by Jane | Nov 20, 2016 | Uncategorized

As many of you saw this week DRYS went absolutely Insane going from $4 to $115. Now this is really a power of low float stocks that have high demand. Simple supply and demand. When there are only 386K shares available and the buyers hear it is moving and more and more people start buying the shares become more expensive. Since it was a low float stock there weren’t many shares to get borrow for shorting so as it sold off the same drop happens to the downside.

This stock is one that changed lives in a great way and a devastating way if you were on the wrong side of the trade. For all those that made great money. I applaud you and good job! For those that lost money. Analyze the trade and see what went wrong. Did you have fear of missing out or too large a position for the large $ swings the stock took.

DRYS was a stock in the shipping sector and as many saw when one stock in a sector is moving it will tend to have sympathy plays for other stocks in the same sector. So DCIX, TOPS, ESEAS and others that even had Ocean in the name all reacted sympathetically and shot up with their low floats.

Once DRYS was unhalted and dropped so sympathetically did the other Shipping stocks.

You will see these sorts of reactions when a major retailers, chain restaurants, gold stocks, or even cyber security stocks are affected. So it is good to know what stocks are in certain sectors. A free source to find them is on Finviz.com and you go under groups, overview and then simply click on the sector and those stocks will come up. It is a matter of preference how you like to look at them to analyze the information in a linear or chart fashion. Check it out and play around. The more you look for different ways to find information the more you learn along the way.

My biggest learning expereince and painful one at that was with RJETQ this week. They filed the good news that they will be emerging from Chapter 11 and then the bomb was revealed in their reorganization plan.

As you probably know I had avidly been following the whole process and looking forward to the filing of their emergence as a positive reaction show in the stock price to profit. Well this time around with an airline stock I did not have the same success as the American Bankruptcy emergence.

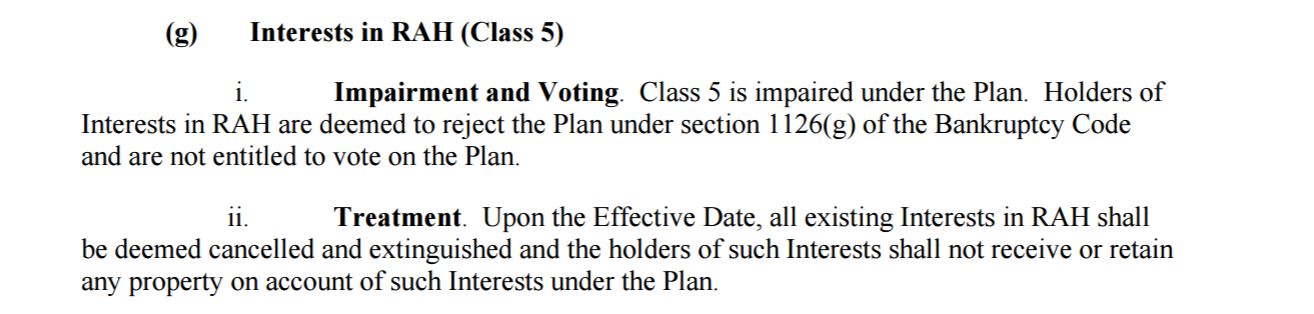

Here is the bad news for any share holders of RJETQ found in court docket 1189. Per my interpretation of the legal jargon. It took a couple steps for me to come to the conclusion that selling is the best option as from my understanding. If the court accepts this plan December 8th the stock could be worthless in my opinion

Step 1 was looking at 6.8

Where they say that All stock should be cancelled and cease to exist. I went back to research what the American Airlines Chapter 11 plan said and sure enough it had the same language. They usually cancel all the stock and if they do convert will reopen with a new ticker.

So next step was to look up the New Common Stock Interests.

So from reading this it became clear unless the shareholders are part of the Class 3(a) then we do not receive anything once this version of the plan is accepted. So the next step is to see how as a shareholder we are classified. Onto researching as a stock holder in the explanation of terms from the beginning of the docket.

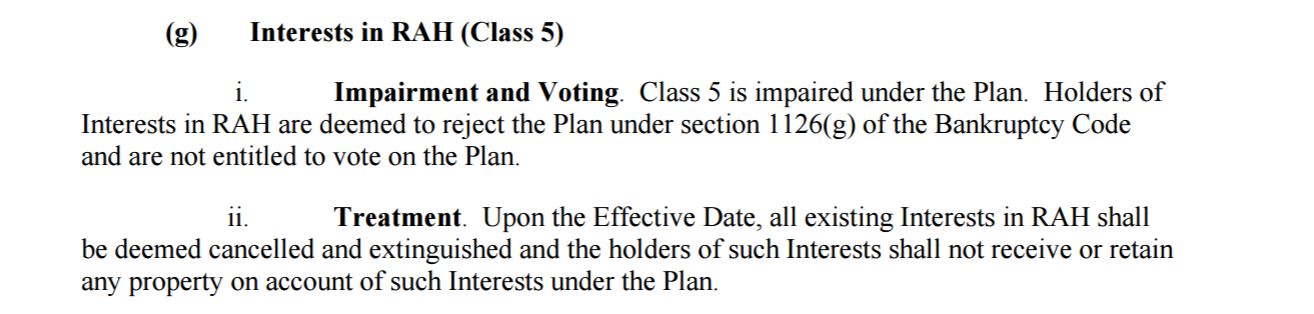

And I found that as an equity interest (which was the verbiage used in the American Plan) we are considered Interest in this document. So then onto see how the “Interest” of RAH is considered underclassification.

