by Jane | Aug 25, 2016 | Uncategorized

So I have been keeping a secret from you guys…..I have to apologize, but you will soon understand why. I had a such a poor performance in June because I found out yes I’m pregnant. I’m now 15 weeks pregnant and Due in February.

For all the ladies out there you can sympathize with the fact that I had baby brain in June. For all the men, baby brain is a phenomenon when the hormones in a woman’s body go haywire with all this baby growth and make your brain fuzzy. It feels like if you have every had a great workout and your blood sugar is low and your brain just doesn’t seem to be clear. That is the best way I can describe the fuzziness that happened.

Not only that but I also had morning sickness where I just felt like puking all day long.

So that is why I only really traded for 2 weeks in June. When my brain wasn’t feeling right and I was feeling sick I stepped away from my desk.

It is very important to be in touch with your body and your mind to have a clear head to make great decisions in trading.

I found I was making super beginner mistakes in June because my reactions were slow.

Again it happened the beginning of this month when I went for the genetic testing. I had my tests done on August 4th and for the next two weeks my mind was slightly distracted. I found out the results last week that the genetics testing was all good and the ultrasound looked like no issues presenting at this time.

We are still waiting on one stressful test of Zika Virus. As you all know my husband is a pilot and flies to Caribbean destinations. Well when he was in Cuba and his fellow pilot opened the cockpit window to get some fresh air he was bit by a mosquito. It was only one bite and the chances are low, but we have to be smart. So we did the test now 3 weeks ago and we are waiting on the serology results to come back negative. So my mind is still a bit distracted.

I have to apologize as being a transparent trader this was a hard secret to keep quiet from you all. For those that will be meeting me in Orlando you will see the tiny belly bump. And it explains my unstoppable cravings for Wings and wing sauce. Mmmmmm

Phew feels good to come clean about that one.

Sometimes I’m also exhausted at the end of the day and that is why my blogs are some times off schedule from Tues, Fri. Trying to get better about that.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Aug 22, 2016 | Uncategorized

As in life you are always tweaking your style. Sometimes we revert back to old habits and have to have something happen to remind us to improve.

Well the pain of Tuesday is one of those experiences. I know I need to put in Stops to protect myself at entry. If it goes up. Move my stop up to protect those profits. I love saying Carpe Profit as it is one profit at a time that will grow your account.

As long as you keep those profits overall bigger than your losses the account continues to grow and grow.

This week was fun with some great stocks breaking out and really spiking. On watch for monday is $SPU with the 46% short float after the spike friday. The stock closed green on the day even though it dropped down from the spike.

I have had people asking me about my schedule at the Trader and Investor Stock Summit in Orlando. I am willing to meet with people from 8-10pm probably in the hotel. I mean a lady needs her beauty sleep right.

I will be there with my family so I would like to prioritize dinner and Bedtime with my daughter. One of my driving factors in going into day trading was to allow more time with my daughter so I will be giving her my attention in the evenings.

I also had people ask if there is an email to correspond with me and I set one up capturing my favorite phase. So if you want to email me my email is carpeprofit@gmail.com I will warn you that if I get overwhelmed with emails it might take me a while to respond.

Another update I have going in on is setting up a weekly vlog. My husband is a huge fan of YouTube and is really encouraging me to do a weekly video. I did a twitter poll and it was a resounding 95% yes. So it looks like we will get things together to do a weekly Video to start sometime in September.

I did take two day to work on my book. I’m hopeful to have the manuscript submitted to the publisher for printing in 2017. I did not realize how time consuming the writing process is for me and so I’m anticipating one day a week minimum to write. I will try to add the afternoons as well to bang it out.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Aug 17, 2016 | Uncategorized

So you ask what happened?!

Well the day was going great. I was having an $1800 + day and then I went long at 39 and I did not follow rule #1 to cut losses early. I was so cautious yesterday and had a 100% green day with no losing trades and improved my win rate to 71.1%.

My mindset was this stock is now showing oversold on RSI and the shorts will cover and spike it up. Well it dropped more and I added around 38. I have been so good about using stops to protect profits but I did not on this trade. I usually go for oversold stocks and this was the reverse and outside of my comfort zone.

After making $1800 on the name I had superhero feelings. I felt like I could do no wrong with the trade. I got stubborn. Then as the loss got bigger I was in denial. Then when it broke down to 35 I was in shock and not sure what to do. Then I reflected and went into acceptance that I was bag holding and I would have to cut the loss. Looking at the chart it looked like it was going to drop more overnight than continue up. I did not want to be in the position as it continues to drop in premarket with sell offs and lose even more money. I let the loss get big enough and now it is time to accept it and move forward.

One of my good friends and great expert in psychology of trading, Mandi Pour Rafsendjani has a great article where she sums up the where feelings can cause that loss to happen.

