by Jane | Mar 12, 2016 | Blog Post

In reviewing my trades, for some reason my lacklustre Friday with $430 in profits I feel like I didn’t perform my best. I think it is because I felt like I was scalping all day. I saw some trades set up today and I entered but was too cautious on my exits.

Obviously I’m never going to be perfect on my entry and exits, but I need to get much better at letting my winners develop and not cutting them too soon. In two trades I wasn’t patient enough and I left potential earnings of $900 in the market.

I entered FXCM after seeing it on Trade Ideas scanner for being oversold and I watched and I entered just 13 cents off the bottom 10.51. For some reason I traded very fearful today and cut way to early at 10.68 as it ran up to 13.00 for the next hour and half.

I did the same thing with STRP too selling it right at open after CLUB failed to spike. It ended up around 37 from my 33.49 entry and I sold at 33.99.

So my lesson for today is to remember to be patient in letting the trade develop and having confidence in it. I am still presently in SCOR from Monday as my swing trade. I entered way too soon with a 28.26 average. The low of the year and this week was 26.21.

So my lesson for today is to remember to be patient in letting the trade develop and having confidence in it. I am still presently in SCOR from Monday as my swing trade. I entered way too soon with a 28.26 average. The low of the year and this week was 26.21.

I felt that the stock was way oversold on news and has more value. This is where my prior training from value investing comes in handy. I am swinging it up to my target from 29-30 depending on action, which will hopefully be met on Monday.

Today’s price action reminded me that this is the right move to be patient. I’m looking forward to watching it at open on Monday.

Looking at my week in review, I hope you had a profitable week and learned from your trades. I know I’m not perfect and try to learn from each trade.

Keeping at it each day and starting with a fresh clear mind has allowed me to end up this week up $2541. I traded 22 trades this week and 15 were wins.

I hope to improve, 2 out of 3 trades winning isn’t so bad.

I think understanding how to read the charts is very important but having the right tools to make it easier really helps. That’s why I really enjoy Trade Ideas with all the different preprogrammed scanners and the ability to create your own alert windows.

It is really amazing and worth the investment to help you make money. Since I have been using it to help me find winning stocks my track record for winners has definitely improved.

This week has been quite complimenting with multiple people asking for help to learn, since Timothy Sykes posted my testimonial.

I am always happy to help others as I was there myself just over a year ago. I am a firm believer that in giving back to others it will come back to me in other ways.

That being said I am happy to answer any and all questions. I think the easiest way to help is to by answering questions here for everyone to read. So if you have a question shoot it my way either here with a comment, on Twitter @Jane_Yul , Instagram Missairplanejane or Facebook.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Mar 5, 2016 | Blog Post

This week was a rough one. I had 3 Red days and 2 Green Days. Overall I ended up with a positive week. Slowly but surely I’m on my way to 6 figure salary. January I had $3001 in profits and $6158 for the month of February, so I’m only shy $90K+ to make my first $100K. Little by little everyday with a fresh positive mindset.

This week was rough starting off Monday with a fever, but freedom to sit at my desk with my daughter at daycare. Unfortunately all week until Friday I had a nasty head cold that filled my sinuses with congestion and I think distracted me from making the best trades possible.

I found I did not have the best executions and rushed trades or tried to anticipate the moves. My biggest loser was a short $RAX that I let get out of control. I didn’t cut the loser quickly. Now in writing this I read it received a forth downgrade to strong sell. Murphy’s Law that since I covered now it will drop like $GLUU last week.

As many people have asked me how I find my trades. I start my day looking for Gappers on Equityfeed (at the bottom of their page you can try it free for 14 days) in the morning. I like that Equityfeed will let you look at yesterday’s ending prices as well as the present day action. I check to see if the gappers up from the night before have continued with higher volume. My morning gappers are run with a scan of price .5-100, Volume over 100K and trades over 100. Sometimes on low volume days I go down to 75K or 50K to get at least 5 gapping up and gapping down. I use that to get an idea of stocks from the open.

Something I have learned this week in particular is don’t anticipate the moves let the stock dictate the reversal from open. I check on level 2 to see where the strength is located and also the RSI and the time. I find anywhere from 950-1015 the stocks reverse pretty strong in the other direction and can be an easy way to profit.

