by Jane | Jun 4, 2016 | Uncategorized

Each day I’m striving to be a better trader. That comes with working on my psychological side, research about stocks in play and protecting my profits.

In the first couple of months when I blew up my account I really struggled with my emotions. I felt awful when I entered the trade at the top and lost as it went down hoping for it to continue back up. Then I did the same short selling at the bottom and getting squeezed. I was chasing to say the least. I was bag holding. It was awful but I got over the feeling bad and stopped to analyze what happened to those trades and used them as positives.

Why was it when I tried to buy at the top did the price drop? Why was I chasing the price action? A whole bunch of why’s that I had to learn for myself so I would understand the theory behind the price action. The why I was chasing was easy. I wasn’t finding the stocks and picking my entries I was chasing alerts. They are great if you get them quickly, but email alerts are slow now-a-days.

So I strived to be able to find stocks that are in play. How I create my watchlist goes like this….I go to finviz.com and I click on screener and then technical. I select short float over 15% and relative volume over 2 and current volume over 200k. Then I sort by RSI and I look at the charts to see if the stocks look interesting.

Then I go to Equityfeed and I open the market view and filter the stocks $0.5-40 with 200K in volume over 200 trades. I look at the % change for the day up and down and look at the charts for daily and 5,10 days. I add the ones to my list that look like a good setup.

Then around 910-915 in the morning, I open up my Equityfeed and I see what is in play for that morning and see if any from my watchlist are active. I try to pick stocks that have volume for easy liquidity and fairly nice % change in price for the reversal.

I have had people ask me why I trade the bottom reversals. For me it is an overextended chart to the downside that is oversold. The likely hood that it comes back to equilibrium for the day is fairly good if there has been a strong move downward. I go long because I can’t always get shorts with my broker and so I work with my limitations. I like going long as well because when you go long your maximum loss possible is your original investment if it drops to zero. If you go short you can get squeeze to the moon like what KBIO did to some shorts earlier this year.

I have learned to have confidence in my trades based on seeing the patterns over and over. When it does go against me I know it is typically a matter of time before it reverses and comes back up to my poor entry. Like I said earlier I always strive to have good entries, but sometimes I don’t cut my losses as fast as I should and it is an emotional entry trying to get in not to miss the action. I am trying to get better at waiting for my 3 green and not getting faked out to enter too soon.

I still learn a nuance each day. I will start to see something in price action or have a lightbulb moment and recognize something that I see day after day. I am very happy to be up roughly $4500 for the month and roughly $90K for the year.

If you follow me on Twitter you see that with this success brings some haters that don’t believe my trades are real because I am not able verify my trades on Profitly. Well my broker, Wells Fargo, doesn’t sync the software with Profitly. I enter all my trades manually with times and prices. Manually entering them all takes time and I don’t feel the need to spend additional time to take photos of every trade and post them each day. The setup for my broker is not the easiest and so I simply manually enter my trade.

It is tough to wake up to see someone calling you a bitch or whore when I have done nothing but share what I know and my experience. I know that person has looked superficially at the information and made a judgement call and hasn’t take the time to find out the truth. I’m sure it is the same for that person’s trading strategy where they don’t do the studying and are losing.

I know there are jealous people out there, but the truth is you can accomplish any goal you put your energy towards. With baby steps and knowing yourself most people can learn to trade. There are definitely some that have a natural talent for it, just like olympic athletes.

I try to be a positive influence and keep a positive mindset and don’t have time for the haters that judge with no knowledge. It makes me sad for their lives and how painful it must be to judge others day in and day out. How do they judge themselves?

I appreciate the support to everyone that helped me report the harassment. I am thankful for the online community of positive people that want to work for their success. I enjoy helping and sharing. As a mom it’s hard not to have those traits as well as teaching.

Ok enough of my soapbox story for the day. However know that when you become successful in trading you might lose friends and some very close people to you might become jealous. It is a shame but the truth. The true friends will be there and be happy for you.

I’m always happy to hear the successes of my followers. It is a great compliment. You do the work, but I help with guidance. Enjoy your weekend with you friends and family. This time can’t be replaced and is priceless. Today my daughter is 22 months old and a reminder that time absolutely flies, so enjoy each day.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Jun 2, 2016 | Uncategorized

As tough as it can be to realize a loss in a trade it doesn’t mean that it is a bad trade. My closing out of my position on $LE yesterday before close was a great decision because holding overnight into earnings is a gamble.