And I see here that it comes full circle back to Clause 6.8 that all existing Interests shall be deemed cancelled and shall not receive or retain any property on account. Now I’m not a lawyer by any stretch and this is 100% my interpretation of the document.

As a result I sold my full position of RJETQ on Friday for a painful loss of 58% which is my largest to date since my day trading career began. It was not an easy pill to swallow. You can ask my husband I was really upset to loose the capital for our family. This however was not a day trade and a long term swing. I think back to the big gain that I had with the American Bankruptcy where I turned 25K into 250K and realize it is small in comparison.

My lesson learned from this is be flat before the emergence from bankruptcy filing is already filed because the shareholders are the bottom of the list. As with every loss big or small or breakeven I look for the lesson to be able to move forward and not get stuck in the past.

When your head is busy thinking about what you should have done it is not clear to move forward with making in the moment decisions to trade well.

For Monday I will watch for the most part and I have my swing of LOPE short from 56.14. I’m looking for it to break down further as it is looking overextended on the daily chart and Friday was a second red day for the stock since the High of 57.47. I have a smaller share position to allow for more room on my stop.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Nov 12, 2016 | Uncategorized

As a newer day trader with roughly 1 year of experience, I am learning to trade big events with caution. Trading through two major world events of Brexit and the most recent US Election has taught me not to anticipate but trade the action. Each day no matter what you must trade what the market is doing and how it is reacting instead of what you think it will do.

It was interesting to see the market react ahead of the the two major events and price the reaction into the market. With Brexit the markets anticipated Britain staying and so the market rallied and then the news came out with a reverse result and boom the market reacted with a drop.

