by Jane | Sep 16, 2016 | Uncategorized

Today was probably one of my most frustrating days in a while. When there are technological or human errors it really frustrates me because I see the stock set up and miss the opportunity I have been patiently waiting to execute.

So Today the first human error was when I was trying to close out my short position of $COH. I was trying to be patient with the 10-1030 sell off. It wasn’t happening and I saw on the 5 min chart it began to curl up. I went in to my orders and selected what I thought was $COH, but it was a $CAH order. I wanted to cover fast so I hit market order. Well I realized after the fact that I had just sold my $CAH long swing at a twenty cent loss and I still needed to cover my $COH. I immediately went in and put in an order to buy $COH and lost an additional penny plus the twenty cent loss on $CAH.

This was the first frustrating event of the day. I cleared my head and waited for a prime entry on $SRPT. I entered down at 29.28, it pulled back down to 29 and I added to watch the reversal setup. It was beautiful it ran up to 29.70 and I was trying to put in my sell limit order. I clicked on my broker Wells Fargo and the server did not link so I had to refresh. I missed the .70 exit it was down to .50 by the time I was signed in and set my limit for .47 on the bid. Well when I hit “send order” it flipped to the ASK and quickly dropped down to .20. It was 1145 at this time and RSI was close to 30 so I knew there would be another run up. It sold off until 12 and I went to set a stop order. Well I went into a prexisting order I had for .47 and wanted to make it a stop at 29. At this point I forgot to change it from limit to stop so it executed immediately.

I was so frustrated after having a great position close to the bottom with minimal risk and upside for the day of reward. Sure enough it ran all the way up to 30.09 before a close of 30.02.

At first I was extremely frustrated and angry with myself. But I knew better than to look for something to revenge trade. I stepped away from my desk to clear my head. I know when I’m angry don’t trade as those trades don’t result in wins.

Went outside to enjoy a beautiful 65 degree sunny day and a nice walk. I was reflecting on my trades and trying to figure out my frustration. My frustration made me see that I’m actually grateful for all my other winning trades.

I was frustrated because I made silly careless errors. I just needed to pay more attention to detail. Majority of the time I don’t make these mistakes so I’m thankful for that.

I was also frustrated because both $CAH and $SRPT ran up to the target price exits and I wasn’t able to capitalize on them. Then I thought about it and it was just my error. At least I had winning stocks that I had picked and the price action did exactly what I was looking for, so it wasn’t an error in me choosing the wrong stocks.

By the time I returned home from my 20 min fresh air walk my mind was clear. I still lay down for a little rest and relaxation as the tension really isn’t beneficial during pregnancy. Around 245 I glanced at the market on my phone and ACIA. I saw the spread was 105.03 and 105.50.

I put in a limit buy for 105.5 Immediately it shot up and ran above 106. I left my limit in and sure enough 20 min later it was back at the support level. I let it run up and it hit 106.80 during power hour, but I was busy with a business meeting so I set a stop for 106.09 and limit of 106.05 it executed at 106.09 and 106.10. Locked a nice $1 a share to minimize my loss for the day.

Some days we make mistakes, but is is how me mentally let those mistakes affect us. Do we beat ourselves up or stop reflect, learn and move forward. Any time it is an individual behind the computer there is a human factor involved in the trade. We are imperfect as humans and mistakes happen. I need to slow down and double check especially when trading tickers are similar.

My swings for the night into Friday are $WTW, $STRP and $TKAI. WTW has a 62% short float and the 6 month low was set up yesterday. $STRP broke 25 today and so I went long at 24.99 and held the position with it closing just below 25. $STRP has a nice void to fill above 25 up to 30 and tomorrow Shorts will likely close out as it has been a volatile week for the stock. $TKAI had a nice run up on August 22nd up to 1.46 but it pulled back the next day. I don’t think there is a coincidence that the 22nd was a Monday and it dropped the rest of the week from there. Tomorrow with shorts closing I believe there will be a bit of a panic and my position of 1.32 is primed when the shorts close and the 8 million float runs up. If we first break 1.46 then looking for a break of resistance at 1.65 for a void to fill up to 4.

