It was another great week with over $4,000 in profits working 4 days at my desk. Where can you make this kind of money? Well it doesn’t just grow on trees you have to study the market and understand what you are getting into in order to be in the 10% of successful day traders.

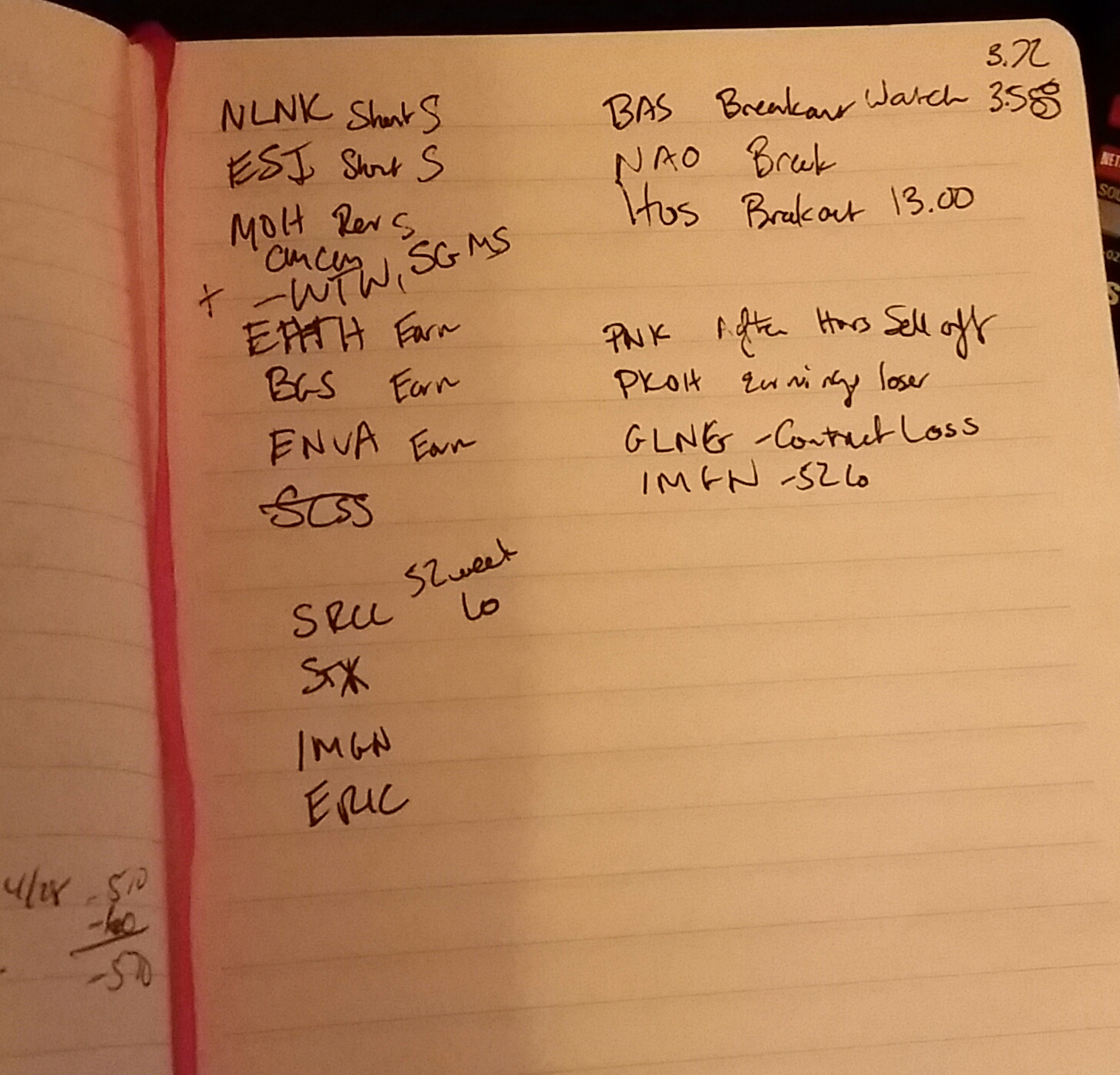

The photo above is a sample of the research I do after 8pm EST to see where the stocks are before open. The general market hours are from 9:30-4EST. We also have after-hours 4pm-8pm and premarket 4am-9:30am. That is another 9.5 hours of price action that can change a stock. That’s why I will do the research, but I really look at the stocks right before open to see the most up to date price action. Day trading is about being present in the price action and reacting accordingly. Yes there can be indicators that lead you to believe something will happen to the price, but the market is not always rational. You can have earnings winners that tank and earnings losers like $NLNK that end up spiking.

I received a Profitly message from safariames to explain what I meant in my watchlist with Reversal, Short Squeeze, Longer Term, Gap Fill.

