by Jane | Mar 5, 2016 | Blog Post

This week was a rough one. I had 3 Red days and 2 Green Days. Overall I ended up with a positive week. Slowly but surely I’m on my way to 6 figure salary. January I had $3001 in profits and $6158 for the month of February, so I’m only shy $90K+ to make my first $100K. Little by little everyday with a fresh positive mindset.

This week was rough starting off Monday with a fever, but freedom to sit at my desk with my daughter at daycare. Unfortunately all week until Friday I had a nasty head cold that filled my sinuses with congestion and I think distracted me from making the best trades possible.

I found I did not have the best executions and rushed trades or tried to anticipate the moves. My biggest loser was a short $RAX that I let get out of control. I didn’t cut the loser quickly. Now in writing this I read it received a forth downgrade to strong sell. Murphy’s Law that since I covered now it will drop like $GLUU last week.

As many people have asked me how I find my trades. I start my day looking for Gappers on Equityfeed (at the bottom of their page you can try it free for 14 days) in the morning. I like that Equityfeed will let you look at yesterday’s ending prices as well as the present day action. I check to see if the gappers up from the night before have continued with higher volume. My morning gappers are run with a scan of price .5-100, Volume over 100K and trades over 100. Sometimes on low volume days I go down to 75K or 50K to get at least 5 gapping up and gapping down. I use that to get an idea of stocks from the open.

Something I have learned this week in particular is don’t anticipate the moves let the stock dictate the reversal from open. I check on level 2 to see where the strength is located and also the RSI and the time. I find anywhere from 950-1015 the stocks reverse pretty strong in the other direction and can be an easy way to profit.