Days like today will happen for you too, but it is how you digest them and move forward that will help. My good friend Mandi has helped me to tackle my own trading demons and will be doing a youtube video for the channel about trading psychology. Since there are many new traders we will try to highlight on the new trader aspect, however we all have the same troubles. If you have any question you would like answered during our video please shoot it to me here as a comment or to carpeprofit@gmail.com. Or if you have other suggestions for the weekly video that you would like to see send them on over.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Sep 11, 2016 | Uncategorized

This is my first day trader conference ever and it has been an amazing experience so far. It is nice to be in a room full of like minded individuals. The beauty is last year I was just beginning my journey of day trading and I wanted to attend but felt like I did not know enough to participate. Well these conferences are all about motivation and getting student traders on the right path.

This is my first day trader conference ever and it has been an amazing experience so far. It is nice to be in a room full of like minded individuals. The beauty is last year I was just beginning my journey of day trading and I wanted to attend but felt like I did not know enough to participate. Well these conferences are all about motivation and getting student traders on the right path.

I was absolutely honoured to be featured in Tim Syke’s opening dialogue about trading and you can see a quick 2 min video my hubby filmed. It is still surreal that I began this journey one year ago and have already broken the six figure mark. The hard work and dedication pays off

After the mention by Tim I have been approached by many aspiring day traders with a multitude of questions. I will try to put a small recap here of the most asked questions so if they can help you as well.

First was when and why did I start? and was I a trader before?

I began my challenge program back in February of 2015 when our daughter was 6 months old. In Canada we have a 1 year maternity leave program and I wanted to find a job where I could provide for my family and work from home to be present for our daughter. So I began studying and broke the rules and was distracted by our daughter. I put it aside until I could devote the time and energy to studying while she was in daycare Sept 2015. I had been a value trader up until 2015. But fundamental value trading is quite different to day trading.

Did I paper trade?

Yes! When I came back to studying, I studied not only Tim’s DVDs and webinars but also the daily market action at open. I took from Michael Goode and started using an excel spreadsheet to track stocks and their actions. I also paper traded to gain my confidence and consistency. From my paper trades I analyzed my trades to see where my strengths lay in my trades. Turns out Tim Syke’s strategies were not the best for me but I had found buying oversold stocks that were reversing were my winners.

Did I have a an Ah-hah moment where it clicked?

Once I analyzed my paper trades and saw my strengths it began to click. Go with your strengths. At that point I positioned small with real money to remain consistent and confident. Once my win percentage started to increase I slowly positioned larger. My confidence went up and by the end of January my positions grew as well as my profits.

Why don’t you trade penny stocks?

I found that trading penny stocks was not a strength of mine and so I stuck with the strategy that works for me. The price action on stocks $5-100 tends to be more predictable and profitable for me. I have a stock scanner that gives me audible alerts for stocks that meet my criteria and I check the charts to see if that chart follows my ideal setups.

If you could go back and give yourself one piece of advice what would it be?

I would stay study the market and terminology before jumping in and trading. Then once you study practice with fake money to build consistency and confidence in yourself and your trades. Once you have that confidence and consistency over 50% position small and protect your equity. Continue to build your confidence and your profits will show that.

Your strategy is different from Tim’s…Why?

Every successful daytrader has their own strategy much like we all have individual fingerprints. It takes time to develop your strengths and your risk tolerance. Your trades are a reflection of you, so take the time to learn yourself through trading and excel with your strengths. It will pay off in the long run to become self sufficient. It won’t be a quick process, but it will be profitable in the long run.

I’m so happy to hear how my blog and tweets have helped others. I was in your shoes just about a year ago and happy to share what I wish I had there to help me along the way. The market is large enough where everyone can win long or short. If you have a bad trade look for the positive in it and take it as a lesson. Try not to beat yourself up but analyze it. You can get there! Surgeons did not wake up one morning and say hey I’m going to perform surgery today. It took time. Day trading is a profession as well and it is expected that if you want to perform well that you study hard too.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com

Working on my book to be released this spring of 2017 available on Amazon and major retailers in 159 different countries. Sign up here for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Sep 7, 2016 | Uncategorized

Coming off the holiday weekend and a 3 day trading week with travel on Friday I was very happy with my $3K+ day.

