I’m very excited to share my experience and inspire more women and men to trade. Women actually make better traders as we are less risk averse. I will post more details as they become available. This idea all started about one month ago when Dan asked me to share my experience to others as he has seen my progression over the past 8 months. For those interested in signing up you can go here.

It was back in March when Dan Mirkin CEO of Trade Ideas first reached out to me via Twitter about trying out Trade Ideas after he saw my budding day trading career. He is one of the few that supported my desire to succeed as a day trader from my beginning.

It has been quite a journey so far in the past year as many of you know. Changing my career to be a day trader. Having some amazing months and days in trading and then I found out I was pregnant with our second child. An amazing blessing to have another daughter on the way for her introduction into the world the second week of February. Then I saw my monthly profits decrease over the past two months.

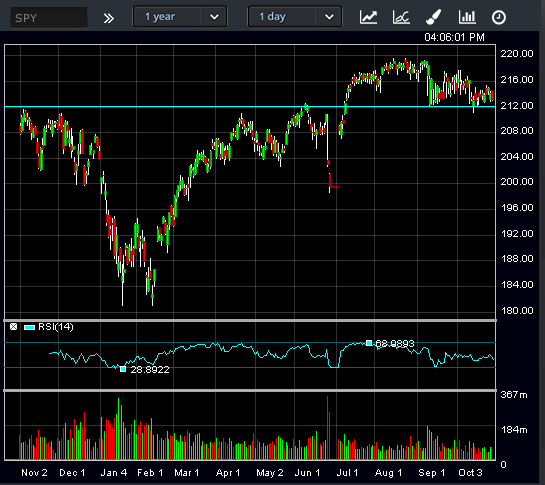

The past two months were definitely not as prosperous for me. I saw my strategy was not creating the same profits as it did before. My husband encouraged me to step away from the market when I had a red week which hadn’t happened in a while. In that time I looked at the year chart of the SPY.

As you can see it was roughly the past two months that the market has been bearish. I posted this a couple days ago on Twitter and advised that when we break the 212 support we will definitely be in a bearish forming market. Sure enough the momentum is continuing downwards with the SPY closing down at 211.01 below that 212 support.

Now there isn’t a reason to fear a Bearish market it just means that the strategy that works really well in a Bullish market won’t be as successful in a bearish market. So this means it is time to adapt to the market. This adaptability will create a forehand and backhand to your trading style . I have been predominantly a long biased trader but I see from the past two months and today that longs are not performing as well as shorts. There is more strength on the selling side intraday as roughly 80% of the market will follow the major indices. So my bounces that I was trading aren’t bouncing as long and as strong with more sellers in the action.

Yesterday was the first day I really flipped my strategy and went short AKAM with clear indicators to me that the momentum was changing. 3 days that showed slowing volume even though the price was increasing with a top of a new 52 week high. Then yesterday it sold off from the 52 week high and day one where it closed red and Today was the second red day selling off another for a daily price drop of 1.80. I did not trade it today and I’m learning that just as there can be a 3 strong up days it seems that there can be a second stronger red day. Time time to study the new market and analyze stocks reactions. I absolutely love the market and this job.

I saw this setup and had so much fun shorting. I shorted more today….INCY and SCAI. The shorts performed well. I also saw a bounce setup for YRD and it never bounced. and I ended up red for the day. Overall I’m red on the week by a couple hundred dollars but I see that it is because my old strategy just did not function.

There is always something to learn everyday in the market and if your trades are not working it is time to analyze the trades. That analysis can only help you and that is why I have partnered with my good friend and fellow female trade Mandi Pour Rafsendjani to create our 6 week Day Trading and Psychology training starting November 13th. You can see a sample of our encouraging style with this free webinar.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Congratulation Jane. You are doing awesome. I don’t think you are the only one experiencing failed breakouts the last couple months. The market sure has been sluggish. Hopefully it will get going again (one way or the other) after the election next week.

In the meantime I’m short biased now and loving flipping my strategy.