Tomorrow’s Midterm Elections will likely determine if we are in a recovery mode or setting up for a bigger downturn in the market. The Image above is the weekly Spy Chart. In pulling it back on a large time frame you can see that we hit the same support that the market hit back in Feb.

However in looking at the differences we have had more downward trending weeks from the top before a bounce and the bounce has taken from that support line to 50 SMA (blue average line) at 275 before pulling back. Another crucial note is that these candles following the bounce are remaining below the averages. There is more volume in this round and the bounce candle has less volume than the red weeks prior.

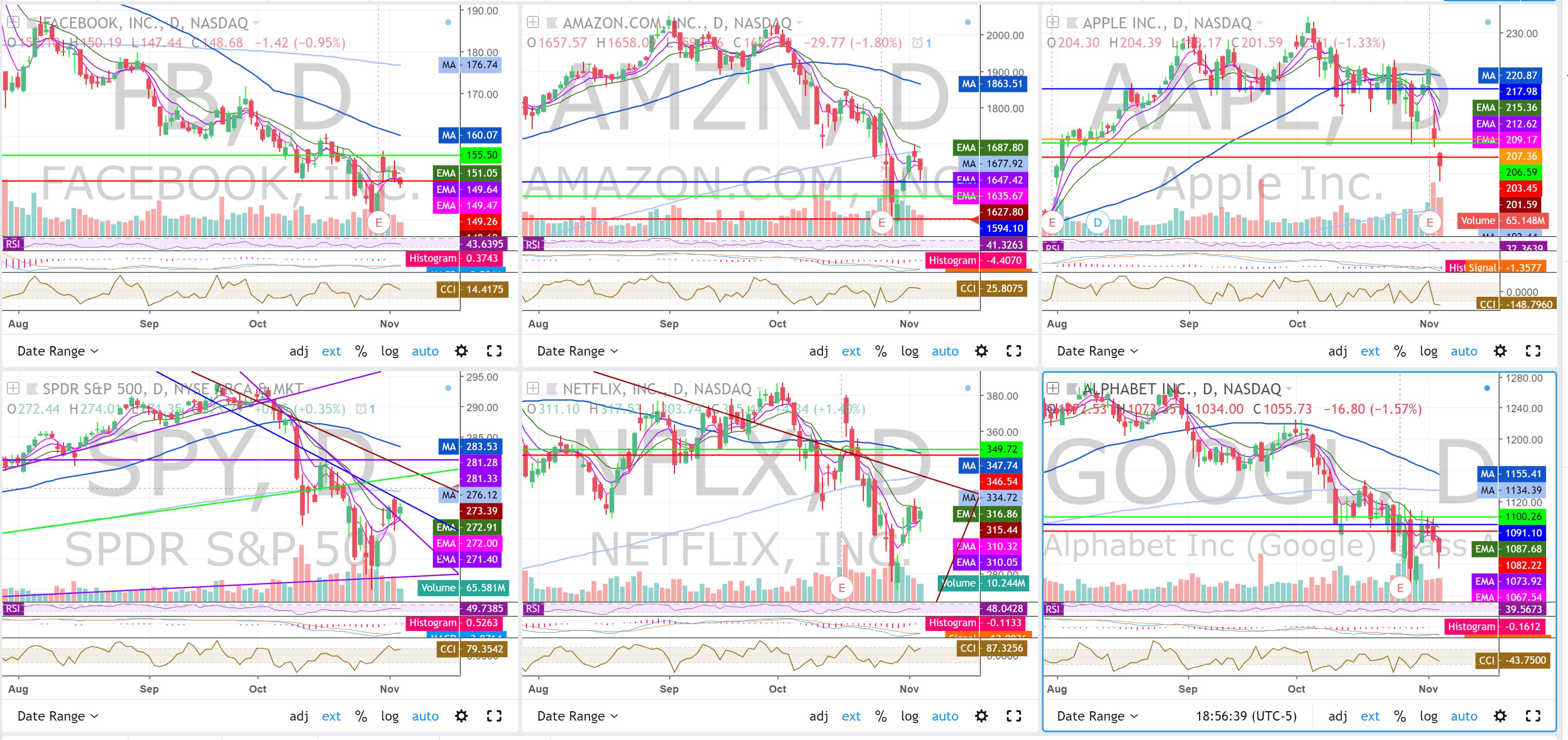

This analysis leads me to believe we are in a Dead Cat Bounce Phase to a bigger downtrend. Another interesting fact is that we had the big FANG stocks reporting and almost all of them had selling after the earnings. Here are links to the Form 4s for $FB , $AMZN, $AAPL, $NFLX and $GOOGL And in looking at their charts almost all of them except for AAPL are below their 200 SMA (light blue line). That does not seem like a healty market to me.

Now it could be a coincidence that the CEOs and COOs are selling or maybe their advisors are saying go ahead a lock in profits on before we see more of a dramatic drop. Pretty much each of the FAANG stocks dropped on day of earnings. If they gapped up and the market thought they would be a good investment I believe we would have seen more upside to them.

In my daily scan of stocks I am seeing many more 52 week lows on stocks and very few breakouts of lifetime highs. So I am leaning bearish until the market starts spitting out data to prove otherwise. Here is a link to check out the daily highs and lows.

There is always money flowing somewhere in the market and if you are limited to going long in a retirement account or cash account definitely check out the finviz.com Heat map of where the money is flowing. It will help you determine the strong sector for the day and or trend.

If you are newer to trading and only experiencing the bull trends here is a great free bear book to help you transition into a consolidation or downward market.

If you had my watchlist this week you could have been banking big time had ACIA run. There is a 20% off Thanksgiving day sale with THANKS promo code. If you opt for the Annual I will offer a complimentary 1 hour training session.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have quest.ions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

If you want a signed copy please go to the book site

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. 15% Off First Month or First Annual – Promo Code CARPEPROFIT15

For my charts I use tradingview.com which offer free charting and paid services

Also Stocks To Trade that has a 1 week $1 trial

For the fastest level 2 I have found I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.