by Jane | Dec 18, 2016 | Uncategorized

This week was another crazy busy week. In trading $ALXN I was rocking with the bottom bounce on Monday and then the nice reversal all week to end up $10 from the bottom on Tuesday at 110. I traded both the stock and options for a nice profit on the name.

With Options I am learning it is even more important to cut the losers quickly because it can grow into an exponential loss with the expiration date cutting the value of the option as well as the stock moving against you.

$AKAO had some great movement on Monday and I traded it for nice gains and went long just before close as a strong stock with momentum looking for the gap up on Tuesday morning. Well at 4:01 I have a trading buddy with Benzinga News and I got a message they were going to do an offering. I reacted to the news and sold for a loss after hours.

$UHS was another great winning stock I traded both long and short on Wednesday. I was timing the momentum well and banked on reading the chart based on RSI and Bollinger bands.

Wednesday was another big day as I was honoured to be interviewed by Jeremy Newsome of Real Life Trading. Jeremy like myself has the goal to really help others profit and learn in the trading world. It is coincidental that we met up through one of my followers Dee who also lives in Nashville. The internet is a wonderful thing. Here is the interview.

Wednesday evening I also had the pleasure of doing another interview for my book about female traders with Latoya who also happens to be a moderator for the Real Life Trading room and has two little ones in her office/playroom while she trades. It is so amazing to hear others’ stories about how they made it to become successful in the trading world.

My book is in the process of being written and hopefully off to the editors come Jan. 1st. My goal is to be able to tell you guys it is available in print and ebook by Middle of February when our little one is due.

Thursday I traded $UHS and I was not trading the chart but trading with hope. It does happen to me sometimes too. When my mind is not in the right place and I think no this stock has gone up so much it must come down. I shorted and exited at stops then resorted and exited at stops and I was trading the wrong side of it throughout the day. So I had a red day on Thursday. Sure enough it was Friday with the trend of the market that UHS ended up

Friday which tends to be my strong day started out rough with the internet crashing before open. OK got that fixed. Then my charting software half of the charts wanted to work. Frustrating and then I was in bounce positions on OFIX and AGIO my broker site went down. I was in the midst of setting up limit orders to execute for the bounces and it went down. So I called in the orders and made a bit. Then I saw JWN on the biggest losers list. In my head it was so oversold and it needed to bounce. So I went long at 11. Well it continued down and I got distracted and ended up taking a $1 loss/share. It ended up being another red day based on JWN.

Overall another great week of profits bringing my month profits to roughly 5k. Not as good as some months this summer but. I am trying to get a lot done before our second daughter is born.

I am loving being able to share my experience to help empower women to step into the trading world. The biggest hurdles we have in life are the ones in our mind. So once we break down that fear and take little steps into the uncomfortable and move forward we make progress. Many time progress comes from stepping into the uncomfortable world and learning something you thought impossible. Thats when the impossible becomes possible.

Super excited about the book and I have a new fire in me to really make it happen to help others. It is a tool I wish that I had at my fingertips when I started really day trading a year ago.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Next week long Open house is coming in January for full pro trial for more than likely less that $10 to sample the software.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Dec 7, 2016 | Uncategorized

It was roughly one year ago, November 2015, that I began my daytrading for the second time with small amounts of money. I was still struggling to figure out the best trading strategy. At this time I also read the book Momo Traders and it inspired me to then work on reaching out to more women about trading.

I realized at that time, there are not many women traders out there to help encourage women to be active traders. So I began working on a book about female traders. Hopefully this will be coming out early 2017 and I will of course keep you informed. There are definitely female traders but not many that want to break down the mental barriers to help others succeed at trading.

I felt the best way to help others is to share my experience along the way and that is what the Women Empowering Women Seminar by Trade Ideas was all about this past weekend. You can view the full recording here Literally I started as an aspiring day trader in my basement office not knowing much and now I’m honored to help inspire others.

It was roughly one year ago when I opened my Twitter account and I went to my husband….Look Honey I have 10 followers. As I began sharing and blogging and tweeting everything grew. I began with Twitter and then people started asking questions, so I began sharing and I thought a blog is an efficient way to answer the questions that I received from multiple people in one forum.

Thus this blog was born and created to share to answer questions that I receive often. This past September I went to the Trader and Investors Summit and was honored by Timothy Sykes with my success thus far as a female trader. My hubby is a big YouTube fan and so I began doing my weekly video about my week in review and answering more questions as well. Slowly as more questions come in I try to film the answers. I also want to share the real point of view not the shiny happy everything is great trading view.

