Each trading day can bring new experiences. I have heard of halts happening before with stocks that have gone bankrupt, but never with the news of a merger. I was out all day yesterday waiting at the OB/GYN office for my appointment and once I was done I checked the stocks ending strong for the day.

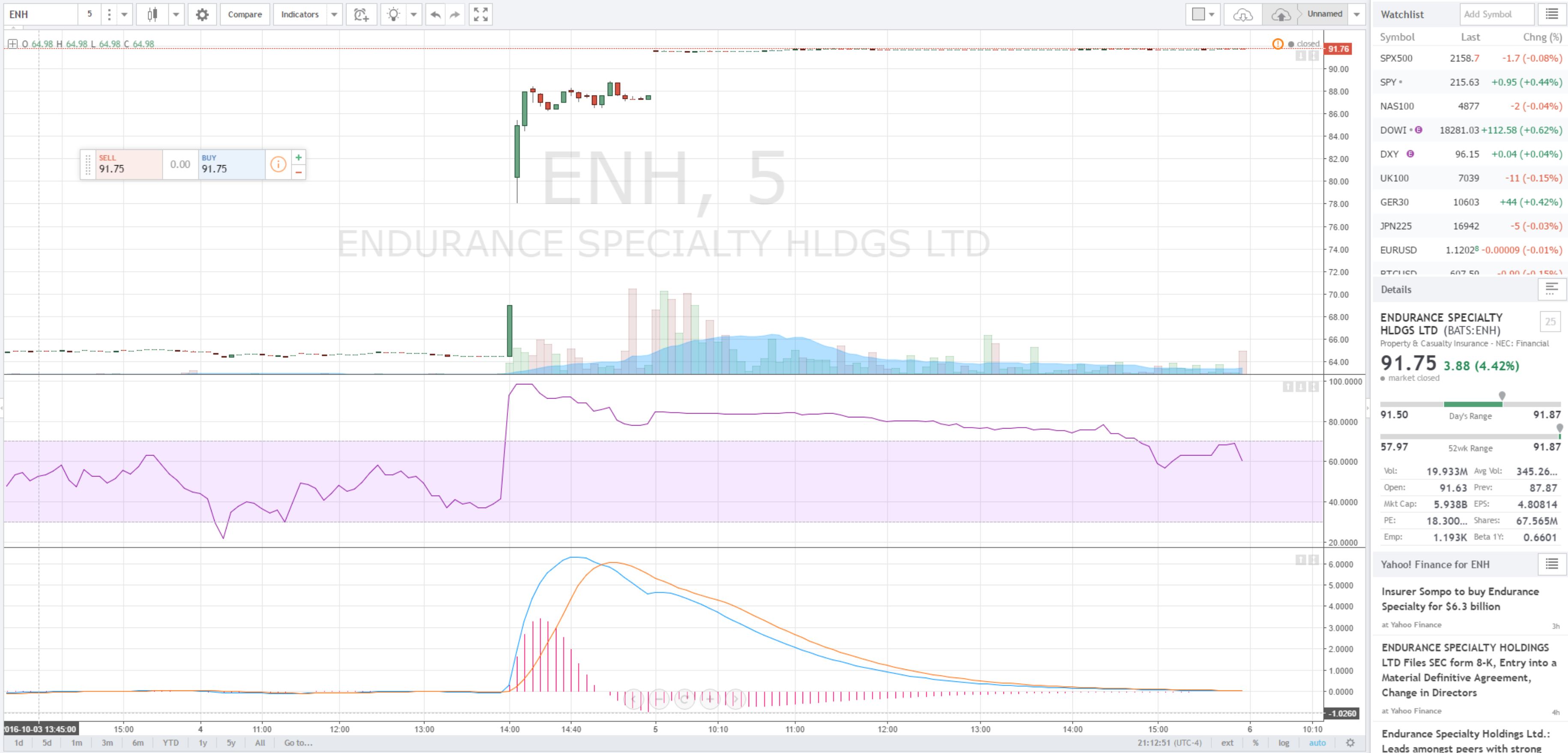

I stopped at the grocery store and in the car at the parking lot I discovered $ENH. Sure enough I saw the initial spike and and entered after the pull back and made a quick $250 on the bounce. I went in bought groceries for dinner and checked it again before heading home. Sure enough it pulled back again. I saw it hit almost 89 and pull back so I entered at $88.44. I went on my way home and unloaded. By the time I was back on my phone checking the stock before close I saw it was halted. They halted it at 3:32 due to the more than 35% increase in value and waiting for further news confirmation about the speculation of the merger.

Before I went back into it the second time I did more research about the speculative offer price of $6.4 Billion and the out standing float of 67.58 Million. Some quick math and it gave me rough merger price of $94 a share. So I thought what a deal at $88.44.

After putting our daughter down to sleep, I diligently checked the news. I went to see what time the halt was lifted which was 4:11 pm. I had also seen that Endurance Holdings had put out a press release stating that they were in final stage talks with Sompo. At that point I was still a bit unnerved by the halt. I knew that Sompo was going to release the news Wednesday afternoon their time in Japan, so I would wake up to the news.

In hindsight I don’t think the NYSE would have lifted the halt if they new that the news was all speculation. It did not occur to me until the morning and I saw the confirmed news that the buyout was going through at $6.3 Billion for a share price close to $93. It was great news to wake up to knowing that the gap up was definite based on the news.

I sold on open at 91.61 to go ahead and lock the profit. $3.17 profit per share which was not too shabby for a strong momentum overnight swing stock. I am finding that I enjoy the overnight swing trades with waking up to profits with the stocks that are continuing based on the overnight interest.

These overnight swing trades are becoming a strong strategy for me especially the earnings winners that tend to be strong for a couple days.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Thanks for sharing this story Jane. I can’t believe how shocking that must have been. I’m impressed by your calm attitude. It sounds like you handled this new trading experience very well!

It’s also great to see that you’re looking for new trading strategies and always trying to refine and improve your edge in the markets.