by Jane | Apr 30, 2016 | Uncategorized

It was another great week with over $4,000 in profits working 4 days at my desk. Where can you make this kind of money? Well it doesn’t just grow on trees you have to study the market and understand what you are getting into in order to be in the 10% of successful day traders.

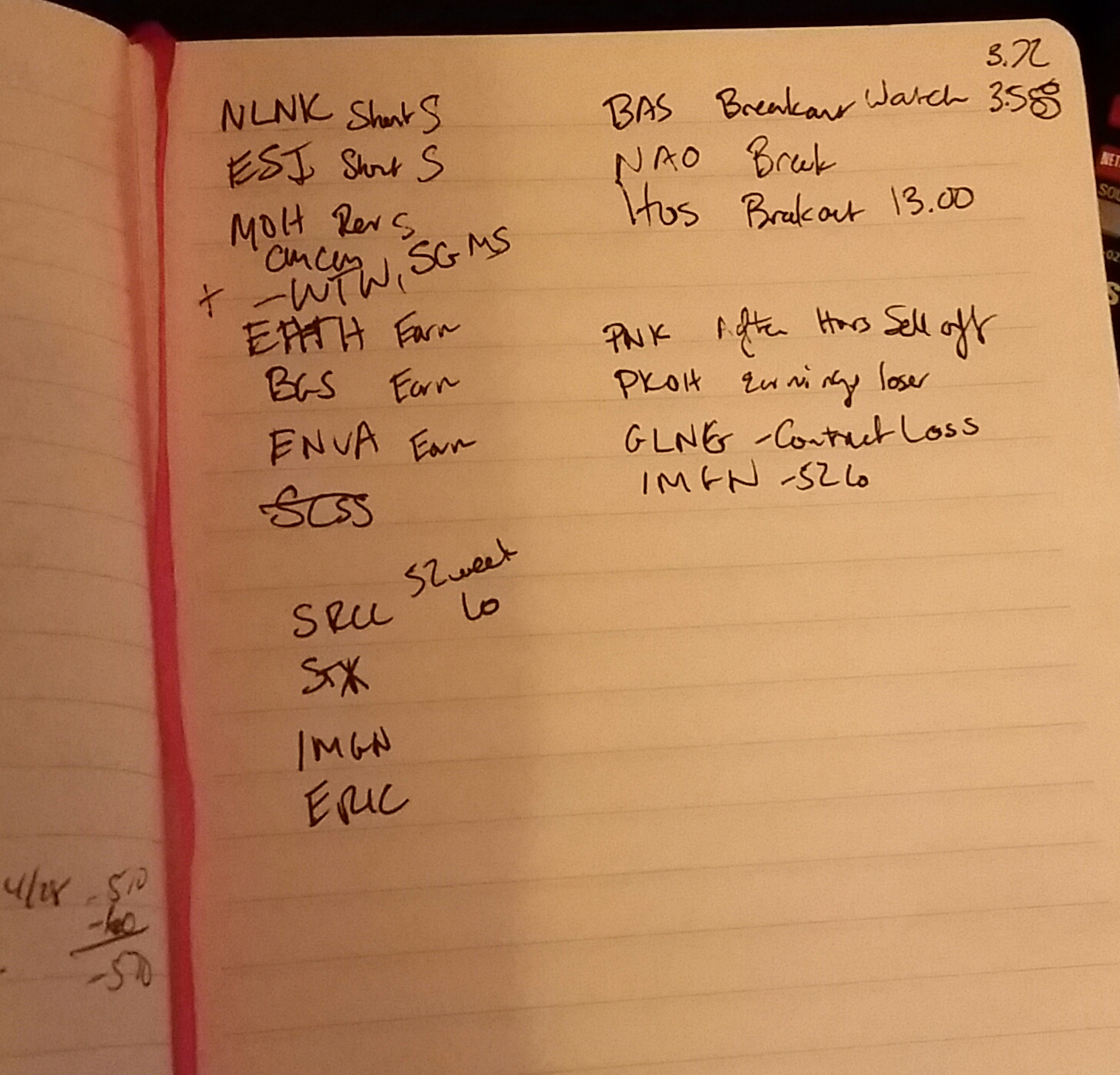

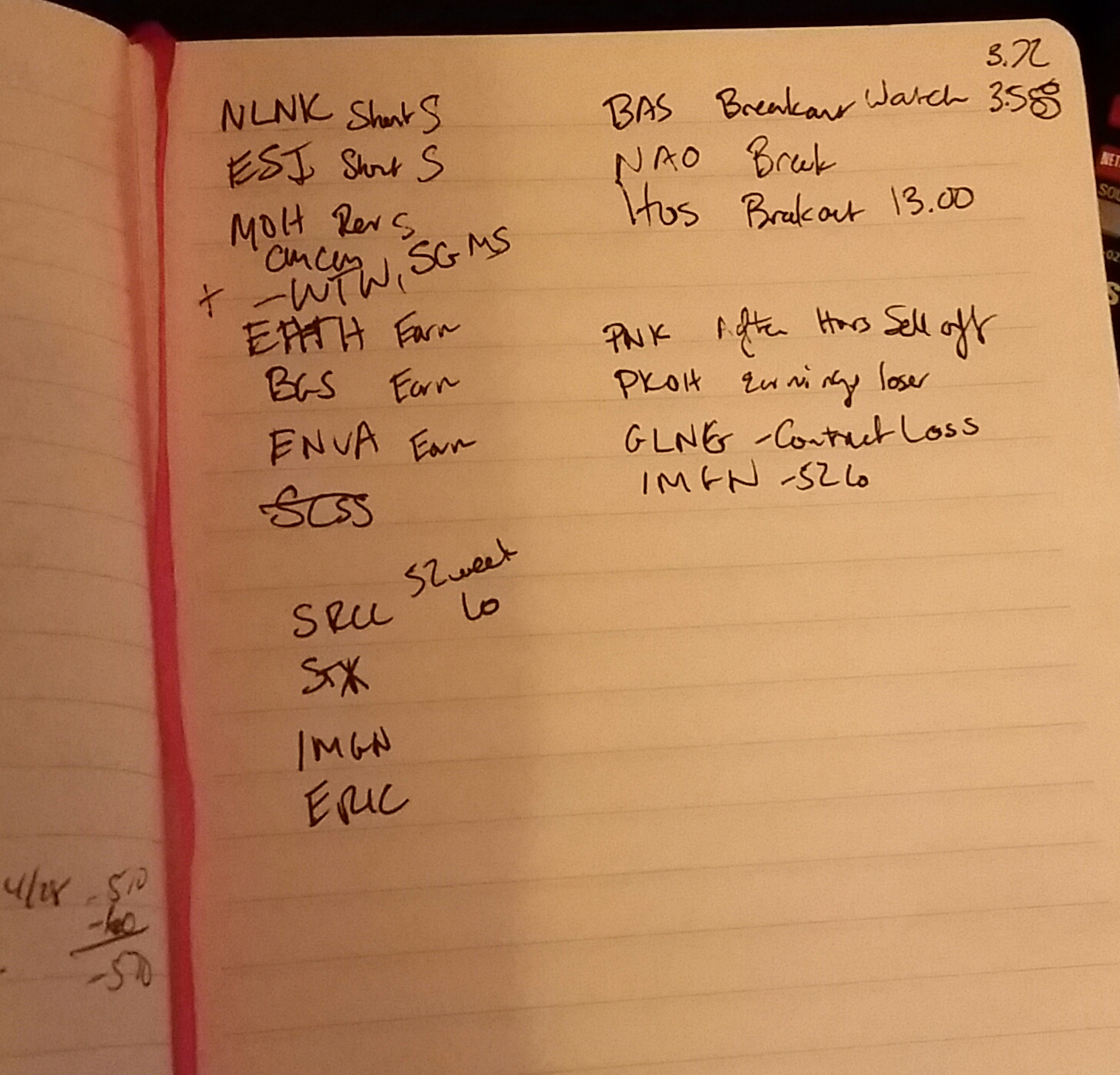

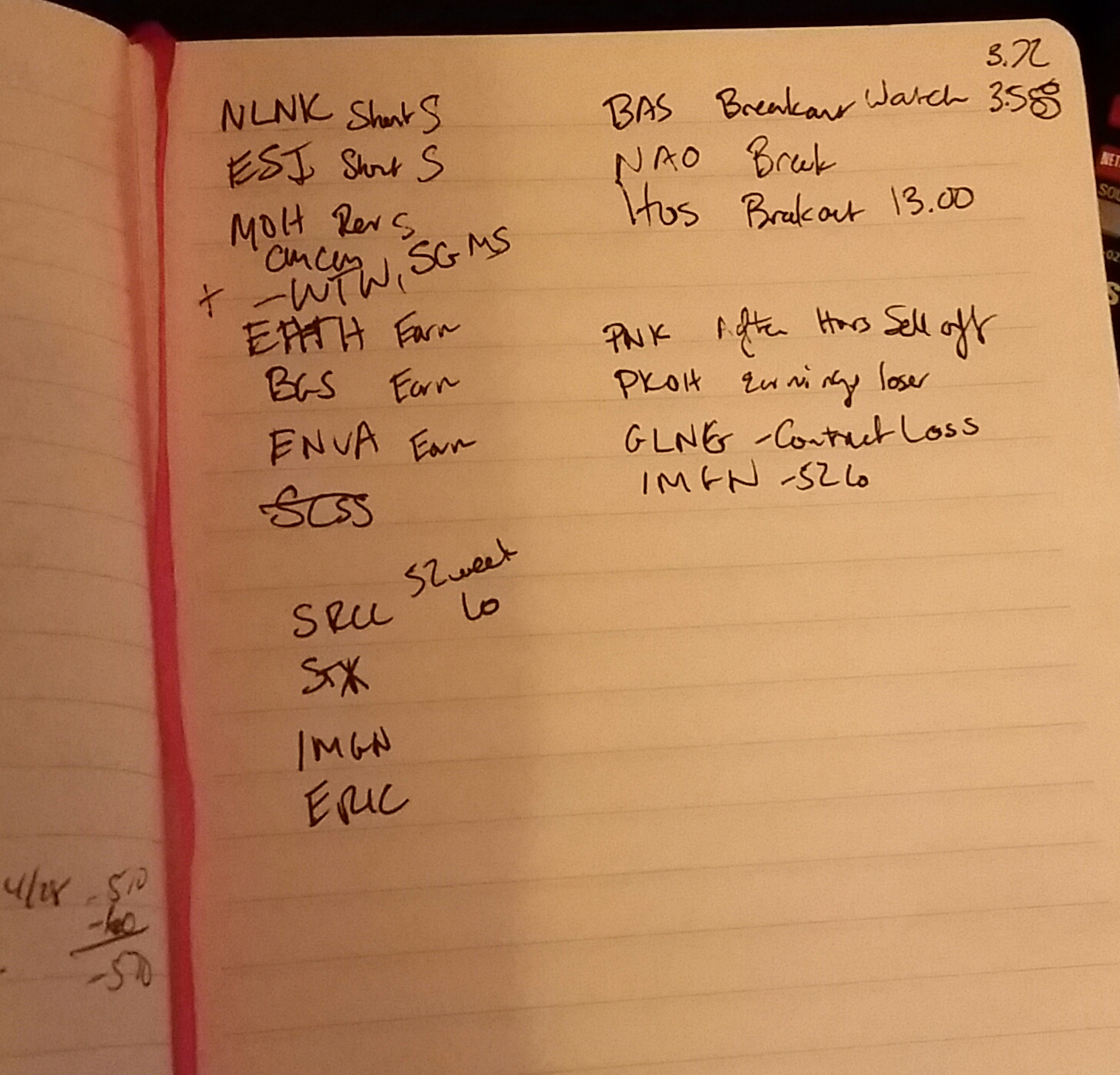

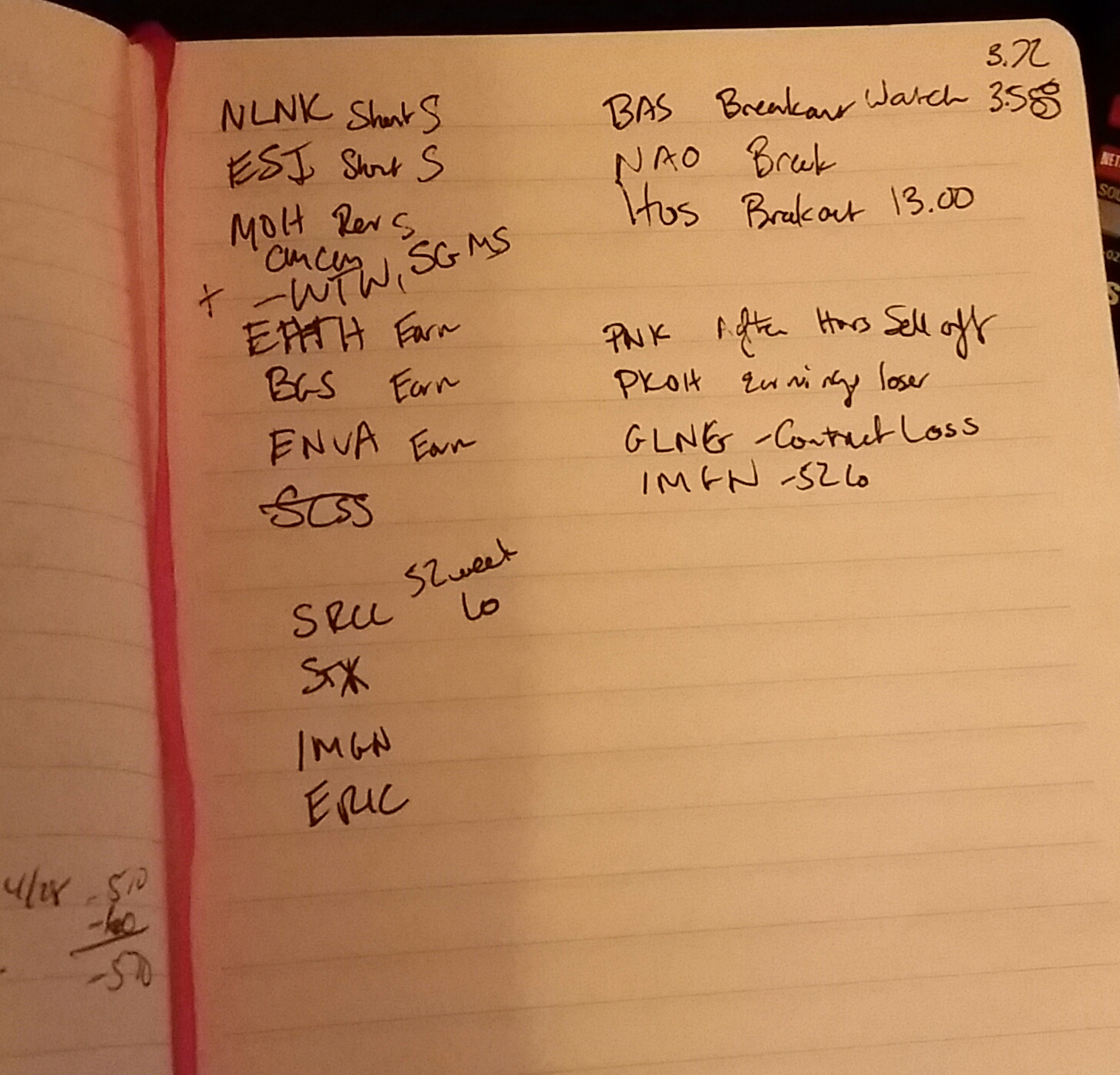

The photo above is a sample of the research I do after 8pm EST to see where the stocks are before open. The general market hours are from 9:30-4EST. We also have after-hours 4pm-8pm and premarket 4am-9:30am. That is another 9.5 hours of price action that can change a stock. That’s