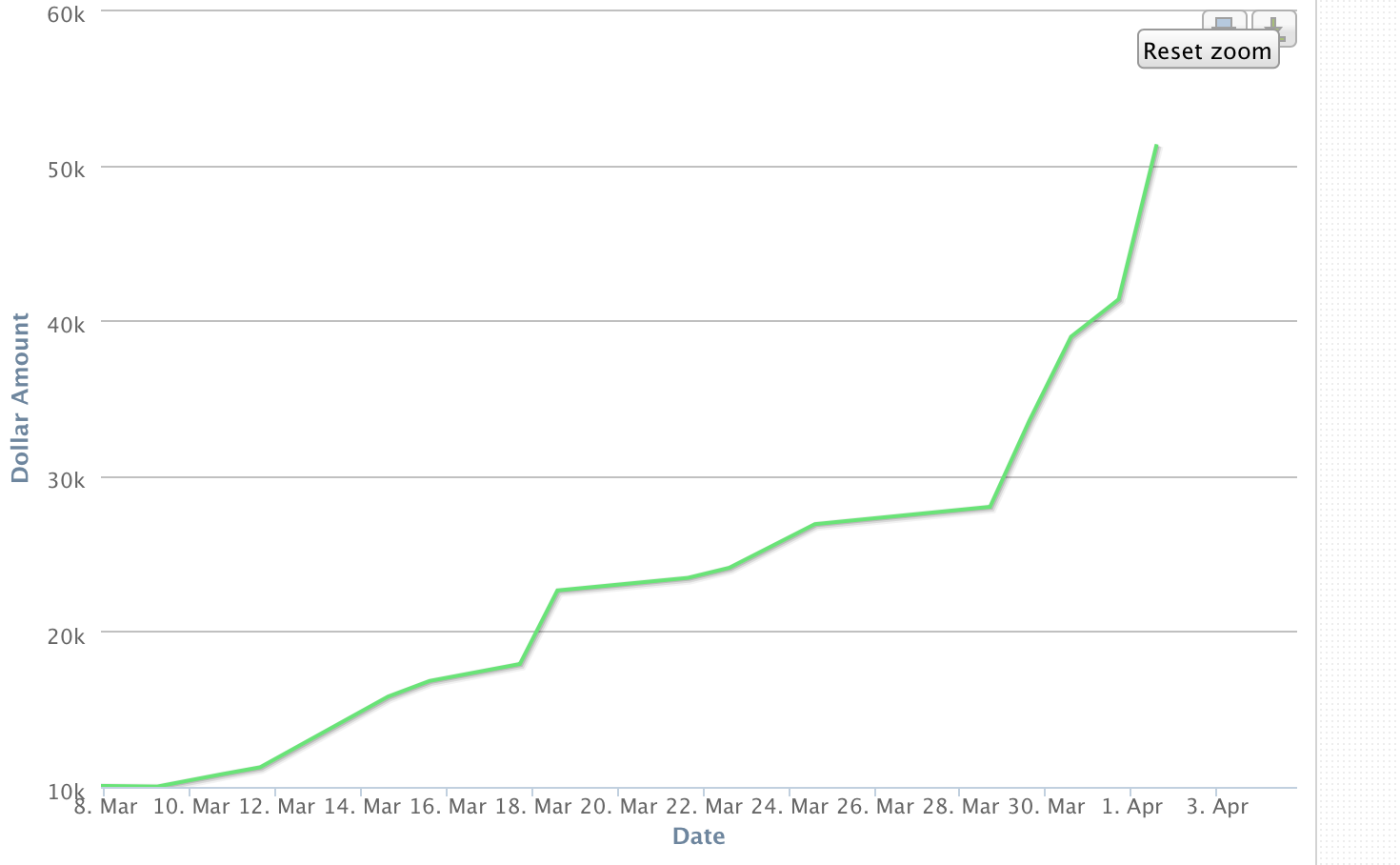

This is my profit chart you can see on Profitly as well as many great tools by Tim Sykes and other stock trading Gurus

Wow what an amazing week? I thought it was going well on Tuesday and I had my swing trade set up for PTLA overnight. Then I began my day and took my daughter to daycare and came back and opened my computer to work on our business investment Miss VVs Mystery and I just glanced at the stock. I saw that it was past my limit order price and sure enough I’d made $3500 by 9:55 in the morning on my so called day off from the market. I continued with business work and looked at around lunch time and saw that it had tanked and was primed for another long opportunity, so I went in again and made another nice profit.

Thursday was a rough day because my daughter was home from daycare sick and I was mentally really wanting to trade. I traded through breakfast with her while she was a captive audience in her high chair munching away and once it was time to put her down closed down my position on my PTLA short stock. While she was napping I scanned and went into some more trades. I completely forgot about PBYI on Thursday which was on my watchlist. I went long OPK and MOV and PTLA again. I let the work for me seeing my risk on the entry was low and watched from my phone while playing with my daughter. My entries on Thursday definitely could have been better but my daughter with her infectious smile had my attention. She gets into everything now at 20 months old. While she was napping in the afternoon I set up my swing trades overnight for PBYI, PTLA and MOV.