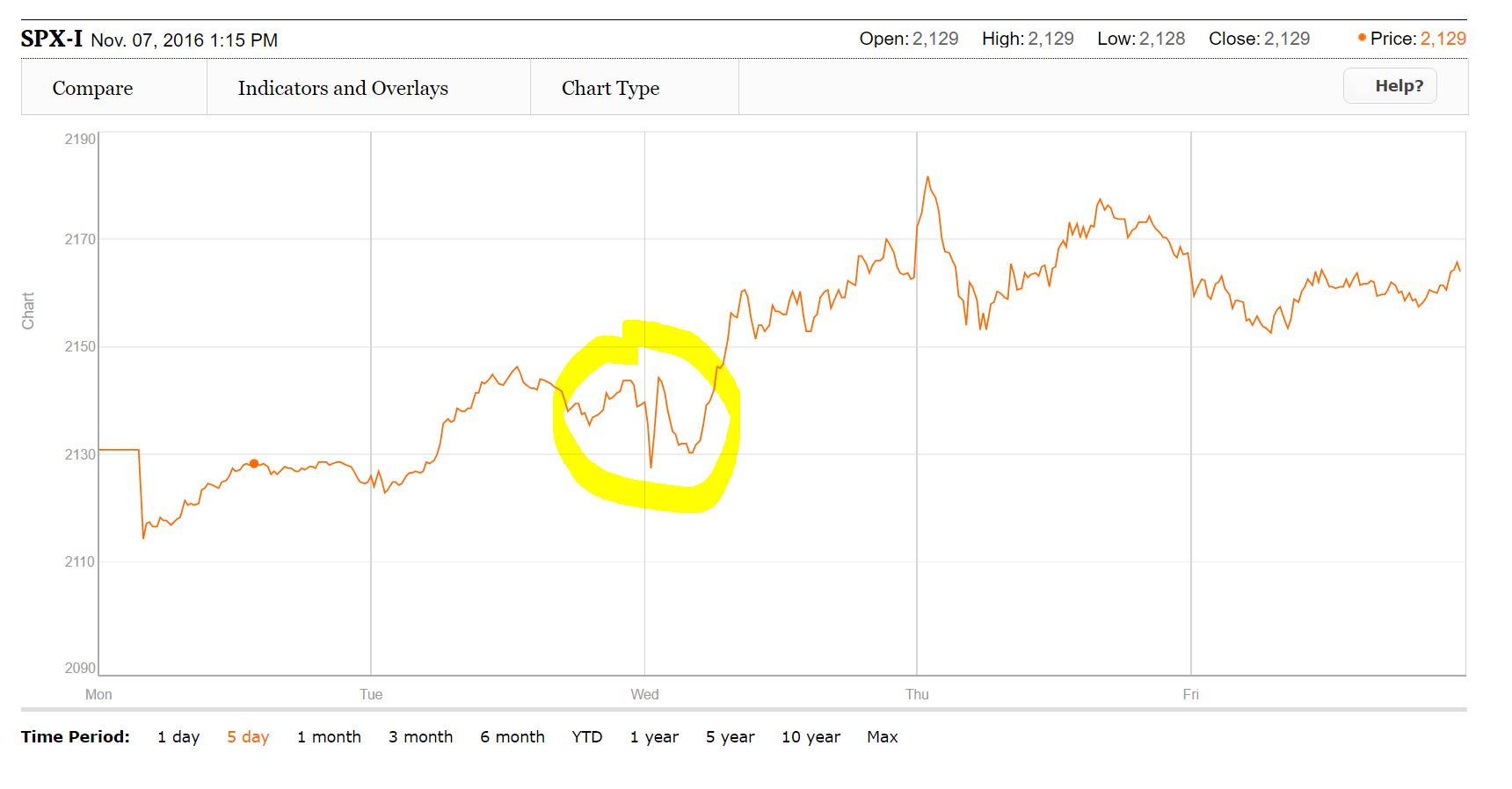

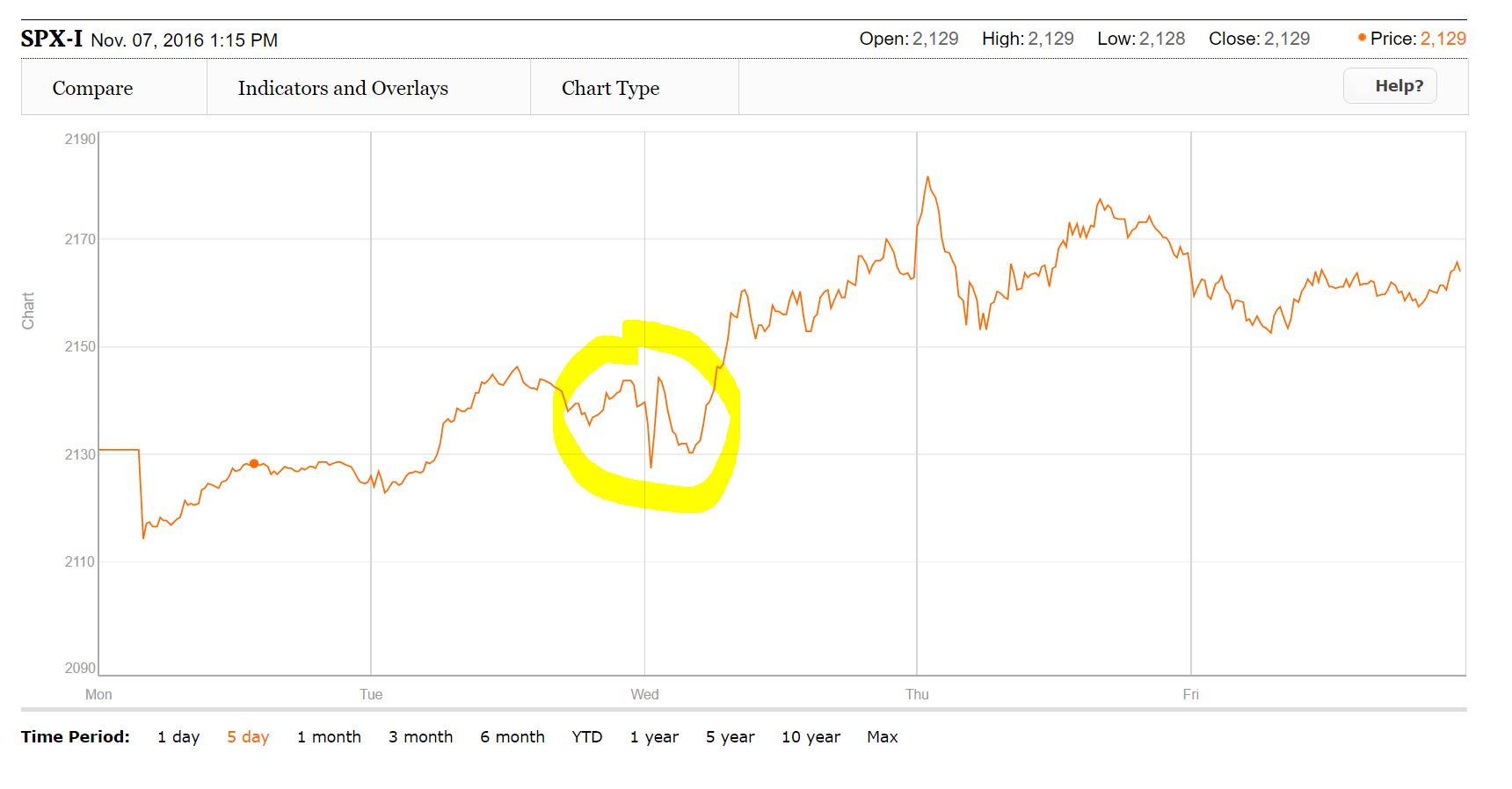

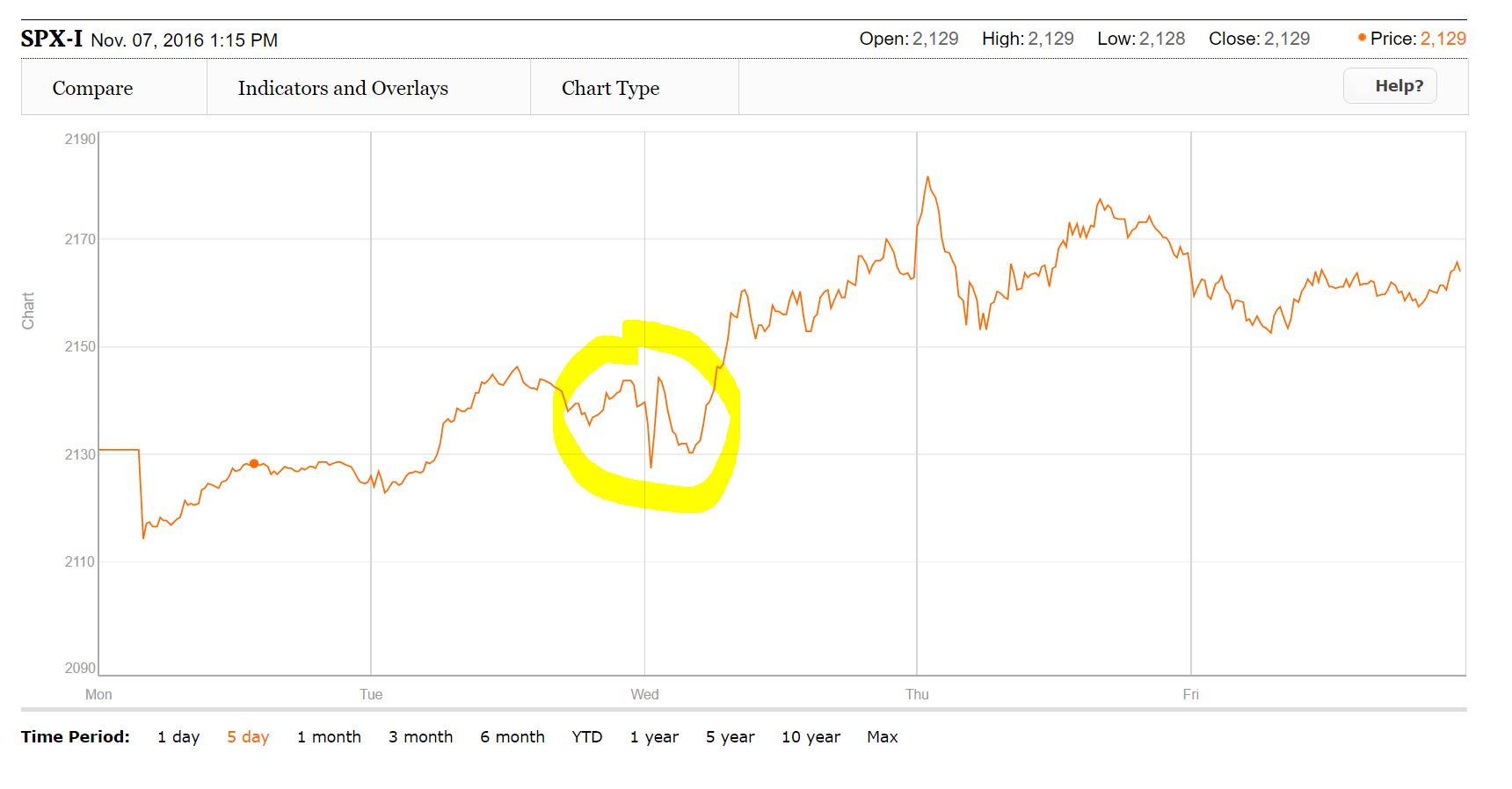

Well the same is true for the US Election. When Hilary was announced to be investigated by the FBI the overall US markets began declining. Then the FBI cleared her and the markets began to rally again. As you can see from the chart about the market sentiment was that she was going to win and the market would recover. All was going well until the Election results started coming in.

I know of futures traders that banked big time on this one event. They sold short before the results and once Trump was leading the market futures began to drop down to the almost limit down maximum of 5%.Which would have potentially halted the markets for the next day. So When I went to bed around 2 am the markets were down roughly 4.6% I think it might not have been the fact Trump was leading but the uncertainty of the results.

Since this was the first time I had traded through and election and also a dramatic one at that I knew Wednesday would be a day to trade super cautiously. When I woke up I saw that A. Trump was the confirmed winner and B. that the futures markets had started to recover.

You can see just how volatile Tuesday night was on the chart. Looks more like an EKG reading than the type of chart you want for a major index. So it tanked overnight came back to open up slightly. Dropped off again and then rallied the rest of the day. A day of major extremes in the market and with my style of reversal trading a great day to capture the reversals. I traded both long and short positions on Wednesday.

It is definitely possible to profit in any market any day, but it is all about your diligence. The riskiest time to every trade is your entry. So you want to make sure that you have a good stop either mental or if you are like me and need hard stops then a hard one. Once it goes in your direction I like the strategy of using a stop to protect those profits if it flips against me or taking 50% off at a consolidation point and a stop for the rest to protect the profits. It is always better to take 50% profit at a resistance point than zero profit and have it go back against you for a loss.

There is no need to be a superstar and try to rock each and every trade. The best way to rock each trade is to take a profit on it. Big or small they all grow your account. That’s why I always say Carpe Profit. Be happy with any and every gain. Over time you will become better at understanding the price action and capture more of the move. The stops will let you trade cautiously while locking profits.