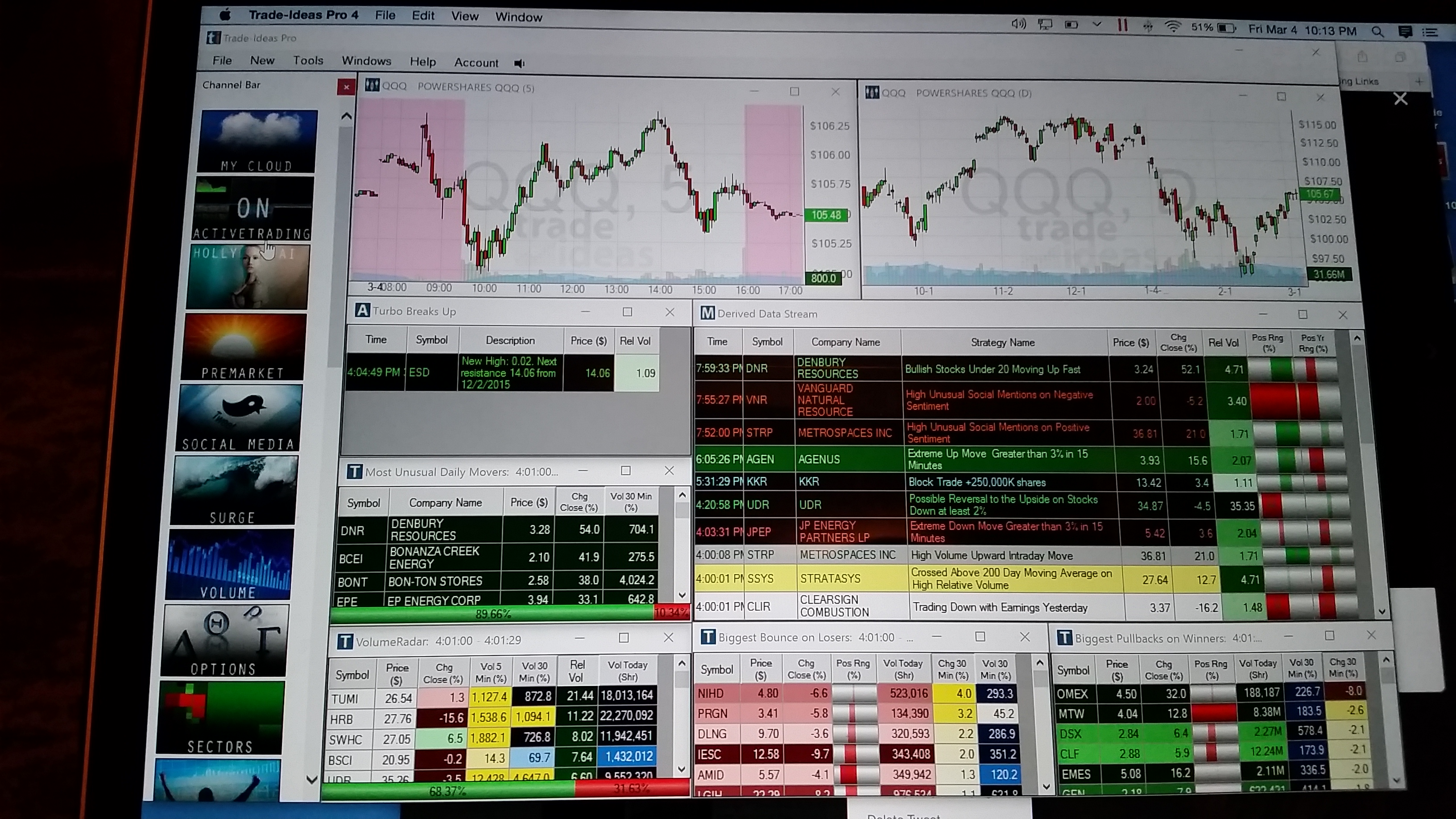

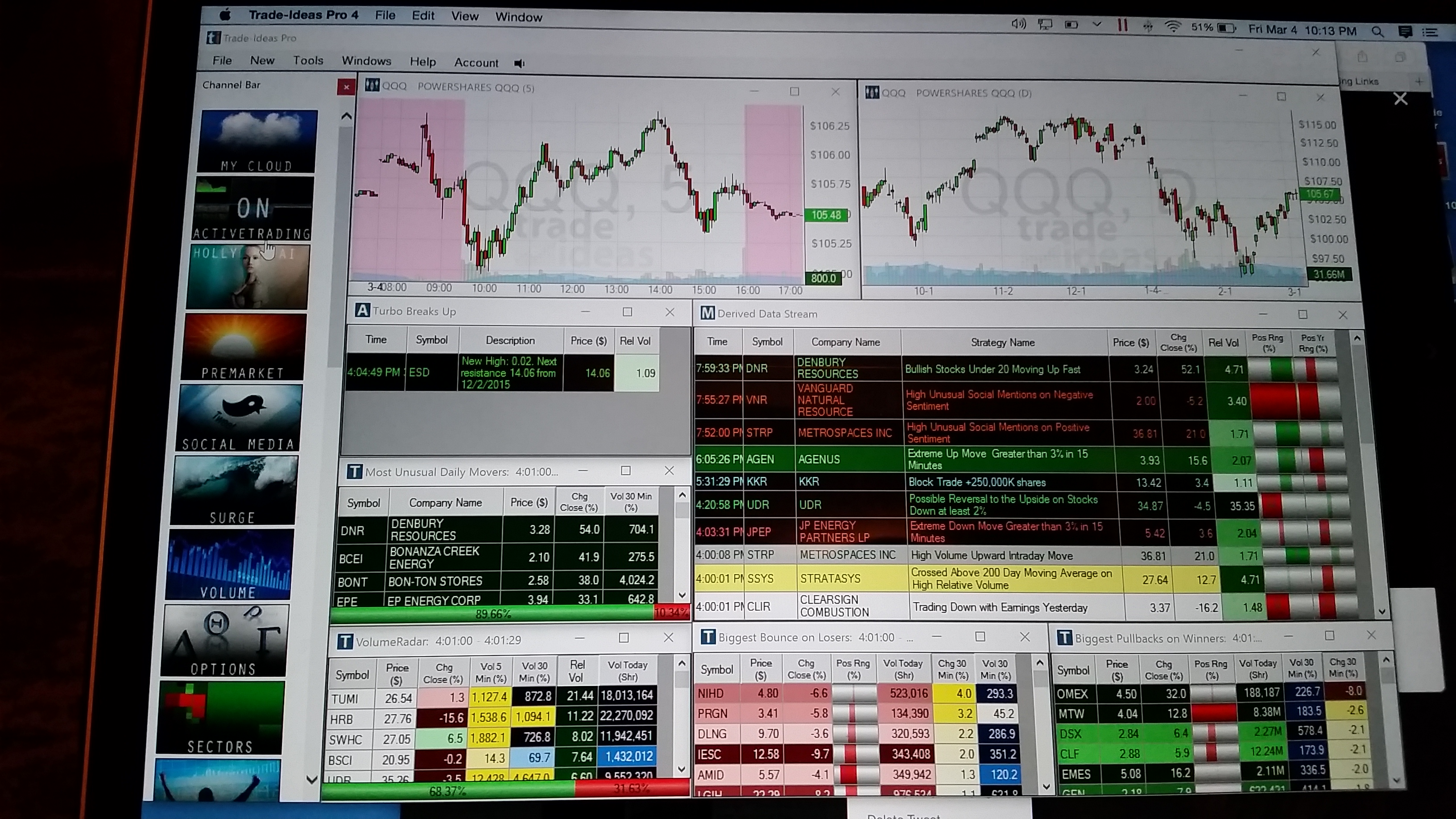

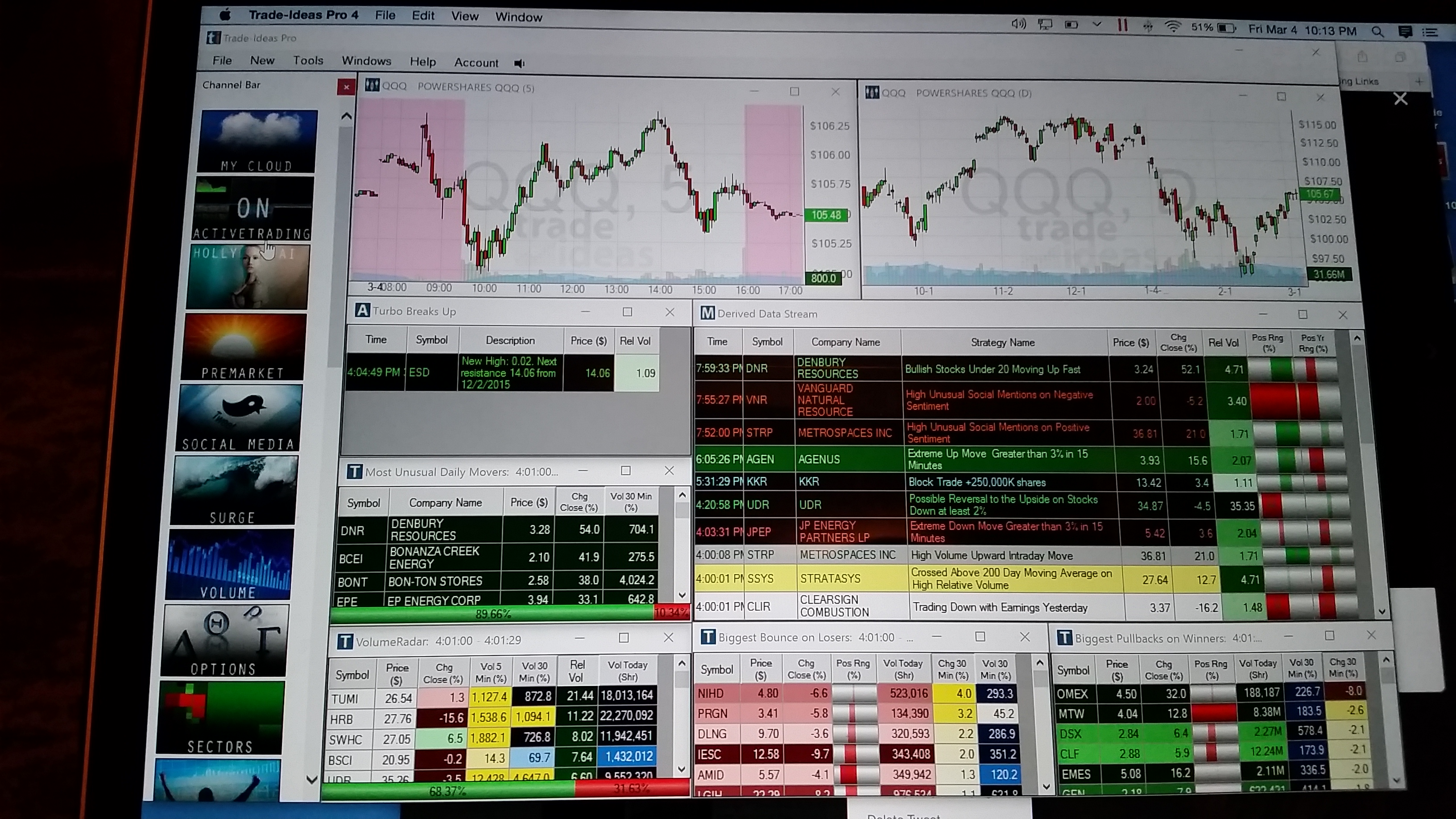

After my initial reversal play, I check on Trade Ideas. Trade Ideas is absolutely amazing. You can set up your own alerts or there are 21 preset scanning pages from channel bar on the left as well as the Artificial Intelligence Holly. Here is one of the preset scanning pages, Active Trading as pictured below. This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.

This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.

I found $SM from Holly, $CENX and numerous reversal plays. Definitely worth checking out the site. On the bottom of the link to Holly page you can sign up to test the demo mode. Check it out.

As always I’m super thankful to be able to have learned this skill and I’m happy to share and help others. If you want to know something please feel free to ask here on on twitter @Jane_Yul.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Feb 27, 2016 | Blog Post

