by Jane | Dec 4, 2018 | Uncategorized

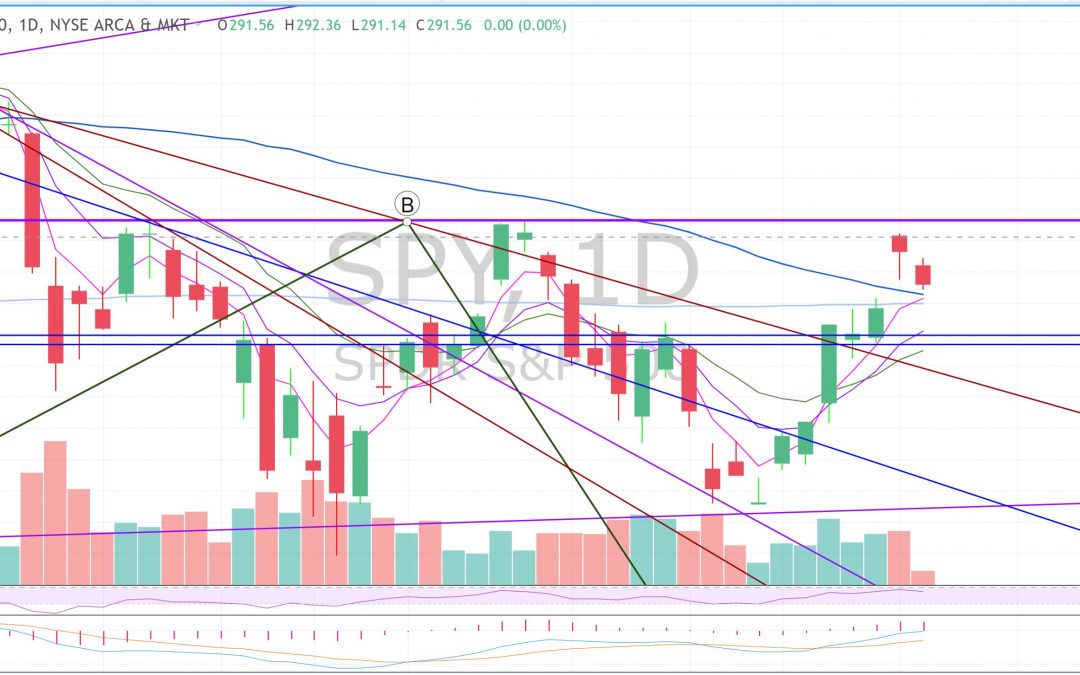

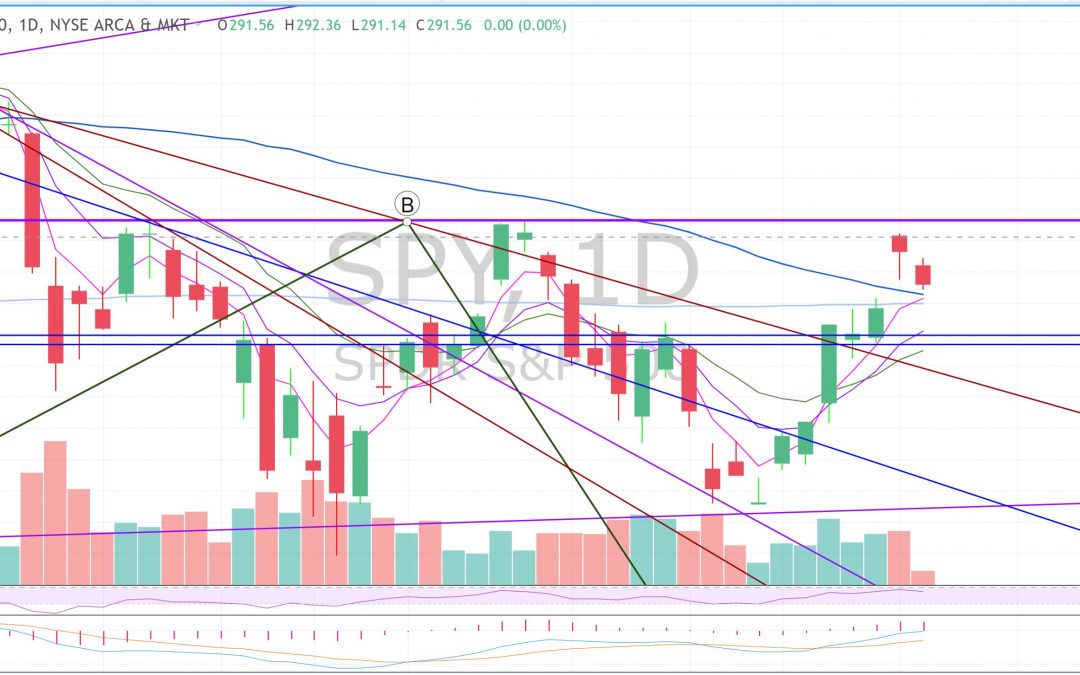

So we all thought yes the recovery is here. Great news with G20 and the new agreements to be enacted with Mexico and Canada and positive news about a tarrif halt for 90 days. That shot the SPY ETf up to that 281 resistance area premartket on Monday Dec 3rd. Yet there was no continuation to the upside to break out. We did break the brown monthly trend line to the upside and through the 200 day SMA. Yet there is more and more press of a recession coming, which leads me to believe this is going to end up in selling from investors on the bounce instead of influx of new money. It we break the 200 (light blue) and 50(dark blue) SMAs then we will likely have the death cross of the averages indicating more of a downturn to come. We shall see if my post of a 236 are in January is correct.

I’m curious to see where this week ends because that 200 SMA is right near by at 275.99 and to me a close above will indicate the buyers want to see the market recover. A close below this week and the sellers are taking losses for maybe tax purposes and will buy back cheaper, but it might be a while before a strong uptrend. Will see where the market takes us.

For now I use Trade Ideas to find those Alpha stocks Like $AZO  where on Earnings it broke out from the premarket highs and then ran up a nice $24 to a pullback and support for a secondary run before the market drop pulled it down. A close above 870 would lead me to believe that this will have a couple days to the upside if the market doesn’t drag it down.

where on Earnings it broke out from the premarket highs and then ran up a nice $24 to a pullback and support for a secondary run before the market drop pulled it down. A close above 870 would lead me to believe that this will have a couple days to the upside if the market doesn’t drag it down.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPEPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | Nov 21, 2018 | Uncategorized

That’s right! Isn’t it nice of the market to drop all the prices this week for Black Friday, Cyber Monday sale. It just so happens that the market is about to come down and test a trend line that has acted as support all year. The lower Trend line that has the A acted as support for the second time as a bounce spot. When we pull it back on the Weekly chart below it becomes more clear.

