by Jane | Apr 9, 2016 | Uncategorized

Monday began the week with a new challenge of trading and teaching. Well the rest of the week has been a challenge too. I think this week in my closed positions after commissions I might be up around $300. It seems like a scratch week for me.

Wednesday morning at 2am my little one woke up with a fever of 101.9, so that meant a day of TLC and no daycare. Not only was my little snuggle bug home, but we also had repair construction going on from water damage that happened back in February. I thought I can still trade.

My mind this week has not been as devoted to trading as it should be and it showed with my poor entries. I have not been attentive to getting out of my trades and cutting losses quickly thinking they will rebound. I am still long $BABY, $HRB, $KORS and $BKE.

This week I feel like I let all my readers down without having a stellar week again, however I know I’m human. I make mistakes and I can only try to learn from them. It has been rough week.

Monday is a new beginning to the week and a new trading day. I will try to start fresh there. I have received some requests for questions to be answered in the blog and I will get to them.

I always appreciate the feedback and all the thank yous. Its easy to write when it has been a successful week. A week like this past one is harder to share.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 6, 2016 | Uncategorized

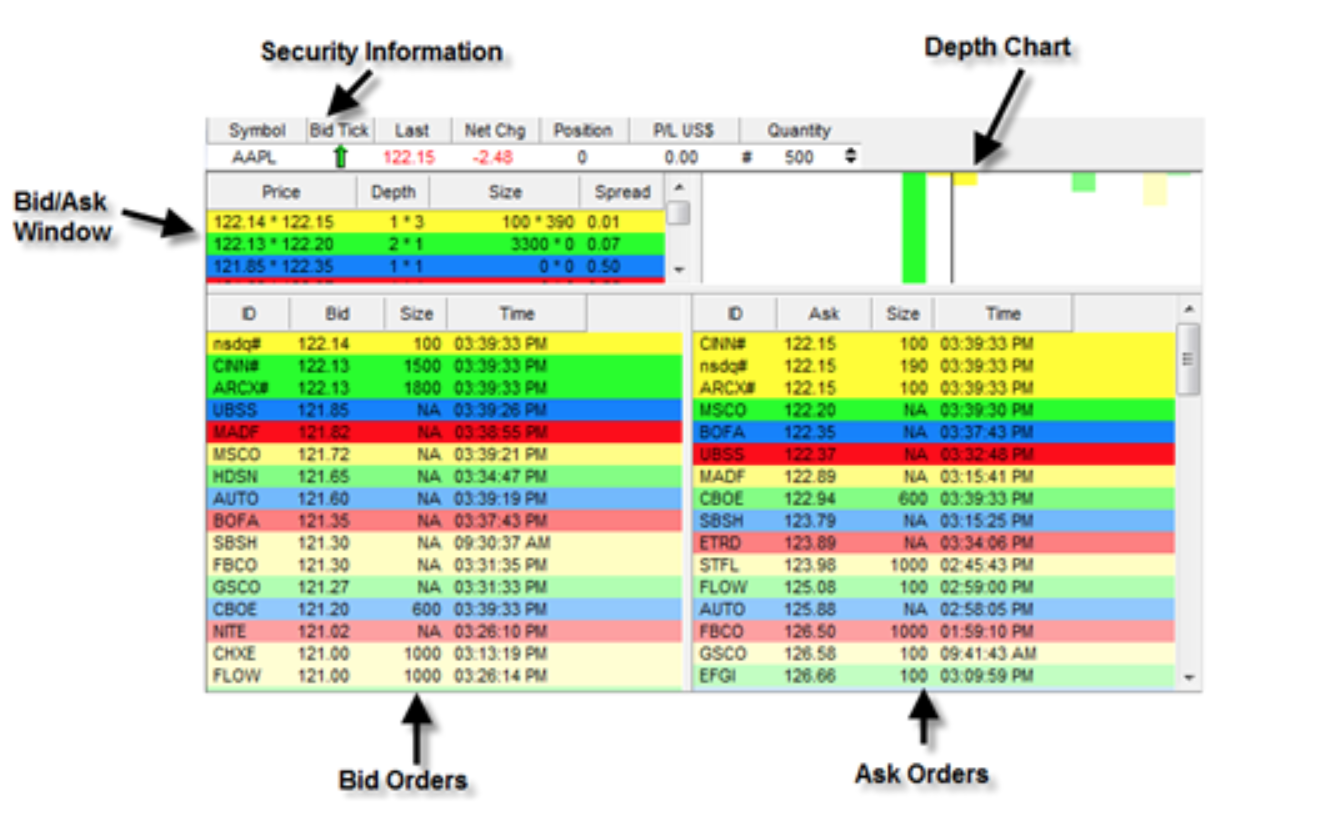

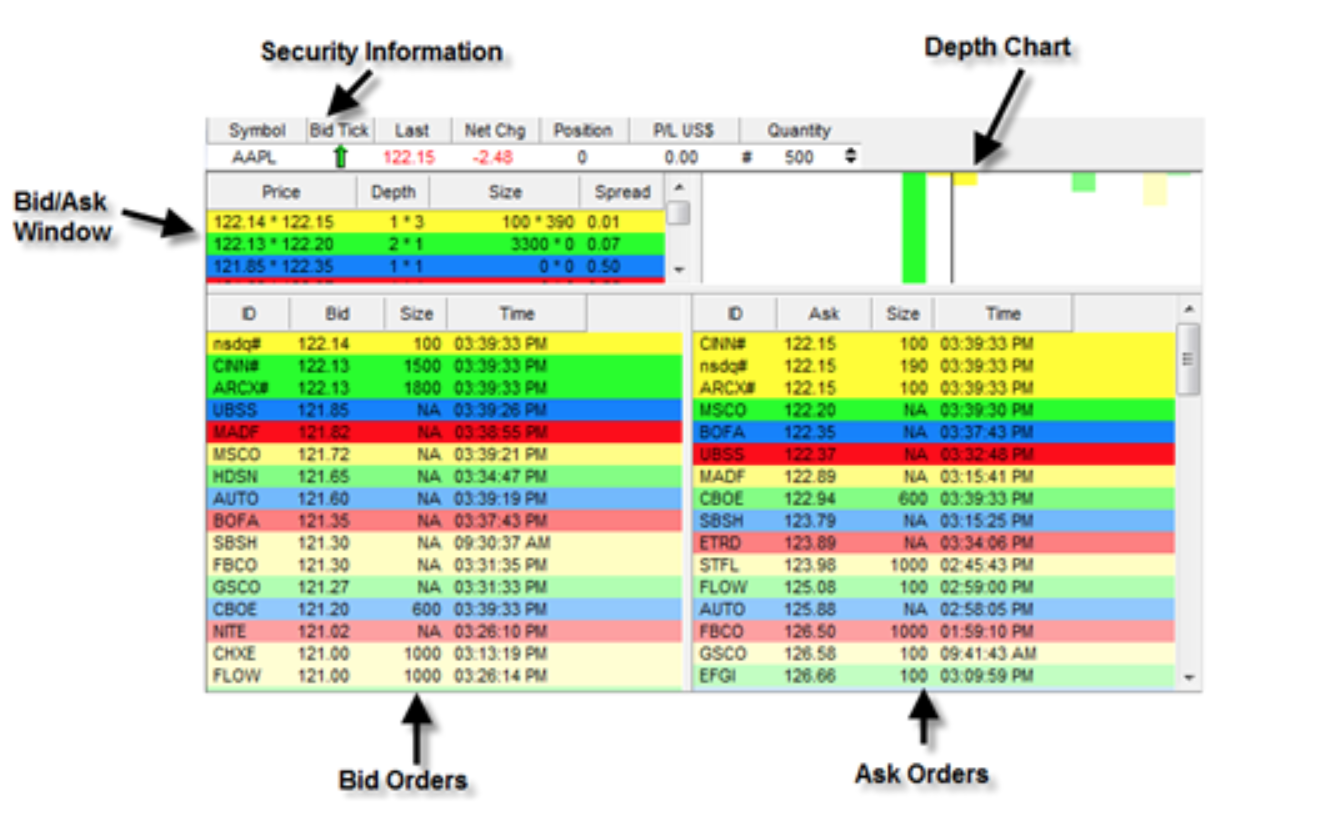

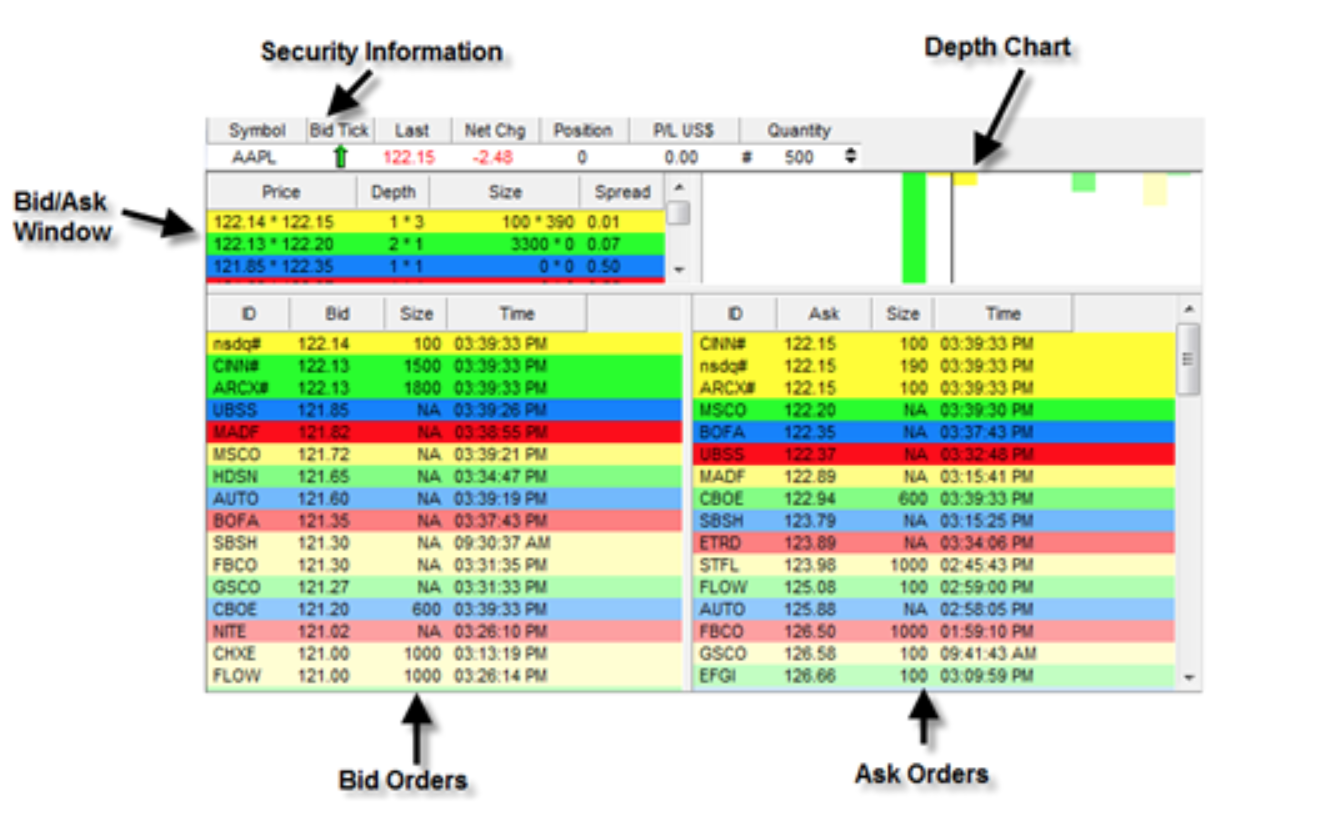

This week I began on cloud 9 from last weeks trades. Excited to teach a fellow friend the foundations from the ground up. I forget that the terms such as Level 1 and Level 2 are not known by everyone. If you don’t already know what I mean by Level 1 and Level 2 here it is for you. Level one is the basic price quote information that you can find on Google Finance or Yahoo Finance or any stock tracking app. It will show you current price and the % change for the day, The Bid price (what people want to pay ) the Ask price (what people want to sell for). Typically the Level 1 will show you the price that it closed previous day, and the high and low for the day as well as the last 52 weeks.