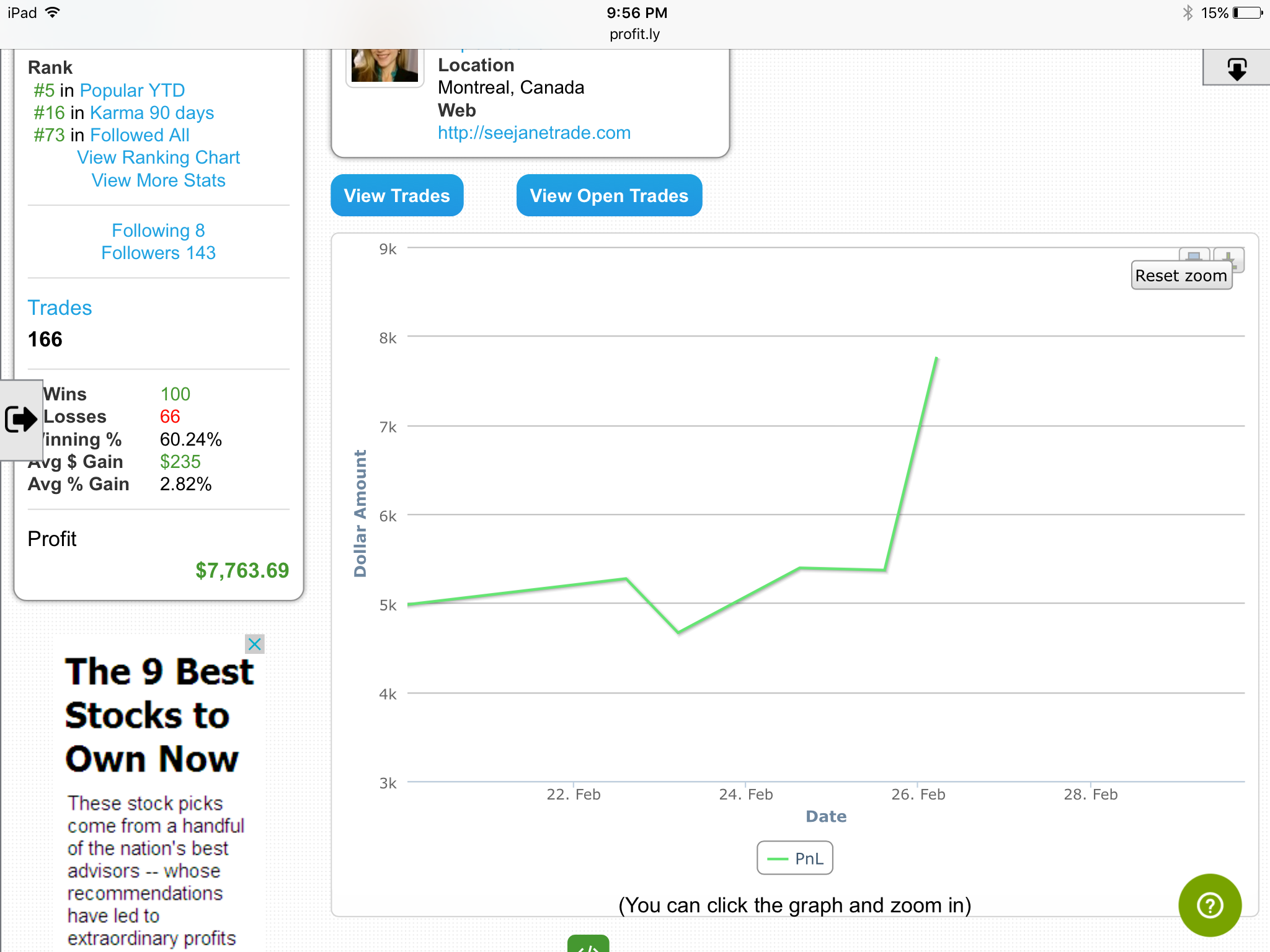

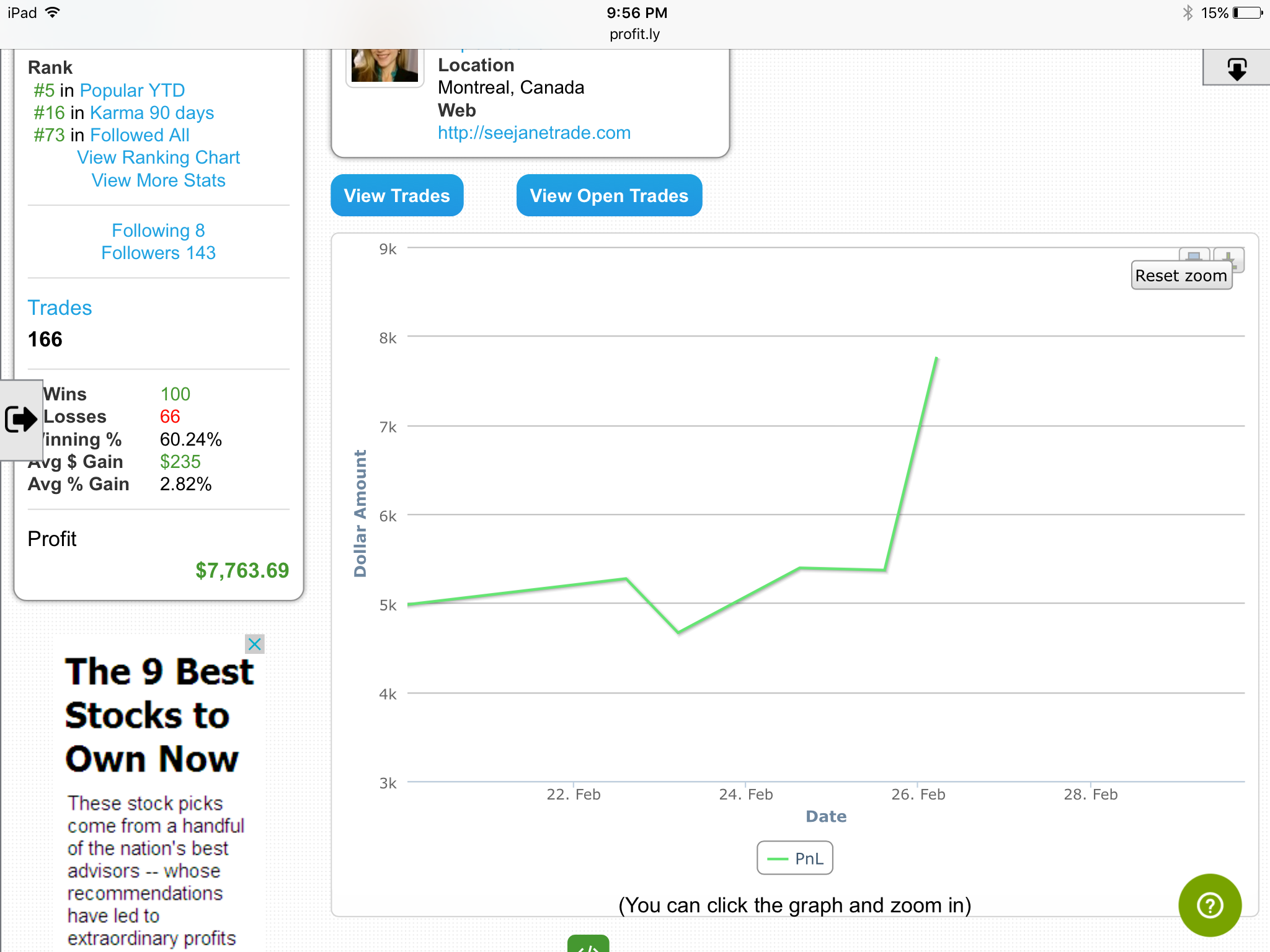

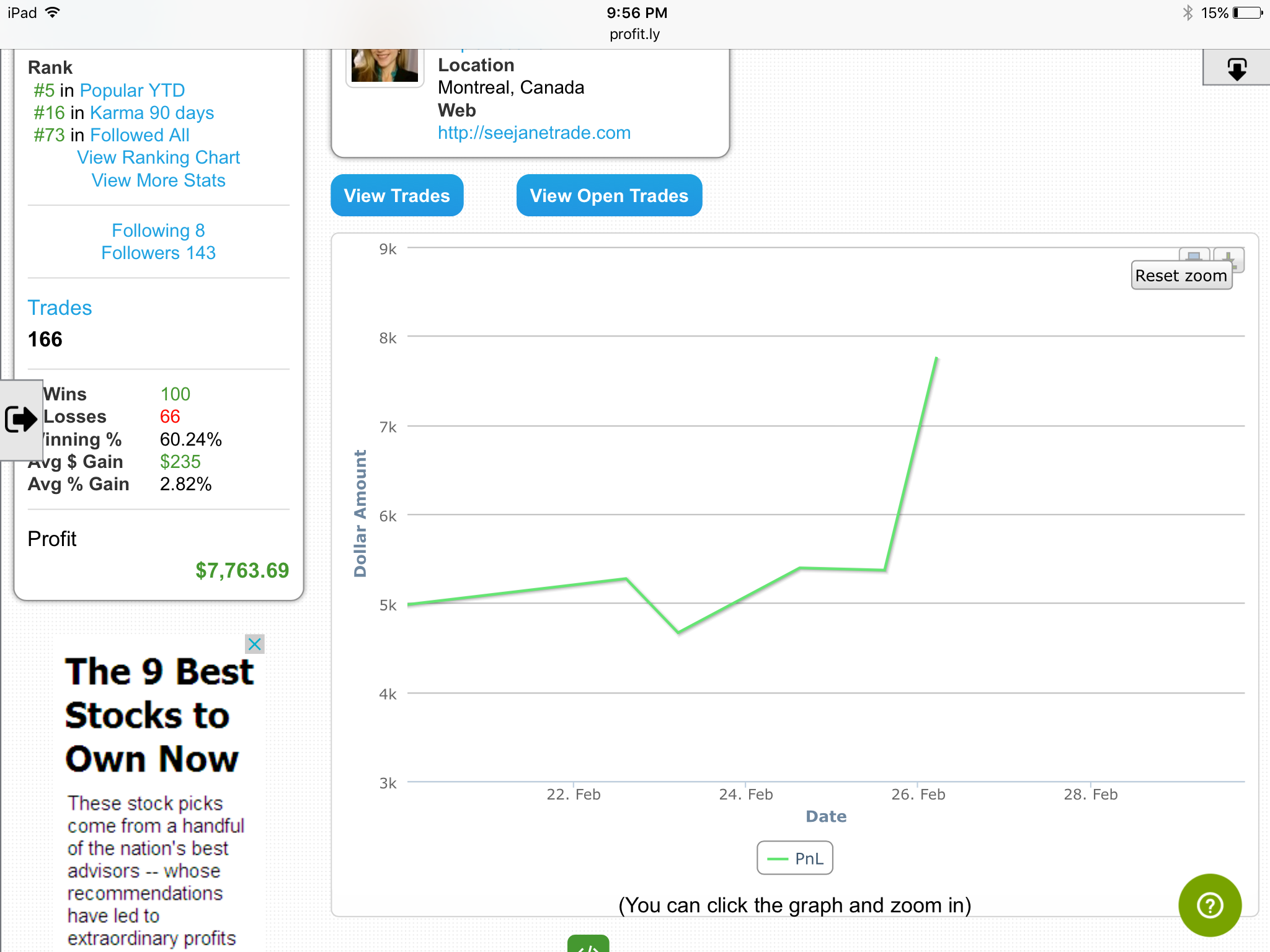

Here are my trades and profit chart for the week.

This week brought me back to the beginning of my day trading career. My daughter was unfortunately home sick 4 out of 5 days this week. The proof of my attention to the stocks was reiterated this week.

Monday a gain 586, Tuesday loss 608, Wednesday gain of 728, Thursday a loss of 25 and baby free day a gain of 2300+. I know I should really call it quits when I have her home sick. I coordinated her naps to the open, but it wasn’t enough. I was still distracted.

I believe as a result of being distracted I went outside my normal routine and it went against me. I tried to hold earnings overnight and a loss happened.

I tried to go long $GLUU and it went against me so I thought it’s up 100% and it will go back down after news, so I shorted it. Well I should have covered Thursday afternoon as soon as I was alerted that Tim Sykes bought.

Covered for a loss this morning to protect myself from a short squeeze like $KBIO. I am seeing that the reversal plays and the earnings winners are the bread and butter that I need to stick with.

The Force of Momentum