The biggest hurdle each trader faces is themselves. Managing yourself will improve your trading. That is why I partnered with Mandi Pour Rafsendjani and we are doing a very valuable 6 week live or recorded Webinar Training about Day Trading and Trading Mindset. They go hand in hand and in understanding yourself you will be able to be a better trader. A inexpensive investment in yourself that will only improve your trading.

If you have been following me for a while you know that I enjoy helping others improve. It is amazing to hear the transformations that I have helped to inspire happen. We can all do what we put our minds to on a daily basis when we direct our energy there. It is a choice of daily decisions. How bad do you want that change in your life. Like a couch potato at 400 lbs saying I want to lose weight and become more active but day after day the same habits of diet and exercise are there. We make choices with our actions and through those actions we see change to make our dreams come true.

When you have a dream or change in life you want to see, it starts with yourself. Your daily actions and decisions determing if you will reach that goal. Each little step will help you get there. Give it time, be kind to yourself and acknowledge the little achievements along the way. Each small one gets you to the end goal. Each day is precious and you need to be kind and positive to yourself to get your end result of happiness in life in whatever form happiness comes to you.

If there are any women interested in the Seminar in San Diego Dec 4th, where I have been asked to speak by Trade Ideas, you can sign up here.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Nov 2, 2016 | Uncategorized

I’m very excited to share my experience and inspire more women and men to trade. Women actually make better traders as we are less risk averse. I will post more details as they become available. This idea all started about one month ago when Dan asked me to share my experience to others as he has seen my progression over the past 8 months. For those interested in signing up you can go here.

It was back in March when Dan Mirkin CEO of Trade Ideas first reached out to me via Twitter about trying out Trade Ideas after he saw my budding day trading career. He is one of the few that supported my desire to succeed as a day trader from my beginning.