Level 2 will go one step deeper to show you the information above the Ticker, whether it up ticked or down ticked with red or green. I will show you the different Market Makers that receive the orders from the brokers and create the market price action. The order sizes and the times they were received. In dealing with a reversal play I look at the Level 2 in detail to see the strength on the buying or selling side. If there are 5 MM on Bid with 2000 shares and 1 MM on Ask side with 200 shares the price would likely go up with the buyers taking out or buying up the shares on the selling side. If at the bottom of a short sell off the short seller wants to cover so they might up their buying 2000 shares to the ask price and then eat up the 200 shares. Then it moves up to the next ask price. And there is a breakdown hopefully for you to understand Level 1 and 2 and a little price action.

Level 2 will go one step deeper to show you the information above the Ticker, whether it up ticked or down ticked with red or green. I will show you the different Market Makers that receive the orders from the brokers and create the market price action. The order sizes and the times they were received. In dealing with a reversal play I look at the Level 2 in detail to see the strength on the buying or selling side. If there are 5 MM on Bid with 2000 shares and 1 MM on Ask side with 200 shares the price would likely go up with the buyers taking out or buying up the shares on the selling side. If at the bottom of a short sell off the short seller wants to cover so they might up their buying 2000 shares to the ask price and then eat up the 200 shares. Then it moves up to the next ask price. And there is a breakdown hopefully for you to understand Level 1 and 2 and a little price action.