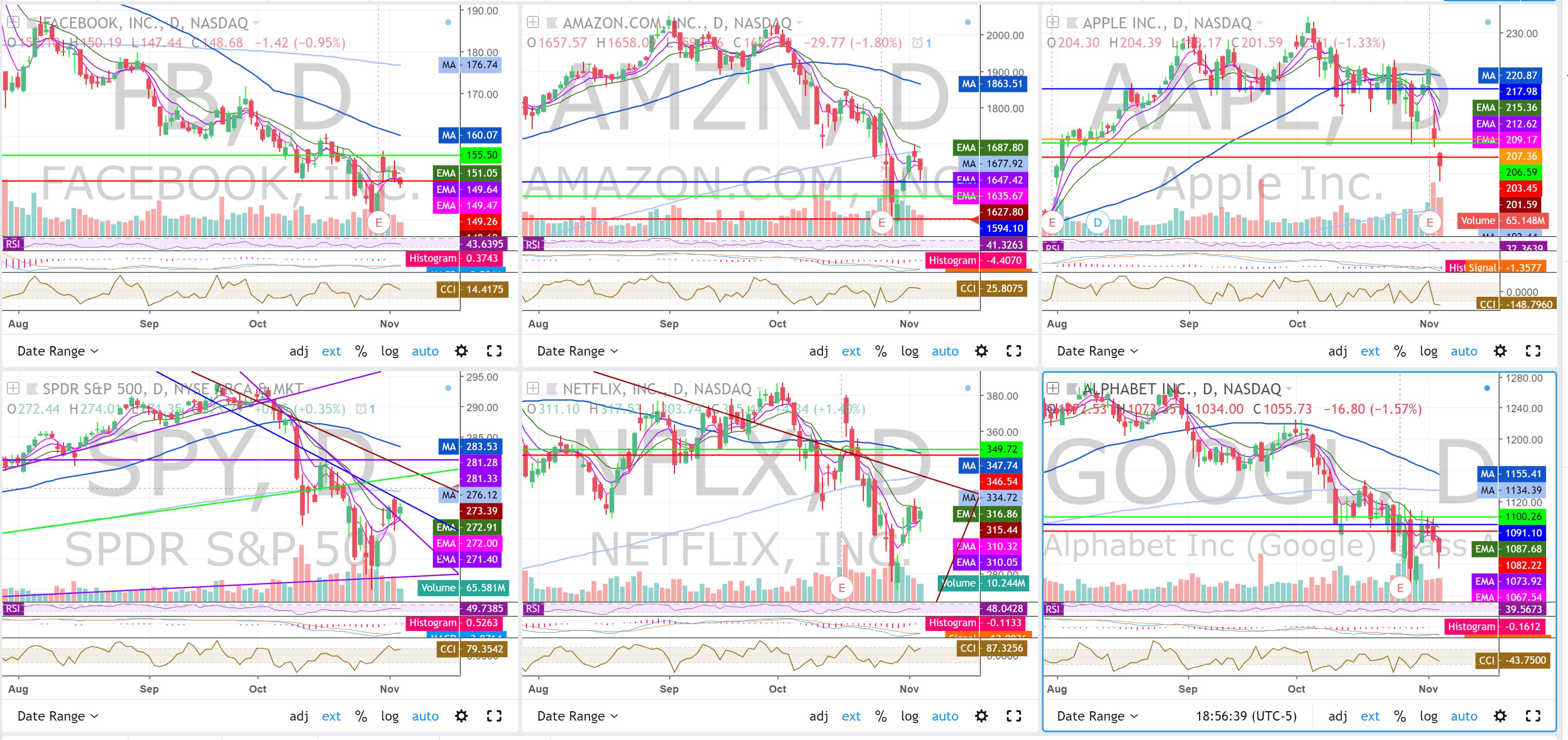

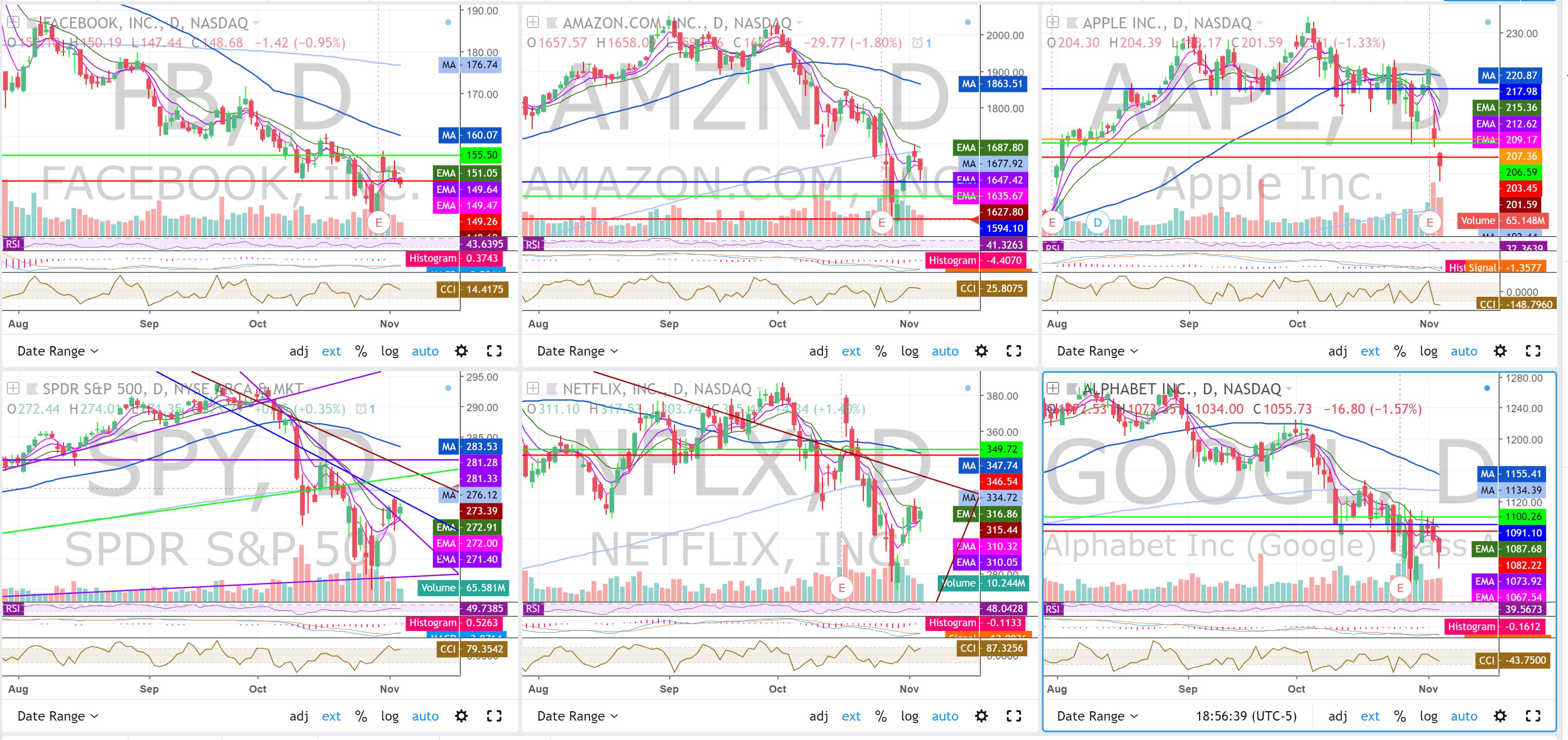

This will now be the third test of the trend line this year. Just recently I learned about the Elliot Wave and to me this is looking like the SPY wants to drop further in this correction C wave to the Monthly 200 SMA of roughly 236. In looking at all the FAANG Stocks $FB, $APPL, $AMZN, $NFLX and $GOOGL are still dropping below the 200 SMA. In Fact more than 60% of the NYSE stocks are below the 200 SMA a good indication of a bearish trend. The furhther out that you pull the indexes you will see that there is a bigger trend of down for now. Also on the weekly chart we do not have the big volume coming in yet that indicates the buying is happening. Will definitely be watching the test of the trend line for a break or bounce.

This will now be the third test of the trend line this year. Just recently I learned about the Elliot Wave and to me this is looking like the SPY wants to drop further in this correction C wave to the Monthly 200 SMA of roughly 236. In looking at all the FAANG Stocks $FB, $APPL, $AMZN, $NFLX and $GOOGL are still dropping below the 200 SMA. In Fact more than 60% of the NYSE stocks are below the 200 SMA a good indication of a bearish trend. The furhther out that you pull the indexes you will see that there is a bigger trend of down for now. Also on the weekly chart we do not have the big volume coming in yet that indicates the buying is happening. Will definitely be watching the test of the trend line for a break or bounce.

What are your thoughts on the market sentiment? Shot me your thoughts in the comment area.

The market as a whole isnt the only area for sales. There are a bunch of sales like everywhere else.

My watchlist is 20% off with Promo Code “THANKS” Through Cyber Monday.

The charts above are from Trading View and they are having their annual 60% off sale on their charting paid services.

Trade Ideas is offering 20% off with “GOODGRAVY”

I hope that these analysis posts are helping you to see the big picture of the market right now. This correction or bigger bear market is a normal occurance of the market to later set new highs. It will be determined in my opinion when we see that big candle like the first test of the trend line that indicates buying is happening. The volume dictates who is winning the bears or the bulls.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPEPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | Nov 6, 2018 | Uncategorized

Tomorrow’s Midterm Elections will likely determine if we are in a recovery mode or setting up for a bigger downturn in the market. The Image above is the weekly Spy Chart. In pulling it back on a large time frame you can see that we hit the same support that the market hit back in Feb.

