When you first start in your trading career it can truly seem overwhelming. If you have never even looked at trading again then the chart wil seem like Greek. What on earth is going on with these charts. Well I will try to give you a cliff notes version here. If you want more in depth reading there are books dedicated to the subject at the bottom.

How to Read the Stock Charts

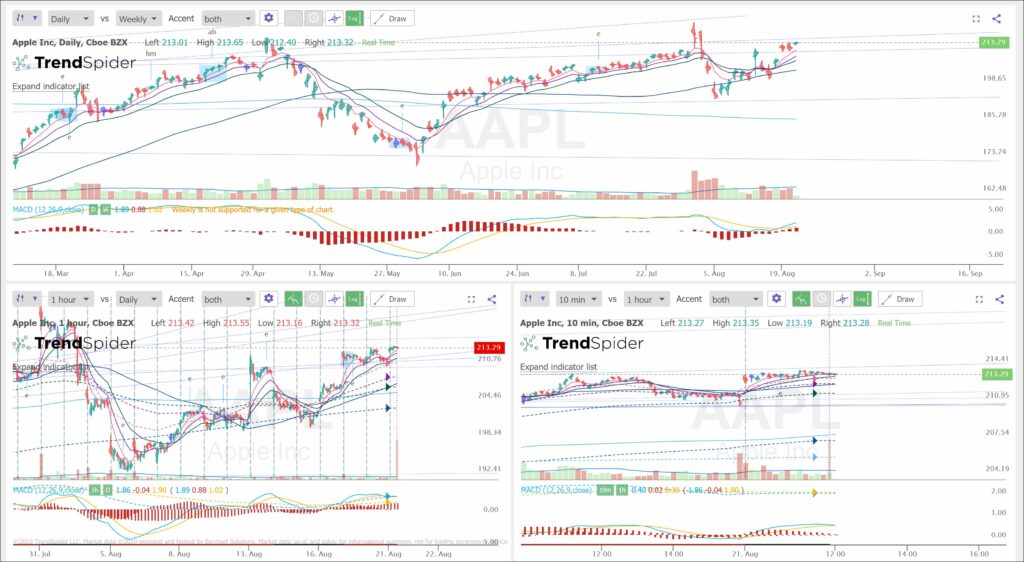

When you are looking at a stock chart the absolute basic is going to be the price vertically and the time horizontally. Above is an example of the daily chart for Apple

When you look at charts there are different time frame that you can look at to help you make your assessment.

Here you can see a 5 minute chart, 45 min chart, Daily Chart and a Weekly Chart. The charting package I am using here is Tradingview.com I absolutely love them as you can transfer your setup from desktop to the app on your handheld device of Apple or Android.

Why do you want to look at a chart on multiple time frames?

It is fairly easy to find an entry on one time frame, but you want to make sure that all of the time frames are showing you good reason to enter. If you see one that is showing a different direction you might want to be cautious knowing that you could be going along the trend.

All of the candlesticks are derived from the volume and price action over a time basis. The smaller the time frame the more erative the movement can be and could shake you out. The time frames tend to be better for scalping a move, but could trick you into getting out of a good trade by micro managing the trade.

Would you believe that sometimes I will look solely at the volume traded on a book map to know where the support and resistance lie for the day. I will also track the biggest buyers and sellers positions as well as where GSCO (Goldman Sachs) is on the book (level 2).

When I see the big guys moving their targets up or GSCO moving their sell up, I have noticed after time they continue to push the stock up to their targets. The same is true if I see the stock price drop and the buy targets dropping as well.

All of this will determine the trend, but does it correspond with the overall trendline?

What is the Trendline ?

Trendlines are a visual representation of support and resistance in any time frame. They show direction and speed of price, and also describe patterns during periods of price contraction. This is from Investopedia.com

Ok lets get into the visuals of trendlines now.

Here is an AAPL stock chart with the yellow trend lines from Trendspider.com You can see the trendlines that the algorithym has automatically drawn as potential spots of resistance and support.

When you have a trend line broken and volume behind it that is when the price action will tend to heat up. Many times shorts and computers will put their stops just above a trend line and the same is true that longs and algos going long will analyze and put a stop just below a trend line to act as support.

The cool thing about Trendspider is that you can overlay timeframes so you have multiple time frame analysis on one chart. So far this is the only software that I have seen that gives you the ability to do that without having to write your own custom script.