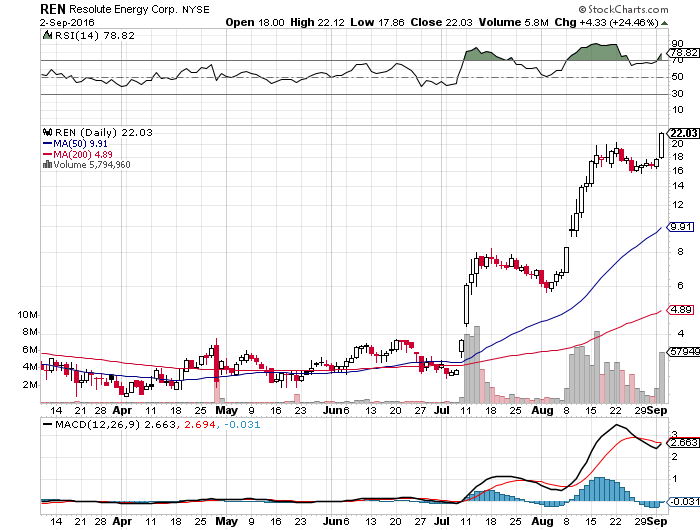

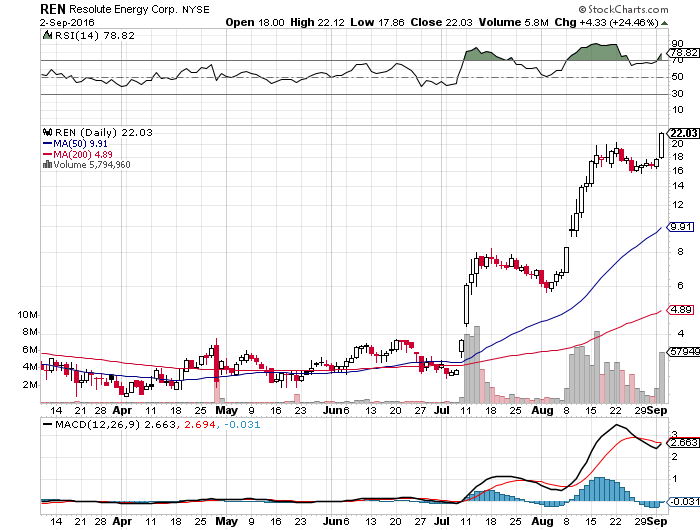

The new strategy of catching the end of day winners and riding the momentum overnight has been working. The news tends to carry at least one night With REN on Friday and today I made over $2800 on this name in two days. When there is strong momentum with a stock, especially low float it is easy to rake in the profits.

However with a low float stock it does also bring volatility which can cause drastic price changes. In order to continually profit it is important to have an exit plan in place. As I learned from another trader it is important to have your exit plan set up when you enter a trade. I usually pay attention to price action to help determine my exits and as the price rises I uses stops to protect profits should it tank. I’m finding that with the lower float stocks stop limits don’t always execute because the price action can be so whippy.

Today while at the Doctor’s office in the waiting room, I watched the price action on REN. I saw the selloff at noon and rocked a trade right before 1230. Then I my blood pressure was taken as a routine check. Well it was a little higher than my usual but still great 125/70. I mentioned to the nurse I thought it would be higher because I had just exited the trade locking in another great profit. Then she asked how do I learn. Simply check out my blog.

It is not something that is learned overnight as you have seen throughout my blog now. Day trading takes time to learn the market. I’m still learning new things everyday. I have noticed with my trading while pregnant I’m trying to diversify. I’m not sure it that is a good thing or not. I want to be effective at a couple different trades.

Lately the strong end of day movers have been gapping up nicely. Today I found a new way to scan for stocks ending up at the highs of their day with the charts and even 52 week breakouts which is why I went long $LMAT at 20.86.

The biggest gainer of the day $CLCD had a great end of day run up from 21.80s. It ran all the way up to 24. I had an entry at 23.54. I should have exited when it dropped to 23 with a stop. and re entered down at 22. I need to get better at stops to protect the drops.

I’m diligent about protecting my profits on the way up, but for some reason I am not the best about a stop on the way down. Rule #1 is always cut your losses early. It is not always easy to take a loss. But the patience of a good or better entry does pay off.