My openess to share my journey led me to being the keynote speaker at the event sponsored by Trade Ideas. It was an absolute honor to share my journey that has been just a year so far. I have big visions for helping more women put the fear aside as far as learning how to trade.

The biggest hurdles in acheiving any dream is the one you present in your mind. Once you put your fear aside and start putting your energy towards your goals and dreams you see you future changing before your eyes. Day by day all the efforts you put out create your new future. Before you know it you have changed your life to be living your dream as reality.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Nov 29, 2016 | Uncategorized

In the beginning of my day trading journey using Timothy Sykes Tools I learned all about pump and dumps, but I never had the opportunity to short one. Well today with Interactive Brokers I was able to get shares. I tried to short when it was up at $8 but there were no shares available. The chart was looking over extended being up 100% on the day and knowing how the shippers have not been able to hold their spikes from DRYS a couple weeks ago I thought this is a great short.

Well I got shares to short at 7.17. I was trying for 700 shares and only got a partial fill at 500. Then as soon as I got my notification that the shares were sold I went to check the stock and boom it was halted.

Immediately I went and googled Nasdaq halted stocks an sure enough there was GLBS with the T12 code : Pending more news. Then there were rumors on Twitter it was going to be halted for 30 days. The last news that I had seen was there was a new executive joining the team and it skyrocketed from $3.80 up to$8 10:50-12:20. With such a dramatic increase in an hour and a half it seemed that is should pull back. So I thought this is a perfect opportunity for a short so I put in the request.

I was a bit hesitant that the stock was going to go up but it had already been halted twice during the day going up and usually I see the third time it tends to sell off. So as soon as I had the shares I shorted.

The afternoon was exciting while patiently waiting to hear why this stock doubled. The last time I was in a stock halted pending news it was ENF where there was news of them being bought out by a Japanese company and sure enough this one spiked once the news was released that the offer to buy them was confirmed.

So not knowing the news was a bit tense but exciting. Knowing that DRYS had just been through a similar situation and sure enough after the halt the stock opened down 50%. As soon as I saw the update on the Nasdaq site for the stock to reopen at 3:35 pm I went in search of the news that was released.

I found the news that they were due to issue shares at 1.60. I had an order in earlier to cover at 4.17 for a conservative $3 a share profit. Well I then saw on level 2 that the sellers lowered their Ask price to 4 so I dropped my buy to a more agressive 2.17.

I was actually on the phone with my husband when it opened and it was open at 2.88 for roughly 18 seconds before they halted the stock again. I thought ok it will continue dropping further so I was even more aggressive with 1.87 for my covereage. It reopened and started dropping. I saw it going down and thought I don’t need to be greedy I’ve already made over $2000 on a $3585 position. So I set a trailing stop for .17 and let it work. No matter what happened if it continued down I would still profit. So my position locked in profit at 2.795.

It was an exhilarating experience to have the opportunity to short a pump and then have it halt and go in the perfect direction and open with not a 50 cent gap but almost $5 gap. I only wish my whole position had been filled. A great trade with 61% return on investment the same day.

As I always say Carpe Profit one trade at a time you will see them grow your account. The trades will not always provide a 61% return but they all grow your account.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Nov 20, 2016 | Uncategorized

As many of you saw this week DRYS went absolutely Insane going from $4 to $115. Now this is really a power of low float stocks that have high demand. Simple supply and demand. When there are only 386K shares available and the buyers hear it is moving and more and more people start buying the shares become more expensive. Since it was a low float stock there weren’t many shares to get borrow for shorting so as it sold off the same drop happens to the downside.

This stock is one that changed lives in a great way and a devastating way if you were on the wrong side of the trade. For all those that made great money. I applaud you and good job! For those that lost money. Analyze the trade and see what went wrong. Did you have fear of missing out or too large a position for the large $ swings the stock took.

DRYS was a stock in the shipping sector and as many saw when one stock in a sector is moving it will tend to have sympathy plays for other stocks in the same sector. So DCIX, TOPS, ESEAS and others that even had Ocean in the name all reacted sympathetically and shot up with their low floats.

Once DRYS was unhalted and dropped so sympathetically did the other Shipping stocks.

You will see these sorts of reactions when a major retailers, chain restaurants, gold stocks, or even cyber security stocks are affected. So it is good to know what stocks are in certain sectors. A free source to find them is on Finviz.com and you go under groups, overview and then simply click on the sector and those stocks will come up. It is a matter of preference how you like to look at them to analyze the information in a linear or chart fashion. Check it out and play around. The more you look for different ways to find information the more you learn along the way.