It has been quite a journey so far in the past year as many of you know. Changing my career to be a day trader. Having some amazing months and days in trading and then I found out I was pregnant with our second child. An amazing blessing to have another daughter on the way for her introduction into the world the second week of February. Then I saw my monthly profits decrease over the past two months.

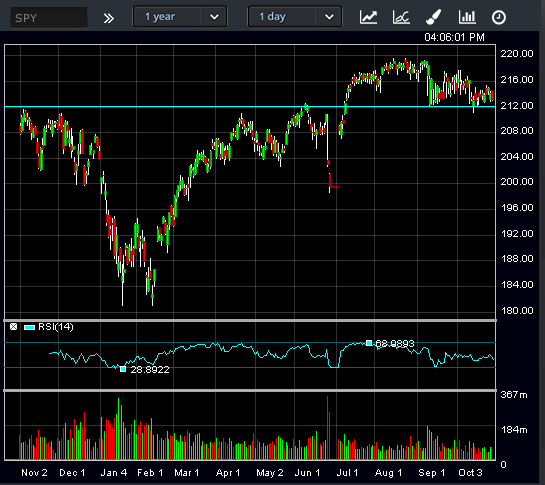

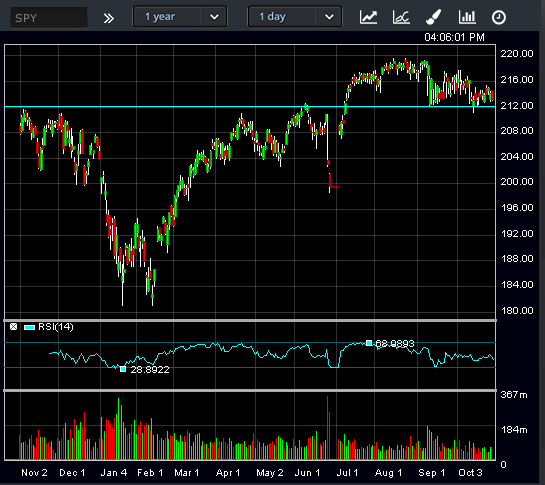

The past two months were definitely not as prosperous for me. I saw my strategy was not creating the same profits as it did before. My husband encouraged me to step away from the market when I had a red week which hadn’t happened in a while. In that time I looked at the year chart of the SPY.

As you can see it was roughly the past two months that the market has been bearish. I posted this a couple days ago on Twitter and advised that when we break the 212 support we will definitely be in a bearish forming market. Sure enough the momentum is continuing downwards with the SPY closing down at 211.01 below that 212 support.

Now there isn’t a reason to fear a Bearish market it just means that the strategy that works really well in a Bullish market won’t be as successful in a bearish market. So this means it is time to adapt to the market. This adaptability will create a forehand and backhand to your trading style . I have been predominantly a long biased trader but I see from the past two months and today that longs are not performing as well as shorts. There is more strength on the selling side intraday as roughly 80% of the market will follow the major indices. So my bounces that I was trading aren’t bouncing as long and as strong with more sellers in the action.

Yesterday was the first day I really flipped my strategy and went short AKAM with clear indicators to me that the momentum was changing. 3 days that showed slowing volume even though the price was increasing with a top of a new 52 week high. Then yesterday it sold off from the 52 week high and day one where it closed red and Today was the second red day selling off another for a daily price drop of 1.80. I did not trade it today and I’m learning that just as there can be a 3 strong up days it seems that there can be a second stronger red day. Time time to study the new market and analyze stocks reactions. I absolutely love the market and this job.

I saw this setup and had so much fun shorting. I shorted more today….INCY and SCAI. The shorts performed well. I also saw a bounce setup for YRD and it never bounced. and I ended up red for the day. Overall I’m red on the week by a couple hundred dollars but I see that it is because my old strategy just did not function.

There is always something to learn everyday in the market and if your trades are not working it is time to analyze the trades. That analysis can only help you and that is why I have partnered with my good friend and fellow female trade Mandi Pour Rafsendjani to create our 6 week Day Trading and Psychology training starting November 13th. You can see a sample of our encouraging style with this free webinar.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Oct 19, 2016 | Uncategorized

Some of the most difficult days in trading are the imperfect ones where your trading decisions for that day are wrong.

This morning I sat down late at my desk because my daughter was being a rascal at school. I am usually at my desk by 9:15-917 but today it was 9:22 and I was opening up my software. I opened it up and it began working and then nothing. The internet shut down on me and it took me a couple minutes to figure it out.

I immediately went and rebooted the router and the modem. I was then able to open up my software after market open and I was able to see that my two stocks I was long overnight were gapping up. I felt unprepared for the day, out of control because I couldn’t set orders to protect the profits. If all was working at open I could have locked my $1k profits in the first 5 minutes of open. I should have sold immediately once I had the internet up instead of getting caught up in my head with emotions.

You can ask my husband I was pissed yelling at the computer. I am usually pretty good about not being frustrated when the internet goes down because I have set up an exit plan already. For some reason this morning that was not the case. I then got held up in the emotions and just watched the market so as to not make a revenge trade or irrational trade based on emotion.

I watched both REN and ACIA follow the way of the SPY. They both went down and I was stuck in the emotions and did not protect myself. My day was thrown off by emotions. By the time that I had calmed down to act rationally it was now 11 in the morning knowing the trend of the reversal throughout the day I did not panic sell at the lowest point. I watched them and waited to minimize my losses.

I was patient with ACIA and locked a nice little profit with a swing entry of 91.93 and an exit at 92.47.