I was in the midst of trying to explain this and I was watching BABY which had gapped down Monday morning. I played it well off the open with a nice $650 gain. Then I was up $400 and I didn’t close as I was still talking away. My lesson is to try to save teaching for after hours for now or don’t trade while teaching. Gotta learn somehow right. It is human nature to answer someone immediately and not ignore them to watch the charts. In reality, I have to watch the charts if I’m trading. I am still long BABY after my poor entry as I believe there is value to the stock and this 30% sell off from 39.60 down to 29.90s is exactly what I look for in my swing plays. This one gapped down 20% then lost another 10% and is almost at the 52 week lo. An entry around 30 is fairly safe to go long and swing as in my opinion is more likely to go up than continue down again. Once it hits the 52 week lo shorts cover and analyst and brokers start to recommend people buy the stock at the bargain price. The initial drop causes panic and it sells off then the smart people come in and follow the saying “Buy Low, Sell High”. It’s the classic phase people mention in buying stocks. It is a matter of finding those stocks and having a great entry. I am under water now, but I won’t panic as I believe in my strategy and will swing it.

That is pretty much my same reasoning with SWHC, HRB and ENDP. I closed out ENDP after it tested resistance of 27 about 3 times and it couldn’t break it. So rather than have it gap down on me at open I closed it out. With HRB my position size is smaller and it is up 20 cents from the new 52 week low, so I went ahead and held it overnight.

My biggest winning trade today Tuesday was SBOT, which I found after flipping over to Finviz.com to check out the market overview. Finviz offers a free view of the market and different sectors and the gainers and losers in those sectors. They also offer their own screener service if you want, but the home page is pretty awesome for being free. I’ve never tried their registered service or the Elite. However for someone starting out the Elite seems like it would be good at $24.95 a month.