However in looking at the differences we have had more downward trending weeks from the top before a bounce and the bounce has taken from that support line to 50 SMA (blue average line) at 275 before pulling back. Another crucial note is that these candles following the bounce are remaining below the averages. There is more volume in this round and the bounce candle has less volume than the red weeks prior.

This analysis leads me to believe we are in a Dead Cat Bounce Phase to a bigger downtrend. Another interesting fact is that we had the big FANG stocks reporting and almost all of them had selling after the earnings. Here are links to the Form 4s for $FB , $AMZN, $AAPL, $NFLX and $GOOGL And in looking at their charts almost all of them except for AAPL are below their 200 SMA (light blue line). That does not seem like a healty market to me.

Now it could be a coincidence that the CEOs and COOs are selling or maybe their advisors are saying go ahead a lock in profits on before we see more of a dramatic drop. Pretty much each of the FAANG stocks dropped on day of earnings. If they gapped up and the market thought they would be a good investment I believe we would have seen more upside to them.

In my daily scan of stocks I am seeing many more 52 week lows on stocks and very few breakouts of lifetime highs. So I am leaning bearish until the market starts spitting out data to prove otherwise. Here is a link to check out the daily highs and lows.

There is always money flowing somewhere in the market and if you are limited to going long in a retirement account or cash account definitely check out the finviz.com Heat map of where the money is flowing. It will help you determine the strong sector for the day and or trend.

If you are newer to trading and only experiencing the bull trends here is a great free bear book to help you transition into a consolidation or downward market.

If you had my watchlist this week you could have been banking big time had ACIA run. There is a 20% off Thanksgiving day sale with THANKS promo code. If you opt for the Annual I will offer a complimentary 1 hour training session.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPEPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | Oct 6, 2018 | Uncategorized

This week has been brutal on the market. Last week we had FOMC meeting with the raising of rates and the indexes went wild. Then Sunday we had NAFTA signed and up we surged. Last week Facebook had the security Breach and the SEC filed against Musk.

All of this has brought volatilitu back in the market. We have seen the FAANG Stocks (Facebook, Apple, Amazon, Netflix and Google) pull back from breakouts. Should we be worried?

It is completely natural for the market to have a correction. When this happens it is a great time to paper trade shorting if you havent done it yet. There are still stocks that run like GTXI today, but it can be harder to go long when the market trend is down.