My biggest learning expereince and painful one at that was with RJETQ this week. They filed the good news that they will be emerging from Chapter 11 and then the bomb was revealed in their reorganization plan.

As you probably know I had avidly been following the whole process and looking forward to the filing of their emergence as a positive reaction show in the stock price to profit. Well this time around with an airline stock I did not have the same success as the American Bankruptcy emergence.

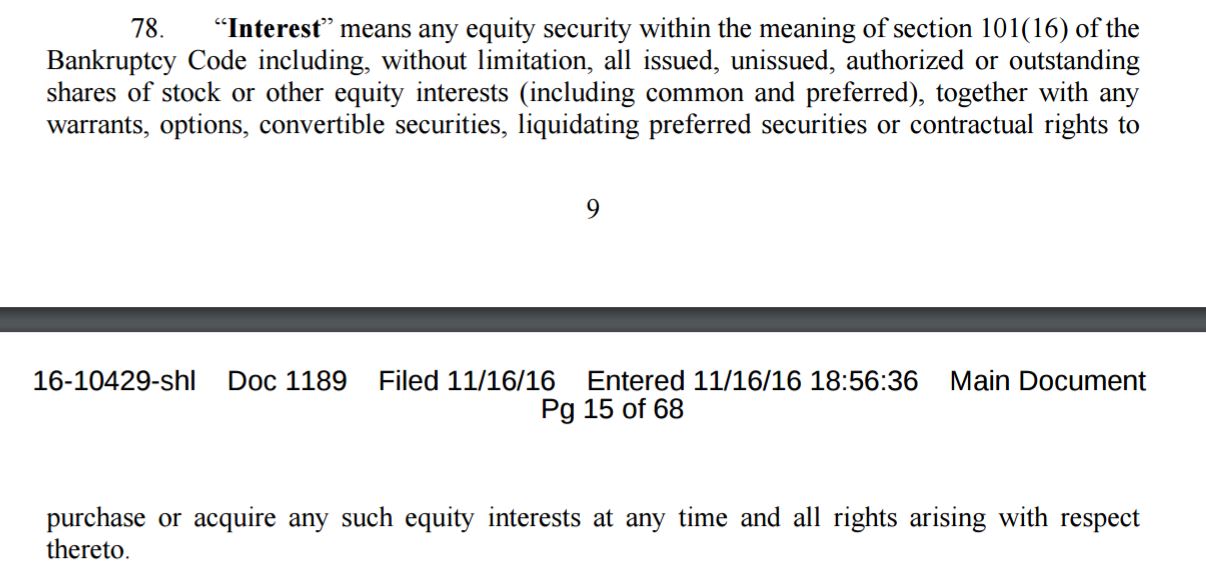

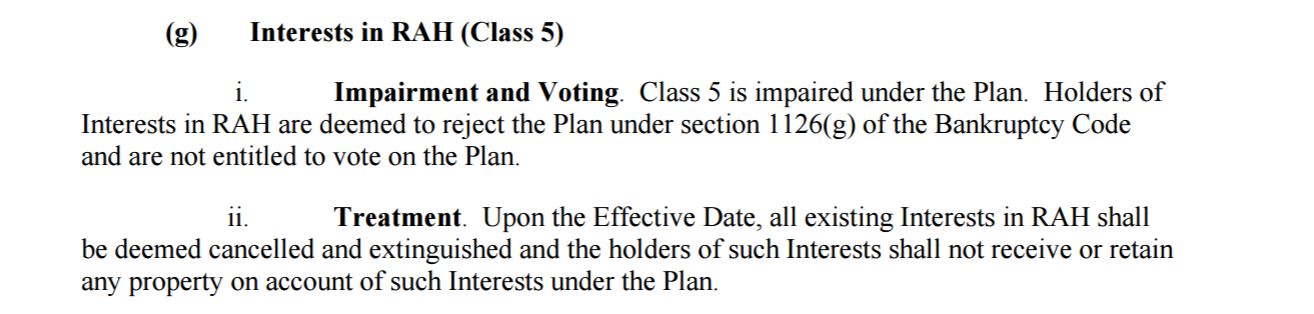

Here is the bad news for any share holders of RJETQ found in court docket 1189. Per my interpretation of the legal jargon. It took a couple steps for me to come to the conclusion that selling is the best option as from my understanding. If the court accepts this plan December 8th the stock could be worthless in my opinion