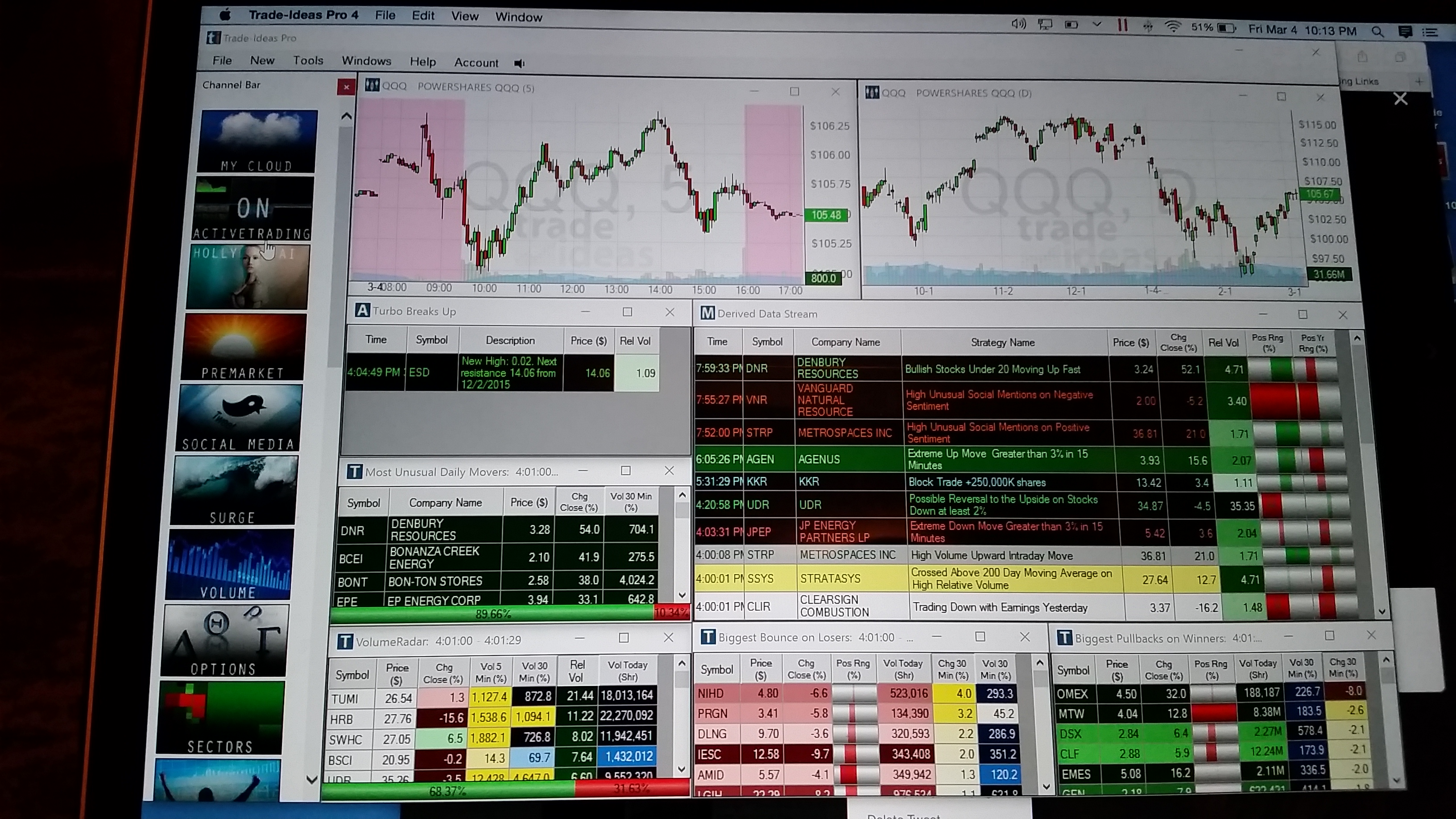

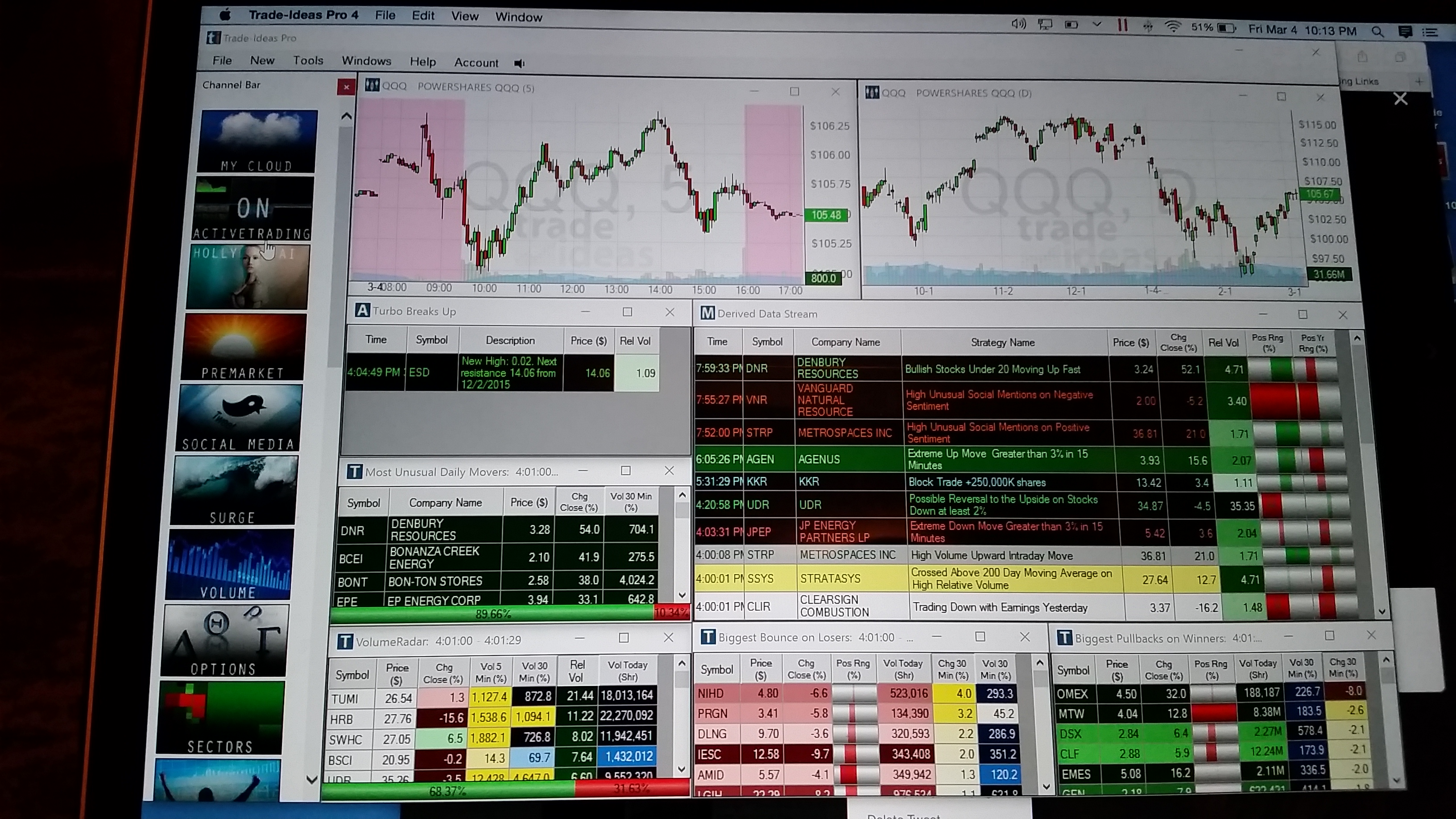

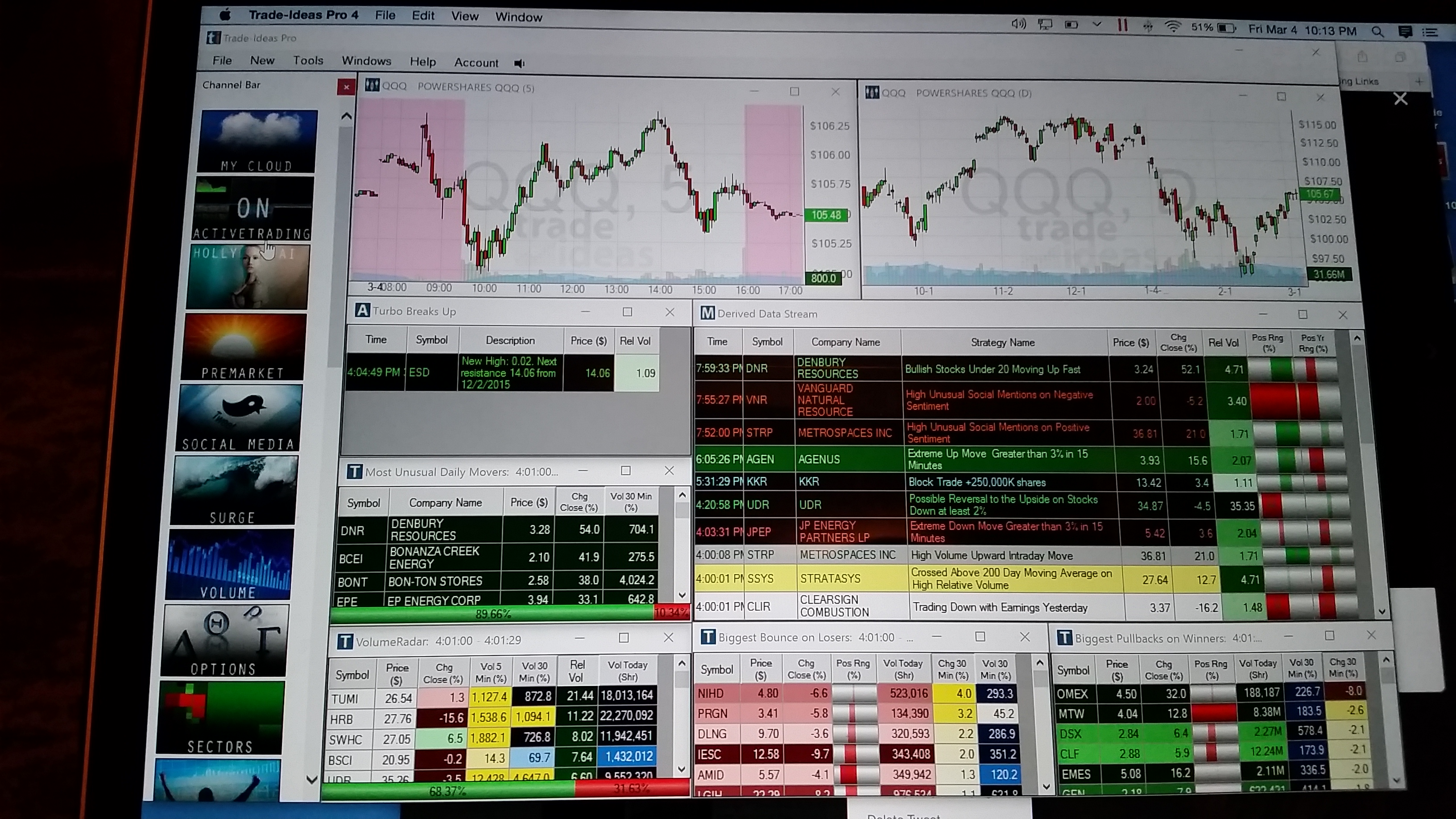

After my initial reversal play, I check on Trade Ideas. Trade Ideas is absolutely amazing. You can set up your own alerts or there are 21 preset scanning pages from channel bar on the left as well as the Artificial Intelligence Holly. Here is one of the preset scanning pages, Active Trading as pictured below. This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.

This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.

I found $SM from Holly, $CENX and numerous reversal plays. Definitely worth checking out the site. On the bottom of the link to Holly page you can sign up to test the demo mode. Check it out.

As always I’m super thankful to be able to have learned this skill and I’m happy to share and help others. If you want to know something please feel free to ask here on on twitter @Jane_Yul.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Feb 27, 2016 | Blog Post