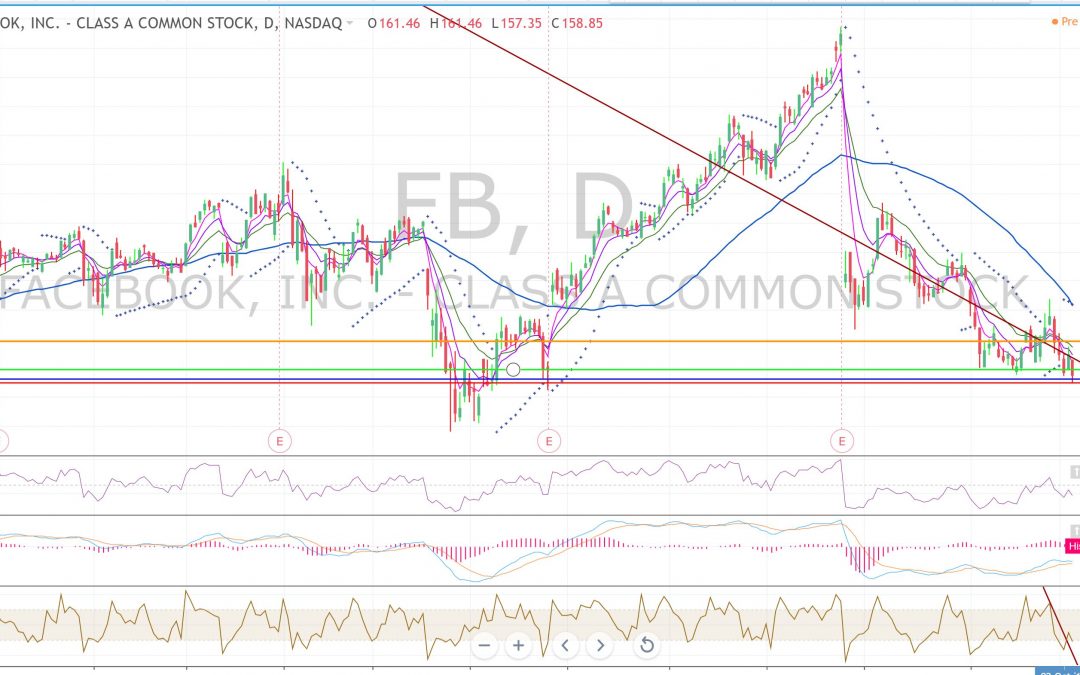

If you are newer to trading and only experiencing the bull trends here is a great free bear book to help you transition into a consolidation or downward market.

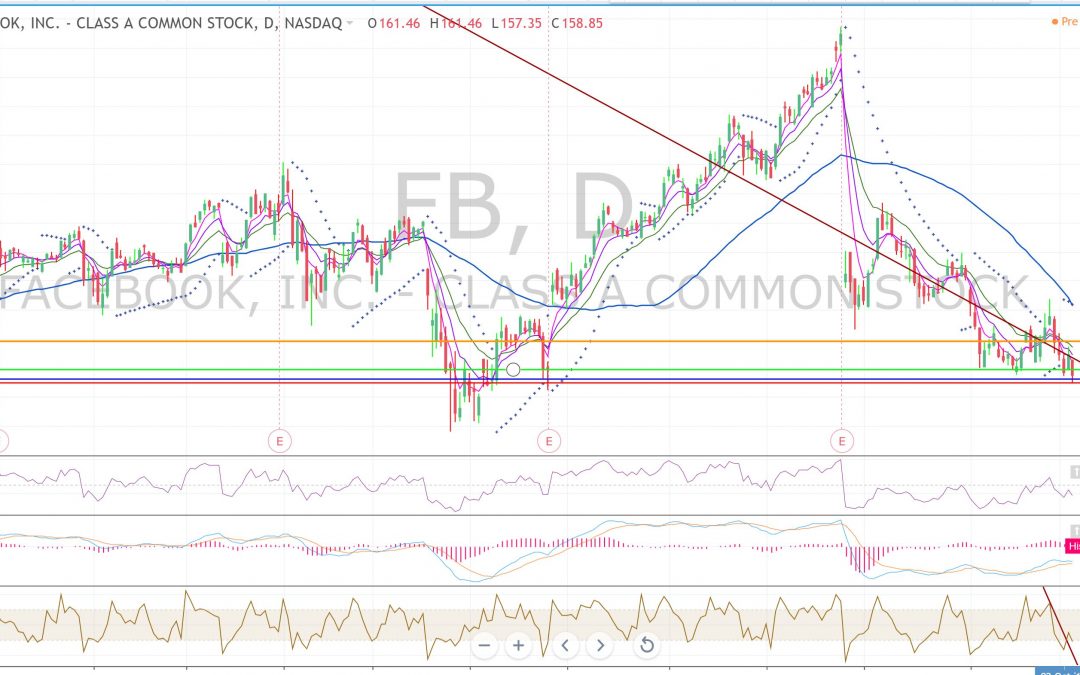

Above is the Facebook’s chart where you can see on the daily the stock is running down below the averages. Well below the 50 simple moving average and broke a support line today of 158.13 and set a new low of 156.22 since the Cambridge Analytica news. What is instock for FB before earnings on the 30th? There are rumors that ad revenue is down and all the negative press has the stock beaten down. It looks like we might see 150 before 200 again as insiders have been selling and likely big houses now too as well as shorters

In my opinion next week will give us clarity if we have found a bottom if it can close aboce 162.5 on the daily chart. Until then feeling bearish like the market.

If you had my watchlist this week you could have been banking big time had FB short for two days in a row. There is a 20% off Columbus sale with OCEAN promo code. If you opt for the Annual I will offer a complimentary 1 hour training session.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

If you are interested in receiving my morning watchlist email sign up here. It is affordable at $34.99 per month, which is roughly $1 a day. Special Columbus day sale of 20% off with OCEAN as the discount code

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPEPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | Sep 22, 2018 | Uncategorized

If you have heard of $TLRY then you have heard of the exponential growth available in the cannabis/pot sector. The whole arena is just blossoming with opportunity.

Has the chance to invest passed you by snd you missed it? Probably not, but for TLRY it needs to come back to reality.

TLRY is the first cannabis grower that was listed on the US stock exchanges. Not only being the first but such a small public float made its valuation sky rocket. There are roughly 17 million shares available to be traded by the public.

If you have followed my blog posts in the past then you know that the low floats have potential to run from 17 to 300 in a couple weeks. As the demand grows so does the price. However as quickly as it goes up it can drop. In fact it webt from 150–>300–150 all in one day. When those major swings are happening its best to trade cautiously with a smaller position.

Does it mean since TLRY is on the way down from its parabolic move like Bitcoin to 20,000 that the sector lost its lustre. In my opinion the sector growth is not done, but Tilrays momentum move is over for the moment.

In fact I have a good 30% in my 401k in the cannabis sector diversified through different holdings. Some value that I see are the Hemp producing companies that then generate CBD for pharmaceutical companies.

The pharma companies or other partnerships then use the CBD oil for health benefits such as pain management, seizure prevention, cancer treatment and more.

Two of the companies I hold that I think have good longer term growth potential are HEMP on the US exchange and ACBFF. HEMP has one of the biggest Hemp processing facilities in the US and the have a Hemp University where they teach farmers about how they cab farm Hemp for profits.