As tough as it can be to realize a loss in a trade it doesn’t mean that it is a bad trade. My closing out of my position on $LE yesterday before close was a great decision because holding overnight into earnings is a gamble.

The market is not always rational. Granted the surprise loss was a big influence in the stock gapping down $1.20 at open. I could have been lucky and got out even today, but there was no guarantee it would spike like that at open. It was a great mover as the short float was very high and when people saw their $1 profit they began to cover and the strength in the market kept the movement going as well as the news of it being a big gapper down for the day and in play.

I still have it on my watchlist for potential reversal going into Friday. It is so beaten down and making a new 52 week low daily this week.

The big spike at open is exactly the reason why I look for high short float stocks because once the price moves up the greed and fear of the short usually causes them to close out their positions in addition to the investors or longs. All this demand for the stock drives the price back up and fairly quickly. Sometimes it takes days for the setups to occur.

In the same way that Tim Sykes likes to short the parabolic move to the top. I like to buy the oversold stock. They all tend to come back to equilibrium from an extreme. When they are at those extremes it is because supply has become so dry it spiked or flooded with sellers that it drops.

Its just like my favorite saying from Warren Buffett,”Be fearful when others are greedy, and greedy when others are fearful”. That is the basis for shorting when people have overbought and buy when the stock is oversold in my opinion.

The basis no matter what for becoming successful in your trading is finding a strategy that fits your personality. I’m a bargain shopper in real life and as a result I found a strategy that basically is buying those bargain, black friday sale stocks. Then once everyone else finds the deal as well and wants it the scramble is like a Walmart opening it’s doors for Black Friday Sales.

Tonight my husband and I spent the night with a good friend and we spent a good portion of the evening talking about studying stocks. As my husband is a serious car fanatic, I like to use a driving analogy to people beginning to trade. Would you really give the keys to a nice new car to a 13 year old to drive. Sure they know how to push the pedals to stop and go but they probably don’t understand how to use the signals to turn and how to accelerate at a moderate pace or decelerate at a moderate pace. Once they have gone to driver’s ed and have learned the rules of the road, They get their learners permit. Then they are on their way with practice with someone by there side after they have invested the time to study and are ready to get their license.

The same is true to a new trader. If you give them the keys, like opening a brokerage account with no knowledge they have a 90% chance of crashing and burning. It would make a lot more sense to have the driver’s ed and study the market and practice with paper trading until they are confident. Once the confidence is there the rules are known then it makes sense to hand over the keys and get their license to trade. Before then it is a recipe for failure.

All that to say if you are just starting. Please take the time to study. Practice on paper and build up your confidence and your success in trades. Before then you are likely to fail. It’s the truth. You need to have the knowledge in starting to trade real money because the emotions you have to deal with at that time can overwhelm you while trying to learn all the rules and information.

As always I hope the post helps you in your trading journey. I always love to hear how I have helped you in your education. If you have any questions, comments or requests please leave them here as a comment or on Profitly or Twitter, Instagram or LinkedIn.

I have people messaging from around the world and I love being able to inspire and help others in their trading marathon. It is a marathon with training everyday. Those that sprint will end up injured and out of the game.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | May 28, 2016 | Uncategorized

This month has been about improving my exits. Protecting profits and trying to become a better trader. I am doing very well up over $7,000 this week and over $22,000 for the month.

With this success I try to improve my losses by making them smaller and letting my winners run. That is why today I was so frustrated because I didn’t protect my profits today at open when I had problems with my charting and price action. I was trading blind. I am not sure if it was my internet or Equityfeed. Whatever it was made me miss the crucial minutes to exit with profits on $NERV and $PSTG.

It really messed up my clarity in trading today and I did not really have any trades that won so I left my desk around 1pm. I am definitely better at cutting my losses with stops. I felt today was off with trading with the volume and price action.

I was anticipating a bigger run up on $ZAGG today. I thought it was going to break out once it broke 5.00 so I added at 5.02. It went up to 5.04 and then started to drop back down. I did not want it to go back down to 4.80 on me so I sold my full position of the stock with 2 cent off.