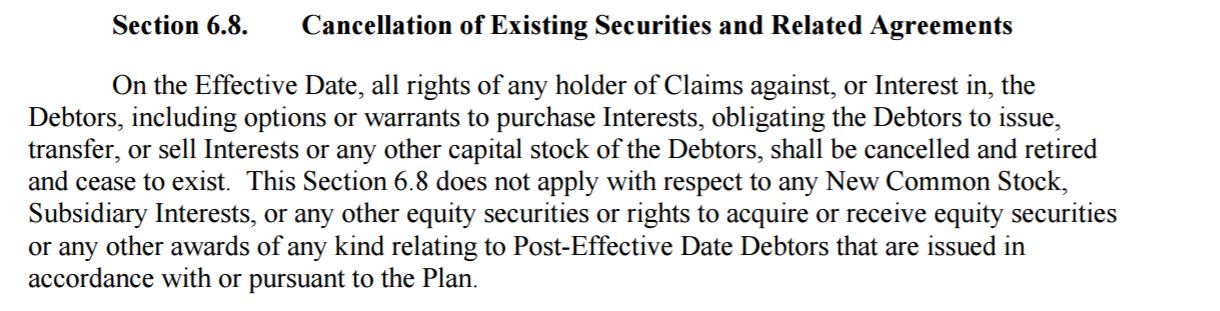

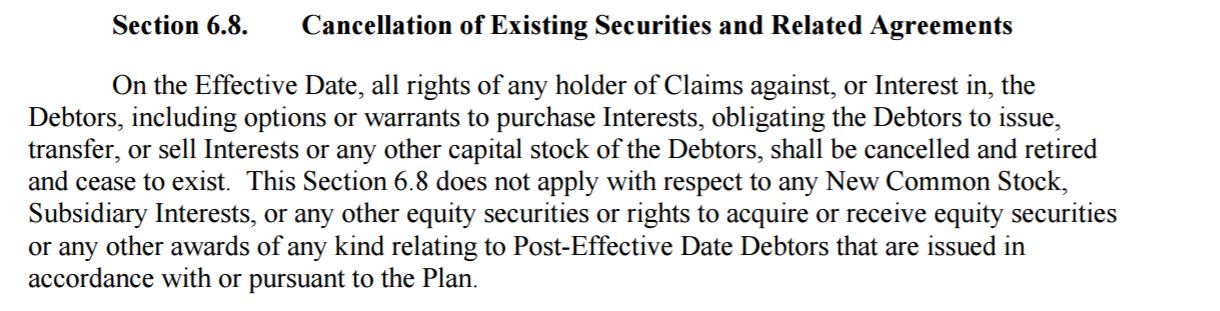

Step 1 was looking at 6.8

Where they say that All stock should be cancelled and cease to exist. I went back to research what the American Airlines Chapter 11 plan said and sure enough it had the same language. They usually cancel all the stock and if they do convert will reopen with a new ticker.