ACBFF is also known as Aurora and they are a Canadian company. They are also big into the CBD production and have a global vision with their market. The reason why CBD can have a bigger reach globally is due to the fact it is legal in more locations than the THC ingredient of Pot. So the CBD partnership potebtial with a beverage company on the horizon could really cause massive growth. The CEO recently did an interview expressing that the comosny has spoken with 3 companies one of which is Coca Cola. No partnersgips signed yet, but one is in the horizon. They are also looking to potentially have a US IPO to come off the pink sheets in the next coming months.

These are just two in the big arena of Cannabis. Another third that just had their uplisting to the US exchanges from pink sheets is CGC or Canopy Growth. Since they had their uplisting they doubled in value as well.

The big day for the Cabadian companies is the first day of legalization in Canada of October 17, 2018. Will the value growth continue after this date? I think that it will, but the hype is definitely driving the stocks up now.

Is it too late to invest? In my opinion I think there is value underlying in the stocks mentioned above, however the ones that have more than doubled have high risk involved.

When a stock like TLRY opens at 17 and then becomes more valuable than 75% of the S&P and is traded at roughly 500 the earnings of the company it makes you wonder?

There are other blue chip stocks out there trading with high PE ratios, but 500-700 is a bit inflated for me. I prefer to stick with the ones where the growth potential is in the horizon instead of explosive move missed.

As always remember to trade with proper risk management and do your due diligence so as to nit get burned like those that bought TLRY at 300.

Other Cannabis Stocks that could be interesting

APHQF – Aphria

CGC- Canopy Growth

EVIO – Evio Labs

OGRMF – Organigram

SPRWF – Supreme Cannabis

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

If you are interested in receiving my morning watchlist email sign up here. It is affordable at $34.99 per month, which is roughly $1 a day. Special Columbus day sale of 20% off with OCEAN as the discount code

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPEPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | Sep 1, 2018 | Uncategorized