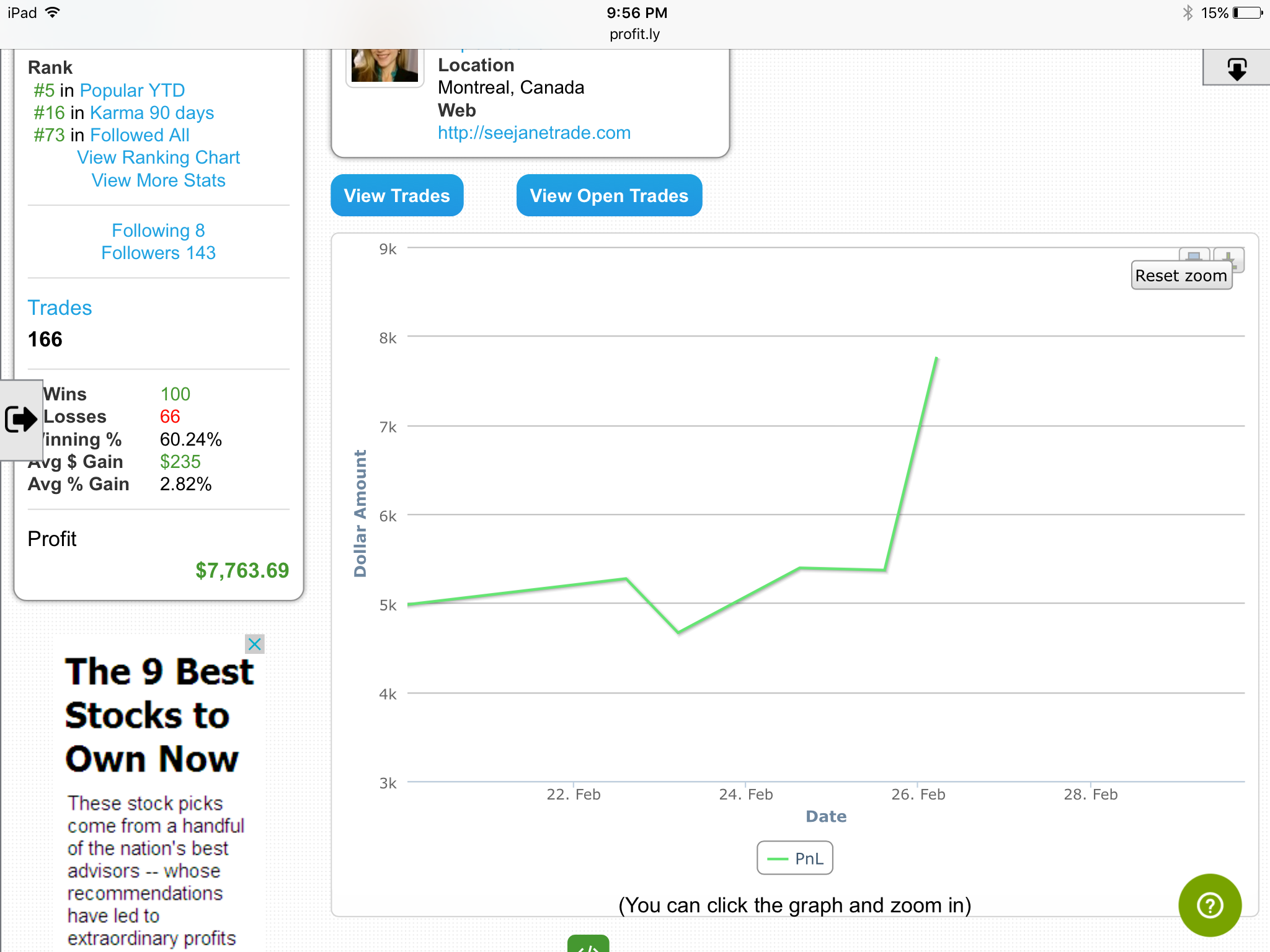

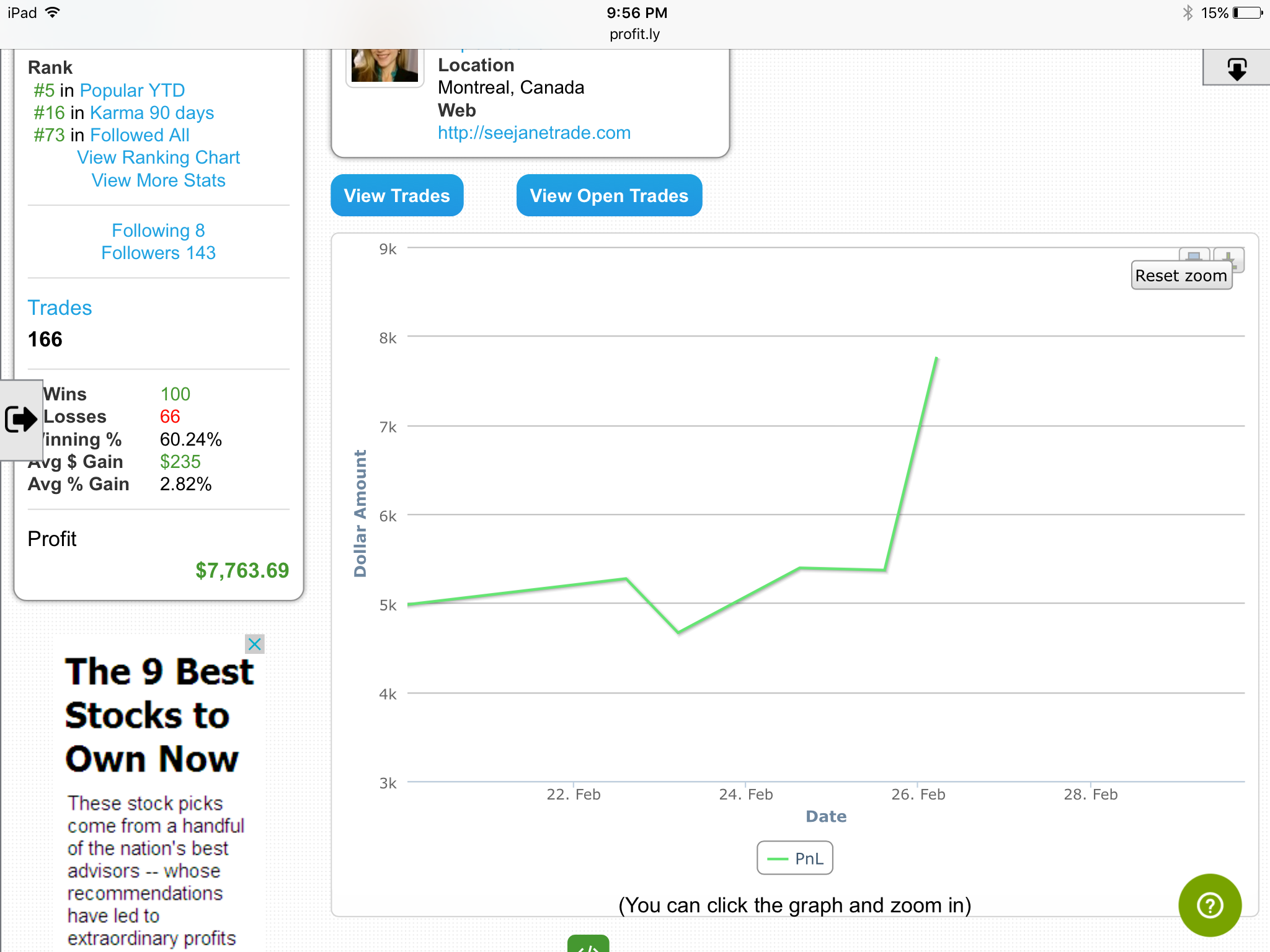

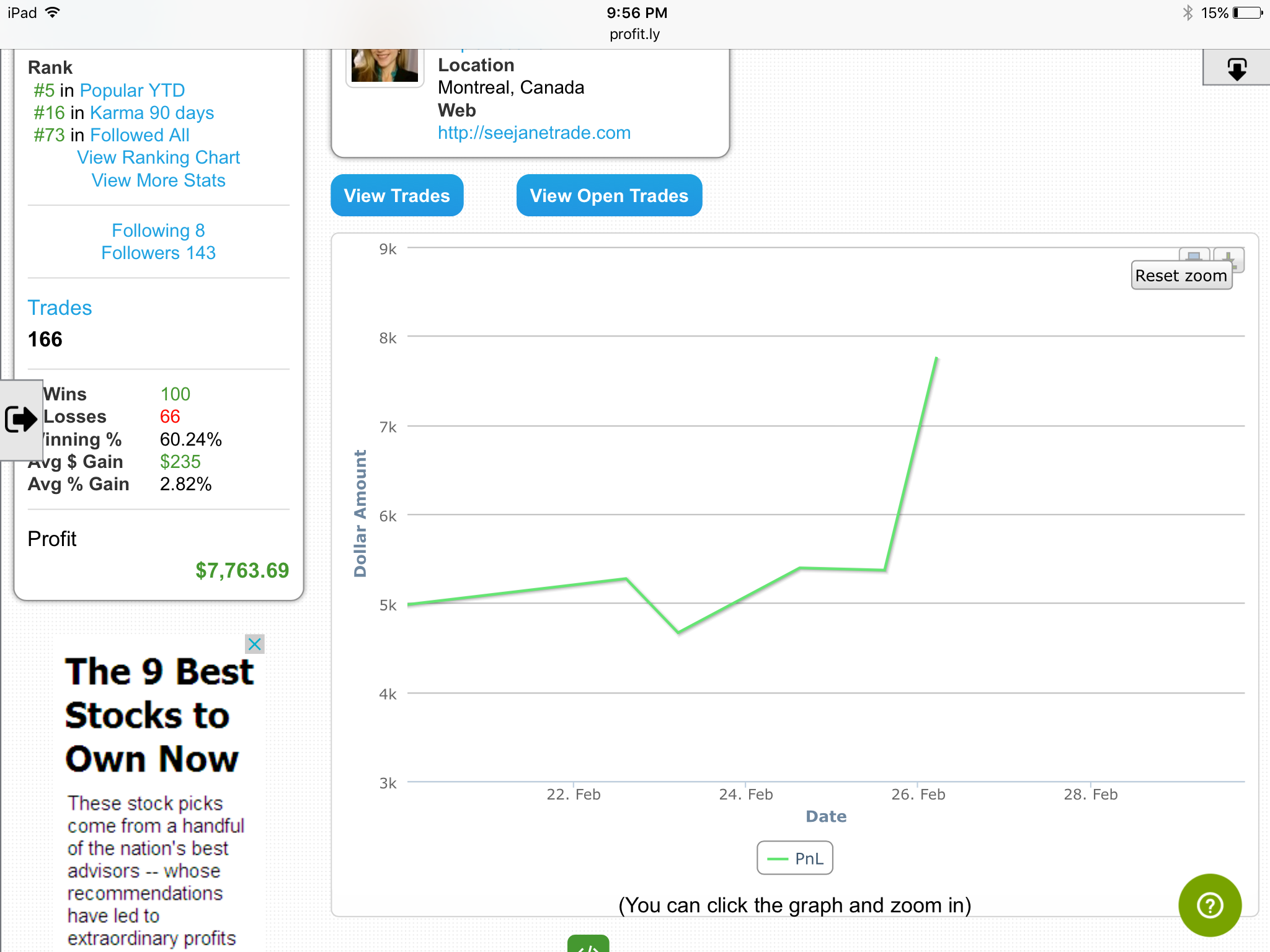

Here are my trades and profit chart for the week.

This week brought me back to the beginning of my day trading career. My daughter was unfortunately home sick 4 out of 5 days this week. The proof of my attention to the stocks was reiterated this week.

Monday a gain 586, Tuesday loss 608, Wednesday gain of 728, Thursday a loss of 25 and baby free day a gain of 2300+. I know I should really call it quits when I have her home sick. I coordinated her naps to the open, but it wasn’t enough. I was still distracted.

I believe as a result of being distracted I went outside my normal routine and it went against me. I tried to hold earnings overnight and a loss happened.

I tried to go long $GLUU and it went against me so I thought it’s up 100% and it will go back down after news, so I shorted it. Well I should have covered Thursday afternoon as soon as I was alerted that Tim Sykes bought.

Covered for a loss this morning to protect myself from a short squeeze like $KBIO. I am seeing that the reversal plays and the earnings winners are the bread and butter that I need to stick with.

