I remember when I was thinking about what am I going to do in order to be at home to be present should my daughter need me. And my real estate career was smashed with the silly language laws in Quebec. It’s not enough that I pass the equivalent of law boards for real estate in Quebec I had to pass a language proficiency test for French. Well that I bombed and I was shattered.

I thought I need to figure something out to be available for my daughter and still make money. I started studying and now after studying and learning every day since Feb of 2015 I’m making my average goal of $1,000 a day.

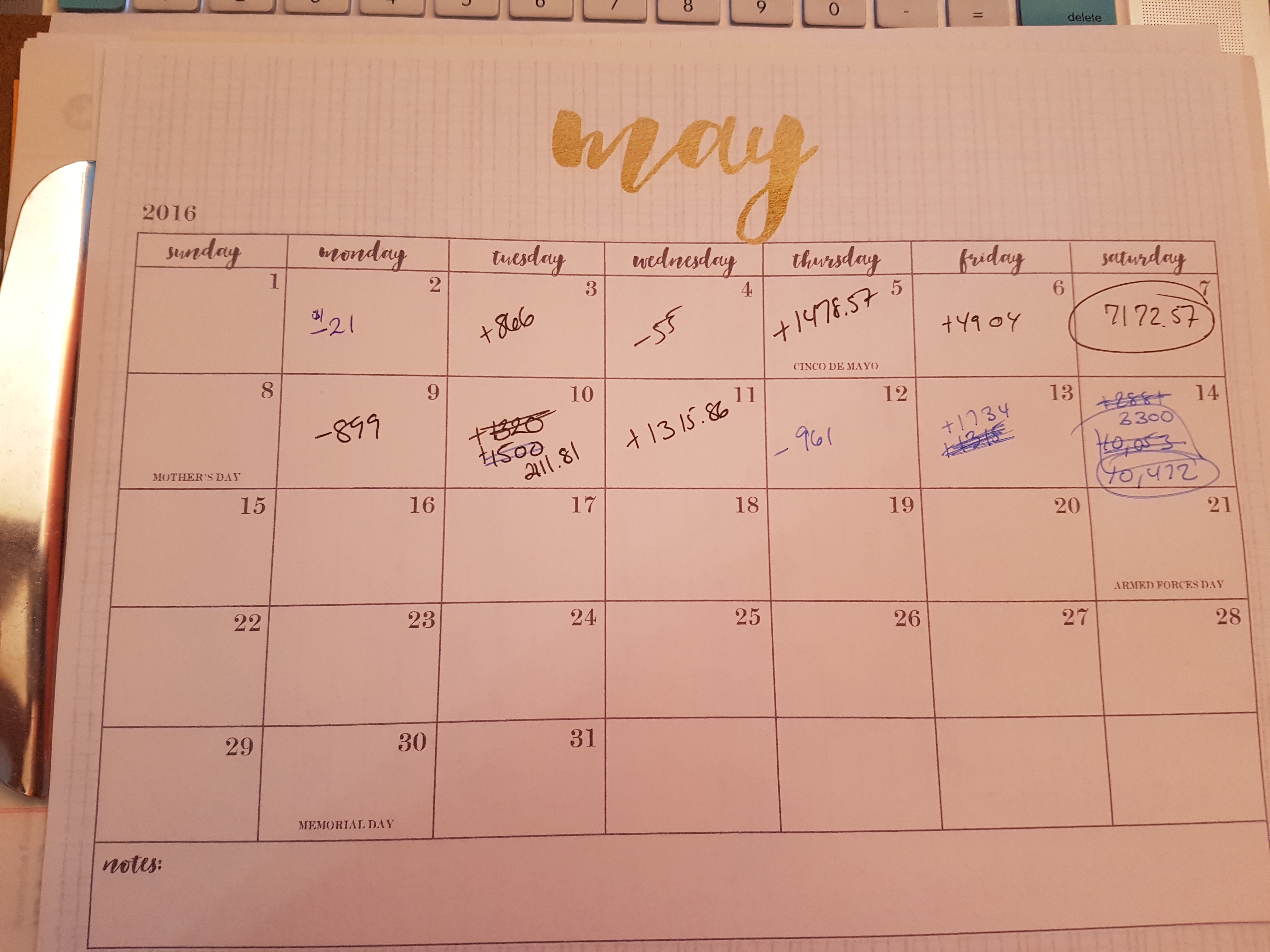

Of course I still have bad days as you can see from my calendar below.

I honestly don’t let those down days get to me. Each day, each trade is a fresh beginning and a new opportunity. When I have a bad trade I don’t beat myself up because it won’t get me anywhere. I try to analyze why it went wrong.

For my two down days. I had bad entries. I know better. I was anticipating the move on the stocks and not letting the trade set up and enter at the right time. As hard as it can be sometimes to take a loss it is better to cut the losses early and use the capital to make money with a better trade.

I also implemented hard stop limit orders to protect my profits as they go up to ensure I don’t give back. On Friday I had an amazing day with JWN. It was on fire. However I still had one trade that I was emotional and entered at the top of a spike and in turn lost .34 a share. It tanked so quickly I didn’t get a chance to put in my stop.

In working on my project to try to help inspire female traders I spent a good hour speak with Mandi Pour Rafsendjani a specialist on trading and psychology. She gave me great perspective about trading. Trading is a reflection of who we are as a person and how we process our thoughts. If you are beating yourself up about what went wrong then you will probably find losses. If you have thoughts that you can improve and look for the positive in a loss like a lesson to be learned it will help you become a better trader.

It is true that our trades are a reflection of who we are as a person and that is why different strategies work for different people. We all have different risk tolerances and enjoy different rates of return. Some people are amazing at swing trades while others are great at breakouts and some are top notch at shorting.

From my perspective it is important to figure out what works for you. What limitations do you have with your broker. Work with them and figure out how to be successful. When you have a negative trade was it trying a new strategy? Bad timing? Where is the lesson in it?

We are all human and not computers so there will always be an emotional side to your trades. For me I know this week I had bad entries. Friday was much better and when I did have a loser my stops protected me.

Each day I trade I learn more about myself. Being transparent and sharing my experience as well helps me to see the sometimes brutal truths about my actions in trading. When you trade it is you and the market. Do you want the market to run your thoughts and be tense or enter trades that have the probability to go in your favor? Studying the market and yourself will teach you what works. Stick with that and be profitable, successful and happy.

As always I hope my posts are helping you. If you have any questions feel free to share them here as comments or on Twitter, Facebook, Instagram or LinkedIn. I love hearing how it has helped you to become a better stronger trader.

With hard work we can all succeed. Enjoy your time this weekend with your friends and family as that time is priceless.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Jane you are inspiring many with your trades, I have been following you on twitter and profit.ly, you seems to put big bets on stocks, so the profits are high, if you don’t mind telling how much was your account size when you started trading, People like me living in asia wont have access to big money for starting to trade, currently I am educating myself, going through Tims DVD How to become Millionaire.

All the Best

Rajnish