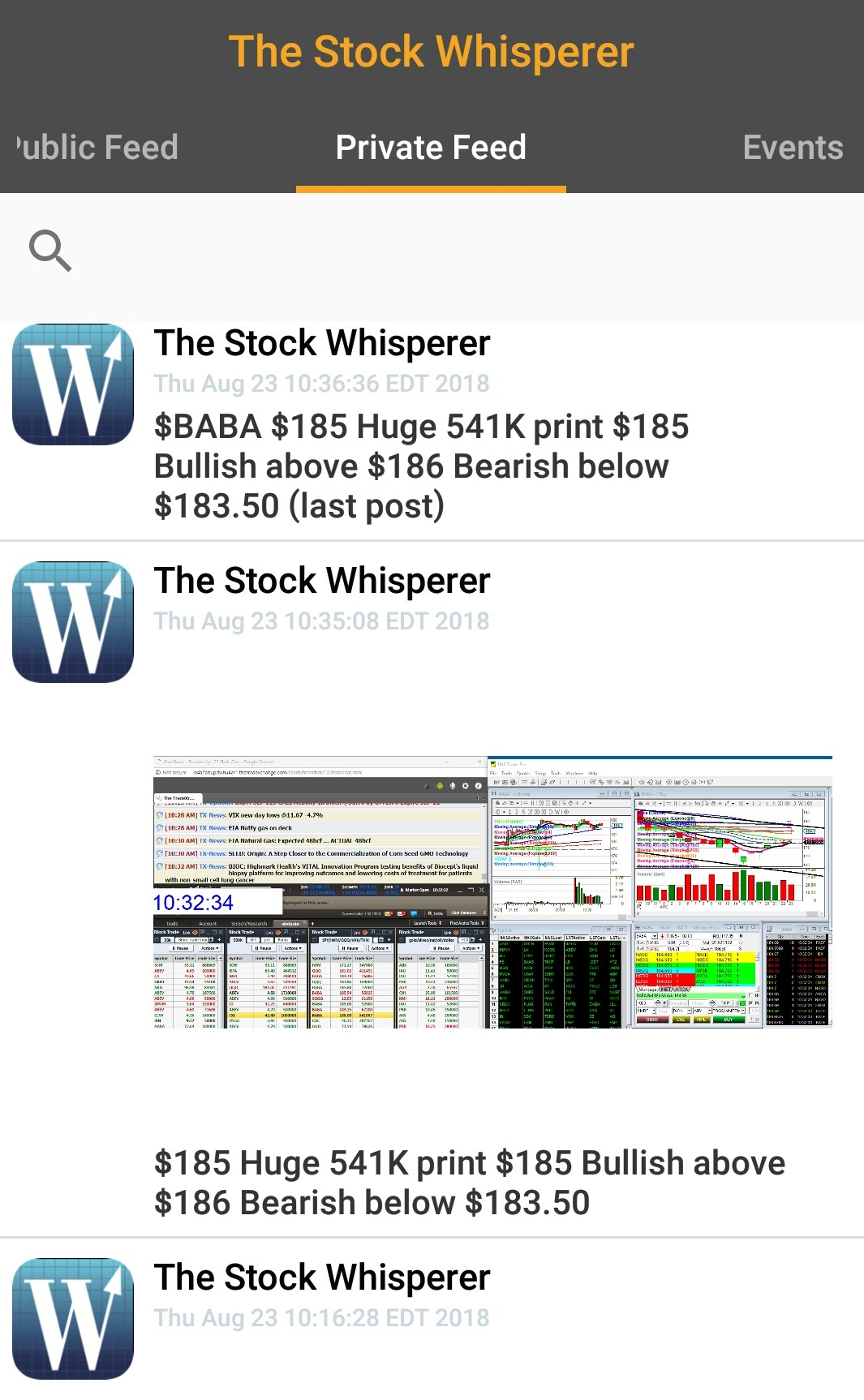

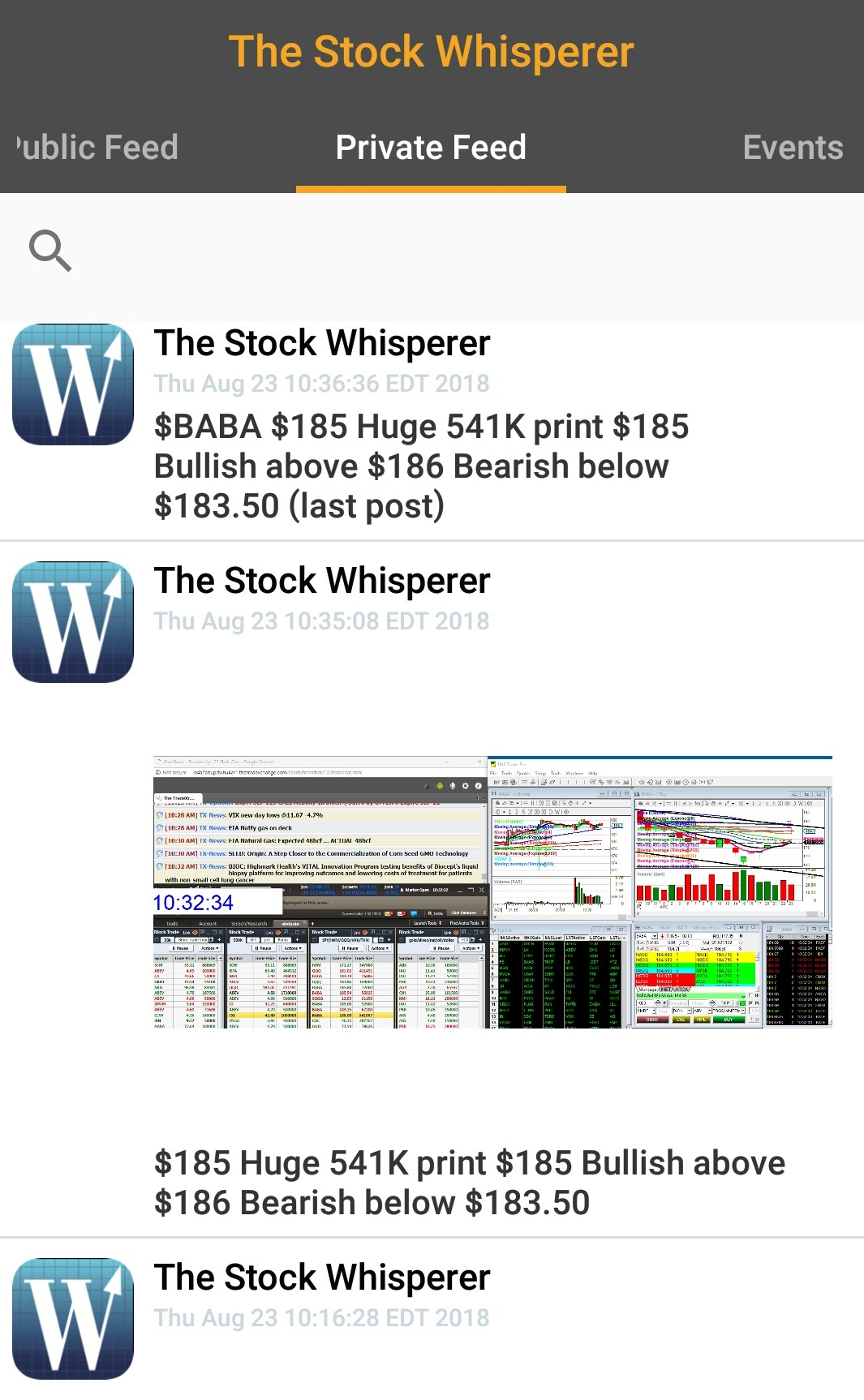

Well I can tell you how to see the big prints to trade like them. We all want inside information that could almost ensure we will know what happens to a stock as far as running up or dropping like a rock.

While I was waiting for my TOT surgery in the preop area I completed the final chapters of Stefanie Kammerman’s book Dark Pool Secrets.

I am no stranger to Stefanie as she is one of the female traders that I had interviewed for my book.

Her book excited me again to so further research and really start following the dark pool prints and the action of the stock. There are crazy levels that you see and watch where the stock goes from there.