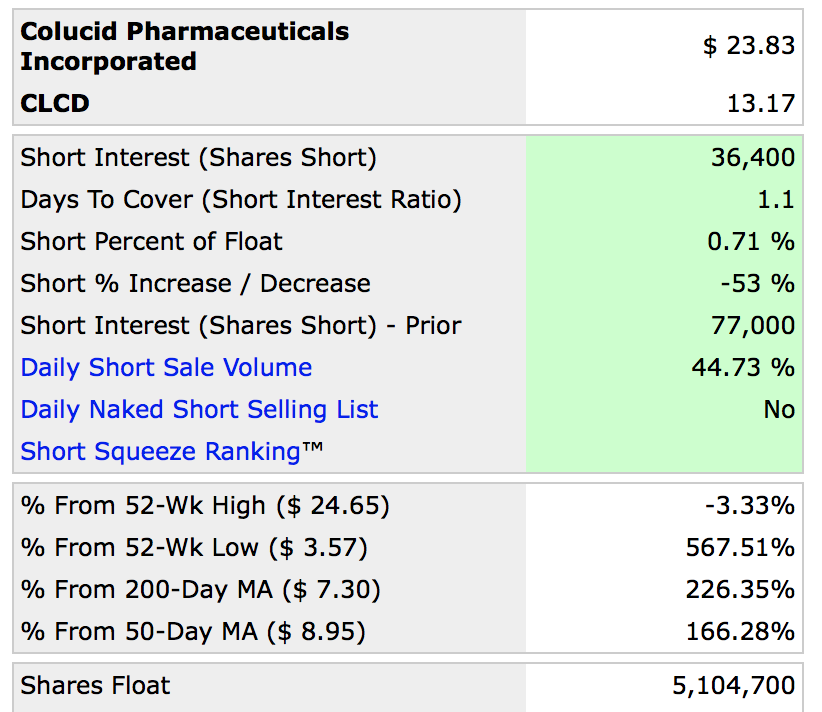

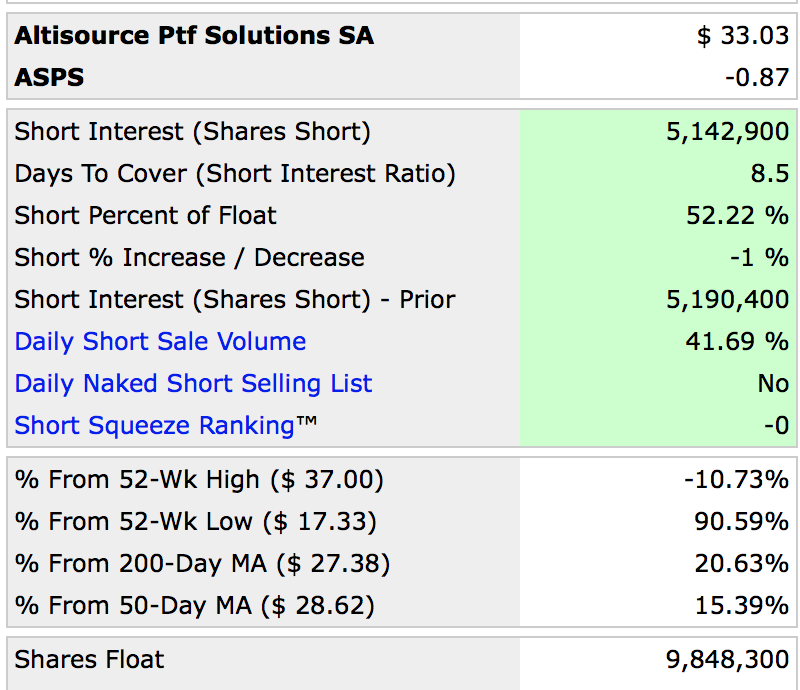

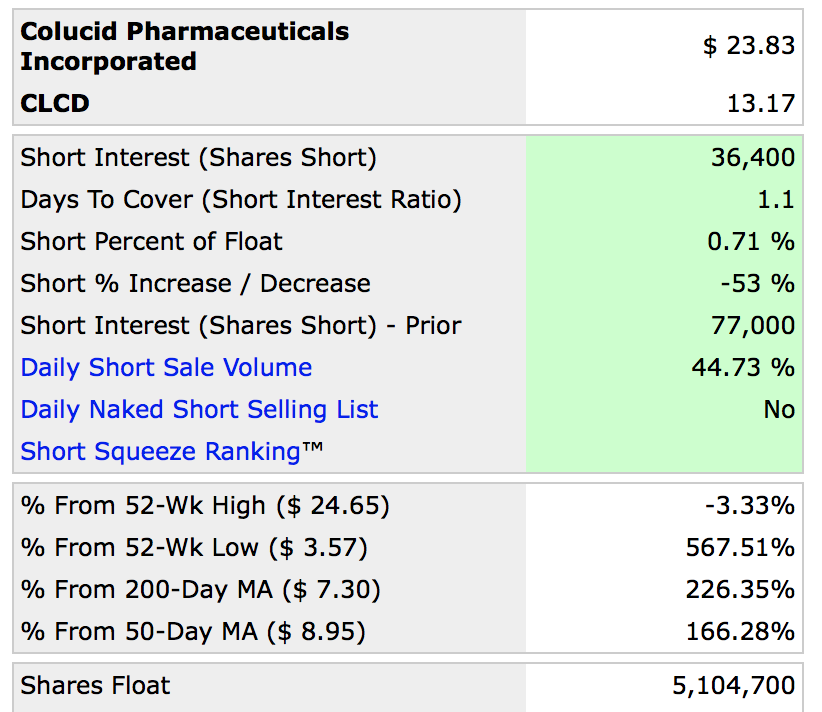

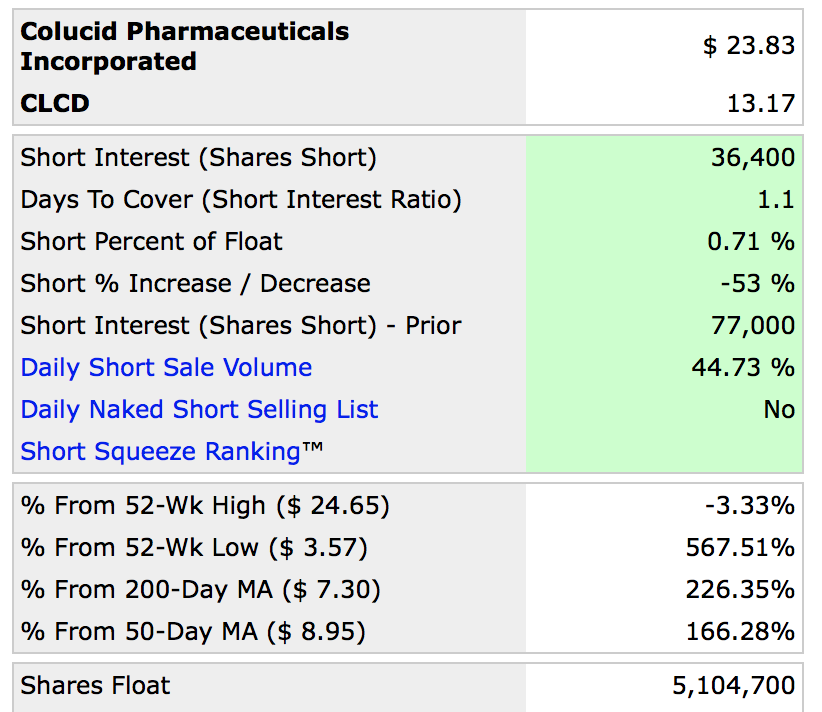

Once I saw CLCD break 24 for the second time during power hour I bought a small swing position at 24.12 and saw it closed up after hours at 24.40. Looking for a gap up above 25 Wednesday morning. CLCD is a lower float stock with 5.1 Million in the float and a fairly high daily short sale volume.This