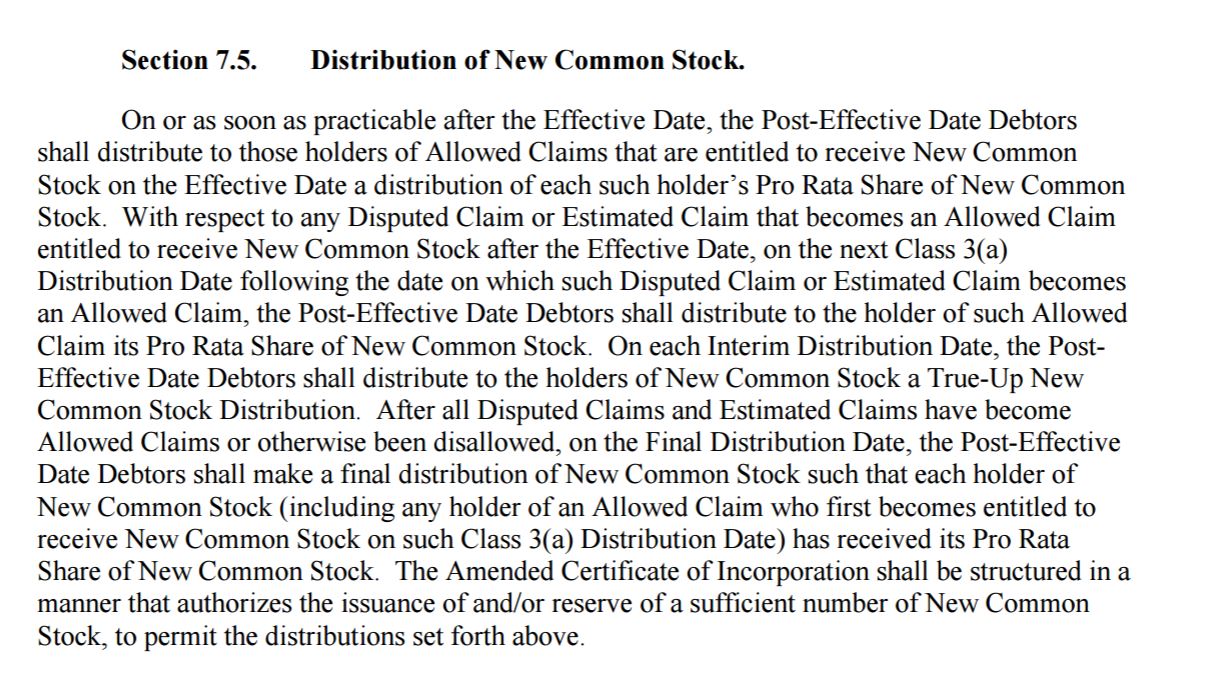

So next step was to look up the New Common Stock Interests.

So from reading this it became clear unless the shareholders are part of the Class 3(a) then we do not receive anything once this version of the plan is accepted. So the next step is to see how as a shareholder we are classified. Onto researching as a stock holder in the explanation of terms from the beginning of the docket.

And I found that as an equity interest (which was the verbiage used in the American Plan) we are considered Interest in this document. So then onto see how the “Interest” of RAH is considered underclassification.

And I see here that it comes full circle back to Clause 6.8 that all existing Interests shall be deemed cancelled and shall not receive or retain any property on account. Now I’m not a lawyer by any stretch and this is 100% my interpretation of the document.

As a result I sold my full position of RJETQ on Friday for a painful loss of 58% which is my largest to date since my day trading career began. It was not an easy pill to swallow. You can ask my husband I was really upset to loose the capital for our family. This however was not a day trade and a long term swing. I think back to the big gain that I had with the American Bankruptcy where I turned 25K into 250K and realize it is small in comparison.

My lesson learned from this is be flat before the emergence from bankruptcy filing is already filed because the shareholders are the bottom of the list. As with every loss big or small or breakeven I look for the lesson to be able to move forward and not get stuck in the past.

When your head is busy thinking about what you should have done it is not clear to move forward with making in the moment decisions to trade well.

For Monday I will watch for the most part and I have my swing of LOPE short from 56.14. I’m looking for it to break down further as it is looking overextended on the daily chart and Friday was a second red day for the stock since the High of 57.47. I have a smaller share position to allow for more room on my stop.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Nov 12, 2016 | Uncategorized

As a newer day trader with roughly 1 year of experience, I am learning to trade big events with caution. Trading through two major world events of Brexit and the most recent US Election has taught me not to anticipate but trade the action. Each day no matter what you must trade what the market is doing and how it is reacting instead of what you think it will do.

It was interesting to see the market react ahead of the the two major events and price the reaction into the market. With Brexit the markets anticipated Britain staying and so the market rallied and then the news came out with a reverse result and boom the market reacted with a drop.