As you can see I also have moving averages on my chart and what is very cool is the multiple time fram analysis will also used the dashed lines for the higher timeframes for the moving averages as well. So I can see the trend lines from another time frame and also the moving averages.

There is not just one time frame that every trader or algo uses for trading so being aware of other walls of resistance or support to act as a hurdle is great profit taking and target setting.

Stock Market Prices Today

The stock market prices today are quite volatile with Trump, FOMC, Trade Wars and more. When you are prepared and have a plan trading becomes much easier. It can be black and white once you set aside your emotions and look at it in a scientific manner.

You must remember there is no rationality in the market and it will always be right. It is how you react to the price action of the market that will allow you to capture gains.

Top 5 books about stock charts

As of August 2019 I have partnered as an educator in The Training Pit that was created to help people learn from zero knowledge or to reset your training.

I hope this post has helped you learn a bit more about stocks and charting. As you can tell helping people is very fulfilling and the whole reason why this blog began in 2015. I will be sure to write more how to in the area to help you in your journey.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you would like to be in Training Pit with me sign up here or if you want one on one training you can email me jane@thedarkpools.com You can contact me here or Twitter (@ItsAirplaneJane), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane) or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. You can receive 5% off with Promo code CARPEPROFIT15 all caps when you sign up here for your first year or month

Trade Ideas will be offering the quarterly full access test drive of their software their software in Nov 2019 for the cost of data fees $9.

Another amazing software is Trendspider that has a new innovative rain drop candlestick that shows the volume for the morning session and afternoon session as far as the weight of it in price action. You can try them for free for 7 days here and receive 20% off with MTS20

My book is available at Amazon FMJ Trust Transition Trade: How Successful Traders Said It, Did It, and Lived It . As well as Barnes and Noble, Indigo, Chapters,and more.

For my charts I use tradingview.com which offer free charting and paid services.

Also Stocks To Trade that has a 2 week $7 trial

This blog is for informational and educational purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any security or fund.

I am a newbie when it comes to trading stock so I found this article most helpful. Thank you for explaining how trendlines work as I was never quite sure.

I will definitely have to take a look at The Training Pit as it will hopefully teach me a great deal more about trading. Trendspider is another tool you have introduced me to. Keep them coming.

Michel thanks for the feedback. The whole reason in me sharing is to help others become successful traders.

Hi,

Thanks a lot for this excellent article about stock and charts. I am an economics graduate and I was always passionate about stock trading. But practically I was not clear about some of the term about stock trading. But after reading this article it makes most of my queries answered. Before study in stock trading, I was confused how this chart works but you make everything very clear than anyone who interested to learn stock and chart, they can not only understand this but they get knowledge about tradeline or rest of stock related topic. Thanks again.

Thank you Nazmun

Thank you for this article. I have been thinking of getting into trading stocks and it’s great to know that there are so many things to help me get started. I will have to look more into the trendspider program because it looks like it’s very helpful. Thanks for all of the great discounts you are offering as well. I will keep this page for future reference when I will get more into trading stocks.

Thisnis a really informative post you have put up here on your site. I like how you have outlined everything making it very understandable. I have a friend who is looking for a very good training in stock and charts. I should recommend this post to him. Its not really so expensive too so its a good one.

I can only give you the information I used when l traded my personal account. All traders have a different approach to trading the markets, some have there own system, some don’t believe in charts, and some are into charts. I personally could not be with out a set of charts. Us chart co. has every chart type from one minute to daily, weekly, and monthly. Once you master the chart reading this will help tell the story for the next trading day.

Jane, wow! The fact that you are publishing about such a comprehensive industry as stock trading is impressive to me. I read your story about how you got started. There must have been some steep learning curve. Your website is a great resource of information for someone looking to get started. You are doing a great job of extending a person’s connections in this industry by listing where someone can go for more information about this, that, or the other regarding stock trading.

I didn’t see your book listed on your Shop page. That would be a quick way for people to get their hands on more of the whole of stock trading. I have some investments in stocks, but I don’t trade them. I let those investments sit!

Do you find stock trading to be a profitable venture for someone who wants to do it part-time? Of course, I would think it would take longer to learn the industry and to keep up with the best investments if one were to do it part-time.