is what interested me in swinging a stock already up 123% for the day.

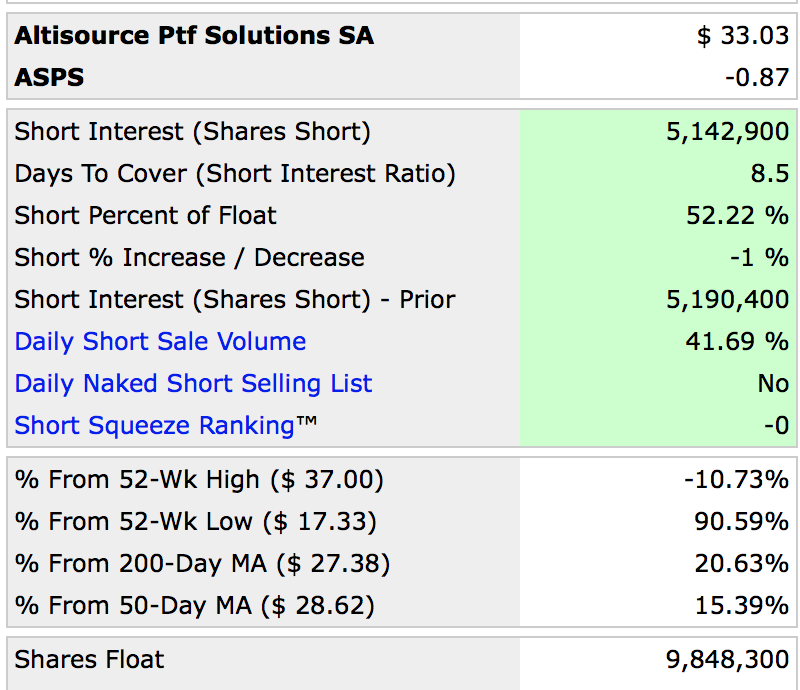

My other swing trade for the night is the trade of the week from Trade Ideas. I bought a small position of $ASPS with 9.8 million in the float and 52% short interest. The short interest can create a snowball effect with momentum. The whole basic supply and demand of shares available and the shorts wanting to cover to lock profits or minimize losses.