I realized that I love Fridays because I usually find the shorts close out all their positions before lunch and it is very easy to make a profit on reversals. With the holiday weekend I feel many people took today off and the shorts closed out yesterday with the end of the day runs on stocks. I will note this for the next holiday weekend.

I felt everything was off for me today and frustrated from the get go in the beginning. I was out at the hardware store at close moving my stop limits up as the price climbed on $NERV. If I had read that the price target had been upgraded to $17 I probably would have held it to Tuesday. I think it will spike on Tuesday with the press over the weekend.

My longs over the weekend are INSY and LE. With LE at close to 52 week lows there is still value for investors. I will watch at open and any articles over the weekend.

INSY still had more growing in my opinion with the phase 1/2 approval by FDA. My estimated target would be up close to 18. The strong finish of today leads me to believe it will climb on open like it did today as well.

As always my goal when I have a red day and losses is to figure out what went wrong. Today was easy. My rule when I hold overnight is to sell at open, but when I can’t see the action then make sure a limit order is in to protect myself.

When mentally my day is off, recognize it and go to enjoy life instead of make poor trades. I’ll be much happier playing the afternoon away with my daughter instead of losing my profits.

I hope you all have a safe enjoyable holiday weekend. Spend time with friends and family and so time to study. The best way to make yourself profitable is to learn from books, DVDs, analyzing trades. When you journal your trades you can see what your weaknesses are and how to improve them. It is always hard to accept a loss. The best thing is to accept it quickly and move forward with improving your actions.

As always I hope this post has helped you to learn and see even when you are profitable losses do happen. It is minimizing those losses to keep your profits.

Another FYI that Trade Ideas who I use when my list doesn’t produce winning trades is having their final days of lifetime licensing of their premium package and AI. It will soon be monthly charges for everything June 1st. The have a free trading room that will be up a Tuesday if you want to check it out.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | May 25, 2016 | Uncategorized