Anilise, thank you. Yes for part time trading and learning swing trading might be best.

Hi there,

I like the website educating people about stock trading. I love trading stocks sitting at home and making some money. These book recommendations really will help me.

I am an active trader. I short sell and add a little bit almost twice a week. I only focus on a few stocks and know where to enter and where to exit. I am not greedy. I don’t look for big gain either. Itis remarkable to say over multiple years I have increased my Roth IRA by al least by10 times.

Personally, it is fun for me. From the money, I made I now have planned for an international on economy class.

Your blog helped me learn a lot where to focus to get some trading education.

Anusuya, That is great to hear you have had such success. Im happy you found the post informative even with experience in the world of trading.

Hi

Thanks for sharing such an important and educative post about Stock and Charts. You have informed us about how to read the stock charts very clearly. By reading your post it is very clear to me that wewant to look at a chart on multiple time frames. You also have shared what is the trend line. The top 5 books about stock charts those you have shared with us I will collect them as soon as possible. This post is very helpful for us to learn a bit more about stocks and charting.

Thanks again. I’ll share this post with my friends and family.

Great Monalisha and I you guys have questions please feel free to reach out.

Great and informative post. I like Trendspider for the fact that you can overlay multiple time frames on one chart, instead of having to keep switching between charts. I will also be checking out The Training Pit to improve my trading knowledge. I’ve dabbled in it for a few months now but haven’t found success.

Joe Trendspider is great platform. And I look forward to seeing you in the Training Pit.

It is a good orientation to learn from ‘How to Read the Stock Charts. I must admit I do not know exactly understand it and even read this post I am still in limbo. However, what I keep to myself are the websites where I could study this aspect even more not to mention the 5 books being offered by the author that is being sold on Amazon. Tradingview gives the explanation on how to look at a chart on multiple time frames as having been given in the post and why? Goldman Sachs or GSCO gives this kind of job and tells us the meaning of trendline – it is something that deals on support and resistance reflected on the time frame. Investopedia shows direction, speed of price. Trendspider, on the other hand, would help us to understand the flexibility whats on a chart and what is very cool on moving average with multiple time frame analysis. I understood that the stock market and price today has become volatile especially due to the combative Trump with China, for instance, FOMC and other trade wars. One sentence I would keep is this ” It is how you react to the price action of the market that will allow you to capture gains.” Similar to what I read from the famous Warren Buffet.

Excellent article on stocks and charts,they are important indicators to study very well before placing a trade,the position would show if that is the best time to trade or not. Trendlines are a visual representation of support and resistance in any time frame which show direction and speed of price, and also describe patterns during periods of price contraction,I love to use it as my trading guide,thanks for sharing this helpful write-up.

I always wanted to become an online investor but hesitating because, these technical aspects scare me. Thanks for this article, I guess if someone like you can do this, then why can’t I?

To get started, I think I have to start reading first the recommended books here. To learn more about candlestick, technical analysis, trends, etc. After I learn all these and become familiar with technical terms, then I will start getting my feet wet by actually participating in online investing as well as in online trading.

Gomer, education is #1 in being profitable in the market and then #2 is to practice with fake money as the market will gladly take your real money if you don’t know how to trade well.

Thank you for writing an article, in simple terms, on something I find to be extremely confusing. You really have a gift for making stocks and trading easier to understand. I still feel confused looking at those charts, but you helped simplify what I was looking at. I have been really apprehensive about buying any stocks because I did not really know how to get started.

I am glad I found your resource, which I have bookmarked. This may sound like a stupid question, but what is the least amount of money I would need to save to start investing? Just to learn the ropes, not take a huge risk.

Thanks for your help!

Ashley, the best thing is to start putting money aside to trade with as your are learning. It is easier to start with over 25k in the USA because of the patterned day trader rule. So I suggest you papertrade while saving capital and learning. Your account will thank you.

We have recently been to see a financial adviser and she said that it’s not a great time to invest as it’s really volatile, would you agree with it? A friend told us only to invest what you can afford to lose…

We’re still trying to make up our minds and learning is definitely a big part of it. I’ll be reading your posts with pen and paper next to me.

Petra, there are always opportunities in the stock market and learning how to find them is part of the process. Day trading is definitely different from investing. Its a matter of education before moving forward