why I will do the research, but I really look at the stocks right before open to see the most up to date price action. Day trading is about being present in the price action and reacting accordingly. Yes there can be indicators that lead you to believe something will happen to the price, but the market is not always rational. You can have earnings winners that tank and earnings losers like $NLNK that end up spiking.

I received a Profitly message from safariames to explain what I meant in my watchlist with Reversal, Short Squeeze, Longer Term, Gap Fill.

When I have a stock on the Short Squeeze list it means I’m expecting there to be a fairly nice upward movement once it reverses. It is due to the fact that the ones I have under this description are popping up under a filter with 30% short float or more. That means of the shares outstanding 30% of them have been sold short with the expectation that the stock will drop. Once there is a nice upward trend then you have people buying long as well as the people that sold short that will buy the stock to cover their position. That in essence creates a nice upward momentum in the stock price. It’s basic supply and demand and the more demand for the stock the faster it increases. Sometimes like KBIO you will see a stock go from 1.50 to 45 but it is a rarity. That is when you don’t want to be one of the shorts getting squeezed.

I did mention reversal in my Short Squeeze list. What I mean with a reversal is when a stock is climbing and it hits resistance such as TRUE that climbed to 7.78 and then stopped climbing and sold off. The stock reversed direction in reaching resistance (you could think of a ceiling that you can break through.) Or it can go the other direction when it hits the LOD or the support and it goes up in price. I have been long biased lately and I look for reversal plays. I like the idea of a long play being limited to the loss of my investment where as with a short the loss potential is unlimited. After watching Mark Croock’s video about shorting with options instead of the stock to limit the loss I want to learn more about options (once I hit my 100K in profits over half way there). I think it is great to limit your loss to your investment instead of unlimited. Sorry off topic back to watchlist.