I sat and watched the market today not trying to revenge trade. I was waiting for perfect setups. I saw PTCT down 50% in 2 days and the volume was slowing and the time of day was right so I bought a small position at 7.22. I proceeded to drop down to 6.90 and bounce. up to 7.60. When I saw the resistance at 7.40 I sold as it could have easily fallen back down.

I felt more confident with my trades and then saw BANC on my RSI scanner at the low extreme. I saw it drop from 16 to 15 and watched further and opened a small position at 14.08. It was testing 14 and forming a 5 min green candle so I added some at 14 when it went down and bounced. Then it dropped further to 13.15 and I added some at 13.25 when it bounced and looked like it was reversing. My average was 13.75. My error with BANC was trying to anticipate the reversal instead of letting it show itself to me.

The emotions of the day got to me and I should have stayed out of this trade. It was a revenge style trade and not cutting the loss early. In the future when I’m that frustrated it is a sign to step away and go enjoy the day. The internet is something I cannot control, but my reaction to the situation is controllable.

My frustration came from wanting to be able to provide the daily profits to my family to support them. In the future I will remind myself the internet is out of control and I will walk away. Exit the trades and a turn the page until the next day.

As I always say each bad trade provides a learning experience. We have to look at why we execute a losing trade the way that we did and what we can do better in the future. I admit my errors and strive to improve on them. Losses are never easy and when you examine them you can see what caused your decisions at that time.

To become a better more profitable trader make sure to examine your wins and your losses. Each one will provide insight into what you can do to improve your trades. All trades come with risk and reward and the goal is to stop the risk from becoming too large.

BANC will be on watch for tomorrow with the speculative Seeking Alpha fraud article written by an author that is Short.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Oct 6, 2016 | Uncategorized