I honestly love seeing the waves of momentum in the stocks and ETFs. Today was also the first day I day traded UWTI and DWTI. Made more than 10% of investment. +$1300. The week ended up being roughly +$2600 making the majority of February almost twice the profits of January.

I’m so very thankful to have found this passion for stocks. Trading from home allowing me the time to be present for my daughter is priceless. Honestly Tim Ferriss’ book the 4 hour workweek helped me to change my mindset to work for myself. I’m also a fan of The Secret and find the stock market truly has abundance for everyone to win and be profitable with the work.

If you are considering trading for a living be aware it doesn’t happen overnight. It takes time to study and learn. Best thing I can recommend is paper trade until consistent. I wish I did before then I would have $6k more to trade with, but I consider it trading tuition to learn.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Feb 20, 2016 | Blog Post

I remember starting my journey the end of February last year with the goal of being profitable as a day trader. Then a couple of weeks ago I had my first day with over $1000 in profits. Now 7 weeks into 2016 I am up $4700+ after a couple losses and I feel disappointed with profits of $1100 this week working 3 days.

I remember when I thought I just want to make a profit.

Dissatisfied with Trading

Now I feel like if I don’t make around $500 a day I’m not satisfied. Its interesting how perspective changes.

What I still need to be better at is cutting losers and not let them get away from me. I had some poor entries this week when I wasn’t a sniper waiting for the momentum to have already changed. Under water right now in 3 stocks $INCY, $TRIP and $RAX.

The best part of this week was chatting daily with my brother who is also excited about learning about day trading and in particular Tim Sykes’ methods. I loved starting off with Tim’s DVDs.

Then I found Warrior Trading Chatroom and I love it. I tried it one day free and I thought if I make in one day what 3 months cost I will subscribe. I did and so I subscribed. What I like about this chatroom is you have Ross as a visual giving you audio and Mike and Ed in the chatroom too. You have 3 great guys with 3 great strategies.

My second reason for the chatroom are the scanners they customized from Trade Ideas. I have used them to find reversal trades and scalps to add to my daily wins. I’m happy to say I’m testing Trade Ideas now and I love all the features that you can add to scans and to alerts.

Artificial Intelligence Stock Software

The AI Holly that runs scans all night to find setups for the next day. It is amazing software. The one issue I have is I feel I still need to understand all the parameters to create alerts that target the stocks I’m looking for to trade.