Mandi has helped me with my emotions to try to reign them in and keep everything in perspective to profit more.

My big faults with this loss are :

- Didn’t cut the loss quick enough. I didn’t use a stop.

- I felt I could do no wrong with this name since I made close to $2K on it.

- Was hoping for action and denying the price action. Looking towards the future instead of being present in the trade.

So in regards to this painful loss I am taking a couple days away from trading to clear my head and work on my book. Not to mention deal with another incident of water damage from a giant rain storm. Sometimes life just happens.

I highly recommend that when you have a day makes you feel bad with trading step away for at least 24 hours. When Life happens prioritize it first instead of forcing trades with a distracted mind. It is important to be focused on trades when trading.

I had two $2K+ days and then another almost $2K day and the superhero mindset, I can do this, set in and caused me to have a bad loss. I know I can recover I just need time to digest and grieve and come back fresh.

I had a follower post on Profitly (AMR024) that they reached their first goal of $2K in profits and I am very proud to help people change their future. It takes time and hard work and practice to become consistency profitable. Those people that want the quick pick and immediate satisfaction usually will not be successful in the long run. The ones that study hard and improve themselves and study their trades will be more successful. So happy to hear that I’m helping others.

Being profitable myself is great, but sharing some of my tips and having others succeed is very fulfilling.

Thank you to my followers that have supported me today and reminded me of what I offer back that each loss is a lesson.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Aug 12, 2016 | Uncategorized

I have to say Thank you to you. I began my real journey of day trading intensely day to day almost one year ago. It was in September that I started to devote each morning to my studies to become a successful day trader.

The statistics of 90% that fail didn’t get me down. I knew that I can do anything I put my mind to and with hard work become successful in that 10%. So I was watching stocks at open to study the charts to see trends. Just like many individuals look for overextended charts to the upside I thought to myself I bet there is a trend to the oversold stocks.

So began my Excel studying of stocks that sold off big with earning losses or negative press. I entered the stocks and I tracked the price action at open and close for 5 days. I began to see trends. And then I began to see trends on certain days of the week.

At this time I was brand new to Twitter I think I maybe had 5 followers. I never thought me as a stay at home mom would have a followers interested in what I had to say. I still remember the day I broke 10 followers and told my husband and then 100. It was exponential growth like a short float stock. Today I broke 5000 and I’m happy to help each and everyone of you.

Having everyone interested helps me to become a better trader. I want to be transparent with my entries and exits, wins and losses and psychology behind it all. When I was just beginning I remember reading about the losses other traders had. There is so much to learn from each loss and not just a negative.

If you continue to make the same mistakes after you have analyzed your trades you are ignoring your own weaknesses. Another very important part of my trading journey has been my trading journal. I write down every trade with my entry and exit. I then review my trade vs the price action of the day. Analyzing both good and bad trades helped me improve.

I also took the time to read books about traders. The Market Wizard books and Momo Traders are great reading material which really helped me to learn from individuals compiled together in one place. This literature also inspired me to work on a book of my own which should be off to publishers for release in 2017.

I say all of this as a thank you, because holding me accountable makes me perform better and want to share more to help others. I am a mom and love teaching my daughter and being a positive influence in her life and I like to help all of you too. When I was just starting off it was extremely overwhelming but I continued my studies on a day to day basis. With perseverance you can do it too.

From past blogs you know that you have to find a style that fits you. Everyone’s risk tolerance is different and so is their timeframe for a trade. Some people love the adrenaline rush of a 1 min trade and some like a timeframe of 1 month spending most of the time away from the computer. It is up to you with practice that you will find your niche.

I will be updating my Profitly profile to reflect all my trades from this week. Honestly this week I learned more about myself. I had set up some swing trades before going on vacation and they have taken more time to perform than I anticipated. I got frustrated and closed some at a loss to have more capital to trade intraday. I know that I really enjoy the intraday work usually from 9-12:30 and then the rest of the day for family and life and maybe a visit back to my desk for power hour.

As you can tell the learning curve to success does not happen overnight with stocks and day trading. My husband has been watching videos and listening to my advice and now his paper trading is becoming successful because he studied first. There is also a learning curve involved with the software and that can’t be rushed either. So bottom line is learn it right from the beginning and don’t waste money in the market with losing trades. You are expected to lose a bit in the beginning but the more you look at risk/reward for each trade setup the more successful you will become.

Someone asked me about stops and stop losses. I use stops many times once the price action is in the green for me. Most of my trades are at what appear to be an oversold area of the stock. As the price action moves up I set a stop to protect profits. Sometimes I get stopped out before the upward momentum is complete, but I’m not upset because I locked a profit. A loss can be frustrating but a profit is never frustrating as it was more than I started with in the morning.