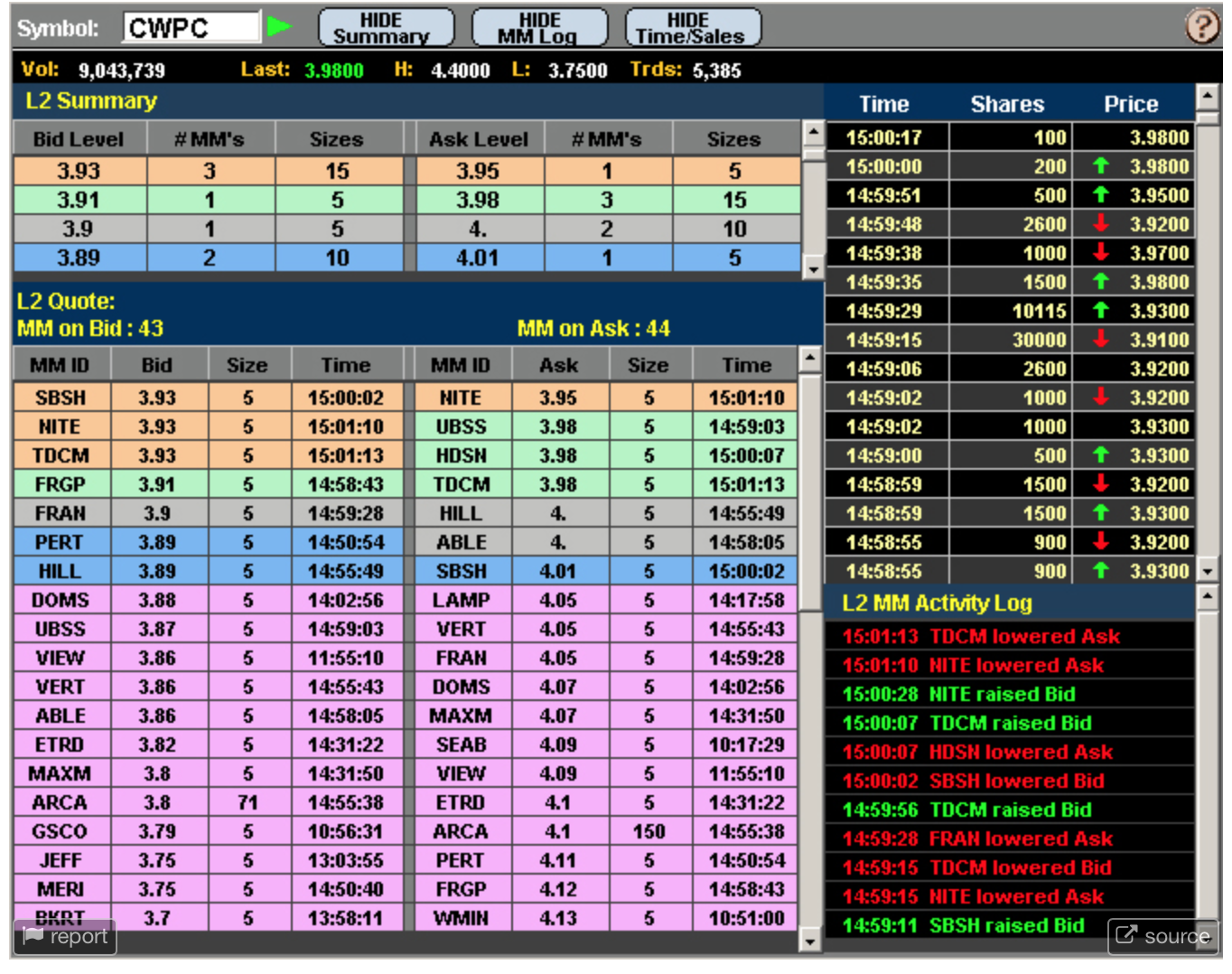

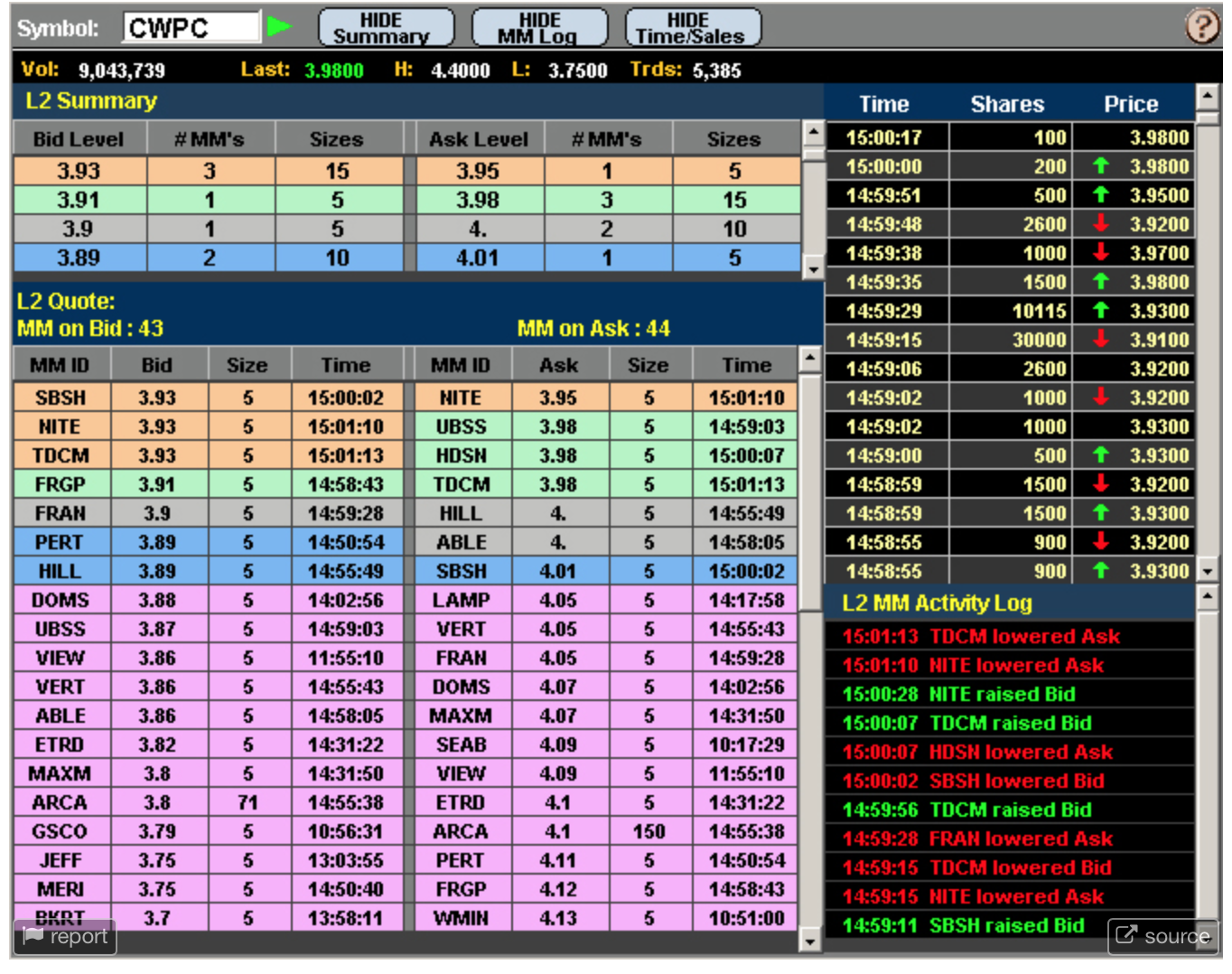

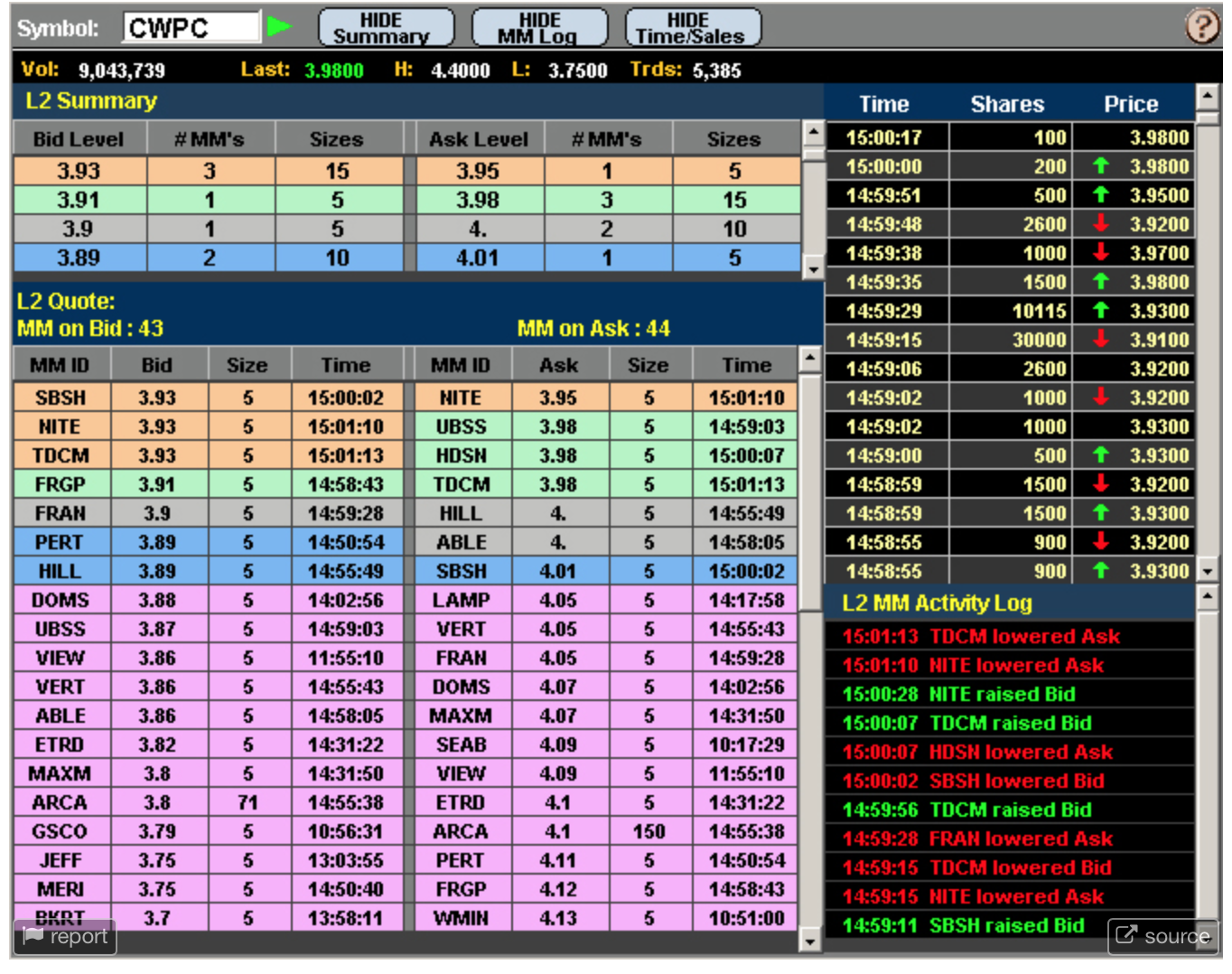

I have been having people sending me requests to write about Level 2. I definitely rely on Level 2 as well as Bollinger Bands to help determine my entry and exit with a stock. For me when I see the price action or the sales going through at the price on the Ask side there are more demand for the stock and they buyers don’t want to always wait for the bid price so they go in at market or Ask. That would be a strong indication to me that the momentum is in the long direction. Once I see the price action change and the sales are going through at the Bid price consecutively there is less demand for the stock so the price is dropping and people don’t want to wait for the Ask price so they are willing to sell at the Bid.

Sometimes there can be large buyers or large sellers that show a support or resistance level, but if the momentum is moving fast enough those sellers or buyers orders are eaten up and the movement continues.

As with JWN, ENDP and CLRB on Friday I could tell from the price action that all those shares were exchanging hands with high volume and the price was fairly flat for the second half of the day, so the stocks would have covers happening on Monday morning. These shorts covering and the investing buyers would cause the people