As many people begin learning about crypto currencies they are fearful that this is just a bubble that will collapse. Like with any investment if you hold it long term you have to be aware that you could potentially lose it all. Now will the crypto currencies collapse completely?

well I’m sure that the first investors years ago thought I’m not sure if I want to pay $500 for a bitcoin as it isn’t gaining in value very quickly. Well I know now that if I had the ability to buy it at 500 I would have done it. I honestly didn’t start researching crypto currencies until I got an email from Timothy Sykes talking about a free webinar.

That free webinar was probably about 6 weeks ago the beginning of November. I listened and a I started studying the crypto world. How on earth do you get into buying crypto currency? Which one do you invest in? How do you store it?

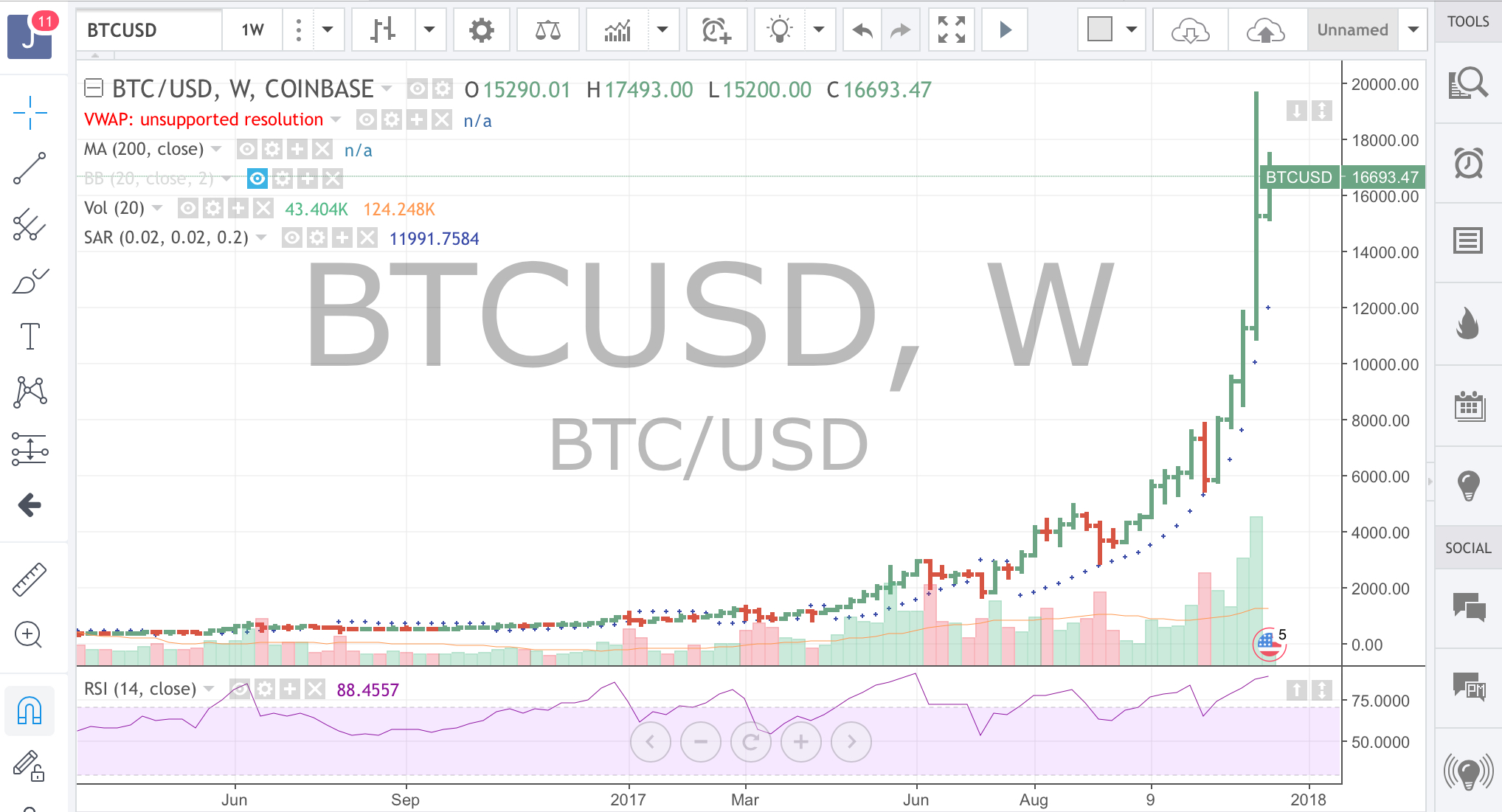

The more I delved into the world of crypto I realized the more I didn’t know. It reminds me of my first days of learning to day trade. But I kept on studying. Soon I quickly learned that there are many different site that you can buy bitcoins or ethereum or lite coin, but how much are you going to pay? The shot above is from tradingview.com and you can view crypto currency charts for free. When you type in BTCUSD you will see there is more than one chart because there are different exchanges where you can buy them. In fact there is also BTCUSDT (Tether) and I’m not even 100% sure what that is just yet. Bottom line is if you are looking to buy crypto currencies make sure you are paying a fair value for your investment and not getting taken with fees for mining them like a stock brokerage firm takes commissions. One that seems pretty fair to me is coinbase.com .

After you decide where you are going to buy your currency, you need to determine where you are going to store it or them. From what I have seen online there are numerous online “wallets” and some hard wallets. The best way I can explain that would be like software for your computer to run versus the actual hard wallet that is tangible that you would be able to hold such as a USB stick. All of these methods have secure measures to protect your crypto currency or virtual currency. From some stories I have read about actual hard ware wallets and probably online ones too make sure to have a duplicate of the security somewhere safe away from your wallet of choice. There was one story I read online where an individual list $65,000 worth of crypto currency because they couldn’t remember their special password. It is definitely worth it to be ocd about it and keep a secret copy somewhere safe.