Thank you again for inspiring me to inspire and help others.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Aug 7, 2016 | Uncategorized

If you have been following me on my blog, Profitly and Twitter you probably know that I look for stocks that have been oversold and down at an extreme looking to return back to a sense of equilibrium.

If you have been following me on my blog, Profitly and Twitter you probably know that I look for stocks that have been oversold and down at an extreme looking to return back to a sense of equilibrium.

This week in particular I was looking at low float stocks because they tend to really run if the demand increases and there is only so much supply so the price really goes up quickly but it also goes down quickly. This past thursday alone there were 3 stocks that really moved and had breakout spikes. It just so happened that I had just set alerts for low float breakouts and caught them. HMNY went from 7 to 15, RGSE went from 6 to 11.60 and GBR had a 30% run from 3 to 4.

I don’t only trade low float stocks, but the potential for great returns in a short period of time is possible. To me and many others a low float stock is typically a stock with 20 million in the float. Now what is the float you might be asking? Well a float is the amount of shares of the stock that are available for the public to trade and exchange hands on a daily basis.

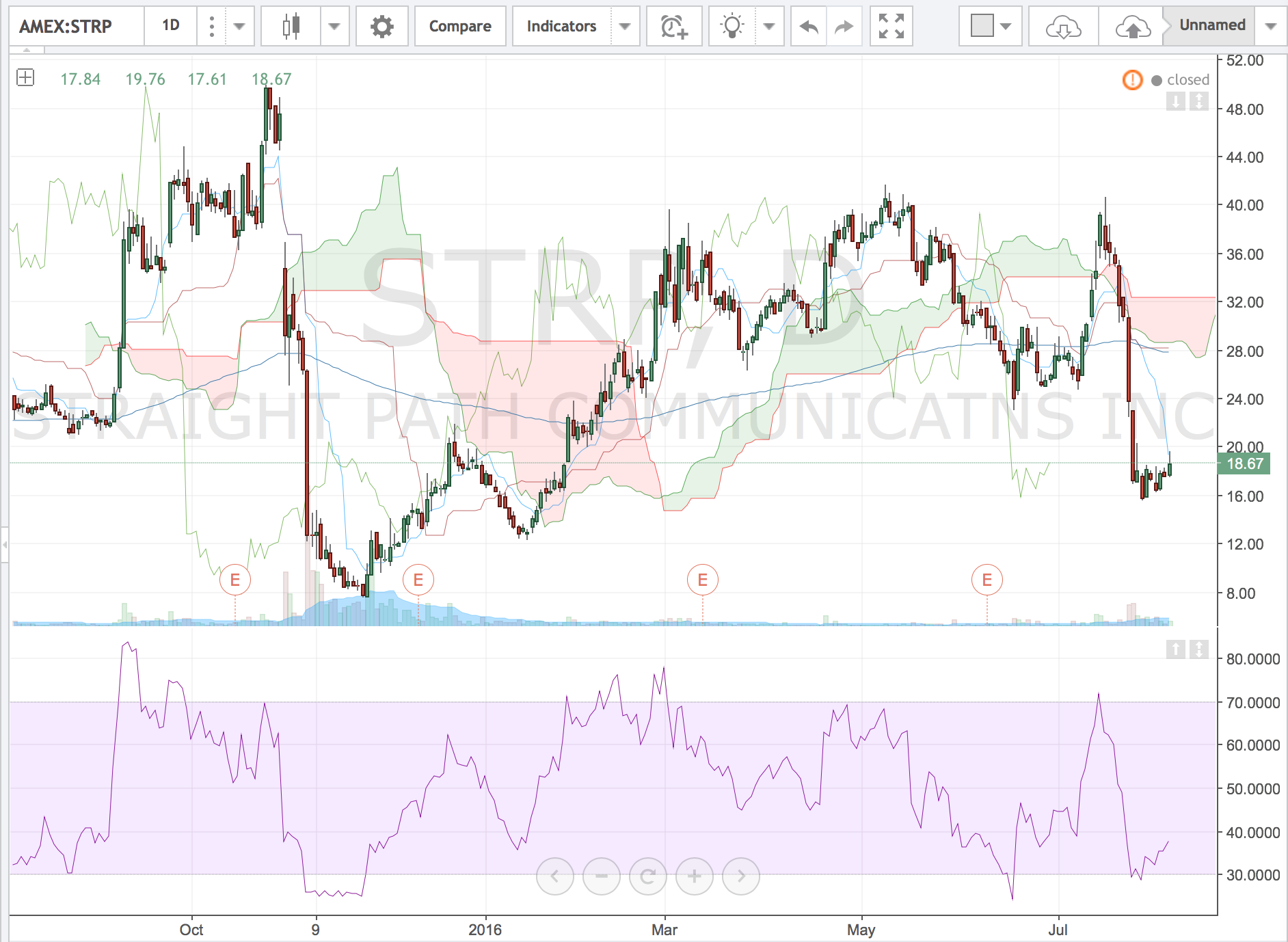

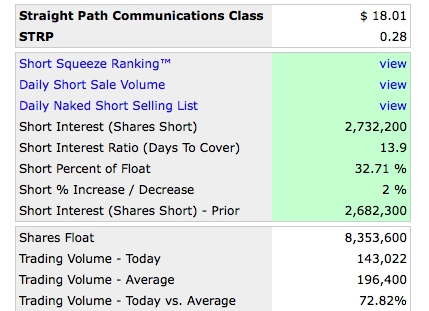

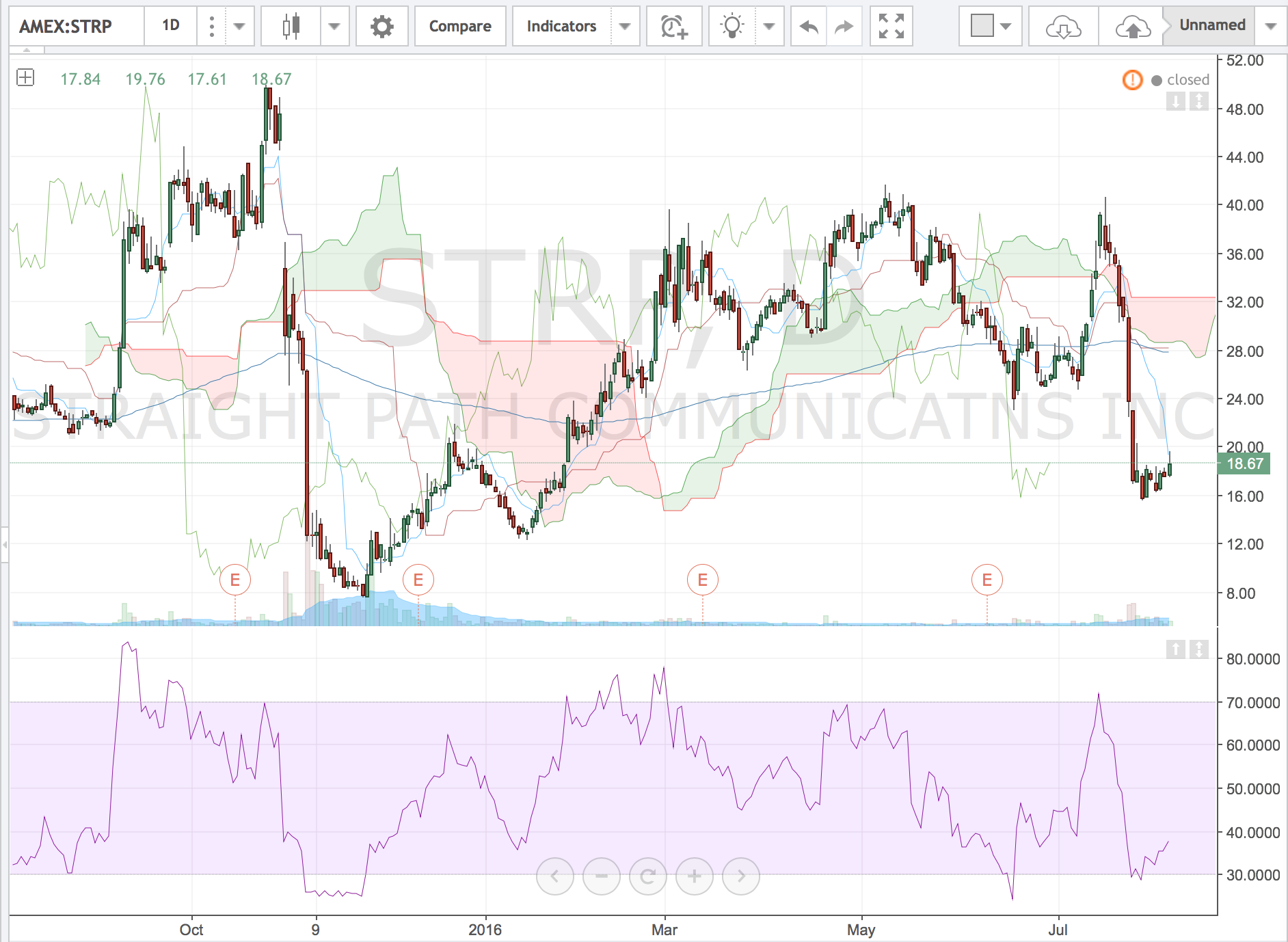

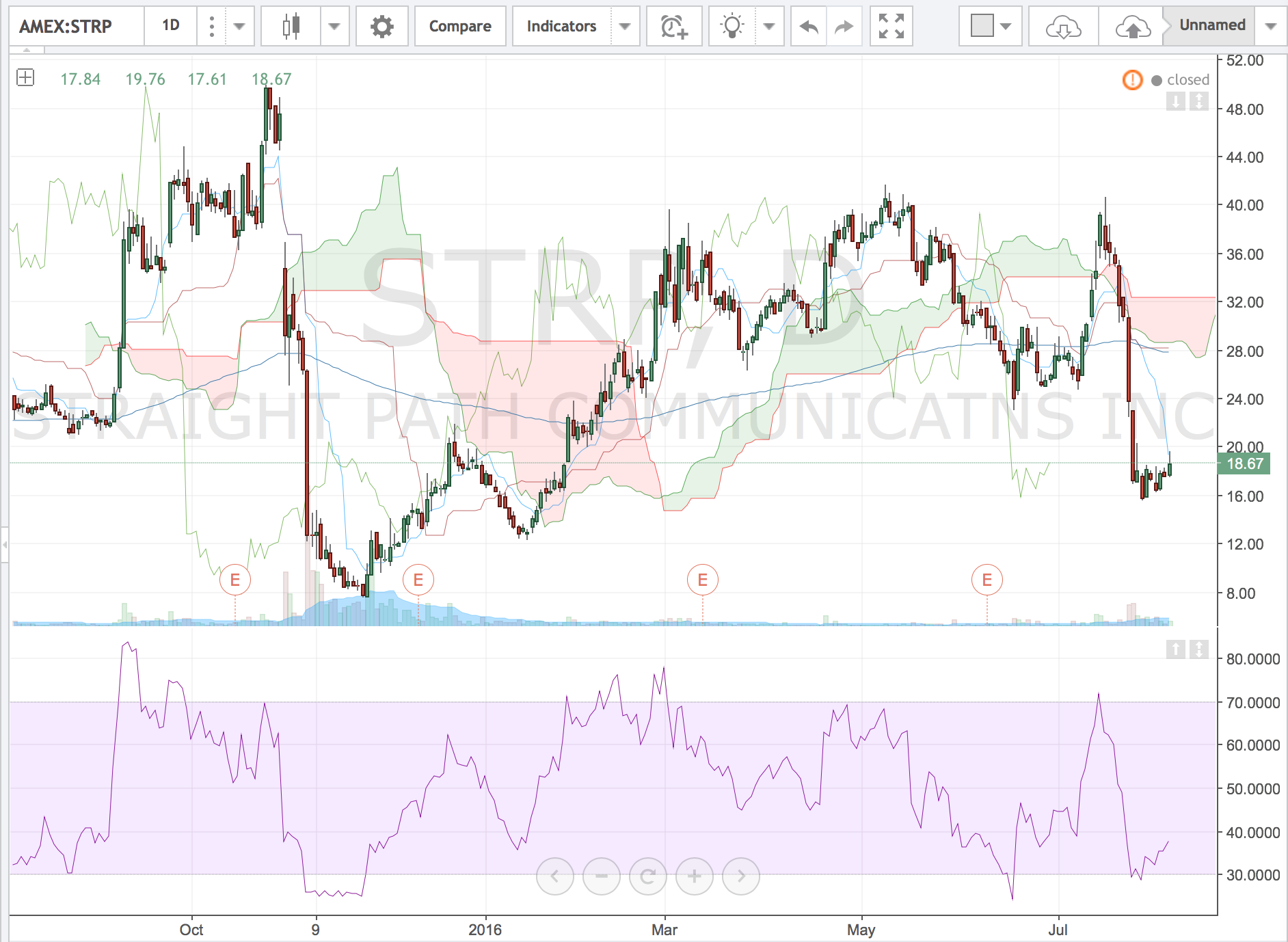

Back to STRP and what indicators give me the signs that this stock should have a nice upward rise soon. Not only is this a low float stock but there is roughly 30% of the float short. As you can see from this shot taken from www.shortsqueeze.com the float is 8.3 Million and the shares short are 2.7 million.

Now if you are new you might be saying what does it mean to be short? Well short means that roughly 30% of the shares available have been borrowed from brokers being sold without ownership looking for the stock to drop. In order for these short share owners to make money the stock has to go down. If the stock goes up then they buy to cover their borrowed shares from the broker.

This is what many refer to as a short squeeze. Many times the fear of a stock going up will cause the shorts to cover (buy) shares to lock in a profit. Not only will the fear cause the short owners to cover their position but the brokers will give the short owners margin calls to buy back the shares. If the owners of these shares do not cover their stock many times the brokers will cover for them. This is a forced buy in and the brokers don’t care what price they buy the stock they want to no longer lend the shares to the short owners.