There are plenty of chatrooms out there and teachers I think it is important to find one that has a fit with you. I like Ross Cameron a lot because I like the audio as he is doing his trades.

I had reminder today with my daughter home from daycare that I really should concentrate on her or trading but not both. I missed my close out opportunity for $TRIP.

Live a Life to the Fullest

As always Monday is a new day, a new week and new possibilities. As a stay at home mom I absolutely love my life day to day and thats what we live. Hard work and studying and adaptability will help you succeed.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

For my charts I use tradingview.com which offer free charting and paid services

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | Feb 13, 2016 | Uncategorized

Day Trading Stocks Online

As many people I was looking for a career to create a life with more pleasure working for myself and more free time. I come from a family that believes in long term investing and I had a long term account. In 2013 I was lucky to make an investment at the right time. I bought AAMRQ at 2.51 and within 8 months it came out of bankruptcy and the stock moved up to $40 with a profit of $225K.

This allowed me to fully enjoy my year of maternity leave (Quebec is amazing and allows women a full year off). In that time I was actually trying to gain my real estate license in Quebec as I love real estate sales. Well I passed all my licensing exams with just the French exam to pass according to french language laws.

Forget all my history in the States I had to take a foreign language exam to even attain my license. Well I had complications with my daughter that did not allow me the free time I anticipated to study to pass the exam. I received 60% and not good enough to acquire my real estate brokers license in Quebec.

How to Turn A Negative into Positive

I felt defeated end of January 2015. I thought what on earth am I going to do. Well my husband said you are so good with long term stocks why don’t you look more at that.

So I began researching and I ran into this page and listened to the video. I thought I now have another 6 months of maternity leave left and I have some extra cash so I want to apply for the challenge. I went through the phone interview to screen if I had the financial ability to participate.

It was roughly $6k for the whole program including Stocks To Trade. More DVDS than you can imagine and a wealth of resources online and via email. Contact to Tim Sykes and Michael Goode and more. I was diligent and set up time to watch my dvds after dinner once my daughter went to bed. I was so excited I opened a day trading account. This was end of February 2015

How to Blow Up a Trading Account

Well I was learning through the DVDs and I wanted to apply what I thought I knew to the action daily. 1. I way overtraded and didn’t realize the fees involved. 2. I didn’t have the experience so I blew through another 5k pretty quickly. I had some winning trades and I tried to do it all while watching a 7 month old baby. Once my daughter was 9 months, I was in a winning trade and had a stop limit order in and the stop triggered the limit and I missed my trade due to not being in front of the computer, so I stopped real cash trading.

Reset Your Mindset

I continued to study for the next 4 months. Watching the live webinars and watching DVDs and watching the market action at open with watch lists that I had created the night before. Once my daughter went to daycare in September I now had my mornings baby free to dedicate the time to watch my trades. So I set up my watch lists and paper traded to become consistent. I played around with trying to find trends that worked for me as well.

Paper Trading Stocks

In Nov 2015 my paper trading became consistent and I thought its time to try with real money. I was scared with my past where I had just burned through money. So I played small until I became mostly profitable with my real trades. If you check my profit chart you will see I was in the red up until about Jan 2016. It seems like it just started to click.

After watching the charts every day you start to see trends and you start to see setups. You understand how to read level 2 and understand the price action. It definitely did not happen overnight. It took time. It took dedication and perserverance. I have some bad losses too, but start each day with a fresh clean slate so that mentally I’m in todays trades.

Please let me know via Twitter @AirplaneJane or here if you have any specific questions I can help you with. I know I had a lot when I started and I found the online help invaluable. I want to help and give back. Thinking maybe one day to set up a streaming channel to help once I’m really profitable. We’ll see…. I’m no expert but as my brother says he thinks I’m in the 10% that get it.I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you would like to be in Training Pit with me sign up here or if you want one on one training you can email me jane@thedarkpools.com You can contact me here or Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTubeThe tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or monthTrade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.For my charts I use tradingview.com which offer free charting and paid services.Also Stocks To Trade that has a 2 week $7 trial This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

So my lesson for today is to remember to be patient in letting the trade develop and having confidence in it. I am still presently in SCOR from Monday as my swing trade. I entered way too soon with a 28.26 average. The low of the year and this week was 26.21.

So my lesson for today is to remember to be patient in letting the trade develop and having confidence in it. I am still presently in SCOR from Monday as my swing trade. I entered way too soon with a 28.26 average. The low of the year and this week was 26.21.