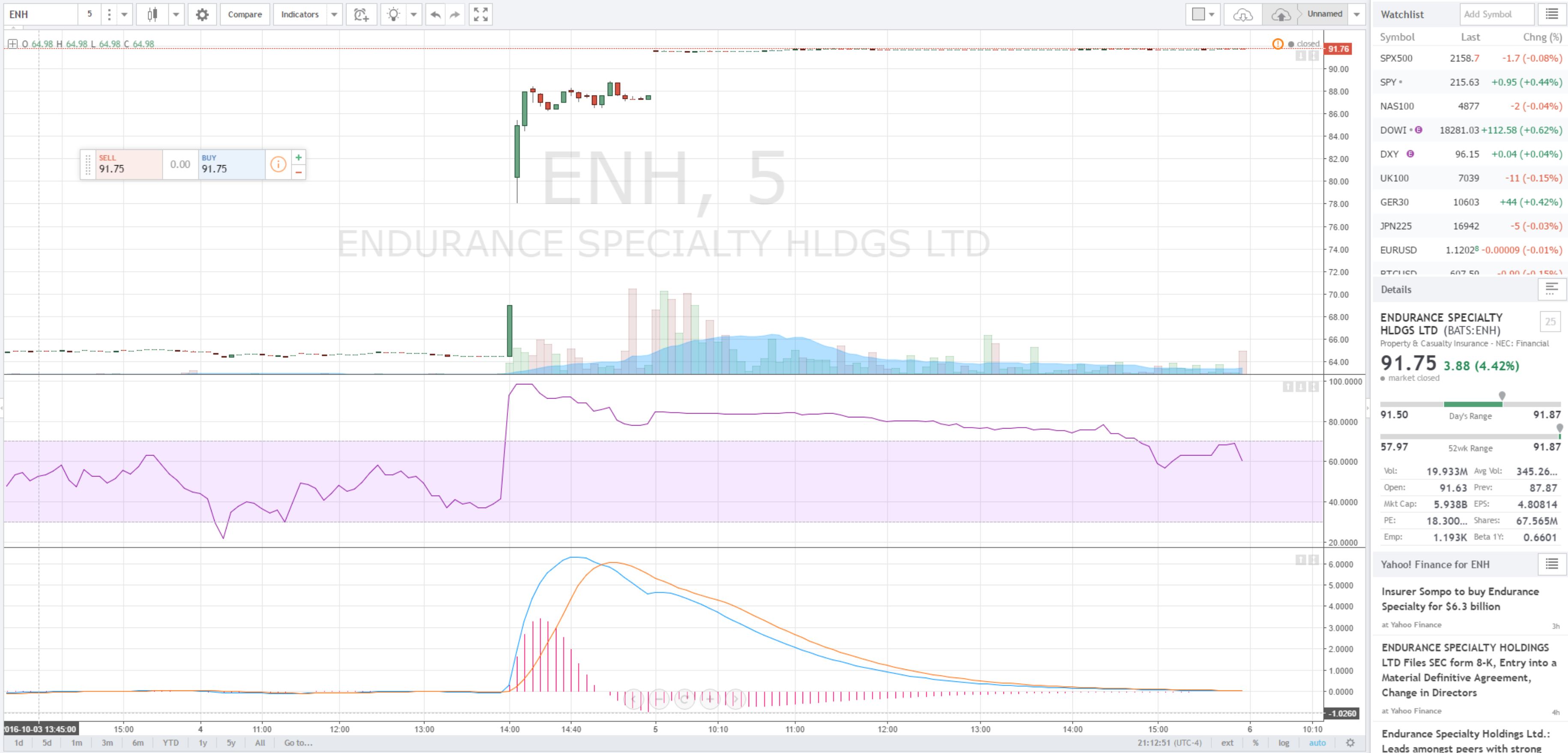

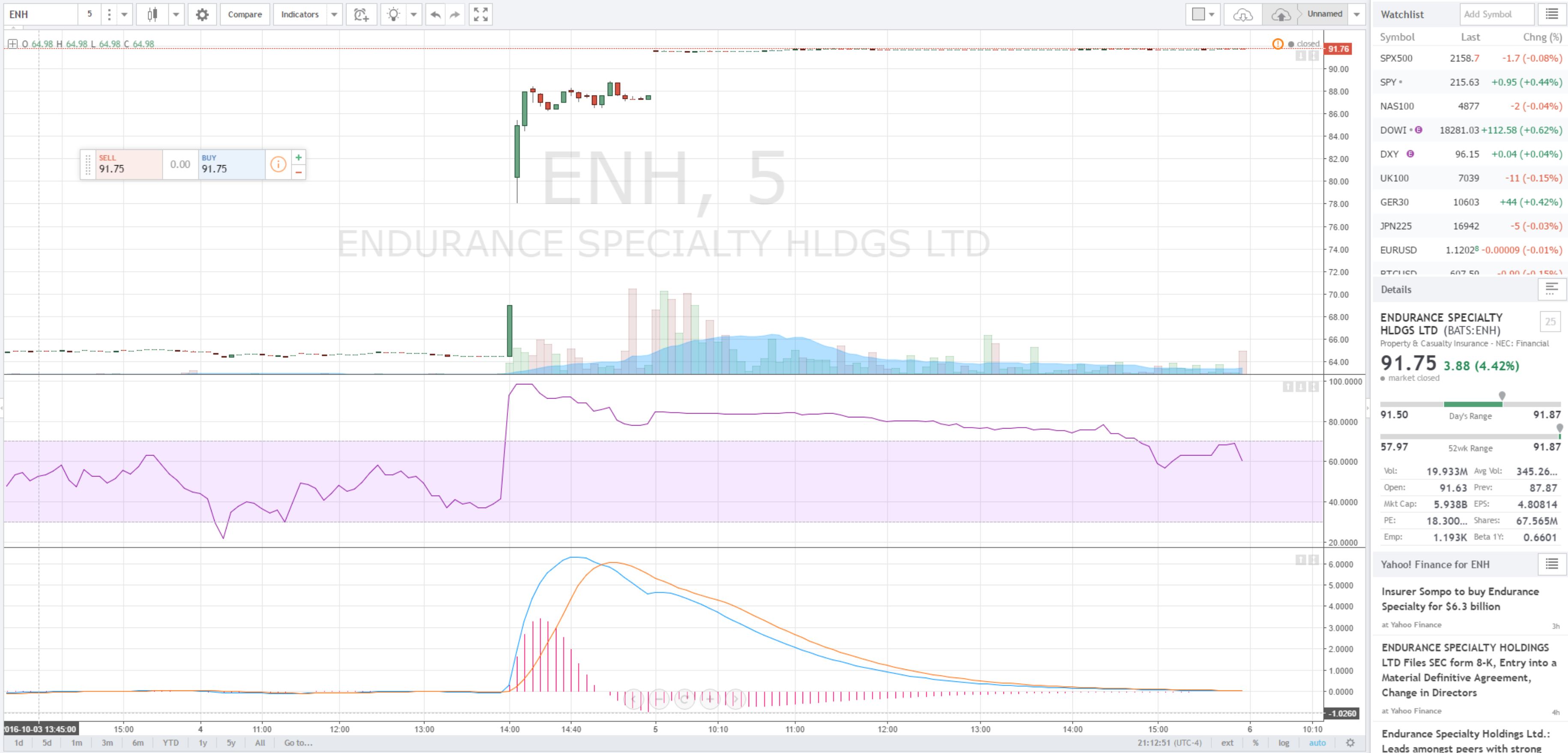

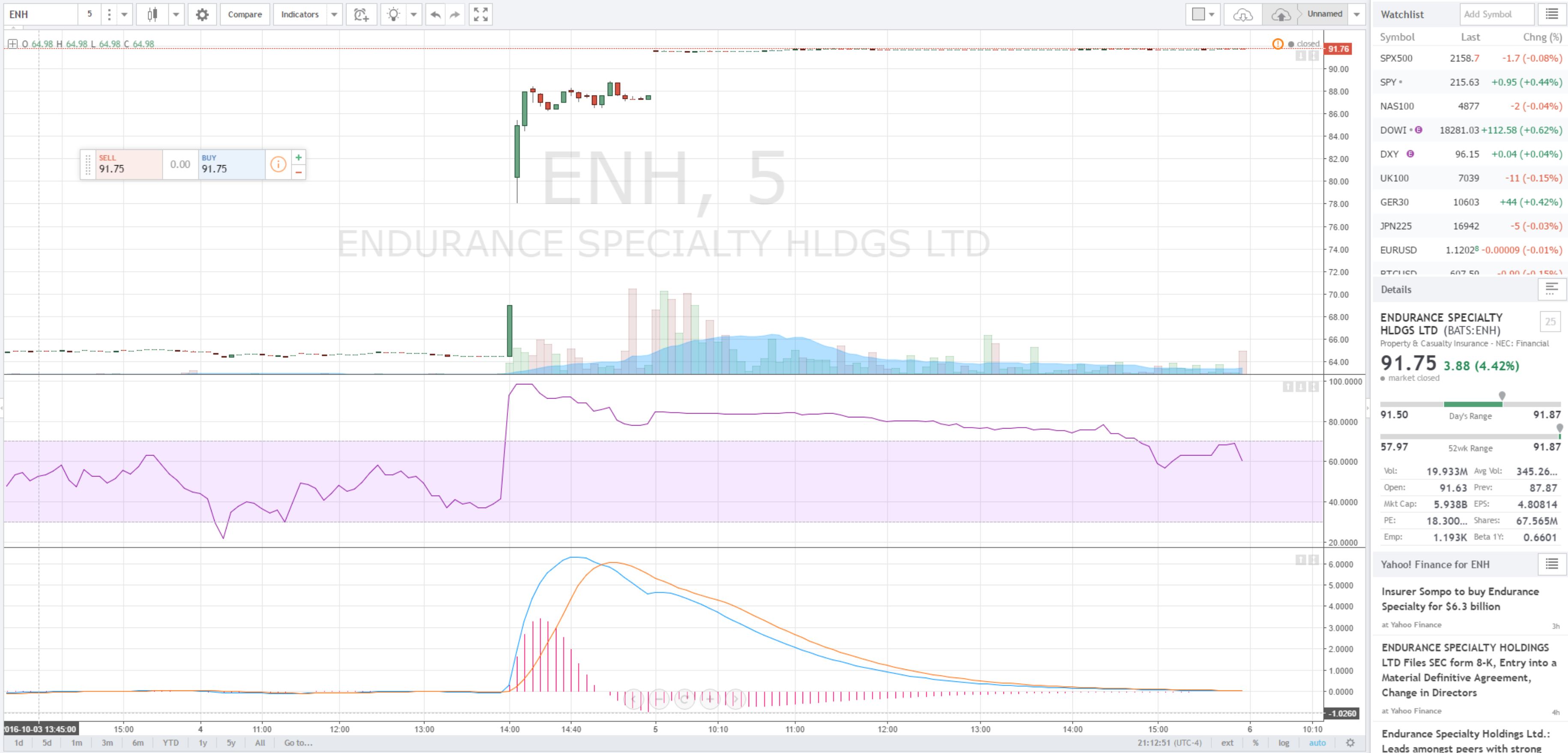

Each trading day can bring new experiences. I have heard of halts happening before with stocks that have gone bankrupt, but never with the news of a merger. I was out all day yesterday waiting at the OB/GYN office for my appointment and once I was done I checked the stocks ending strong for the day.

I stopped at the grocery store and in the car at the parking lot I discovered $ENH. Sure enough I saw the initial spike and and entered after the pull back and made a quick $250 on the bounce. I went in bought groceries for dinner and checked it again before heading home. Sure enough it pulled back again. I saw it hit almost 89 and pull back so I entered at $88.44. I went on my way home and unloaded. By the time I was back on my phone checking the stock before close I saw it was halted. They halted it at 3:32 due to the more than 35% increase in value and waiting for further news confirmation about the speculation of the merger.

Before I went back into it the second time I did more research about the speculative offer price of $6.4 Billion and the out standing float of 67.58 Million. Some quick math and it gave me rough merger price of $94 a share. So I thought what a deal at $88.44.

After putting our daughter down to sleep, I diligently checked the news. I went to see what time the halt was lifted which was 4:11 pm. I had also seen that Endurance Holdings had put out a press release stating that they were in final stage talks with Sompo. At that point I was still a bit unnerved by the halt. I knew that Sompo was going to release the news Wednesday afternoon their time in Japan, so I would wake up to the news.

In hindsight I don’t think the NYSE would have lifted the halt if they new that the news was all speculation. It did not occur to me until the morning and I saw the confirmed news that the buyout was going through at $6.3 Billion for a share price close to $93. It was great news to wake up to knowing that the gap up was definite based on the news.

I sold on open at 91.61 to go ahead and lock the profit. $3.17 profit per share which was not too shabby for a strong momentum overnight swing stock. I am finding that I enjoy the overnight swing trades with waking up to profits with the stocks that are continuing based on the overnight interest.

These overnight swing trades are becoming a strong strategy for me especially the earnings winners that tend to be strong for a couple days.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Sep 29, 2016 | Uncategorized