I do still love my bottom bounce reversals, but I have found going with the momentum tends to be a bit less stressful than the bounce. The bounce plays when timed right are fast and easy money to be made.

I have to say I have had some great emails to carpeprofit@gmail.com about people letting me know how my experience has kept them motivated. It is touching to know that I can help people around the world even when I have losses. The name of the game is keeping your wins bigger than you losses.

We are imperfect as humans and have emotions, so those losses are expected sometimes. And just because you locked a loss it doesnt mean it is a poor trade. Did the price action continue to go against your plan then it was actually a smart trade for stopping the loss.

We all learn from each trade. I’m still learning everyday and I am looking forward to the convention in Orlando where I hope to learn more. As a profession I’m passionate about I don’t get bored learning new things in the field. I’m still a newbie, granted a profitable newbie. There is so much and it does not happen in one day. Looking to have more great days like today.

Goals for September:

- Patience on Entries

- If it goes against me cut losses quickly.

- Try to let the profits rise and not sell too quickly.

- See if the new momentum overnight trades work well. Will that work for long and shorts?

- Write down the trades as they happen and enter trades nightly. (Pregnancy has me tired more quickly)

We all get better when we step outside our comfort zones and challenge ourselves. So take a step forward and try to learn something new. When you put in the effort the reward usually follows. Just make sure to follow the rules. It’s always good to analyze your trades

See you in the morning on Twitter and Carpe Profit one at a time to grow your account.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpe profit@gmail.com

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Sep 5, 2016 | Uncategorized

If you have been following my trades you will see I’m attempting to try to add a new styles to my trading. It is the breakout fill the gap and the overnight momentum plays.