The Gap Fill is another type of reversal but it is one that I’m looking for after a huge gap down. An example of this is COWN it gapped down from close of 3.60 to open of 3.20 and it ended up closing at 3.49. This is a one day fill of most of the gap. I think of gap fills taking a little longer but the best are the same day. Which brings me to the longer term.

I do swing trades and hold them longer term for stocks that I believe have value to them and will gain value again. My best stock for this is WYNN when it was at $58 close to the 52 week lo. Over the next month it climbed $40 a share to $98. I played it very conservative taking max I think $6 a share.

I hope this helps you to decipher my watchlist and learn more about the plays I target. The market is always changing and I do short as well, but for the present time I’m more long biased.

Have a great weekend. As always enjoy the time with your friends and family as those moments are priceless and irreplaceable. If you have questions shot them to me on Profitly, Instagram, Facebook and Twitter. I enjoy helping you as I was in your shoes not long ago.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 27, 2016 | Uncategorized

For those of you that follow me in the USA and have a 401K you should know that you more than likely have the ability to control the growth yourself. I had a request from Wavey Crocket to talk about 401k trading.

Mine is with Fidelity from my former years working with USAirways. I was able to open a self directly account with Fidelity. I was able to convert the money from Mutual funds and use the funds to trade with stocks for myself. In your 401k you can make trades only to the long side. When you go long or buy a stock the maximum loss you can have is what you invest. I don’t know of any brokerage house that will let you short in your 401K because the loss potential is unlimited and then you would have to contribute more to your 401K.

Trading in your 401K account when managed by yourself can be as aggressive or conservative as you like. I tend to pick longer term stocks that I think will be growing in months to years. I have been trading a fair amount of UWTI and DWTI as the price of oil oscillates and I take my profit with limit orders. The downside to the 401K trading for me is the fact that I have to wait the 3 days for the funds to clear after the trade. There is no margin trading that I know of for 401k so you have to wait your trade to settle in the account before you can go into another trade. For that reason I don’t tend to trade my faster paced day trades more longer term. For today I sold my position in UWTI that I entered around 19.50 and sold at 28.25. I will wait until it settles and assess whether DWTI or UWTI would be better to enter. Looking at after-hours I see that UWTI is up .99 from close to 29.23. As with all my trades taking a profit is always better than a loss.

Which brings me to one of my trades today that I was trying to protect my little profit with a hard stop on ENDP and it executed immediately at 29.32 and then the stock proceeded in the afternoon of 30. I was way to conservative in trying to protect my profit. I was being conservative because I did not feel I had the best entry here as after I bought the stock at 29.22 dropped 80 cents down to 28.40 and I did not want it to go against me again. I was trying to let the trade have legs with a hard stop. Yet I don’t like hard stops because I always find my stops execute right after I put them in. I’m almost convinced the market makers see them and manipulate the price to execute them. However when life happens and I’m in a business meeting for 2 hours I want to protect profits I use them. It is always great to protect them.

Just like at open today, I had my limit order in from yesterday and when ENDP spiked at open it locked in a small .17 cent profit at 30.54. If I had not had my limit order in there was the potential for me to forget about the stock and take a loss. I like setting an exit right after I enter in case the stock spikes like crazy with a squeeze or I am pulled away from my desk for some reason.

My biggest wins of the day were on CWEI. One trade that I swung overnight from the trade of the week idea from Trade Ideas. I entered in at 17.15 and then the stock sold off to 16.57 and I added more for an average entry of 16.95. I had a target exit of close to 18 but I saw the initial spike this morning was up in the 17.60’s and knowing the trends of a reversal typically around 950~10am I seized the profit and sold at 17.57. Also my position size on this stock was fairly large in relation to the volume so I had to plan my exit accordingly. I in fact tried to go back in when it was down at 16.80’s but I made the mistake of hitting market and I had an average entry of 17.15 a big 30 cent spread from 16.80. A lesson I learned about sizing and setting a limit so as not to really get burned on entry. A partial lower is always better than a bad entry.

My real pleasure is in seeing STX finally having the upward momentum the past two days. I had a bad entry seeing that the stock dropped 2 dollars from when I went long. I really hope you were more patient and have already made money on this $2 gain that has happened over the last week. After reading the article about the company announcing their new 10TB storage drives for cloud storage companies the viability of the company as a value stock is reiterated. I think this stock will recover more of the bid drop it had two weeks ago from 33 but how quickly I’m not sure. My ideal target is up between 28-29 however I will trade it based on price action. The fact that they are announcing before the market on Friday leads me to believe they will meet their estimate. We shall see…In the mean time I’m looking for that price target and will enjoy this week’s momentum.

