$SPY dropped to 252 is it time to panic? What does this mean?

So what do we do now? This is a daily chart of the $SPY. If you are newer to day trading you might not know what SPY, QQQ, IWM mean. To explain them they are the ETFs of the S&P500, Nasdaq and Russell 2000. If you are unsure of what an ETF is click here for the investopedia.com definition. Also if you ever hear a term in trading you don’t understand I recommend popping over to investopedia.com to learn more about the subject. They have amazing definitions about indicators, terms and more.

It’s all over the news its the biggest drop in many years of the market. I used Heikin Ashi candles for the chart which will show you more of the trend of the stock or ETF. When you look at the chart you see that as of Dec 29th the SPY was in a breakout mode for 20+days. It followed the trend and kept growing and growing. Like a low float stock that has had a big run the SPY as well as the stocks in the SPY were showing overbought.

Another indicator that can show when a stock is RSI. As you can see on the chart the RSI reached roughy 91 and anything over 70 is considered overbought and usually will cause a correction. On the flip side any RSI below 30 is considered oversold. Fridays close measured 28.4 on the RSI. This doesnt mean that it won’t continue further down, but a likely indication of a bounce or consolidation before a reversal or continuation of the trend. As yo can see on Tuesday the RSI also dropped below 30 and recovered to then continue in the down trend.

In trading I never rely on just one indicator to make a decision but use them to see a bigger picture.

So back to the question what do we do from here? If you are a long biased trader I would definitely say it is time to practice paper trading. One of the best things this week is shorting or buying puts as the market trend has been bearish. It tends to be easier to go short when the overall trend is bearish and long when the market is bullish.

I have many friends asking me are you ok with this massive drop in the markets. My response is yes. I love all the volatility that this market is bringing. Volatility and Volume are great for price action and liquidity to trade and make profits quickly. There are so many opportunities out there long and short. One of the best things I can recommend it you are newer to trading is really study the market price action and what happens with volume. The catalyst this week for many stock to drop was the overall trend and fear of the stock holders.

You will also see if you look at an intraday chart of the spy there are different times at which you can see reversal or trend changes in charts.

I have people ask me if I’m in any stocks long and I did just re enter OLED at 140.66 for a long term swing again. To me the bounce off of 242 for the SPY is the start of a reversal. I will wait for further confirmation. However if the SPY can stay above 250 for this upcoming week in my opinion we are consolidating and gaining investors confidence to once again invest.

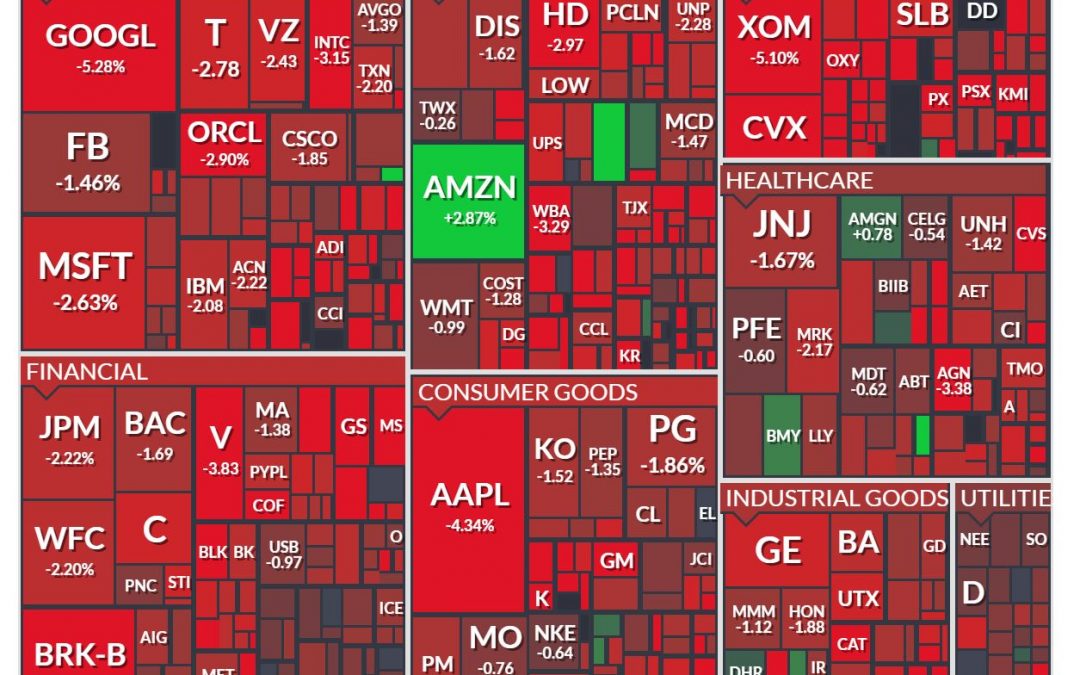

I try to always put myself into the mind of other stockholders to think of what they might be thinking. When the stocks are dropping your average Joe trader gets fearful and then sells and it snowballs into more selling and more selling until an extreme when people see the stock on sale. Like AMZN to me. I think AMZN is on a deep discount down at 1311. I think AMZN would be a good long term swing from here as they are a good value company in my opinion. They just posted biggest earnings ever and with the market trend dropped 200 points. They just announced to further vertically integrate their company with a trial of setting up a delivery service in the LA area. This was a big reason for the drop in UPS and FDX on Friday. And they just poached an NBC exec to help them with their own studios. They are looking to compete directly with Netflix in the streaming content arena.

To me this past week of the market has brought forth many potential long term swing opportunities as we see many stocks large cap and small fall to support levels which are great for longs. It minimizes your risk going long or buying the stock at a support level.

I know you must have many questions and I’m always happy to share what I have learned to help you shorten your learning curve. I was in your shoes a short 3 years ago just beginning my studies of the day trading world. I now wake up everyday and feel incredible blessed to have found it as a career. I remember back in 2009 a friend of mine did it and I said teach me. I never realized how passionate I would be about it and helping others in the same journey.

To help more people in person I set up the Modern Traders Summit which will be June 23rd in Orlando Florida. If you are interested in learning more make sure to check out the website where you can learn about other like minded traders that will be speaking about how they can help you improve as a trader. Seats are selling quickly so make your you secure your spot.

I have also partnered with Tradealike to provide my real time alerts via their mobile app. It is cool because there is no subscription cost and you can pick and choose which alert you would like to purchase.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

If you are interested in receiving my morning watchlist email sign up here to receive 3 days free. It is affordable at $19.95 per month, which is roughly $1 per trading day.

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPETPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.