Now that you know where you can buy and how to keep it safe what are you going to buy? This comes back to whole bubble idea. It seems like this year the crypto world is just becoming known and hot. I know that Bitcoin was around $6000 when I first started learning and now it is well over $15000. In the past week we saw it go from $11000 to almost $18000. So will this continue or burst….

My thoughts are that is it going to continue to gain in value as more people become knowledgeable about it and how to purchase cryptos. As a fairly smart person it was a bit difficult for me to figure out as there was no clear path to me about how to do it. Back when I was first reading Lite coin was $46 and today it broke $400. Well remember those people that bought Bitcoin at $500 and now it is over $15000. It is proof that as the demand increases so does the price.

Have you known about cryptos for a while and done nothing? I am going to start out small and dollar cost average in maybe $100 a month into different currencies and see how they grow for crypto currencies.

In my 401k I am also investing ins crypto related stocks. There are quite a few that have been hot lately. Some of them popped and then dropped. Here are a list of them.

GBTC COIN RIOT OSTK SSC MARA BITCF XNET GROW BTSC BTCS MGTI SRAX GAHC UBIA ARSC UTSC PRELF BLKCF CRCW COINB SPLY

I did invest in 4 of these in my 401k for long term growth. I was actually nicely suprised to see that my investments in GBTC SPLY BTSC and BTCS gave me an unrealized gain of over $3,000 in today’s trading session alone. The crypto boom is not only affecting the currencies but also related stocks. I would definitely take the time to note the above stocks and see their highs and set alerts for breakouts. You could trade them for daytrading for some and longer term swing trades for others.

I purchase my GBTC back at 981, BTSC avg entry of .10 BTCS avg at .115 and SPLY at 1.45. So if you a Leary of the crypto currencies yourself you can trade the related stocks that are still feeling the effects like an earthquake aftershock.

Don’t worry if you are just learning about crypto currencies you have to start somewhere. I knew nothing a couple of weeks ago and immersed myself and shared with you what I know so far. I’m only looking to expand on it and I will share more as I go and with the currencies that I think might have potential in the long run as well.

If you are interested in receiving my morning watchlist email sign up here to receive 3 days free. It is affordable at $19.95 per month, which is roughly $1 per trading day.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPETPROFIT15

Also Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.