I hope you have had a profitable week and keeping those profits protected. It’s always nice to end the day green. I have felt that I have been just ok with my trades the past two days getting back into the swing of things. I feel like my timing was off and I need to wait for my 3 greens for entry. I mean the real move on ENDP was from 28.40 to 30 and somehow I only locked 10 cents of that 1.60 Not the best, yet a profit. When you find that you have a trade that did not work out like you expected. Swallow you pride analyze it and figure out what went wrong so you can try to prevent it from happening the next time.

Day trading for me is being present in the price action and not acting fearfully or emotionally with excitement. The best trades are simply watching level 2, RSI and time of day. When you track your trades and study your weaknesses you can improve.

Enjoy your trading day tomorrow I will be back on Twitter on Thursday. Tomorrow is a day filled with meetings.

As always shoot me comments, Tweets or messages on Facebook, Instagram and Profitly. I’m happy to help where I can.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 25, 2016 | Uncategorized

This week I anticipated $STX to have more of a bounce than 60 cents up to 26 dollars. I am analyzing if I want to minimize my risk and lower my position size and take a partial loss. I was thinking that it would be more like $1-$2 jump after a drop of $10. Looking at the announcement time of the earnings being in the morning on Friday the 29th leads me to believe that it is not going to be total bad news and the earnings losers tend to push back their announcements until after the market closes.

I probably minimize my position by roughly 1/4 are hold the rest through the week. $BABY I cut too early and sure enough it went from $29 up to $34 I was too impatient with my swing trade and looking more into the action.

As I’m just back and home, unpacked and back into the swing of prepping of the week I will review Equity Feed. Once I have my list I will open up trading view and check out the charts. I’ll also look at Trade Ideas to see what the software is analyzing as social media posts. Usually when people are talking about a stock there is volume and price action behind it. Of course all sorts of news can come out between now 9 pm and 9:30 am tomorrow, so I will analyze my watchlist again tomorrow morning just before market open to see if my picks are in play or there are others with more potential.

I hope you had a great week this past week and a good weekend. This new job with the freedom to travel to see my family is invaluable. I used to work for free standby travel and now it is much nicer to be able to fly confirmed and enjoy time with family.

I did miss trading, but I was happy to have a week to simply play with my daughter and her cousins those moments are priceless.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 20, 2016 | Uncategorized

I have had a couple people ask me how I scan for stocks to add to my watch lists.There are a couple important factors in day trading to have a successful trade. One very important one is liquidity or number of shares that are being bought and sold. If you get into a stock and there isn’t enough liquidity when you want to sell your position depending on the size of it you might drop the stock price on your exit.

So to find a stock that has good liquidity. I will usually do my morning gap scans with more than 100,000 shares changing hands and more than 100 trades for the premarket. I also look at the stocks from the previous day on market view with Equityfeed. I look at the stocks that had the biggest gap down and up for yesterday and premarket today.

Typically the stocks that have had big movements from the day before and that morning are good to trade because the bigger movements come with news of some sort to drive the price action. I tend to be someone that will trade a stock that is reversing so if it is overextended in the buying side or the selling side. There is what seems to be a rubber band effect once the price goes above or below the Bollinger Bands (BB) on 1 min chart. Also the RSI or relative strength index above 70 can indicate overbought and below 30 to indicate oversold.

For my day trades I use the BB and RSI together to time my entries looking at primarily the 1 minute chart. You have heard me refer to my three greens for going long in which I look at 3 charts for the same stock of 1,2 and 5 min charts and I would look for all three charts to show green candles. You probably won’t enter and the bottom but it tends to be a fairly good indicator of the momentum shifting. It can sometimes just indicate a bounce and fake you out.

For my longer swing trades I will look more at the price action of a stock over a year or longer time frame. I posted the STX stock chart as an example of why I entered the trade. This stock looks to have set up a double bottom and is ready for a bounce or upward movement like it reversed in February. When you look at the chart over a year or in this case 3 years you can see the RSI for the daily chart is below 30 a typical indication of overselling. My swing trades I use more of my value trading history to reason the trade in that this stock has good value to it as one of the S&P 500 stocks and one of two major producers for hard disk drives. The press has been the driving factor in the selloffs/shorting that we have seen. Same thing happened to TSLA that drove it down to 140 now it’s up in 240s. Once the momentum shifts people see that it is rising again they will jump back in and drive the price action up.