I know with my friend yesterday she was talking about all the upfront fees with broker and level 2 and scanning services. It can be overwhelming so anytime that I can help with trying to find a quality service at an affordable beginners price I will try to pass it along for you.

Back to SBOT. I found it at that moment as one of the two oversolds stocks listed. The homepage is updated throughout the day. I looked back at the chart for the past month and it really did look oversold. I went in at 3.19 and I held it until I saw a big seller on the ask side with 8000 shares at 3.40. Rather than have a sell off happen I went ahead and took my 20 cent profit. Man was I wrong it went on up to to 3.80 before coming down to close at 3.73. I will watch this for tomorrow. In fact it might gap up at open. A good penny stock to watch.

As always I hope these help and if there is anything in particular that you would like me to write out in a blog post for everyone please let me know.

Even thought I have a bad entry I will not let it destroy my confidence in trading. I am human and learning from my lesson on Monday.

Don’t let a bad trade get you down, simply learn from it and how you can improve from the error. We are all human not computers.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Apr 2, 2016 | Uncategorized

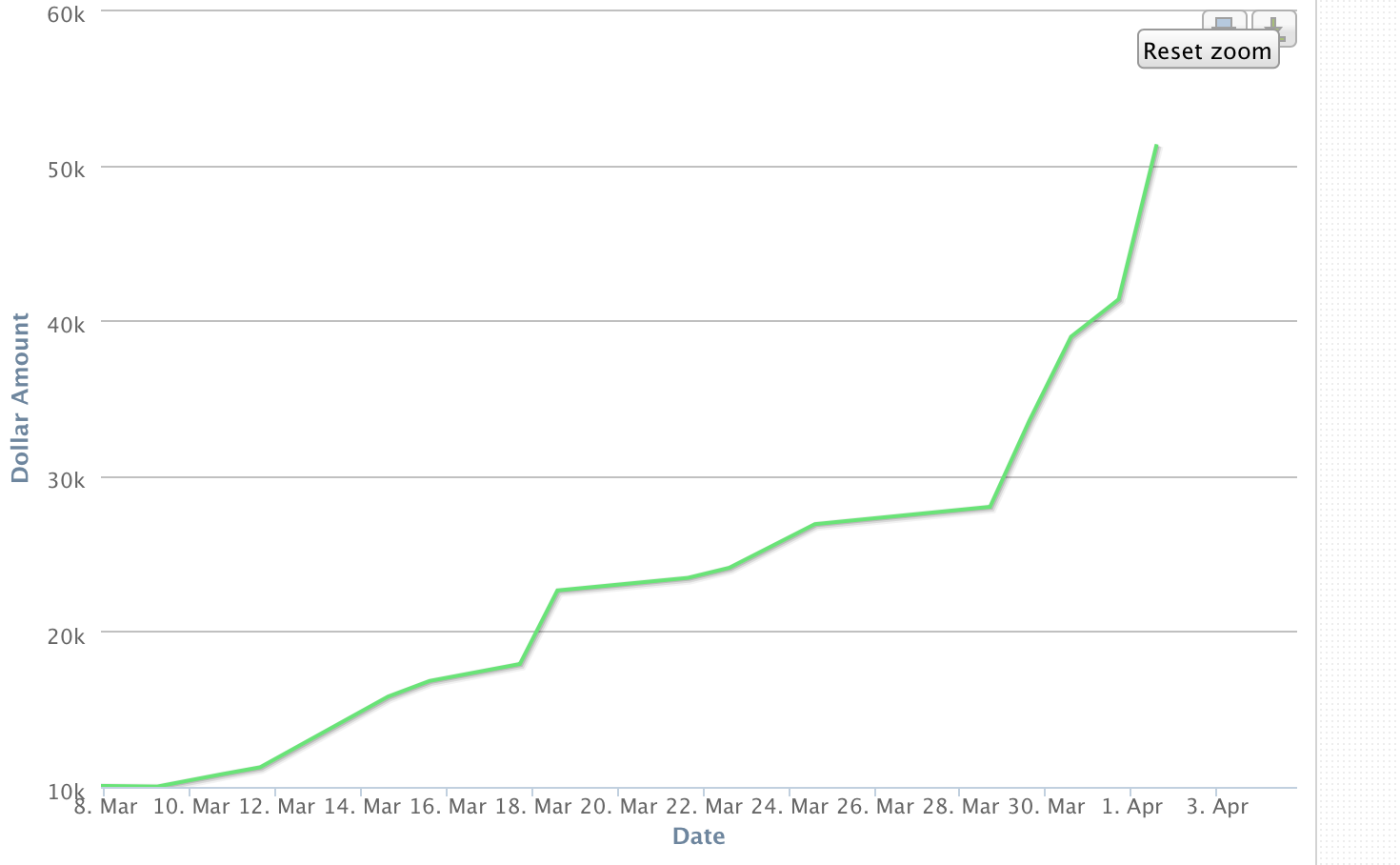

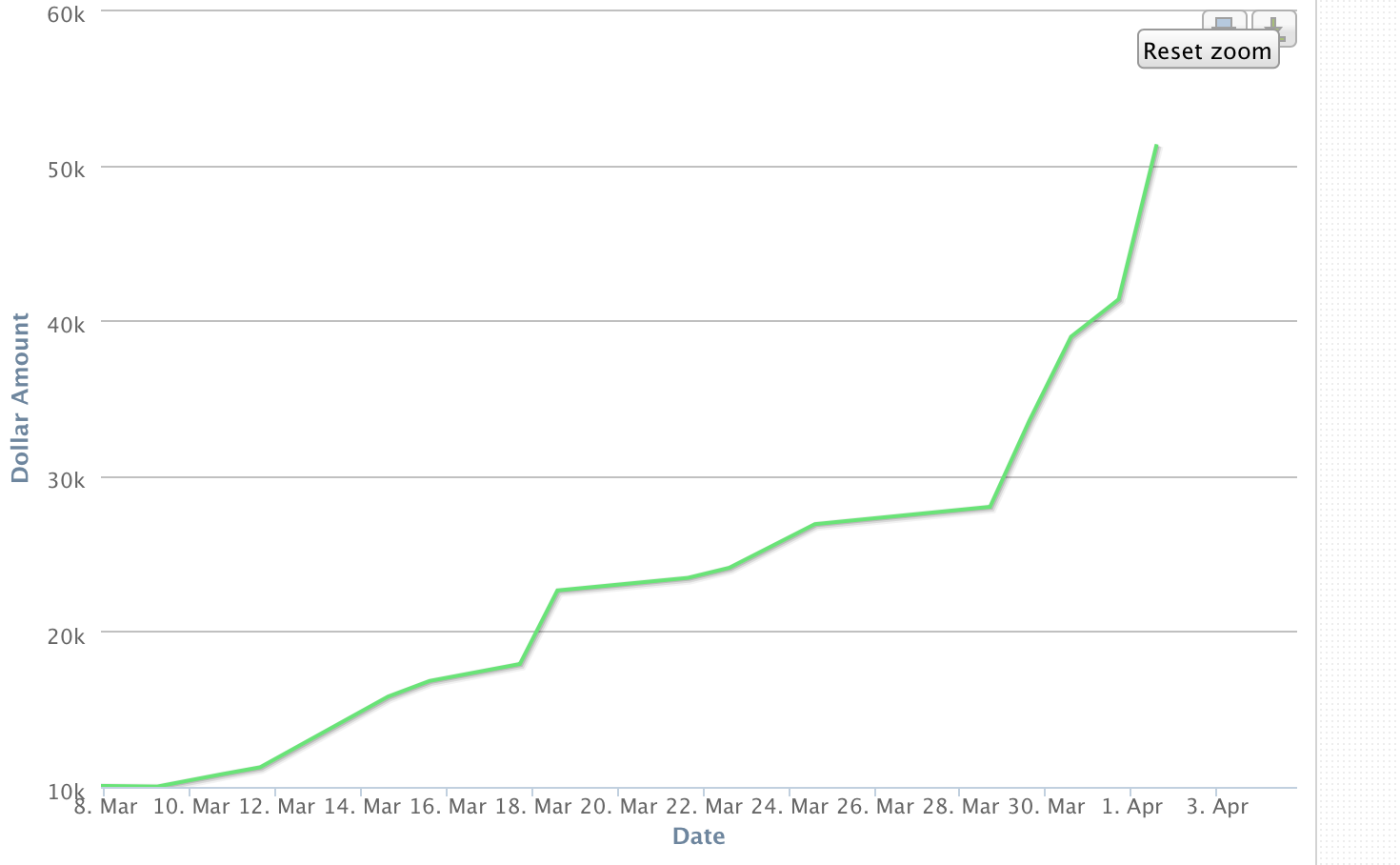

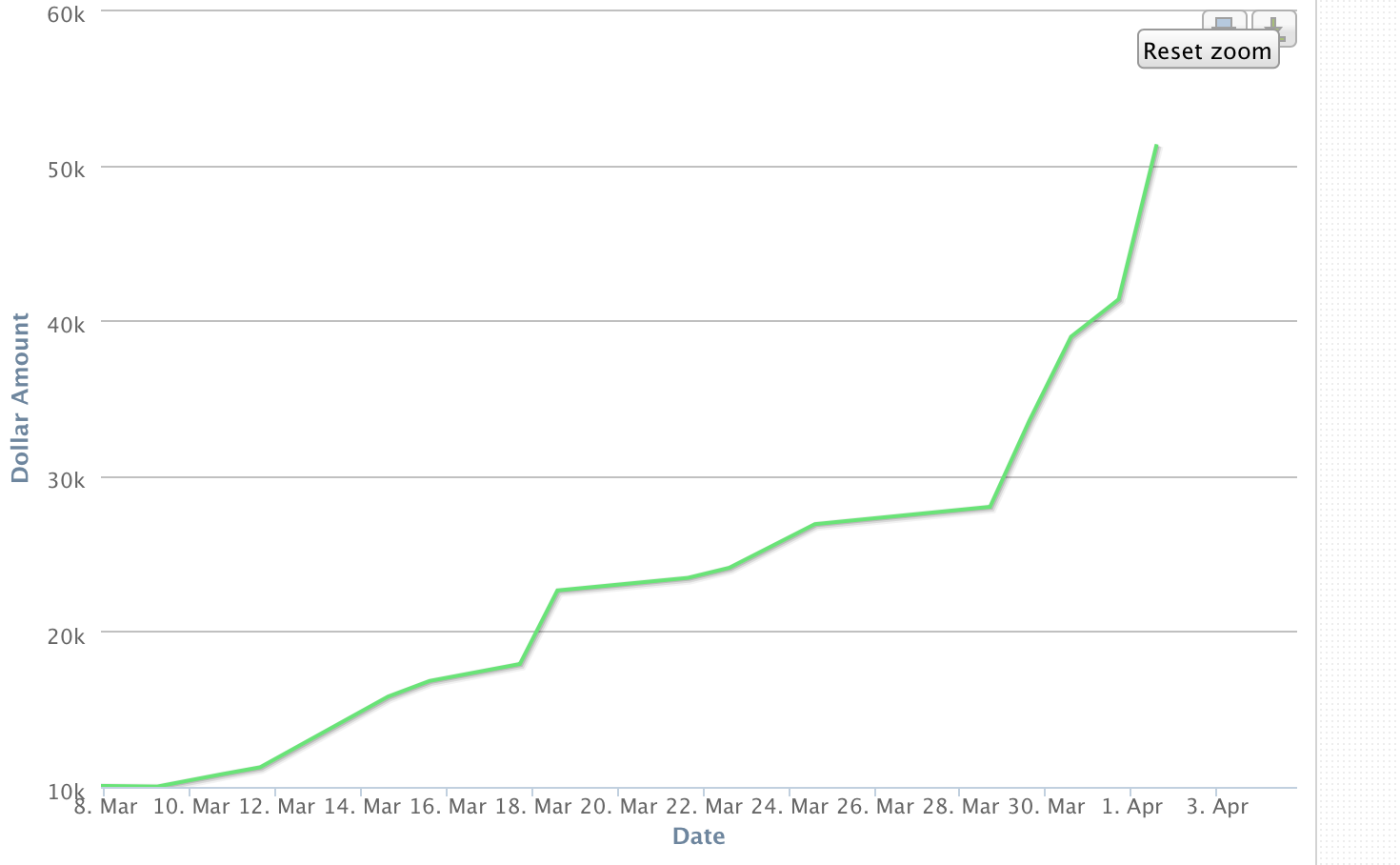

This is my profit chart you can see on Profitly as well as many great tools by Tim Sykes and other stock trading Gurus