This all causes the momentum and volume to increase as well as demand for the stock. Then you add the traders that are interested in capitalizing off this squeeze and their demand to buy the stock low increases and drives the price up as well.

When you look at the big chart at the top (tradingview.com) you can see the RSI for STRP dropped below 30 on July 26th and 28th. When it hits 30 it can be an indicator overall that the stock has been oversold. Since the 28th the price action has slowly increased but the volume has still been around average of 196K a day. Friday had an above average day in volume and the price broke out a 6 day high. The next level of resistance is 20.46

From July 18th at a high of 40.75 to July 28th with a low of 15.65 there is big range of growth potential from the 18.67. I’m swinging this stock and looking forward to when the volume and demand drives the price up above 20.50 and the shorts stops start executing and driving the price up at a fast rate.

Please note my blog is based on my personal opinion and my experiences in the market. I am NOT a licensed broker.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Aug 4, 2016 | Uncategorized

As I learned back in March, when I had my most profitable month, sometimes I need to take a break and step back to enjoy life.

Each month that passes with trading I find out how to balance life and trading together. It is truly a career that I love going down to my desk. I’m seeing that my trades are better in the morning ending around 12-1. The afternoon volatility isn’t as good in the morning and it results in slower more boring trades.

So I tend to try to trade the mornings from 9:10 to 1 at the latest. Leaving mom duties, exercise and relaxation throughout the day. Sometimes I will watch a stock on my phone and use the stock tracker app to monitor if I want to enter a trade if I receive an alert that a double bottom has set up for the day.

As a mom I see more value in family and try to visit my family in the States at least 4 times a year. When we pack up shop for a trip I try to change the focus for my setups to a week long swing trade. In doing this I look at a longer time frame of a stock.

For a swing trade I look to see is there a nice void to fill? Does this stock have value to it? Is it oversold on the yearly chart? What day of the week am I going long?

Sometimes the swings take longer to really perform, but the initial buy does perform. These trades take patience. This patience I find is easier when I disconnect from my laptop and step away and let the trade develop. I do check in periodically while on vacation, but I try to prioritize time with family and friends.

When we were at the airport ready to leave I locked another $1000 profit on $STMP. I was daring and bought 200 shares at 80 to swing through earnings. It spiked to 87 after hours and I set a limit at 86 to sell at open, but it only went up to 85.44. So my swing idea was correct but my limit order was too high. Still long for a small loss now and giving it time to develop.

I was also alerted from an apprentice (Thanks Chris) who knows my style and asked me to look at $INFN. It looked like it was primed for a gap fill above 8.64. It was slowly approaching and so I bought at 8.62. I gave it time to really spike above 9 and nothing happened. Then Cramer touted no one should buy it so it sold off a bit. Today I put in my limit for 8.79 and it executed and continued on up. I was curious why there was such a spike in price action and read that the CEO had bought 100,000 shares when it dropped down to 8.48. So I decided the original idea was correct and went long again at 8.94 looking for a spike with the positive news in AM.

All this being said it is possible to find balance in trading and in life. It is great to be able to sit down at my desk and make these profits, but there is definitely more to life. Taking the time to step back and put it on simmer watching the daily price action instead of minute by minute is important.

What is all this work worth when you don’t enjoy life. For some it is traveling the world, which is what it was for us before our child. We specifically worked for an airline and flew around the world for $300 as part of the perks. Now with more perspective in life we value family time and need to honour it.

In stepping back it also allows you the time to look at your trading with a new filter. Like when you are first absorbed in a relationship and it is hot and heavy and then you need a break to assess these intense emotions. Trading is great, but sometimes too much of a good thing is not good for you.

So balance in life is important in whatever you do. Not too much of one thing as it will cause your equilibrium to be thrown out of whack. Like my style of trading looking for price extremes to come back to equilibrium, life is easier when you are not living in an extreme.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Jul 23, 2016 | Uncategorized

Very thankful to have my trading head back on my shoulders. All of our home repairs are done and I see the results in my trading. When you have clear head it makes all the difference in your trading. It allows you to be present in price action and make the best entries.

In that past year I have really learned that low float stocks are great because they can offer amazing moves in price action. Of course, you have to be careful with them because the moves are not always in your favor. These big price moves come because the supply i.e. the float is not always that large and when people want it the price has to go up. A simple understanding of Supply and Demand.

Last week I stumbled on STMP with its big moves and kept it on my radar this week. The stock tends to have big runs in the afternoon after 1pm. The price action can be upwards of a $1 move at a time. This week alone I capitalized with the price volatility on this stock to profit over $9,000. When you spot a stock that is being actively traded it is good to capitalize on the moves while the volume is there.

STMP had negative press this past week trying to really drive the price down when they recommend it is worth $15. This did drive the price down to a low of $69 with a speedy recovery. Once it hit $69 I reviewed the 10 day chart. Down from $90 to $69 in 8 days means oversold to me.