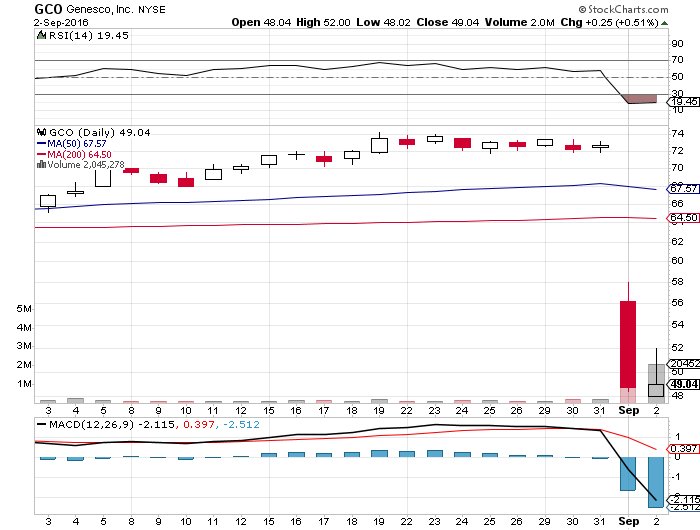

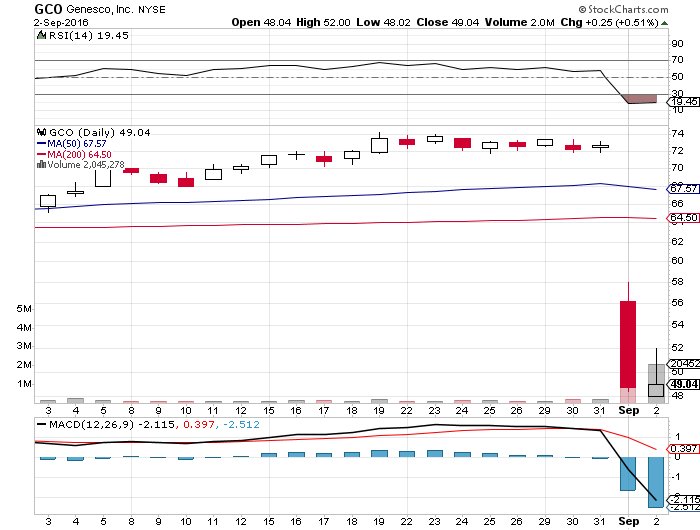

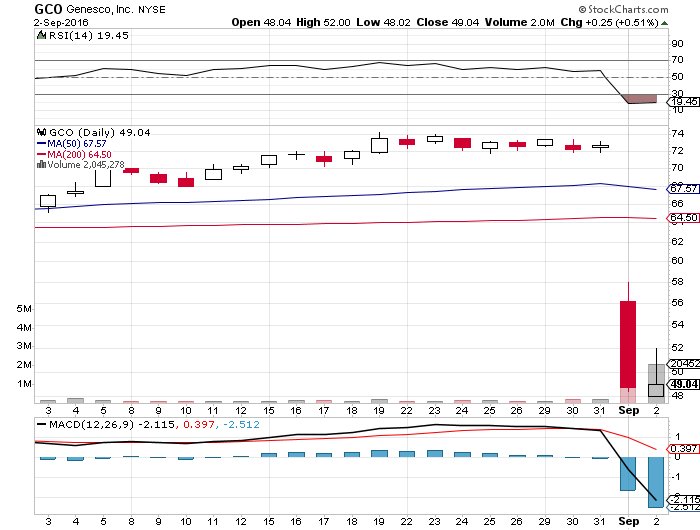

With the breakout to fill the gap I look for a chart where it has had a huge overselling of the price recently. A big example of one I will have on watch with a price alert is $GCO

As you can see on September 1st they had poor future estimates for the company and it tanked. First it opened down at $56 from a previous day close of around 73. It sold off all day down to around 48.50. I played this one for a bottom reversal play with shorts covering from the long weekend. For those that went short on Wednesday August 31st they were definitely happy with roughly $25 a share profits in the crash. This one will take more time to recover and I will put it on my watch list for when it finds a bottom and starts to uptrend. Once it breaks that HOD (high of Day) for the 1st of 58 it should start to fill the gap. There is a nice void from 58 to 72 a $14 gap to be filled. It probably wont happen as quickly as it occurred but it should create some momentum.

I am also working on Overnight Momentum trades like with $REN

As you can tell with $REN it is in breakout mode. July 11th it started to spike up and doubled in value from $4 to $8. This stock is one of my favorites with a low float of 10.8 Million and a short float interest of roughly 14% now. There was a secondary surge in the beginning of August with positive earnings and positive forward looking outlook for the company. This third wave is a break out of the company’s 52 week high. It closed on Friday with a price of $22.03 and had a high after hours of 22.74 before closing after hours at 22.59. This low float stock had an amazing day Friday. It broke out new 52 week high and the low float with shorts that tried to short at the high should have them covering on Tuesday.

$SPU is another one that is known to run.

On Friday it hit a new high for the week with a sell off right before close. This Stock has 994K in the float so less than 1 million which leads to volatility. They just won a contract in China on the 31st of August which caused a huge spike on the first and the second. With such a strong finish on Friday looking for the continuation of the move on Tuesday. With move volume we could easily see it hit up to 15. I will have a stop as this is a volatile stock and could easily whip the other way.

My third stock I’m excited about for Tuesday is $RJETQ. If you have been following me on Twitter you know this is one of my long term holdings. Republic is a bankrupt airline stock. As with American Airlines when I purchased it in bankruptcy I knew it was going to come out restructured and more powerful financially. Republic filed Bankruptcy to eliminate certain aircraft from their fleet as well as the extra costs such as maintenance, hangar rental space and more. They also filed in order to go through contract negotiations again after it took them 7 years to finalize this newer costly contract last June. This company is concerned on bottom line numbers and did this simply to save money. Now that they released this 8 K SEC filing. and have come to an agreement with American, the 3rd and final airline. Now they will be able to petition to exit bankruptcy. This is huge and could be the catalyst that causes this stock to go from a close Friday of $0.88 to well over $2. The stock traded at a high of $15 in the past year and a half.

I do well with the reversals, but I’m trying to broaden my repertoire and this week I’m due to hopefully fit in a one on one training with Dan Mirkin from Trade Ideas about learning Options.

I think Options would be good for me as I tend to see bottom reversal setting up on higher priced stocks and to my knowledge I would be able to leverage my capital better with options rather than buying the shares outright. We’ll see I need to learn before I jump in head first.