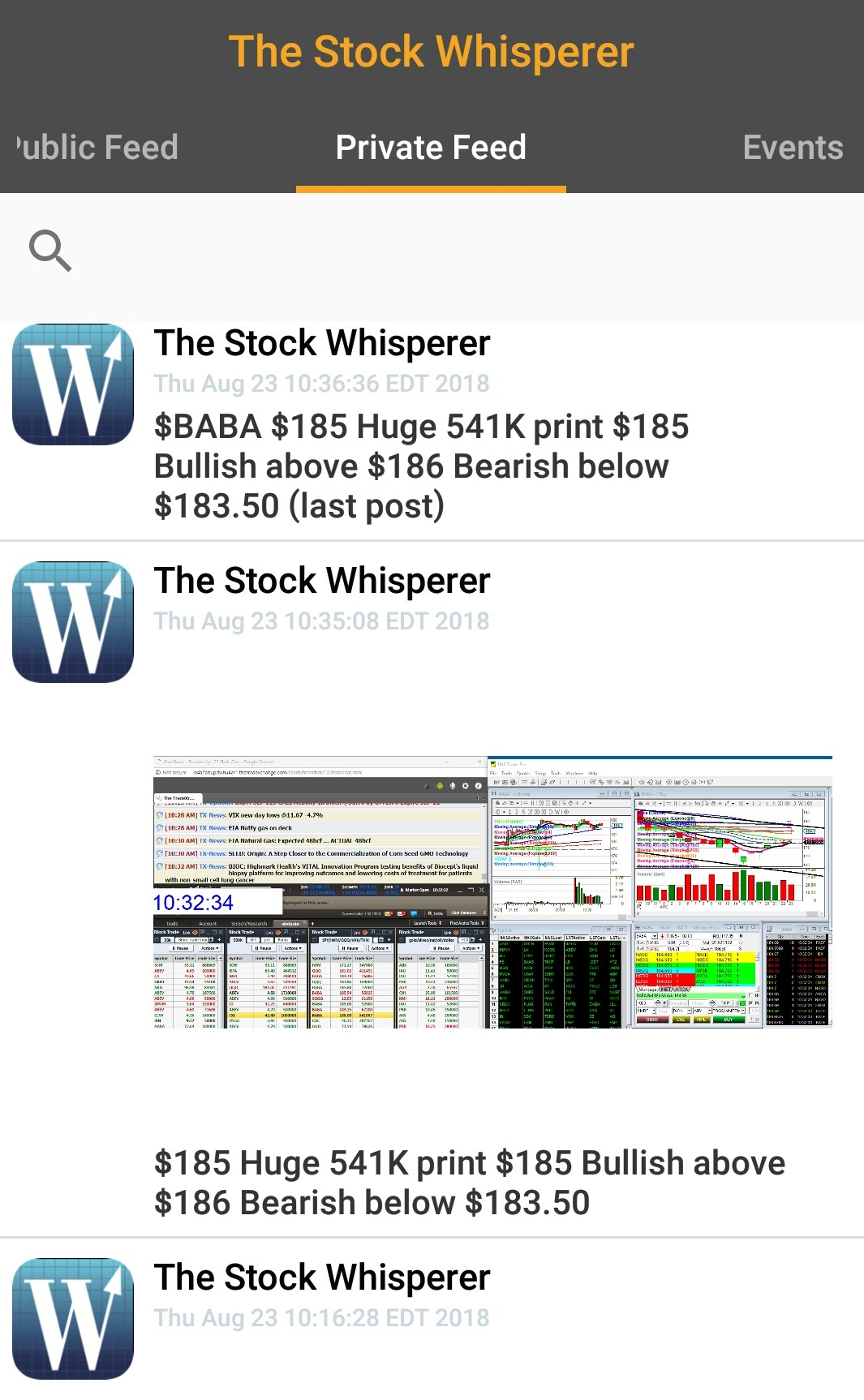

I am now an avid watcher of the prints in her trading room The Java Pit. Where everyone keeps an eye out for a big print to indicate a move on a stock. The two that were probably the most dramatic were BABA and FL. Both had earnings and you know the earnings can be stellar and the stock reacts how the market decides.

Well BABA had amazing earnings and many people likely thought this is a sure bet to run for days. Well on her app notification shown below and also in the room we spotted a massive print.

And what do you think happened from there. It dropped like a rock to a low of day of 171.91. I truly feel bad for the longs in that scenario, but you can easily see that if the price action stays below the stock is bearish and above bullish. Now not every stock reacts immediately. There are some that take days like the recent AMZN upgrade that the prints came 2 days prior.

The price action that follows these prints is a pretty good indication that there is some market manipulation going on with the guys with big pockets. Just like pump and dumps of penny stocks that hype up the little penny stocks it happens in the big name stocks too. And those secret signs can be seen in the dark pool prints.

Now in using these secret dark pool print information you need to be patient. Sometimes it can take days for the direction to be shown or news to be released. However patience pays off and you know that the prints are backed by big $$$. So you dont want to go against this big money or you will definitely get burned.

I am always looking to expand my knowledge in reading trading books and books in general. If you have a great book recommendation shoot it my way. The more we read the more knowledge we gain and can make better educated decisions.

Im thankful for the copy that Stefanie gave me at the Modern Traders Summit. Who wouldnt want to trade with these secret prints.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

If you are interested in receiving my morning watchlist email sign up here. It is affordable at $34.99 per month, which is roughly $1 a day. Special Labor day sale of 20% off with LABOR as the discount code

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 25% Off First Month or First Annual – Promo Code ALPHADAY

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | Jul 29, 2018 | Uncategorized

That is what drives us to do what we do everyday. Why are you in the job you are in right now? Is is a stepping stone to something bigger and better? Is it because you are in your comfort zone?

Are you truly happy with where you are in life? What do want from your life? Ok now we are getting somewhere closer to your real why and motivating factor in life.

If you are new to following me you know that my why is the blessing of our 2 daughters. I wanted to be home and present for them growing up and so I turned to learning day trading.

Then I set out to help others find out their reason why they might want to get into it and help motivate them along the way. Getting into trading and making profits comes with self motivation. For those that want to do zero work this probably isnt for you and simply hiring a financial professional might be better for you.

If you really want to take control and make a difference in your life and know you will do the work necessary lets get you there.

One of the tools I have helped to inspire and shorten that learning curve is the recent Modern Traders Summit. A great event which recently took place in Orlando. Everyone there loved the event from speakers to attendees. When you put passionate people in one room that are encouraging each other we all rise up. I thought ahead and made sure to record the event for others to learn from themselves and it is now available in my Videos On Demand in the main menu. We are in the planning phases for next year as well.

Like first turning to trading it was something out of my comfort zone, however I did not let that stop me from making it happen.

All our growth personally happens when we do something new. It can be a success or a leaening learning experience. The same is true with a trade. It can be a successful profit or a learning experience about how to be better tomorrow.

No baseball player has a 100% batting average and yet they have success. No trader has 100% trading success yet as long as the profits out weigh the losses there is success.

So to create that success you have to master your skill. That is why I asked 8 speakers to share how they had their success with trading. We are all different and have different thought process and enjoy different strategies. The main common attribute is locking gains and minimizing losses. So how can you get there?

Study, attempt, refine and do it all again. If you are building up capital practice the beginning steps with fake money as it is alot less painful to pay $30 a month to trade monopoly money and lose while perfecting your skills than your hard earned money.

For those that are ready for trading a real account or have one open I started sharing my watchlist daily to subscribers as a learning tool. I set up a Tutorial Video to walk you through how to use the watchlist and learn on how to set one up for yourself once you are comfortable. If you are interested in trying it simply sign up here or at the top of the page.

Carpe Profit! And grow that account one trade at a time!

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

If you are interested in receiving my morning watchlist email sign up here. It is affordable at $29.95 per month, which is roughly $1 a day.

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPETPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | Jun 17, 2018 | Uncategorized

You maybe be questioning why I’m thankful as a mom on Father’s Day. Well it was the blessing of becoming a parent that allowed me to find the energy and drive to change my life and the live of our family.

Change in life comes from that change in your mindset to MAKE IT HAPPEN! Once your brain has that as a goal nothing can stop you. IT probably won’t happen over night but the change in your brain can happen in a split second.

What is it that will truly drive you to change your life for the better? For me it was having children.

Also having children and helping them grow and learn made me realize how much I enjoy giving back and seeing success for them, but also for you. All of my sharing comes from a place in my heart of wanting to see you succeed. We all need cheerleaders in life and you never know someone’s story.

I have people that reach out to me on social media and tell me their life story of how they have not let the negatives let the down in life and instead fuel their success. A challenge in life will cause one of two things to happen. It will swallow you up or it will push you to succeed. A lesson either way.

Trading is very much a challenge and will keep you on your toes. If you don’t take the time to learn from your mistakes it will swallow you up. However if you truly learn from your mistakes you will succeed like no other career out there with the flexibility you might have only dreamed about. So the hardwork and outcome are 100% up to you.

I believe that everyone has the potential to succeed in trading, it’s a matter of the process people are willing to put forth to acheive that success.

Bringing it full circle it is the reason why I am constantly sharing to try to help you shorten that learning curve. Many people still need to experience it for themselves.

Next Saturday is the Modern Traders Summit and has like minded traders that want to see you succeed. The last day to purchase in person seats is Wednesday June 20th. I realize not everyone can be there in person, so I set up Streaming and On Demand after the live event. There is a 15% of discount code for streaming of 5gz625.