Wow what an amazing week? I thought it was going well on Tuesday and I had my swing trade set up for PTLA overnight. Then I began my day and took my daughter to daycare and came back and opened my computer to work on our business investment Miss VVs Mystery and I just glanced at the stock. I saw that it was past my limit order price and sure enough I’d made $3500 by 9:55 in the morning on my so called day off from the market. I continued with business work and looked at around lunch time and saw that it had tanked and was primed for another long opportunity, so I went in again and made another nice profit.

Thursday was a rough day because my daughter was home from daycare sick and I was mentally really wanting to trade. I traded through breakfast with her while she was a captive audience in her high chair munching away and once it was time to put her down closed down my position on my PTLA short stock. While she was napping I scanned and went into some more trades. I completely forgot about PBYI on Thursday which was on my watchlist. I went long OPK and MOV and PTLA again. I let the work for me seeing my risk on the entry was low and watched from my phone while playing with my daughter. My entries on Thursday definitely could have been better but my daughter with her infectious smile had my attention. She gets into everything now at 20 months old. While she was napping in the afternoon I set up my swing trades overnight for PBYI, PTLA and MOV.

This morning I was way to conservative with my exit on PBYI and MOV. I have a hard time letting my winners develop. I see a pullback which I know is due to happen with the RSI going higher and then I let fear jump in and protect the profit and right after I close the position it goes up. For most of my trades today I found I had to use market orders because my limit orders were not getting filled. The size of my orders was too much and causing a price barrier. Rather than let it bounce I would play the spread and if selling wait until the bid price reached a price I was happy with and execute there. Honestly today was my biggest day with profits before commissions were just shy of $10k. It’s on days like these that I really have to pinch myself to see if these numbers are real. My husband is still in denial phase that it is happening. The week before commissions was $27K.

If you have been following my trades you can see that I tend to gravitate to stocks that have been largely oversold. When I began my paper trading I started trend following at the same time. I would write down data and compile it on excel spreadsheets and I found my strategy. So I tend to look for Gappers in both up and down directions from the night before and that morning.

I look at the charts back 2 days, 5 days, 15 days , 1 month, 3 months and 6 months. The key to have and amazing week like this past one is definitely entry point and risk liability. If it looks like a good entry I will load up on shares.

Prior to going on maternity leave, I was working as a part-time customer service agent for a major airline for an annual salary of roughly $14K CAD. It blows my mind that I made almost double that in a week.

I have come along way in 14 months and you can too. I posed a question on Twitter if you would pay for alerts and the response was 75% yes. It will come but for now I want to give back and help people that are in the same place I was 14 months ago.