This holiday weekend has been a great time with the family and this extra weekday off I use for studying and will be expanding my knowledge to learn more about options. I’m excited about Friday , where I will be heading to Orlando for the Trader and Investor Summit. If you will be there and want to meet up I’m planning and meeting some people at Hooters on International Blvd. from 8-10. It will be a long day of travel and I get exhausted more quickly now that I’m 4.5 months pregnant so an earlier night for me. If you can make it I would love to chat in person.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. They have an amazing discount going on through Monday Sept 5th with promo code LABOR2016

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Aug 28, 2016 | Uncategorized

As we approach September 1st, the beginning of my intensive studying of the market 1 year ago, I think back to the questions I had just starting out. One of the biggest questions was how do I find these stocks to trade. Sure I had studied Tim’s DVDs and the theory behind the winning trades made sense, but how was I going to find these stocks that are so active.

Well it took time, but I figured it out by finding the right tools. There are some free tools that are useful, but as the saying goes you get what you pay for. It’s like trying to make a fine dining pasta dish with frozen pasta mass produced versus fresh handmade pasta.

So in the beginning before I found my favorite tools I would use Yahoo’s biggest gainers or Finviz . Both of these are good for information, but I found it was good for stocks at the end of the day. Sure it is easy to see what has happened, but the key to getting into these stocks while the movement is happening is a tool that is up to the minute.

I definitely used Yahoo and Finviz for research at night. It was great practice to see the charts and what happened throughout the day and if there was a catalyst. Was there a big announcement of a contract win? Positive Earnings? or maybe a low float stock that had a little bit of movement and the shorts got squeezed on the stock?

In the beginning it is important to understand how news is likely to affect a stock. I say likely because the market does not always react rationally and stocks can tank with positive news like $PSTG on Friday.

So write down the big movers and see the reason why they moved as well as what happens the next day. Try to figure out the why and put yourself in the brains of the other traders to understand their moves.

Back to finding the stocks. So I had found a great way to find stocks at the end of the day but how was I going to find those stocks in play at that moment. There does tend to be momentum to stocks on the second and third day as not all traders are day traders. Many people think the stock is still at a great deal even if up 5-15% so they buy looking to make money. That continued momentum will usually keep it going for max 3 days. Although sometimes it can be one day affair and boom the stock crashes.

I tried Stocks To Trade 1.0 which was served data by EquityFeed and I liked their service, but it still did not give me quick snapshot of the market to find this stocks. There was too much specific filtering for the lists for me to easily find what I wanted to see. Don’t get me wrong I love Equityfeed for my level 2 data and charting but the lists of active stocks was still missing.

Then I found Warrior Trading Chat Room that had a free Monday Trial and they had this great software on screen sharing. Well I wasn’t shy and I asked what software it was that they were using to filter all the data to come up with their lists.

Turns out it was Trade Ideas. After seeing a demo of the software in the trading room I began to do more investigation. I began using the full pro package with the back testing and Holly. Sure enough it very quickly paid for itself. The software is amazing and the customer service they provide is even better. This software no lie can be overwhelming with all the possibility of personalizing it to each individual user. However they also have amazing present channels like Surge which shows you the stocks that have a surge in volume right up to the minute.

Finally it was exactly what I was looking for in software to find stocks to trade. I mean the company name says it all Trade Ideas. This system lets you put your finger on the heartbeat of the market with the stocks that have volume and price movement.

Navigating the ocean of stocks without the right tools is like trying to cross the Atlantic with a raft . Why would you do that to yourself and make it so difficult. I completely understand the costs of getting into trading in the beginning. It can be overwhelming but not having tools that make it easy to me is foolish.

It was interesting too because it wasn’t until after I was using the software that I discovered the Free Trading Room. A Trade Ideas sponsored room that is very positive with Barrie the moderator (just tweeted 8/30 Get TI Premium for 25% or regular TI for 20% until Sept 5th! Use Promo Code LABOR2016) and Dan the CEO and other great traders all providing their experience. I have learned from them as well. It is a nice positive area to learn about the software and some winning strategies for profiting on stocks.

The whole journey of becoming a day trader is not easy. There is the psychological aspect of it. The funding of your trading account and how to use the trading software and then how do you find the stocks. I hope this helps you with the last step.

90% fail because they don’t study and learn. It’s easiest to learn from others’ successes and failures. The goal is to become self sufficient and not follow anyone but you need to learn how to do that. It doesn’t happen overnight.

So in the early phases study successful people and use the tools to help you succeed. Don’t trade blind. Do the prep work and understand what is going on before jumping into a stock.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

Working on my book to be released this spring of 2017 available on Amazon and major retailers in 159 different countries. Sign up here for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.