error is you. Sometimes it is technology and sometimes it it is software that doesn’t work right. There are many errors possible.

When you step away stop looking at the negative and look at what you could or will learn from the situation you move forward. What will you do better in the future? Forgive yourself and know that it is a learning experience. These bad days can mentally derail you from having a clear head to trade. So if you are feeling fearful or upset stick to paper trading until you get back on track.

Knowing you can have these bad days before you get into trading is reality. Once you study hard and practice with paper trading to instill confidence and consistency you can slowly transition to trading full time.

Trading as a profession is a huge blessing that comes with hard work. You have freedom to work anywhere you have internet access… you can trade in a car or out while camping in the wilderness or on a beach. You are free from the four wall of an office. You could even trade while being a salesman on the road while bolstering your income.

The world becomes your oyster! So know that all your hard work can pay off. Remember to motivate yourself everyday to work hard. You are the only person that can get yourself there. If you want to change your life you need to put in the effort everyday. It is possible!

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Sep 23, 2016 | Uncategorized

This week I had a good day on Monday with a profit over $500 and then a loss of $100 on Tuesday and another loss on Wednesday of roughly $600. So I chose to take today off to try to clear my head. I did have a swing trade in $NVAX for my hubby’s account and so I waited until open to put a trailing limit order in to make sure there was a profit locked. It closed out with a nice little profit of $125.

When I have two days in a row or a big loss day I find it very beneficial to clear my head and review what has happened. For my trades on Wednesday I would have actually been up $2300 if I didn’t want to be flat when the fed made their announcement. Like with earnings you can’t predict the outcome and I did not want to gamble with my trades. Sure I could have re-entered the trades, but my thoughts were off because of closing the losses. So I stepped away and closed my trades.

In taking the day off from intensely watching the market I had a chance to reflect a bit more on my trade decisions. I find that as I’m further along in my pregnancy I need to snack more often in order to stay alert.

Sometimes I become absorbed with the stocks and watching the alerts on Trade Ideas and studying charts that I forget what time it is and need to eat. Well in the process of growing a new life I need more healthy fuel for my brain.

In addition to the blog and tweets, I have also started to do a weekly YouTube video about my week in review and stocks that I’m looking at going into Monday. The goal is to post them on Sundays for everyone to see before the start of the trading week.

I try to share my experience in the positive and negative the best way possible. The week has been a good one so far as I have swing trades that are working well in $NVAX, $WTW, $STRP and $RJETQ.

In addition to being profitable in day trading, I’m doing some longer term swings of either a week or more. Once our second daughter is born I am thinking that I might very well swing trade as well as overnight momentum plays for what is strong from the day before.

Going into Friday I’m looking at $ACIA $SRPT,$CWEI, $MLHR, $VA, $TTOO and $MRTX

I love hearing feedback from you. It makes my trading more persnal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.