Also this weekend being Father’s Day there is a 25% off sale with one of my favorite Stock alerting softwares Trade Ideas. Make sure you use discount code THANKSDAD through Monday at midnight for 25% off your first month or year.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

If you are interested in receiving my morning watchlist email sign up here to receive 3 days free. It is affordable at $24.95 per month, which is roughly $1 per trading day.

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPETPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | May 28, 2018 | Uncategorized

Change comes from stepping out of our comfort zone. The change of becoming a stay at home mom day trader was not an easy one or without fear. However the only way to overcome fear in life is to face it head on no matter what the situation is you are fearful about. Usually that fear is just a mental hurdle that we battle.

Never did I think the day that I started my journey to daytrade back, that I would be so open to helping others in the same journey. First with Twitter, then this blog, then YouTube, the book and now the Modern Traders Summit June 23rd.

I am always trying to put myself in your shoes to think about what someone could need in starting out and how I can help. Little did I know that in setting up the Summit I would be so challenged. With each new adventure in my journey of helping I discover newhurdles.

Planning the summit has been one full of suprises and great new challenges that I just tackle head on. I have been a bit absent from the blog because I did not anticipate all the details to be in planning the event. I am so thankful to all my friends and husband for their help and support in keeping me on track to make it happen.

We are now 3 weeks out and the speaker line up is amazing to cover all sorts of trading styles and markets. We have Cryptos, Futures, Options, Stocks, Shorting and more. All of the speakers have the same intention to help you succeed in your trading journey.

We all know that with the success comes hard work. It is not a get rich quick scheme. You must devote the time and there is not one time frame that works for each person on the road to success. The goal is to help you shorten that time frame. However with each personal goal it is up to you to succeed.

The time and effort that you put forth in challenging yourself each day will help you make it happen. I can’t remember if it was Grant Cardone or Tony Robbins or Jim Rohn that said if you want change in your life you need to have change in your actions. It is 100% true. If you want something different in life you need to do something different. So that means you shouldn’t wait, take that action today!

That is what it was for me in setting up the Modern Traders Summit. Taking action everydat to make it happen for you.

The opportunity for you to improve in trading from the speakers is right in front of you. It’s now your choice to take action to attend or watch it streaming.

Are you going to let this opportunity slip by or take action today?

Do you want that change to start today? Your actions predict your future….

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

If you are interested in receiving my morning watchlist email sign up here to receive 3 days free. It is affordable at $19.95 per month, which is roughly $1 per trading day.

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPETPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

![So you want to be a day trader….Do you have what it takes?]()

by Jane | Feb 24, 2018 | Uncategorized

Today in meeting with our good friend Michelle it brought back all the memories of my start in the day trading world.

The first day I remember finding Timothy Sykes and starting to research terms and feeling overwhelmed. For those that know absolutely nothing about trading terminology you are going to find investopedia.com your go to spot for informing you.

Don’t be fooled that is just the beginning of learning the market. As like any profession you have to build a base before you can begin your trading journey

A guideline of how to make it as a trader as a profession. It will take hard work and patience in your journey.

Step 1. definitely start studying anything and everything about the market. The more you learn the more you will find you don’t know. The market is every changing and you have to adapt as the market changes.

Step 2. try to find a program or mentor that you mesh with that will keep you motivated along your journey. There are many out there. Make sure whomever you choose that they don’t boast a guarantee of their product to make you profit. Everyone learns differently and everyone has to find a strategy that works for them.

Step 3. Determine how much time you can honestly devote to trading. This might be something you will be doing part time to start as you are still working you 9 to 5 job.

Step 4. Once you know who you want to work with and how much you can devote then study up, and start your paper trading. I highly recommend paper trading to find your strategy. It is much easy to pay $30 a month to practice than lose your hard earned money. Remember that if you need to paper trade for a year that is roughly $360 versus thousands you could lose in your first account (I speak from experience on this one…I blew through a $6k account in a couple months not knowing)

Step 5 Once you have consistency and confidence in your personal fingerprint strategy. It is time to open your trading account. Depending on where you are in the world there are different brokers that you can use. If you are in the States and starting with a smaller account then you will probably encounter the PDT Rule

To name a few good brokers Think or Swim, Interactive Brokers, Trade Station, Fidelity and Lightspeed. There are other off shore brokers that you can use, but myself I have never been intersted in going with an unsecured company.

Step 6. Journal you trades from the moment that you begin trading a free site is Profitly

In trading you are not in competition with anyone else. Everyone learns at a different pace and your goal is to be profitable. Trading the right setups at the right time will help you be profitable. The more you keep track of your trades and your emotions in entering the trade and exiting the trade you will understand your trading pyschology. You are your own worst enemy in trading.

Step 7. Continue to grow in your trading. As your real money profits begin growing remember there are 4 outcomes: Big Wins, Small Wins, Small Losses and Big Losses. If you simply get rid of big losses and learn to let the Wins grow then you should be able to continue growing your account.

When you mess up know it is part of the trading journery and use it as a learning experience. If you need to step away from trading and don’t take it out on the market. Trade with a clear head.

I know you must have many questions and I’m always happy to share what I have learned to help you shorten your learning curve. I was in your shoes a short 3 years ago. I now wake up everyday and feel incredible blessed to have found it as a career. I remember back in 2009 a friend of mine did it and I said teach me. I never realized how passionate I would be about it and helping others in the same journey.

To help more people in person I set up the Modern Traders Summit which will be June 23rd in Orlando Florida. If you are interested in learning more make sure to check out the website where you can learn about other like minded traders that will be speaking about how they can help you improve as a trader. Seats are selling quickly so make your you secure your spot.

I have also partnered with Tradealike to provide my real time alerts via their mobile app. It is cool because there is no subscription cost and you can pick and choose which alert you would like to purchase.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

If you are interested in receiving my morning watchlist email sign up here to receive 3 days free. It is affordable at $19.95 per month, which is roughly $1 per trading day.

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

. As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPETPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

where on Earnings it broke out from the premarket highs and then ran up a nice $24 to a pullback and support for a secondary run before the market drop pulled it down. A close above 870 would lead me to believe that this will have a couple days to the upside if the market doesn’t drag it down.

where on Earnings it broke out from the premarket highs and then ran up a nice $24 to a pullback and support for a secondary run before the market drop pulled it down. A close above 870 would lead me to believe that this will have a couple days to the upside if the market doesn’t drag it down. . As well as Barnes and Noble, Indigo, Chapters,and more.

This will now be the third test of the trend line this year. Just recently I learned about the

This will now be the third test of the trend line this year. Just recently I learned about the