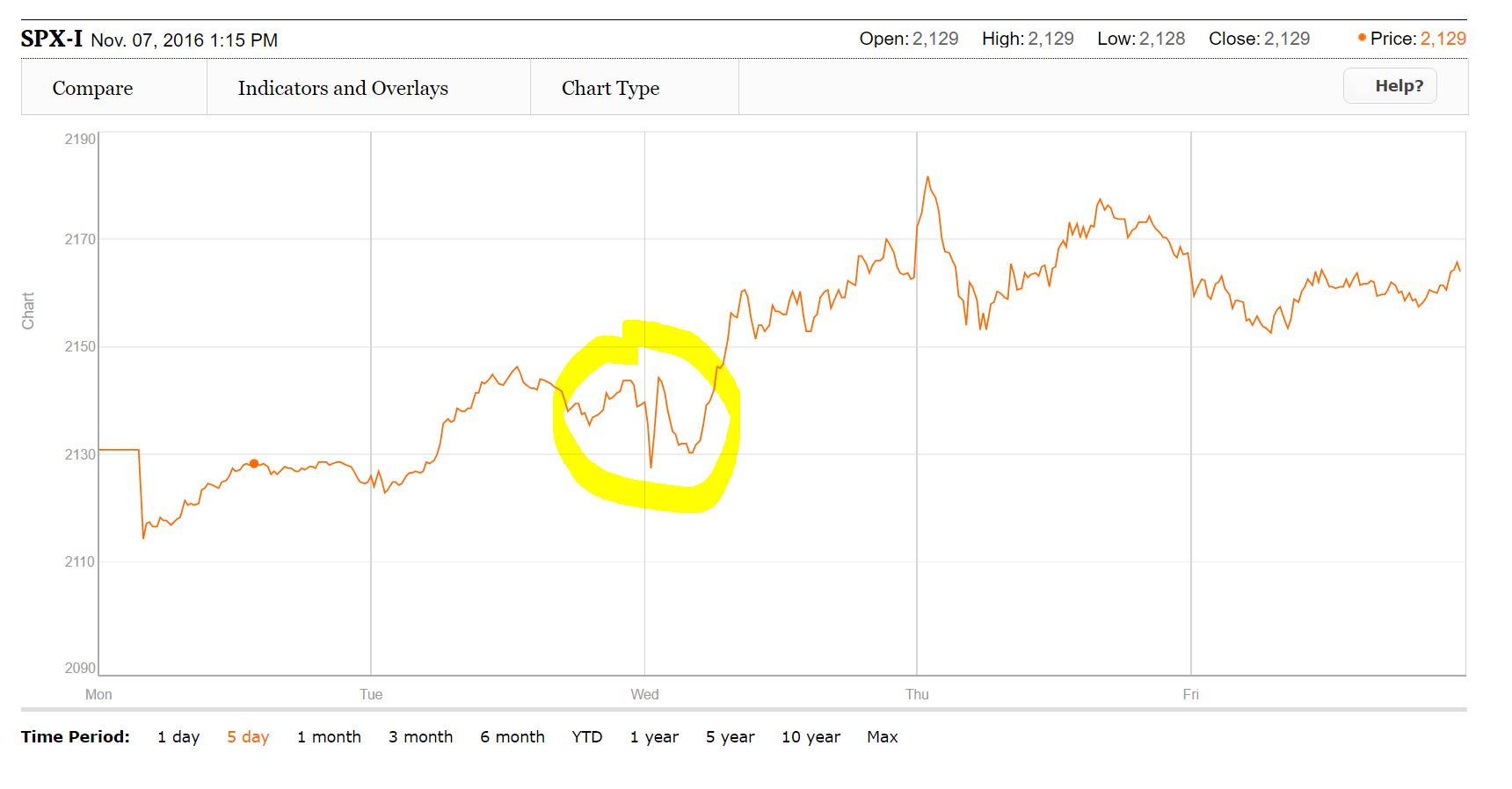

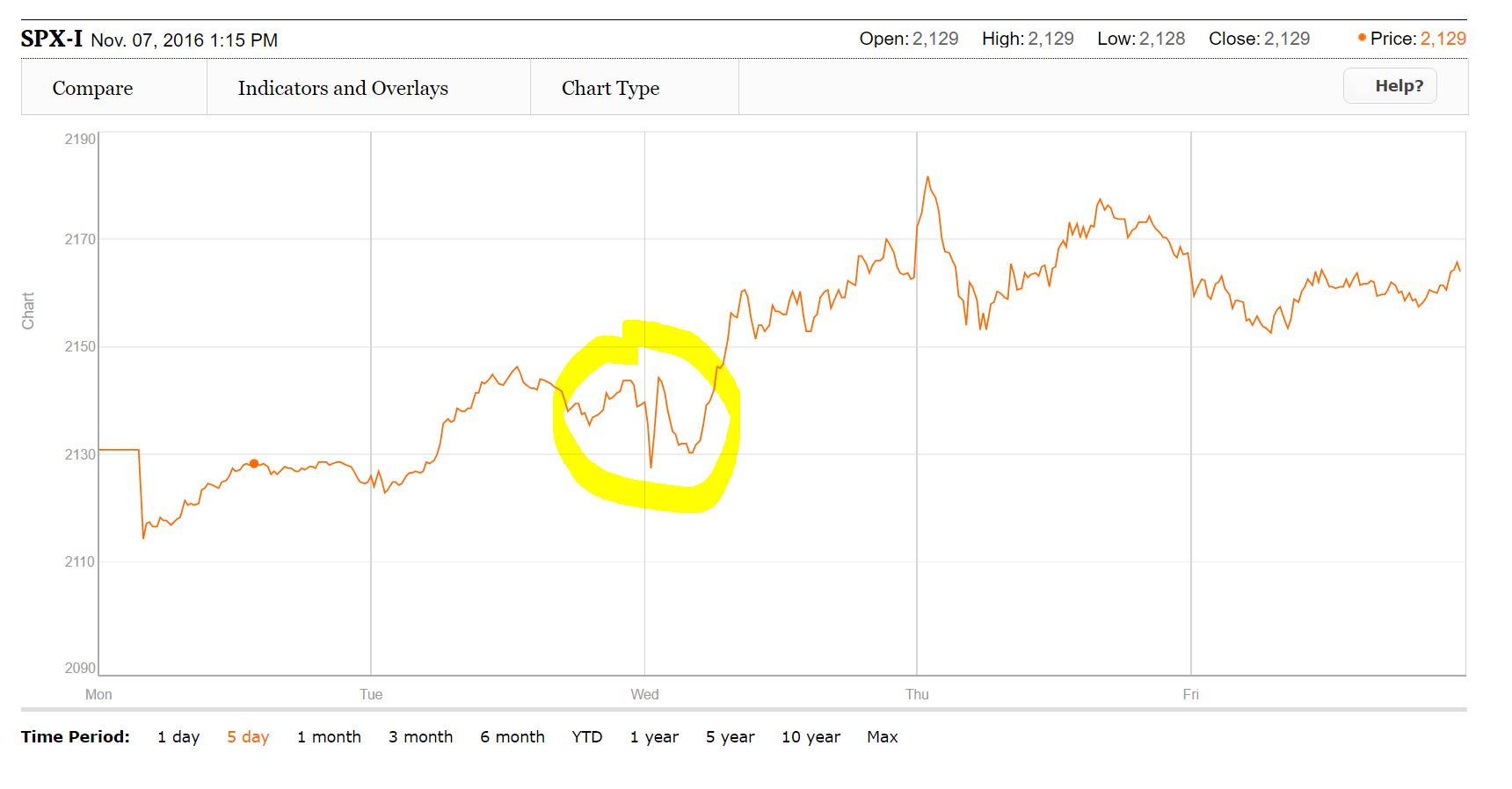

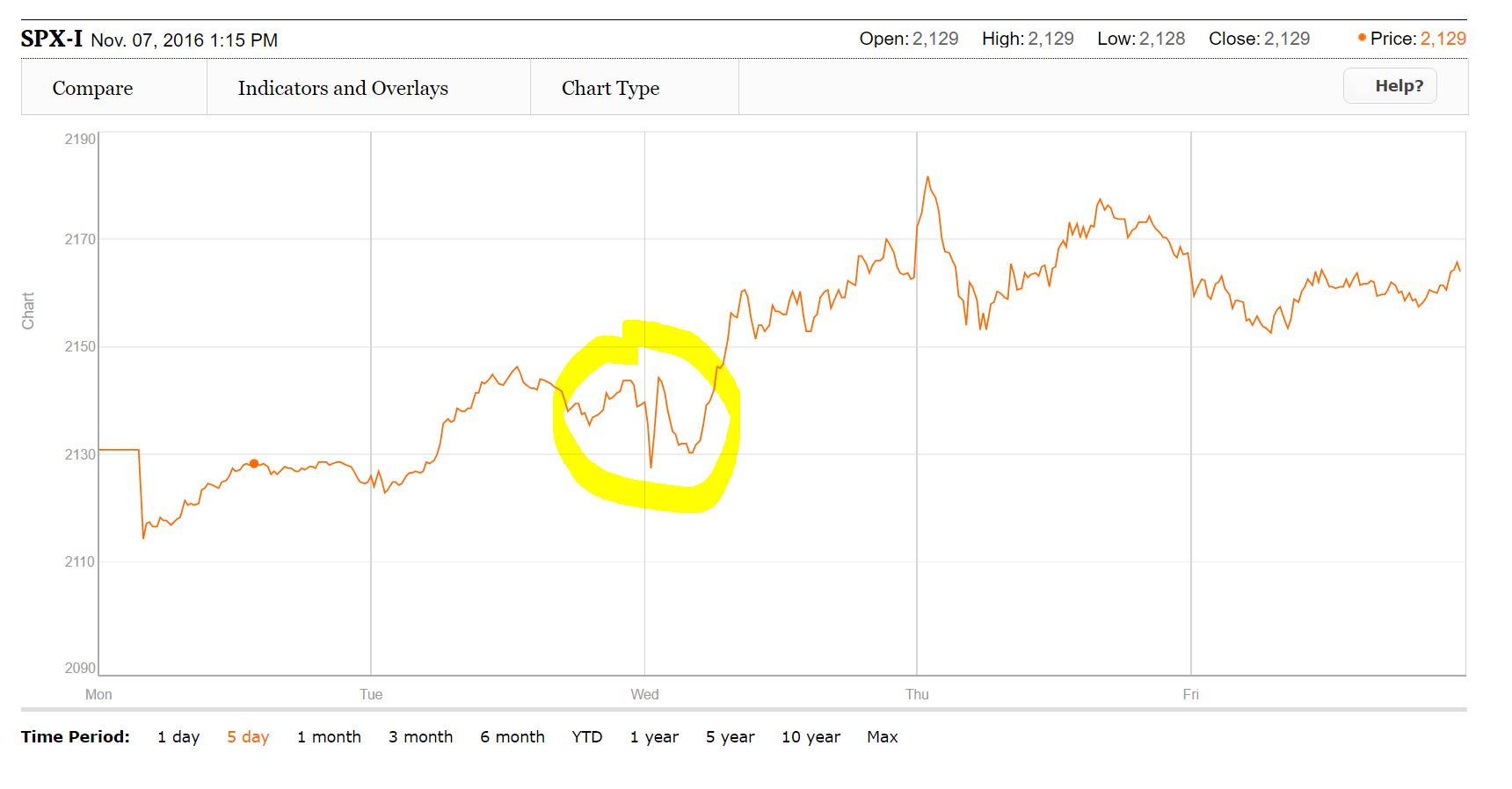

Well the same is true for the US Election. When Hilary was announced to be investigated by the FBI the overall US markets began declining. Then the FBI cleared her and the markets began to rally again. As you can see from the chart about the market sentiment was that she was going to win and the market would recover. All was going well until the Election results started coming in.

I know of futures traders that banked big time on this one event. They sold short before the results and once Trump was leading the market futures began to drop down to the almost limit down maximum of 5%.Which would have potentially halted the markets for the next day. So When I went to bed around 2 am the markets were down roughly 4.6% I think it might not have been the fact Trump was leading but the uncertainty of the results.

Since this was the first time I had traded through and election and also a dramatic one at that I knew Wednesday would be a day to trade super cautiously. When I woke up I saw that A. Trump was the confirmed winner and B. that the futures markets had started to recover.

You can see just how volatile Tuesday night was on the chart. Looks more like an EKG reading than the type of chart you want for a major index. So it tanked overnight came back to open up slightly. Dropped off again and then rallied the rest of the day. A day of major extremes in the market and with my style of reversal trading a great day to capture the reversals. I traded both long and short positions on Wednesday.