Once you have put in the time in studying and practicing everyday the rewards pay off. You are able to set your schedule and enjoy your life from anywhere in the world. It is not an overnight process.

There are hurdles along the way. You have to be willing to fail and learn from those failures. If you don’t stop to analyze your errors you will continue to blow up your account and be in the 90%. That 10% that makes it as a day trader have dedication and drive and the mentality they can do anything they put their mind to.

So know that in moving forward you will make errors. I had someone message me yesterday about getting into a stock and then the stock was halted and lost 76% value after the halt due to an announcement of bankruptcy. This individual had a stop limit in but it dropped so fast that the limit did not execute because it bypassed the limit price. Now there are two different outcomes from this situation.

One is you mentally shut down beat yourself up and get frustrated. You could revenge trade lose more money and go into a downward spiral. You can blow up your account and quickly if you are not careful. This is not healthy thought process.

The better way to look at this situation is to step away from your computer. Know that you are human and you will make errors in trading. You will have bad days, but how are you going to deal with them. Sometimes the error is you. Sometimes it is technology and sometimes it it is software that doesn’t work right. There are many errors possible.

When you step away stop looking at the negative and look at what you could or will learn from the situation you move forward. What will you do better in the future? Forgive yourself and know that it is a learning experience. These bad days can mentally derail you from having a clear head to trade. So if you are feeling fearful or upset stick to paper trading until you get back on track.

Knowing you can have these bad days before you get into trading is reality. Once you study hard and practice with paper trading to instill confidence and consistency you can slowly transition to trading full time.

Trading as a profession is a huge blessing that comes with hard work. You have freedom to work anywhere you have internet access… you can trade in a car or out while camping in the wilderness or on a beach. You are free from the four wall of an office. You could even trade while being a salesman on the road while bolstering your income.

The world becomes your oyster! So know that all your hard work can pay off. Remember to motivate yourself everyday to work hard. You are the only person that can get yourself there. If you want to change your life you need to put in the effort everyday. It is possible!

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.