that shorted on Friday to cover creating more demand and driving the price up. My understanding allowed me to profit almost $5,000 in the first 15 min of the trading week. I learned from 1 week ago and I walked away happy with meeting my weekly goal in 15 minutes.

My 4 stocks that I have long right now are INSY 14.37 , ENDP 15.36 , LE 17.21 and ZAGG 5.19

INSY from Finviz.com is showing 24% short float interest. It has had 9 days of upward momentum. Today at 651 from Briefing.com They have passed their phase 1/2 for their new cannabidiol drug.

6:51 am Insys Therapeutics announces ‘successful’ completion of phase 1/phase 2 safety & pharmacokinetic study in pediatric subjects with treatment-resistant epilepsy being treated with cannabidiol oral solution (INSY) :

“We are excited that our synthetic pharmaceutical CBD in a non-alcoholic, medium chain triglyceride-based formulation was studied up to a daily dose of 40 mg/kg in subjects with pediatric epilepsy. The data is currently under analysis, and the CBD appears to have been generally well tolerated,” said Dr. John N. Kapoor, Chairman, President and Chief Executive Officer of Insys Therapeutics

“We anticipate meeting with the FDA to discuss the subsequent steps for this program, as well as the development program for the treatment of Dravet syndrome and Lennox-Gastaut syndrome, two rare forms of pediatric epilepsy for which Insys’ pharmaceutical CBD formulation received orphan drug designation. Additionally, we have an ongoing trial evaluating CBD in infantile spasms, a catastrophic form of childhood epilepsy. These efforts underscore our commitment to advancing our pharmaceutical CBD program in pediatric epilepsy and we look forward to updating you on our progress in due course,” added Dr. Kapoor

I have been holding INSY as a swing trade because the stock was so beaten down hanging around the 52 week lows. The high short float interested me knowing that as soon as there is volume behind upward price action it should drive the price up fairly quickly. Also the CEO bought 50K shares back on 5/11 and the CFO just exercised his options 5/23 for 10,000 shares. When the two insiders are going long it is a pretty good indication that positive supporting news is coming out.

For ENDP I have had this one on watch and trading it almost each week as it seemed to keep hitting a new 52 week low. Until last week. Then we saw Billionaire John Paulson invest 30% of his initial holdings and the stock has had nice upward momentum to recover some of the loss in value over the past year from a stock price of $90. It actually looks like the shorts have wised up and the float has decreased down to 2.73%. That would also lead me to believe the shorts think this stock is going to continue growing.