Earnings are due to come out July 28th moved up date, and I anticipate the stock should uptrend until then. It just had a price target recommendation today of $150. I would not swing this to $100, however I did learn from my WYNN trade in the past.

With WYNN I bought it when it was oversold and then they had earnings and opened the new casino. I was in around $55 and thought I was conservative taking $6 a share profit. Oh was I wrong. It ran all the way up to 100 in a month and half. And WYNN wasn’t even a lower float stock.

So I have learned from WYNN and with a float of roughly 38 Million and Earnings to be announced July 28th I believe the price action should be volatile until then and look to recover some of the selloff down from $90.

My swing trades over the weekend are $TYPE (Oversold to me based on news), $ZFGN ( 52 week low this week) $PYPL ( void to fill above 37.52) and $SMCI as it is slowly filling a void.

I hope many of you checked out Trade Ideas Open house this past week. Their software is amazing and the support is unbelievable as well as the free trading room. That’s right FREE everyday.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Jul 20, 2016 | Uncategorized

I set an initial goal of making $100K profits by Feb 1, 2017 and then once I broke $50K I moved it up to my birthday of August 15th. Well I exceeded that goal and surpassed $100K in profits July 8th.

I set an initial goal of making $100K profits by Feb 1, 2017 and then once I broke $50K I moved it up to my birthday of August 15th. Well I exceeded that goal and surpassed $100K in profits July 8th.

After training for 4 marathons in life, I find it helpful for myself to have small goals along the way to my ultimate goal of 1 Million. My next stepping stone in profit goals will be $250K by Jan 1, 2017. I didn’t expect to have an absolutely amazing week of $20K+ in profits.

I’m not sure if it has to do with the market rebounding from Brexit or it that I’m becoming more diligent with my stops. I do still make errors and forget stops. I try to learn from each error. I know I am human and I hate taking a loss, however it is better to take a small one than a huge one.

I really enjoy trading and I think that comes from now being able to look at a stock and see where it is in the price pattern and know if it is a beneficial spot to enter or if I need to wait. I remember in the beginning of my studying I was watching Tim’s DVDs and he would look at a chart and say yes or no. I thought I need to get to that point. I feel like I have reached that point after watching the market daily. The patterns are recurrent and the volatile stocks tend to act the same. It will take time for you to learn and understand what drives the price action.

I have to say that my husband is doing very well in his trading studies. He is being a diligent student and studying hard. He has just begun paper trading with Think or Swim. In his first day he spotted ALR on Friday breaking out. A great trade. Then yesterday he spotted BAC running up. He is beginning to see the stocks to trade, but still curious on how I find my winners.

Well I use two tools. I use EquityFeed Market View and usually keep it on the biggest losers of the day. I will look at them to see where they are in the sell off cycle and how much longer to wait before the reversal happens.

I also use Trade Ideas scanning software. Their software is amazing as is their customer service and their always Free Trading Room. I definitely look for stocks that are setting up for reversal and one of the key alerting indicators I use is RSI. In fact one of the best things about Trade Ideas is when you have an alert that you customize you can share it with others as a cloud link. As a Warrior Trading Chat Room member, I saw Ross’ customized RSI alert and continued to profit if of it. As a genuine caring teacher, when I asked him if I could have the cloud link he gladly share it with me. There are some amazing people and services out there that do look for you to profit. Ross and his Team are great at helping new traders learn and providing tools to help them.

These are two amazing services and both have some free services too. In fact Trade Ideas is in the process of an Open house this week to test out their pro software for $7.99 for the week and there always Free Trading Room. Warrior Trading will also offer two FREE Mondays a month in their Chat room. Great way to see the tools before you invest.

In my opinion you don’t have to have the best tools, but when you do it makes profiting that much easier. Yes the expenses in the beginning add up, but they very quickly pay for themselves.

The first free Monday I traded in Warrior Trading chat room I made enough to pay for 3 months. I subscribed and then in a month I made more than enough for a year. So I upgraded. As a result I discovered Trade Ideas in their room and then went out to connect with Dan the CEO from Trade Ideas and now I use the best stock scanner out there in my opinion.

Enough rambling on about tools back to stocks.

This week there has been great volatility in the stocks. Today I absolutely rocked HAS on the long and short. I did the same to STMP in the past week as well. Once you start to see the patterns and know when the stock will sell off it seems to become easy and stress free. When you have confidence the trades become fun and passionate.

This is the first job in my life I absolutely love getting up to do each day. I know a lot of people have questions and I am always happy to help.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Jul 14, 2016 | Uncategorized

My trading experience that has brought me to 100,000 in profits by acknowledging these simple key points.