This morning I was way to conservative with my exit on PBYI and MOV. I have a hard time letting my winners develop. I see a pullback which I know is due to happen with the RSI going higher and then I let fear jump in and protect the profit and right after I close the position it goes up. For most of my trades today I found I had to use market orders because my limit orders were not getting filled. The size of my orders was too much and causing a price barrier. Rather than let it bounce I would play the spread and if selling wait until the bid price reached a price I was happy with and execute there. Honestly today was my biggest day with profits before commissions were just shy of $10k. It’s on days like these that I really have to pinch myself to see if these numbers are real. My husband is still in denial phase that it is happening. The week before commissions was $27K.

If you have been following my trades you can see that I tend to gravitate to stocks that have been largely oversold. When I began my paper trading I started trend following at the same time. I would write down data and compile it on excel spreadsheets and I found my strategy. So I tend to look for Gappers in both up and down directions from the night before and that morning.

I look at the charts back 2 days, 5 days, 15 days , 1 month, 3 months and 6 months. The key to have and amazing week like this past one is definitely entry point and risk liability. If it looks like a good entry I will load up on shares.

Prior to going on maternity leave, I was working as a part-time customer service agent for a major airline for an annual salary of roughly $14K CAD. It blows my mind that I made almost double that in a week.

I have come along way in 14 months and you can too. I posed a question on Twitter if you would pay for alerts and the response was 75% yes. It will come but for now I want to give back and help people that are in the same place I was 14 months ago.

I just listened to Tim Grittani’s Q&A on Digital Stock Summit and it is very true that in the beginning it is important to find a good mentor who can help you learn the basics and then you can blossom into a trader with your own niche. So learn from others now while it seems like an overwhelming mass of information. Take it one step at a time. I’m making what seems to be ridiculous profits now, but I know I can still learn. Will I necessarily change my strategy…. I don’t think I will for now, but I can improve on it.

One of the hardest things I found in the beginning was accepting a loss. It is humbling when you first lose $500, or even $50. Especially if it is hard earned money. It is a punch to the ego. Don’t be negative about it. Instead turn it into a positive and figure out what went wrong. The psychological aspect really got to me in the beginning and that is why I turned to paper trading. It will build you confidence so that when you are ready to use that real money you know more how the stocks act and will be less likely to loose your initial account funds. Instead you will be more likely to grow them.

I have had a couple people reach out and ask me questions through DM on Twitter and I really enjoy helping them and seeing their growth. It is inspiring to see people take on the challenge. Way to go! keep up your hard work and don’t get discouraged.

Have an amazing weekend and enjoy your time with family and friends. Money can’t buy that.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Hi, thank you for sharing your success . Where can i find the stocks that are oversold?

Galexia,

I use equityfeed for scanning and Trade ideas for alerts. Both are great tools. You can try both free under tools I use.

Jane

Kudo’s to you Jane. The market by far is the best business in the world for those that commit time, patience and effort. It is not the strongest, nor the fittest that survive, but those that can ADAPT to change. There will come a time where you will make your former yearly salary on a daily basis…Can you feel it?

🙂

You can’t have a million dollar dream with a minimum wage work ethic – Zig Zigler

Thank you Elias, yes I believe it is true to make my old salary daily however it is still surreal.

Su marido tiene que estar muy contento con usted, no?

2016-04-02 4:06 GMT+02:00 SEE JANE TRADE :

> jhgallina posted: “This is my profit chart you can see on Profitly as well > as many great tools by Tim Sykes and other stock trading Gurus Wow what an > amazing week? I thought it was going well on Tuesday and I had my swing > trade set up for PTLA overnight. Then I began my da” >

Es la verdad y si el esta contento

Hi Jane,

It’s Kevin again – do you you usually swing your positions or just trade them intra day? It seems like you find the largest gap downs and like to go long on them – Thanks so much for the inspiration – I took what to me is a quite a large loss of $500 on April 1st. But I know I had the right idea as the stock came back, I guess I just entered wrong – do you usually scale in to a position or just go in with your desired number of shares?

Also If you can somehow share your trading rules to help you become profitable it would be much appreciated. Would be a nice blog post! I would definitely love to trade with you somehow and learn from you!

Cheers!

Kev

Hi Jane! Thank you so much for your posts.I am learning a lot from them and from your trades.

I am using EquityFeed as well, but I haven’t been successful at finding bottoms so far.What I’m trying to do is find stocks that go down to a support level and then come back up, for an long entry at the bottom.Can you please give me some advice on how to set up the scan?

Thank you again, and I hope you keep posting and tweeting.You have a lot to teach!

Congratulations on your success!

I usually use the market view and sort by %change to find them. Then I analyze the charts.

Jane,

Blog post idea: risk mgmt and whether you scale in or out of a trade? Also, what happens if you are up 50c or so but your profit target was let’s say…80c, would you take the profits or just readjust your stop to break/even (including cost of commissions) and wait for your profit target to be met?

I read all of your blogs and tweets, please continue being so fluid with your thoughts, we all really appreciate them and are learning from them. Thank you so much.

Ashley I will incorporate that into a blog post. One I need to remind myself about after this last week.