I just listened to Tim Grittani’s Q&A on Digital Stock Summit and it is very true that in the beginning it is important to find a good mentor who can help you learn the basics and then you can blossom into a trader with your own niche. So learn from others now while it seems like an overwhelming mass of information. Take it one step at a time. I’m making what seems to be ridiculous profits now, but I know I can still learn. Will I necessarily change my strategy…. I don’t think I will for now, but I can improve on it.

One of the hardest things I found in the beginning was accepting a loss. It is humbling when you first lose $500, or even $50. Especially if it is hard earned money. It is a punch to the ego. Don’t be negative about it. Instead turn it into a positive and figure out what went wrong. The psychological aspect really got to me in the beginning and that is why I turned to paper trading. It will build you confidence so that when you are ready to use that real money you know more how the stocks act and will be less likely to loose your initial account funds. Instead you will be more likely to grow them.

I have had a couple people reach out and ask me questions through DM on Twitter and I really enjoy helping them and seeing their growth. It is inspiring to see people take on the challenge. Way to go! keep up your hard work and don’t get discouraged.

Have an amazing weekend and enjoy your time with family and friends. Money can’t buy that.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Mar 30, 2016 | Uncategorized

This month is not over yet, but I have had 3 days with more than $4k in profits. I find the importance to having successful winning trades is timing and confidence. I was off with timing today but still did incredibly. Yesterday however was not the same.

I find most of my losing trades in the morning come from opening a trade before the morning panic trades have figured out a trend. Yesterday would have been better if I had waited to open my ACAD trade at the bottom of the morning selloff and rode the spike up to 25. Instead I was in a losing trade and didn’t give it time to work for me and locked in a loss. Patience on Entry is important.

With ARIA I found the stock on the bounce scanner with Trade Ideas and it looked like the RSI and the timing of the trade would cause it to have a pre-lunch cover as I like to call it. I see that on Mondays many times that isn’t always true. I try to figure out the psychological state of other traders when making my decisions. I made the mistake of adding and averaging down on my entry price and the stock never bounced. Even if I had swung this trade through today it never hit my initial entry of 6.21. I ate the loss instead and moved forward today with a clear head. More than 75% of the trades found on the bounce play alert tend to be winners and this was one of the 25% losers.

With PTLA my biggest stock I’m playing this week I saw the big selloff on Thursday and knew I would put it on watch for my long plays. Sometimes I can’t get shares to short so I try to be patient for long entries. This stock has had a great deal of liquidity to get in and out of easily. I had a great long trade Monday and added again end of day looking for a gain at open today. It did climb but I thought it would stall around 19.40 so I took my profit on a pullback. I locked a good gain, but I could have been patient to let my two limit orders execute and more than double my profit. Cant be overly greedy. Taking a gain is a gain and not a loss. I sold all my long position around 19.37 and then looked to short. I did not time my entry correctly and only had a minimal profit. I had a good long entry again 19.55 and sold it when I thought it would not cross 20. It did cross 20 but happy with my gains again and I put in a limit buy order while changing our winter tires of the cars. It executed and then I added again at 19.59. Since I plan on taking Wednesday off I will set a limit that I think will likely execute.

Monday I took my profits from GIII swing trade that ended up strong on Friday and continued the momentum. I was conservative in taking my profit just below 46 since it went all the way up to 46.69 in the am upward momentum. Looking at it today I could have even held all the way up to 47. Live and learn. I have found a winning strategy for myself and will stick to it for now.

My trades for today include the P long where again I didnt wait until the reversal happened after open. I began my position too soon.

In writing these trade reviews it really helps me to see my issues. A great trade begins with a great entry, otherwise you can be fighting the action more than you anticipate. It also allows me to study the timing in the market of how other traders act. Whether it is the robot computers making trades that are timed or real people I see the trends.

I have had a bunch of fellow traders responding about how these blogs are helping. I’m so happy to hear that I can help others in starting to day trade as it is an ocean of information. Best thing I can say is take it one day at a time and try to study and gain a grasp. Once you feel you understand, paper trade until consistent.

Just like running a marathon you don’t wake up tomorrow and run it you need to train to prevent injuries and have the mental ability to finish. The same is true with trading you need to add to your knowledge each day and it will compound and become easier. The psychological aspect in the begin can be very tough especially when you feel you can’t make a winning trade. Study to ensure you don’t end up there.

I love hearing from you and how I can help. To each person that says I inspire them, you guys inspire me to write these blogs to help with your feedback. Thank you and know you can do it too. When you have a passion you make time!

I love my job now and I look forward to sitting down to trade each day. You can love you life too. Your days of your life are what you do and who you associate with in you time awake. If you aren’t happy, make steps to change that and do it today.

If you are brand new I recommend Tim Sykes How to Make Millions DVD. The proceeds go to charity so you are able to help others while educating yourself.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Mar 23, 2016 | Blog Post, Uncategorized

A good trade is a combination of multiple items and timing is very important. After the absolutely amazing trading week last week I felt like I should be able to find some amazing trades.

Well the result was overtrading both days. In overtrading you can stack up wins, but you also stack up commissions.

Todays frustration was with VRX seeing the evolution of the rise all day and My poor entries and exits on GIII. VRX. I had a good entry both times, however the second time I could have let it develop more for a better gain.

On GIII my timing was all off. I started my short and it continued to rise. So I added and I added and then when I say I was in the green I tried to be patient to let the trade develop when I really should have taken the gain.