I hope this has helped you to understand how I scan for my stocks. As for finding them with scanners Inuse Equityfeed for the gapping stocks and sortability. You could use finviz.com or Yahoo biggest gainers if you can’t afford to pay. Intraday I use Trade Ideas for stocks that are in play. You can find links to all of them under the main menu page how to start daytrading.

I hope this week has been green for you so far. I’m having a great time with my family and having my daughter play with her cousins. I miss my trading desk, however these moments are priceless. I’m so thankful I took the time to study the market to make this work schedule freedom a possibility.

I always love hearing how I’ve helped you or questions you want answered. Leave a comment or shoot me a message on Instagram, Facebook or Twitter and I will answer to the best of my ability. I should also be having an upcoming interview from Jacob Whitish the guy that created the Digital Stock Summit and on my trip I just came up with a great book idea.

Have a great day, afternoon or night and know you can do it all too. Just take steps to change your reality into what you want it to be.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 16, 2016 | Uncategorized

Depending on your style of trading it can be very intensive to watching the level 2 and price action to be a sniper on the best execution. Part of what I learned from last week was don’t do too much at once. It is ok not to force a trade. The timing is important to get a good execution.

On Tuesday I saw the alert set on my phone for the Stock Tracker app that Insy was trading down near the 52 week low that it had hit that day. As it closed up for the day I believe the strength would cause it to gap up and I bought just before close Tuesday to sell on the gap up on Wednesday. I have learned as it gaps up. My new phase #CarpeProfit and take that profit before the sell off happens. It is always better to have a small profit instead of a loss.

That is exactly what happened on my KORS trade as well. I bought in on Monday and was patient in letting it rise and once it had the first pullback in the morning I went ahead and locked my profit. I closed it at 52.75 when it continued up to 53.50 during the day. Some days I will be patient enough to sit there and watch the action, however I’m trying to find more balance and trade mostly before 12 and after 2 pm with time for lunch and the gym in the middle of the day.

In the strength of the day on Monday I somehow executed a successful Short. In hindsight with such strength it was a gutsy move to short with such upward momentum in the market. MU was looking overextended ( High RSI, Multiple upward 5 min candles and volume slowing) so I siezed the tension and shorted it and once the stock slowed in its drop and went sideways. I closed immediately as I was hesitant it would go against me and I had to leave to go for training.

Once I got done trained I check on HRB that has been repeatedly hitting new 52 week lows. I saw it had broken a round resistance of 25 and it seemed to be struggling in upward momentum so I took the opportunity again to lock the profit. I really prefer trading in front of my computer. When I’m on my phone I use the Stock Tracker app for alerts to let me know the stock has broken resistance or support for entry or exit.

When I arrived home for power hour I saw GPRO had closed up high and the news of the AAPL team member had moved over so I piggy backed on the news and a gap up for Thursday and bought before close. I did the same for FIT as it was coming up off the low of the year.

Thursday morning I was watching GPRO with first its selloff and then spike. I was happy with my growing profit and then Ding Dong, someone at the door. I saw the price was slowing some and I didn’t know if it was the tree trimmers or a delivery so I went ahead and locked my profit. Murphy’s Law it continued to go up another .30 so I could have put in a stop. So my lesson on that one would be put in a stop and not a limit sell to let it grow. Can’t be upset with the profit, but figure out how to protect it better.

FIT was a little more delayed with it’s spike and did not go as high as I was hoping on Thursday. In hindsight it would have been better to hold until today as it continued to grow in value before the weekend.

AEM I was much better waiting for the sniper entry on a sell off and watching the price action and level two until it hit 39.60 and lost a couple cents in entering the order. A great profit.

Thursday just before close I received Tim’s Alert that he bought DRWI and I knew that the stock would run when it goes up from an earlier trade, so I went long. I made a fat finger error with a 3:59 trade and bought just 200 shares instead of 2000. I was also long STX and RDC from their big sell offs on Thursday.

This morning I was busy watching the price action on STX and RDC right at open and I happened to glance at my portfolio and I saw DRWI. I forgot I was in the position and when I looked at the price it had spiked up over 8. I immediately sold and locked the profit. Looking at the chart it was the right thing as it sold off the rest of the day.

RDC had a bigger sell off than I expected at open and rebounded just up to 15.75 area and my average was up at 16.16. I instead took the loss and put my money into an add on STX.