It is definitely possible to profit in any market any day, but it is all about your diligence. The riskiest time to every trade is your entry. So you want to make sure that you have a good stop either mental or if you are like me and need hard stops then a hard one. Once it goes in your direction I like the strategy of using a stop to protect those profits if it flips against me or taking 50% off at a consolidation point and a stop for the rest to protect the profits. It is always better to take 50% profit at a resistance point than zero profit and have it go back against you for a loss.

There is no need to be a superstar and try to rock each and every trade. The best way to rock each trade is to take a profit on it. Big or small they all grow your account. That’s why I always say Carpe Profit. Be happy with any and every gain. Over time you will become better at understanding the price action and capture more of the move. The stops will let you trade cautiously while locking profits.

The biggest hurdle each trader faces is themselves. Managing yourself will improve your trading. That is why I partnered with Mandi Pour Rafsendjani and we are doing a very valuable 6 week live or recorded Webinar Training about Day Trading and Trading Mindset. They go hand in hand and in understanding yourself you will be able to be a better trader. A inexpensive investment in yourself that will only improve your trading.

If you have been following me for a while you know that I enjoy helping others improve. It is amazing to hear the transformations that I have helped to inspire happen. We can all do what we put our minds to on a daily basis when we direct our energy there. It is a choice of daily decisions. How bad do you want that change in your life. Like a couch potato at 400 lbs saying I want to lose weight and become more active but day after day the same habits of diet and exercise are there. We make choices with our actions and through those actions we see change to make our dreams come true.

When you have a dream or change in life you want to see, it starts with yourself. Your daily actions and decisions determing if you will reach that goal. Each little step will help you get there. Give it time, be kind to yourself and acknowledge the little achievements along the way. Each small one gets you to the end goal. Each day is precious and you need to be kind and positive to yourself to get your end result of happiness in life in whatever form happiness comes to you.

If there are any women interested in the Seminar in San Diego Dec 4th, where I have been asked to speak by Trade Ideas, you can sign up here.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.