When I have a stock on the Short Squeeze list it means I’m expecting there to be a fairly nice upward movement once it reverses. It is due to the fact that the ones I have under this description are popping up under a filter with 30% short float or more. That means of the shares outstanding 30% of them have been sold short with the expectation that the stock will drop. Once there is a nice upward trend then you have people buying long as well as the people that sold short that will buy the stock to cover their position. That in essence creates a nice upward momentum in the stock price. It’s basic supply and demand and the more demand for the stock the faster it increases. Sometimes like KBIO you will see a stock go from 1.50 to 45 but it is a rarity. That is when you don’t want to be one of the shorts getting squeezed.

I did mention reversal in my Short Squeeze list. What I mean with a reversal is when a stock is climbing and it hits resistance such as TRUE that climbed to 7.78 and then stopped climbing and sold off. The stock reversed direction in reaching resistance (you could think of a ceiling that you can break through.) Or it can go the other direction when it hits the LOD or the support and it goes up in price. I have been long biased lately and I look for reversal plays. I like the idea of a long play being limited to the loss of my investment where as with a short the loss potential is unlimited. After watching Mark Croock’s video about shorting with options instead of the stock to limit the loss I want to learn more about options (once I hit my 100K in profits over half way there). I think it is great to limit your loss to your investment instead of unlimited. Sorry off topic back to watchlist.

The Gap Fill is another type of reversal but it is one that I’m looking for after a huge gap down. An example of this is COWN it gapped down from close of 3.60 to open of 3.20 and it ended up closing at 3.49. This is a one day fill of most of the gap. I think of gap fills taking a little longer but the best are the same day. Which brings me to the longer term.

I do swing trades and hold them longer term for stocks that I believe have value to them and will gain value again. My best stock for this is WYNN when it was at $58 close to the 52 week lo. Over the next month it climbed $40 a share to $98. I played it very conservative taking max I think $6 a share.

I hope this helps you to decipher my watchlist and learn more about the plays I target. The market is always changing and I do short as well, but for the present time I’m more long biased.

Have a great weekend. As always enjoy the time with your friends and family as those moments are priceless and irreplaceable. If you have questions shot them to me on Profitly, Instagram, Facebook and Twitter. I enjoy helping you as I was in your shoes not long ago.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Hi Jane, really interesting. Do you mind sharing what filters you use for the scans mentioned above? Particularly interested in gap fills and short squeezes

I use three different sources to find the stocks. Equity feed Market View for stocks 5-50 over 200k volume over 200 trades and look and biggest % gainers and losers. I also use Finviz screener on Fundamental page and look for stocks with more than 2 relative volume over 200k volume and more than 15%, 20%, 30% short float. I also use Trade Ideas Social Media page on filters.

How long does it take you to complete a watchlist?

Clinton it doesn’t take long to find the stocks it’s the research to eliminate at find levels maybe 45 min with research

Thank you! I’m fairly new and don’t make many trades but I love when people share and answer questions. I enjoy reading your blog and look forward to more posts. I see this as a lifetime thing and am wanting to learn as much as possible. Thank you for helping and inspiring. Thank you so much.

HI! Great post! i follow you on twitter and read your blog , i learn a lot from you , please keep up the good work. btw i am a beginner trader testing with small amount made 10% so far in 1 month. Thank you!

Great job on your 10% earnings. Always remember to keep your gains bigger than your losses and cut the losers quickly. Stay green awesome job!

I wanted to know what was the reason you invested in HRB long? is it oversold?

how can we find out who is investing in a particular stock like ( if any popular hedge funds etc ?). where will this information be available?

Yes it is oversold if you go to tradingview.com a free charting site and look at 1 yr of HRB and look at the bottom of the page you will see RSI is below 30 for sometime now. Most stocks go back to equilibrium stage and it is so low I’m willing to swing it and capitalize once there is positive press behind this value company

Hi Jane,

I’m curious to what type of software you use to see how much % of shares are short. I’m looking into a type of screener software that has everything included and see you have two listed (Equityfeed and Trade Ideas) but I’m not sure which shows the current shares short and I think that’s a pretty big factor in some trades.

Equityfeed does have a short view on the market view selection it is a tab. You can also go to Finviz.com or shortsqueeze.com for short float information

Hi Jane, for the short squeeze scanner, do you add any filters to leave out the green stocks that are up? In other words, do you only show the red stocks (negative) that will hopefully start uptrending due to the large amount of short sellers?

I look at the RSI and location of how far away they are from 52 week lo

Hi Jane, regarding choosing a period (in days) for RSI what would you recommend? I day trade and rarely hold overnight and I know that differs slightly to your strategy.

I’d be very grateful for any insight into this!

Thank you again!

I use daily charts 5 min and 1 min charts for RSI In this market I’m not holding overnight longs as the market is breaking down, but maybe overnight shorts as I become more confident in the trades.