The Force of Momentum

I honestly love seeing the waves of momentum in the stocks and ETFs. Today was also the first day I day traded UWTI and DWTI. Made more than 10% of investment. +$1300. The week ended up being roughly +$2600 making the majority of February almost twice the profits of January.

I’m so very thankful to have found this passion for stocks. Trading from home allowing me the time to be present for my daughter is priceless. Honestly Tim Ferriss’ book the 4 hour workweek helped me to change my mindset to work for myself. I’m also a fan of The Secret and find the stock market truly has abundance for everyone to win and be profitable with the work.

If you are considering trading for a living be aware it doesn’t happen overnight. It takes time to study and learn. Best thing I can recommend is paper trade until consistent. I wish I did before then I would have $6k more to trade with, but I consider it trading tuition to learn.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Feb 20, 2016 | Blog Post

I remember starting my journey the end of February last year with the goal of being profitable as a day trader. Then a couple of weeks ago I had my first day with over $1000 in profits. Now 7 weeks into 2016 I am up $4700+ after a couple losses and I feel disappointed with profits of $1100 this week working 3 days.

I remember when I thought I just want to make a profit.

Dissatisfied with Trading

Now I feel like if I don’t make around $500 a day I’m not satisfied. Its interesting how perspective changes.

What I still need to be better at is cutting losers and not let them get away from me. I had some poor entries this week when I wasn’t a sniper waiting for the momentum to have already changed. Under water right now in 3 stocks $INCY, $TRIP and $RAX.

The best part of this week was chatting daily with my brother who is also excited about learning about day trading and in particular Tim Sykes’ methods. I loved starting off with Tim’s DVDs.

Then I found Warrior Trading Chatroom and I love it. I tried it one day free and I thought if I make in one day what 3 months cost I will subscribe. I did and so I subscribed. What I like about this chatroom is you have Ross as a visual giving you audio and Mike and Ed in the chatroom too. You have 3 great guys with 3 great strategies.