I see the reversal happening right in front of my eyes and then boom in one minute it moved 54 cents and my gain was washed away. I then took the time to no longer fight the trend and go long.

Trading is a perfect example of being in the moment and not hoping or living in the past. I was watching GIII and eating lunch with my husband. I saw it come to 15 cents from my exit target and a moment where I was hoping and not trading the action.

I was distracted by conversation and didn’t sell with a nice gain. I then left for the gym and saw it retest up by 46 but it did not cross it again. Then it had an afternoon fade.

I added one more time when it seemed like it had bottomed at 44.50 and then it collapsed down to 43.80. I feel this week I’m off with my timing and need to be a sniper on entries and exits.

I am finding the stocks with the movement and just not executing them correctly. I am still profiting, but I have room for improvement.

At the time of writing this GIII has moved up in after hours trading to 45 and should have a nice spike up at open for shorts covering. I anticipate it will hit 47 before the closing bell on Thursday. Don’t forget a shortened trading week with Good Friday.

My take away from the first two days of the week is be patient for the right stocks. Be a sniper on entries. The right stocks will perform. I feel like with GIII I almost had the deer in headlights watching it hit my targets twice and I did not execute. It’s ok something to work on and get better. Once I do I will be well on my way to making my cool Million ok first my $100K.

I hope you were successful yesterday and today and if not analyze what went wrong to try to correct it. My areas to improve are not to overtrade and wait for ideal setups with indicators on all three charts 1,2,5 min charts when entering a reversal trade. Then allowing the trade to work for me and when I see resistance or support don’t fight it take the profit.

I’ll be back on Thursday and hopefully will open my account tomorrow to see my GIII limit orders executed for a nice profit on my day off from the market.

Don’t forget you can alway check out Trade Ideas Trading Room for free during trading hours and they are allowing you a full free trial Wed and Thurs. Check it out!

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Feb 13, 2016 | Uncategorized

Day Trading Stocks Online

As many people I was looking for a career to create a life with more pleasure working for myself and more free time. I come from a family that believes in long term investing and I had a long term account. In 2013 I was lucky to make an investment at the right time. I bought AAMRQ at 2.51 and within 8 months it came out of bankruptcy and the stock moved up to $40 with a profit of $225K.

This allowed me to fully enjoy my year of maternity leave (Quebec is amazing and allows women a full year off). In that time I was actually trying to gain my real estate license in Quebec as I love real estate sales. Well I passed all my licensing exams with just the French exam to pass according to french language laws.

Forget all my history in the States I had to take a foreign language exam to even attain my license. Well I had complications with my daughter that did not allow me the free time I anticipated to study to pass the exam. I received 60% and not good enough to acquire my real estate brokers license in Quebec.

How to Turn A Negative into Positive

I felt defeated end of January 2015. I thought what on earth am I going to do. Well my husband said you are so good with long term stocks why don’t you look more at that.

So I began researching and I ran into this page and listened to the video. I thought I now have another 6 months of maternity leave left and I have some extra cash so I want to apply for the challenge. I went through the phone interview to screen if I had the financial ability to participate.

It was roughly $6k for the whole program including Stocks To Trade. More DVDS than you can imagine and a wealth of resources online and via email. Contact to Tim Sykes and Michael Goode and more. I was diligent and set up time to watch my dvds after dinner once my daughter went to bed. I was so excited I opened a day trading account. This was end of February 2015

How to Blow Up a Trading Account

Well I was learning through the DVDs and I wanted to apply what I thought I knew to the action daily. 1. I way overtraded and didn’t realize the fees involved. 2. I didn’t have the experience so I blew through another 5k pretty quickly. I had some winning trades and I tried to do it all while watching a 7 month old baby. Once my daughter was 9 months, I was in a winning trade and had a stop limit order in and the stop triggered the limit and I missed my trade due to not being in front of the computer, so I stopped real cash trading.

Reset Your Mindset

I continued to study for the next 4 months. Watching the live webinars and watching DVDs and watching the market action at open with watch lists that I had created the night before. Once my daughter went to daycare in September I now had my mornings baby free to dedicate the time to watch my trades. So I set up my watch lists and paper traded to become consistent. I played around with trying to find trends that worked for me as well.

Paper Trading Stocks

In Nov 2015 my paper trading became consistent and I thought its time to try with real money. I was scared with my past where I had just burned through money. So I played small until I became mostly profitable with my real trades. If you check my profit chart you will see I was in the red up until about Jan 2016. It seems like it just started to click.

After watching the charts every day you start to see trends and you start to see setups. You understand how to read level 2 and understand the price action. It definitely did not happen overnight. It took time. It took dedication and perserverance. I have some bad losses too, but start each day with a fresh clean slate so that mentally I’m in todays trades.

Please let me know via Twitter @AirplaneJane or here if you have any specific questions I can help you with. I know I had a lot when I started and I found the online help invaluable. I want to help and give back. Thinking maybe one day to set up a streaming channel to help once I’m really profitable. We’ll see…. I’m no expert but as my brother says he thinks I’m in the 10% that get it.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you would like to be in Training Pit with me sign up here or if you want one on one training you can email me jane@thedarkpools.com You can contact me here or Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use tradingview.com which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.