1. For everyone looking to enter the market there is so much to learn dedicate time to studying the market to build your confidence before simply throwing money at the market. If you don’t know what you are doing you will likely be in the 90% that lose.

2. Tackle your emotions. Trading will present a reflection of who you are in your trades and you must face them or else the bad habits will blow up your account.

3. When I had losses in the beginning or even a bigger loss now. I return to paper trading or trading smaller positions to reconfirm my confidence in my trades. Trading is psychological and you need to trust your trades.

4. When you get in a trade that goes against you don’t let your ego take over and make you a bag Holder. Cut the loss.

5. Analyze your trades. The good ones and the bad ones. Your worst trading enemy is yourself and only if you reflect back on your trades will you learn from yourself.

6. Try not to follow everyone else. Study the charts and patterns to identify setups for yourself. If in a chat room and you are alerted on a stock, then analyze if the setup works for you.

7. Be true to yourself in trading. What I mean by that is learn the setups that work for your risk tolerance and personality.

8. Be present in the moment of the price action. Don’t find yourself hoping or wanting something to happen to the price react to what is going on. If you close your profit early it is still a profit and always 100 times better than a loss.

9. When the market opens take each day and each trade as a fresh opportunity. If you feel you are revenge trading or have superhero I can’t mess up feelings step away. The market will be there tomorrow when your head is clear and you will trade better.

10. Acknowledge how much your learn each trade and each day. You have to start somewhere and your knowledge will grow with each success and loss. The positivity will help keep you on your path of learning and it is an eternal road to learn how to be a better trader. We can all improve.

Even after 100,000 K in profits I find I can improve in my trades. I make mistakes I acknowledge them and hold myself responsible. You have to trade with risk tolerance in order to be comfortable to sleep at night.

I hope these points help you in your trading journey. Each person learns at a different rate and you honestly can’t rush the process. So just like a losing trade accept it will take time and it is not an overnight process. Take it one day at a time and grow your own personal Google database of trading information.

Also check out the Trade Ideas Open House July 18-22nd for $7.99. You can try their pro package the whole week and you are always welcome in the free trading room.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Jul 8, 2016 | Uncategorized

After a rough month in June, July is starting off much better. As you can see by my profit chart I am so close to 100K in profits I can taste it. I am however in two trades that are at a loss right now so I don’t expect to break 100K tomorrow.

This week I was better about setting my stops, but I can always improve. Two of the Three stocks that I’m in at the moment have tanked hard this week a liable to have a nice short squeeze up tomorrow.

XBIT from a very unfortunate entry of 18.15. I saw a huge buyer of 180K shares at 18 and thought that was a good support. I should have cut the loss when it dropped down to 17’s but I let it run against me. I will watch and see what happens before lunch and close it out before the weekend not to be a bag holder any longer.

It is always tough to admit that I’m in a bad trade and I let it go waaaay too far. The other one that got away from me is FSLR from today. I re entered at 46.05 and it went up to 46.20 while I was in a meeting with the lawyers. I didnt put my stop in and then we went onto further meetings and it ran against me. Same thing. I will close it out tomorrow before lunch.

My third long is LEDS which had a crazy day up almost 225% from 3.30 close on Wednesday. The run happened with a small float of 1.5 million. It traded 9 times the float today and I imagine that some shorts will squeeze it up tomorrow. My entry is 10.66 so I will watch the premarket action. With all the positive news as a giant gainer it has a good chance of having strong buyers at open based on the chart.

More on watch for tomorrow will be the 52 week low club members this week

7/5 DB, CS, CVRR, VLO FCAU, DAN, UBS, PAG

7/6 LYG, RBS, DB, VLO

7/7 VLO, DB, DHT, TNK

I am so happy to be feeling more concentrated. Of course I know better than trading today while at meetings. My lesson is always put the stops even if it ends with a loss. A small loss is better than the two big ones I have on my hands at the moment.

As Tim Sykes says cut the losers early and it it true. It is important to try to keep the losses small. I have two on my hands unfortunately that I did not follow that rule. When you break the rules it does cause errors resulting in losses.

When you examine your trades you see your faults as a trader. My husband is learning to trade now and always asks me why I did something when I have a loss. The truth is I’m imperfect and I need to try to protect myself all the time. I am not good at mental stops so I need to set those hard stops.

This week I also booked my space at the Trader & Investor Summit in Orlando September 10th-12th for a deal right now of $297. When you think of Tim’s DVD’s for the past seminars are roughly $800 it is a great deal for 3 days of experienced traders giving you their knowledge and being able to ask questions. Investing in your knowledge is always great.

I know of a bunch of Twitter, Profitly and Instagram followers that have reached out and are going as well. I am really looking forward to networking with everyone and comparing stories. This is a chance to all learn together and bring the online community together in person.

As always I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.