My second reason for the chatroom are the scanners they customized from Trade Ideas. I have used them to find reversal trades and scalps to add to my daily wins. I’m happy to say I’m testing Trade Ideas now and I love all the features that you can add to scans and to alerts.

Artificial Intelligence Stock Software

The AI Holly that runs scans all night to find setups for the next day. It is amazing software. The one issue I have is I feel I still need to understand all the parameters to create alerts that target the stocks I’m looking for to trade.

There are plenty of chatrooms out there and teachers I think it is important to find one that has a fit with you. I like Ross Cameron a lot because I like the audio as he is doing his trades.

I had reminder today with my daughter home from daycare that I really should concentrate on her or trading but not both. I missed my close out opportunity for $TRIP.

Live a Life to the Fullest

As always Monday is a new day, a new week and new possibilities. As a stay at home mom I absolutely love my life day to day and thats what we live. Hard work and studying and adaptability will help you succeed.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

For my charts I use tradingview.com which offer free charting and paid services

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

by Jane | Feb 6, 2016 | Blog Post

Today was an amazing day! After a rough day yesterday of being down $500 to back into the green with just $22 I came to my desk with a clear head. I had a swing trade of FB that I initiated back on 1/26/16 and I was waiting patiently for the price to correct itself from the 20%+ it gained in value in 3 days. Of course having Jim Cramer pump the stock nightly because his trust owned it didn’t help matters.

Trading FB for profit

My first big trade of the day was my FB short closing out at my limits. I see in retrospect I could have made much more but I was underwater for so many days I was happy to exit the trade. I began the position at 106, 109, 110, 112, and 115 with an average entry of 108.41. Seeing it go into the green really excited me.

I have been know to watch my profits fade away and I didn’t want shorts covering to take me back in the red so I covered all pretty early in the day at average price of 107.24. I also rode an additional wave by adding some back into my position 107.80 and closing out at 107.01. So overall for my trade in FB today I closed out a profit of $840.

I also went long FB with avg entry of 104.12 in hopes for end of day spike. I didn’t see the price action at close so I am holding over the weekend for open. A risk I’m willing to take with such an amazing day.

Trading Gaps Stocks

I have also been following the trend of gappers up and gappers down to see the momentum actions for the first day. For the most part the gappers up tend to continue up the first day and the gappers down continue down.

Seeing HBI had gapped down already in the day I knew it would continue down. However I was impatient on my entry. I tried to short too close to open before prior shorts had covered and caused a spike up to 26.80 when my average entry was awful at 25.47. I need to have more patience on the entry. It was the same as on FB I was so happy to finally be green I didn’t wait for the bottom to cover at 25.25.

Realistically I know I won’t get exact tops and bottoms, but I do know that I can at least get a better entry closer to 26.80 with some patience in watching the stock. It was 30 min into the day when the high was hit then it faded down to 25.10.

My second profit on HBI was a long from 25.10 up to my limit order of 25.49. Knowing the time of day and the downtrend in price would probably lead to shorts closing before lunch I went long at 25.11.

I set my limit as was patient in letting the trade develop. I figured it would reach 25.50 and would have some resistance there and it did then continued on up to 26 as resistance. I left money on the table but 100% happy with the day and making a total profit on HBI of $641.

First $1000 Day

So my grand total for the day was $1481.

As my first blog post ,so please let me know what sort of questions I can answer for you. I was a novice beginning in day trading the end February 2015 with my first born 6 month old daughter.

I’m becoming exponentially better with confidence in my trades. $3001 in profits for January and the first week of February at $2,682. My goal is to make 6 figures by February 2017. On Monday I joked just $99k left to go since I didnt count January. I will try by Jan 1, 2017. So just a little over $94k left to go.

Little by little each day I will accomplish my goal.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you would like to be in Training Pit with me sign up here or if you want one on one training you can email me jane@thedarkpools.com You can contact me here or Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use tradingview.com which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.

This software has found me numerous winners definitely worth the investment. Holly runs over 35 different alerts and audibly announces the ticker when she enters a trade.