I’m in STX as a swing trade that I will give some time as an S&P 500 company that is oversold due to their estimated earnings they will announce. They have had multiple years of roughly 2% dividend issued back to the shareholders and they should be announcing that shortly. I will put in a limit order for a nice profit so the stock will work for me while I’m traveling and more analysts review the stock saying it is oversold and a bargain. These stocks work well while traveling for me or someone that might not be able to babysit price action.

I’m also long YGE 4.90 and SKLN 0.217 for more growth maybe a week or a month. They are smaller positions and giving them time to grow longer term. I bought YGE after a trader who is a prominent shorter went against his protocol and went long. As for SKLN this one had parabolic moves today and it seems it is one of two things. A pump and dump in the beginning phases or there is news that is due to come out the increase in volume has brought attention to the stock.

I will be spending the week with my parents in the States. I am not sure I will be blogging next week. It depends if I have any trades to review. I know that I will be talking with my brother about learning the ins and outs of trading and meeting with my brokers office.

After starting the week with a big major loss. I feel better this week, however I was rushing my entries and emotionally jumping in too quickly. For the big sell off stocks. New rule wait until day two first initial dip to go long, if not the third day.

It is very nice to hear back from everyone about how my blog has helped or what you have questions about. Trading is a passion for me and I love sharing and hope to help inspire and educate that you can do it too. You can really do anything with the right mindset and actions to make it happen.

Have an amazing weekend. Study hard and spend time with the people you love. Those moments are worth more than any $$. Our daughter just started saying Hello, bye, Bubble and Cookie this week. Those moments are priceless.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 13, 2016 | Uncategorized

I would say the hardest part about closing out the loss was accepting it. I had to accept it wasn’t going to rebound soon and I made a mistake. It’s the hard part of looking yourself in the mirror and being honest with yourself about it. Sure I could have easily said I had 1,000 shares, but that is not being transparent. It is refreshing to be completely honest with everyone about wins and losses.

In writing this post I want to answer both Ashley’s and Lam’s questions that they shot over to me. Lam’s question was how do you recover from a big loss and Ashley’s is about risk management.

Getting over this loss happened when I took the weekend to fully accept that I made a bad entry. I analyzed why it happened and I was not in the trading zone. I was distracted and made a bad entry. I should have cut it while up $400. I need to get better about taking the profit while ahead. I really had to swallow the tough pill that I let a loss get so bad. However I have learned not to live in the past. I can’t change what happened, but I can learn from it to improve my trades in the future. Day trading is about being present in the moment. If my mind is caught up in a past trade or overthinking or clouding my judgement it will be a bad trade. So my best recommendation is accept you can’t changed what happened in that trade. It is ok you are not perfect. Size smaller until you gain your confidence again. Lock profits quickly if you have to and try to stay green.

I feel like my big loss was a basic risk to reward novice mistake. I saw the stock dropping and I didn’t cut the loss. I saw the momentum was going down. To me I enjoy shorting a stock from the top or buying at the bottom. I did not wait for 3 greens( 1,2,5 min chart) to go long . My best example for risk reward was my entry today on INSY. I saw that it had hit a new 52 week low of 12.50 and it was at 12.96. The high of the day was 14.23. So to me there was .46 cents to the downside and the whole year to the upside. My target was preferable up to 14 if it could get up there, but I pay attention to price action and try to lock a profit before it drops. So I watched it go up to 13.47 and it was struggling. I thought it might tank the rest of the day. So I went ahead and locked my profits at 13.40. I have learned taking a profit is always better than a loss. The goal to grow your account is consistent wins. There are some wins better than others, however all help to grow your account.

A good entry is crucial in your trade being easy and stress free. When you chase the price action and enter in the middle it is really easy for momentum to shift and you end up under water. If you are stressed about your entry don’t let it go against you. For me I have found I tend to have bad entries around 1030 am so for me my goal is to either stay in a trade or try to sit on my hands.

My office is also my daughter’s playroom as well as our workout room, so I will try to get in a little home work out. Or go to get a snack, as I tend to forget to eat lately while trading. I become engrossed with price action. All part of my plan to get balance back in my life.

As always, I love hearing how I have helped you or if you have questions you would like answered. I was brand new to day trading not long ago and now I feel blessed to have stumbled across Tim Sykes’ page armed with the DVDs to help learn the basics.

If you have a bad day. Don’t let it cloud your judgement. If needed step away for a day or two. Digest and more forward.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.