LE is another retailer that has been beaten down and with the news of the marketing director stepping down it lost some additional value. This week it is setting new 52 week lows, but has been holding 17 support fairly well. The short float on LE is 18% and the RSI on daily chart is 18.75. The volume has been light just 150K shares traded today. Once there is movement on this stock it should surge upward nicely. Earnings are due to be reported 6/1.

My last long position is ZAGG with the two days of new 52 week lows. They just announced their earnings 5/10. My main reason for going long besides the 18% short float and the new 52 week lows is that the CFO just bought 10K shares of the company. To me the CFO knows the financial health of the company and knows a good point to invest in the company.

As always I hope that my blog posts help you in your trading adventure. Remember to study hard and if you are just starting be kind to yourself. Position small in the beginning to limit your losses and gain confidence with profits. Once you see you are profiting more often than losing slowly add to those position sizes.

If you have any questions or comments you can always reach me here on my blog with comments,Twitter, Profitly , Instagram, Facebook or LinkedIn.

I love hearing your success stories so feel free to share. They also inspire others.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | May 21, 2016 | Uncategorized

It was another stellar week locking in roughly $5,000 in profits up to $15,000 for the month. Don’t get me wrong I had a bad start to the week self sabotaging my winning trades of $980 in the first 45 min. I am learning a lot from Mandi Pour Rafsendjani about the psychology of trading. I definitely had wonder women syndrome where I could do no wrong. I positioned large and gave back my gains and then some.

Tuesday I started fresh as each trade is a new possibility. I made roughly $1700 for the day. Trading is definitely a reflection of your mindset for the day. So I am working on myself to get better with my trades. Let me ego go and set hard stops to protect myself from myself.

I find that the entries in going long are the riskiest time in it going against me. I am trying to get better at adding hard stops right off the start to minimize my risk. If I enter at the wrong time I would rather take a small loss than be a bag holder all day and waste my time. If I entered at the wrong time the hard stop will help me defeat my ego and protect myself.

I used hard stops all week and I feel less stressed in my trading. I move the stops up as the profit is climbing so I don’t let those profits tank away on me. We are our worst critic and I have seen my weaknesses of not cutting losers. This week I had 4 green days and 1 red.

Onto the the stocks above. I wish I had more capital to hold $JWN over the weekend as well. All 3 of these stocks I believe will have a spike up at open on Monday.

$JWN has been oversold with earnings and then just announced their dividend. In the past two days it has gone up $2 and it was continuing to rise over the weekend. In my opinion value brokers are going to push this value stock to the baby boomers who are interested in looking for residual income on stocks that are fairly safe. It is due to grow and give them income in the next week. Monday I think will provide a nice spike at open and slow growth through Wednesday a great swing trade to sell just before dividends, since the next day the stock usually tanks.

$ENDP is down to $15.44 from the $80’s last year. This stock is oversold and just had a Billionaire John Paulson increased his position by 30% in this stock. I executed my trade awfully today getting out too soon. I made $500 and if I had left my limits it would have been $4950. I did not see the news or else I would have held until it hit all my limits. Seeing the fact that the stock did not tank down and consolidated all day. In my opinion the shorts tried to sell off the stock all day, however the investors saw that it is a bargain after a Billionaire Investor jumps on board. My anticipation is that the news will spread over the weekend and the stock will have buyer and shorts getting squeezed.

$CLRB was a huge penny stock winner of the day with a patent issued by FDA. The same thought process led me to hold this over the weekend as a couple months ago this stock was at 10 dollars. It is a lower float stock, so that usually means faster runs in price action. The stock held its value all day with dip down to 3 and then a high by end of day of 3.89. The shorts were trying to find borrows and trying to knock down the price. It did not happen and I believe the strength of today and the news will excite more buying on Monday and a pull back on Tuesday. Could be a bit squeeze, but more upside before tanking in my opinion.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. I’m working on a training site with Mandi which will be coming soon. I have had people ask me for personal training and I am willing but it comes at a cost. The idea of having the training site will be more affordable for more people.

If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

As always take time this weekend to spend time with friends and family as that time is priceless. If you are in Canada have a wonderful Victoria Day Weekend.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.